The Future Of Monetary Policy...

I read a great thread on the three stages of a bear market:

Stage 1— Unwind: It may still feel like the good times, but the seeds of the bad are starting to appear. Mini-narratives of bad times to come are proliferating.

Stage 2— Forced Capitulation: Positive narratives die and negative narratives reign supreme. Deleveraging spirals, layoffs, and company shutdowns.

Stage 3— Bottomless Exhaustion: Long, painful nothingness. No positive narratives or catalysts for improvement. Extended period of darkness.

Now I’m no economist but from looking at markets we seem to be in stage 2. Stage 1 was early Q1 before the Russia-Ukraine war when the inflation scare began to realise.

In my last article, I spoke briefly about the highly anticipated Fed rate hike of 50bps; as we can see that didn’t happen. Let’s take a look at what’s really going on.

To recap the Fed meeting, Jay Powell was very adamant about seeing “consecutive, sharp drops in MoM inflation prints” before declaring mission accomplished. Referring back to the three stages of a bear market, we’re currently sitting somewhere around stage 2, which is perfectly in line with the Fed’s target for rates by year-end where we can expect interest rates to be above the neutral rate and the economy to be in stage 3 due to the tightening.

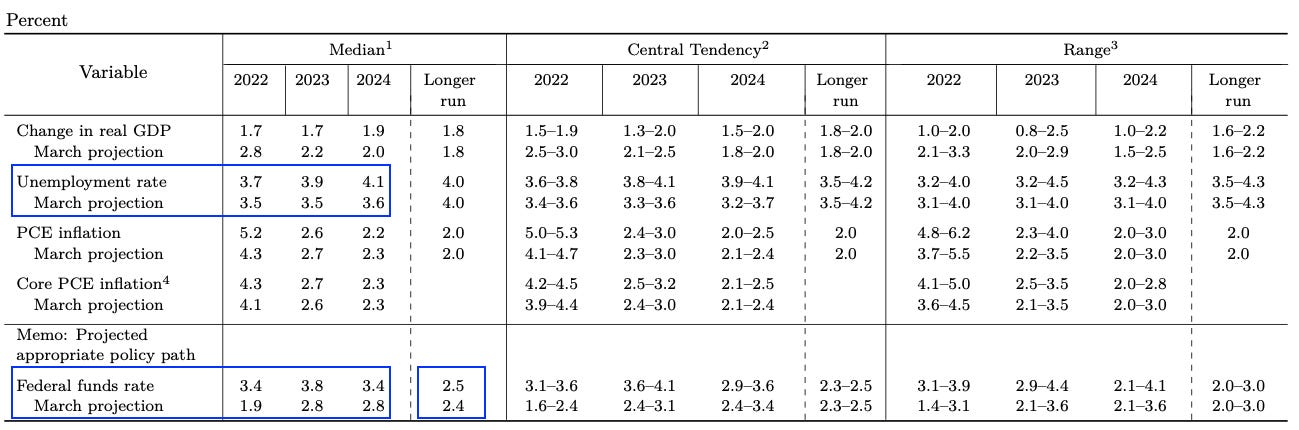

Now, in conclusion of FOMC meetings, members submit their projections of the most likely outcomes for GDP growth, the unemployment rate and inflation including a path for the federal funds rate. This is called the Summary of Economic Projections (SEP).

Now comparing the March projection to the current projections we can see that the neutral rate (longer run) has been moved slightly higher to 2.5%. By the end of the year, the expected Fed funds rate is 3.4%, and we currently sit at 1.75%; so the expectation of the Federal reserve to go in with another heavy 75bps is less likely as we approach the neutral rate where anything above this figure is now real tightening within financial conditions.

Do you remember that old tale by Fed Powell on inflation being “transitory”? Great, just keep that in mind whenever you hear him speak about the current state of the economy. More recently we heard from Jerome Powell that we can expect a “soft landing” i.e the labour market will still be healthy and robust.

Taking a look at the projections for the unemployment rate we’re expected to see unemployment rates reach a high of 3.9% up from 3.5% expected in March.

Now moving on to inflation, the Fed’s focus on inflation is more so on the PCE figure than headline CPI; however, from the recent press conference, it seems the Fed is going to focus more on CPI data showing signs of successive declines. Taking a look at the SEP chart even though the Fed is set to hike rates 130bps above the neutral rate (2.4%) you can see that inflation is still predicted to sit above the Fed’s mandate of 2%. Looking at the economy now whilst rates are accommodative relative to the longer-run rate you can imagine the rocky road ahead for asset markets as conditions tighten.

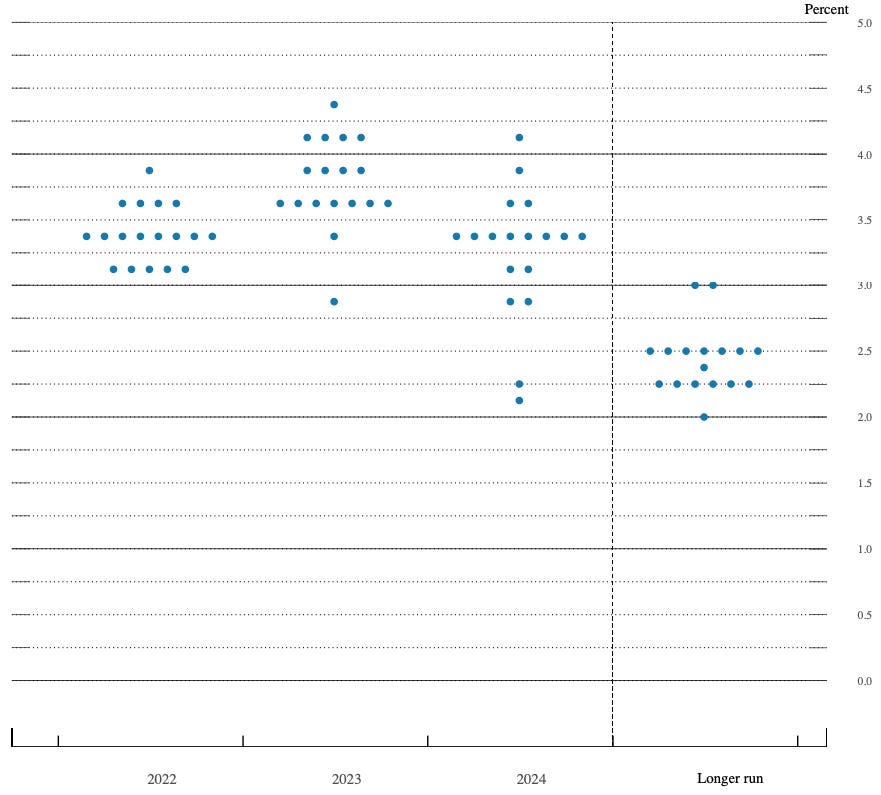

Take a look at the most recent revision of the Fed dot plot. For those who are not familiar with this monetary policy gauge, the dot plot is a chart which displays each of the Fed official’s projections for the central bank’s key short-term interest rates in the future.

If this doesn’t show what length the Fed are willing to combat inflation then I’m not sure what will. It’s clear that we will hover around the 3.0% - 3.8% rate mark for a while.

What Does This Mean For FX?

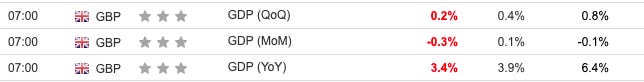

As you may have guessed. Firm dollar for the foreseeable future. The BoE also hiked rates to 1.25% from 1.00%, however, I expect the BoE to slow down the pace of their interest rate hikes due to the lacklustre economic data we are seeing.

Growth is already weakening and showing signs of further decay, this will be weighing in on Gov Bailey and the BoE members in their future decisions.

The mighty BOJ met later on Friday, and as expected rates remained the same however the focus shifted to the 10-year JGB’s which pushed higher than the target of 0.25% forcing the BOJ to step in and continue with its unlimited purchasing of JGB’s.

With the Yen, rates will continue to weaken as long as the interest rate differential remains wide, which seems set in stone as the BOJ is adamant about keeping its accommodative policy. The Pound Will continue to slip against the dollar due to its greater perceived risk than the dollar, the uncertainty of the economy battling double-digit inflation this year and a flatlining economy.

Thanks again for getting to the end of this article! It’s been a massive week in markets so be sure to keep up to date with my next piece on Monday

It costs nothing for you to share within your network & social media but means the world to me!—Also any feedback feel free to get in touch via LinkedIn, Instagram & Twitter