The Fed Is Done.

Volatility in bonds sparked by weak jobs report from Non-farm payroll

Hey guys,

I’ve been thinking about starting another blog.

But part of me isn’t receptive to the idea.

“Great ideas only”.

Something I’m sure I picked up from observing Steve Jobs.

Anyways, non-farm payroll data from the U.S came out today and it sent both a relief and shock to investors and markets, so let’s uncover it here.

The End of The Cycle

I guess that title is rather appropriate after the recent jobs report out of the U.S today. On Wednesday we heard from a rather dovish Powell judging from the bond market’s reaction to his pause; subsequently today we have October’s jobs data which all but reaffirms his stance on holding rates. Here’s where we currently stand with the employment market data.

Let me explain what you’re looking at here.

Firstly, a figure which many people, including myself, wouldn’t have come across so easily. Two-month Payroll Net Revisions, are adjustments made to the number of jobs reported by the BLS over two consecutive months to ensure optimal accuracy. Over the previous two months, the cumulative (net) payroll revision showed a downward revision of 101k, meaning over the previous two months there was a -101k change in unemployment than originally reported. That means for the September NFP report the revision is now 297k vs 336k (before revision).

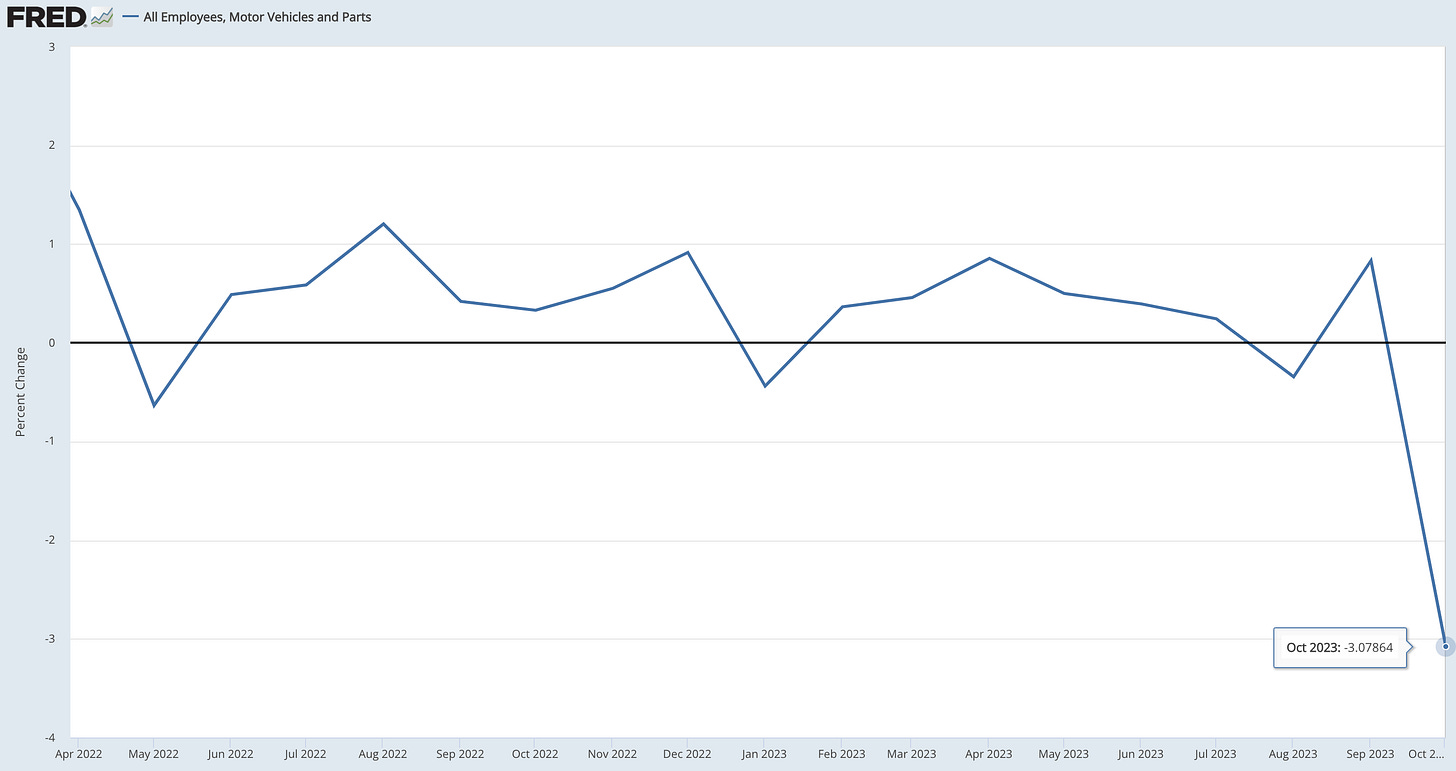

The headline figure showed a miss of 30k vs the consensus, but as we look deeper into the data we understand what factors contributed to the weakness in the jobs report. In the manufacturing sector, we saw a huge decline in the monthly payroll change, which can be attributed to the strikes by the UAW (United Auto Workers) union. The strike was targeted at the “Big Three” Detroit car markers, GM (General Motors), Ford and Stellanis; there are c.34,000 on strike collectively against the big three firms contributing to the large decline in manufacturing payroll as well as headline figures.

This sharp contraction in motor vehicles and parts employment is a representation of the union strike.

On Wednesday we received ADP payroll data which also signalled slower growth in the private jobs market in the U.S. ADP is used as a great indication of how the overall jobs market (public & private sector) performed because of its early release but it is not always a guarantee keep that in mind.

Reviewing this data the Fed should be fairly proud of such a report, the looseness is starting to seep into the U.S economy with the baseline unemployment rate rising to 3.9%. Looking at the annualised average hourly earnings we’re still seeing some relative stickiness with the figure north of 4%; that will be the main tail risk the Fed will aim to eliminate to avoid the potential resurgence in inflation that Europe most likely may face.

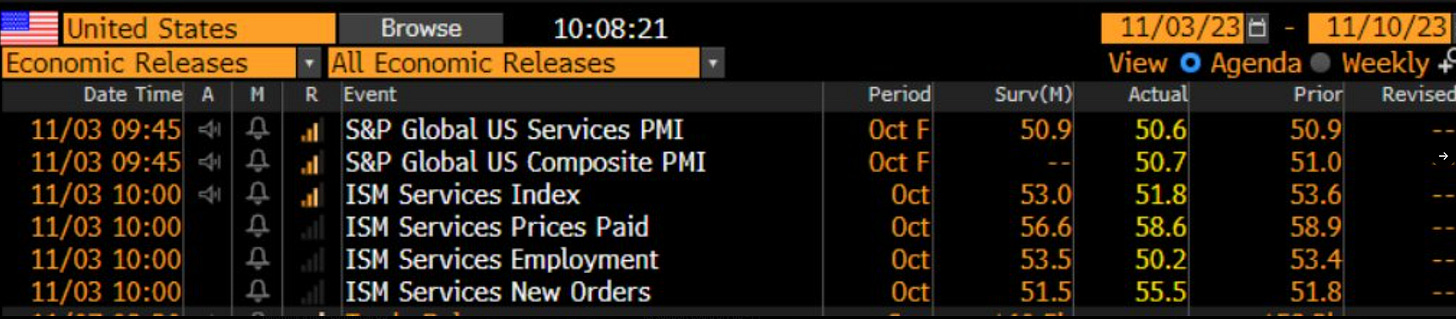

As many of you will recall, ISM/PMI data is a strong leading indicator of US economic health; this reading is something I recommend you pay greater attention to across all G10 economies. Now although you may look at these figures and default to the basic assumption that “we’re still above 50, so we’re fine” I urge you to pay close attention to the slight changes because in macro such observations help create a better understanding of the progressive change within the wider economy. Most notably services PMI data came in lower than expected, registering at 51.8, which although still echoes growth within the sector, the 1.8 point drop from September is something to be observant of.

Post-NFP bond yields plummeted across the yield curve alongside the dollar as investors began adjusting to the expectation that the Fed hiking cycle was officially over.

On the short end of the curve, the 2s dropped shy of 20bps in the aftermath of the jobs data. In the space of 1 week, the 2s have declined from GFC highs of 5.107% to 4.832% as investors expect a further shift lower in yields ahead of the expected Fed cutting cycle next year.

The front end of the curve is experiencing a sharper decline in yields than the long end with yields on the 10s only declining 10bps post NFP.

The consensus remains that rates will remain relatively elevated as we shift into a new macro regime where 0% rates are truly a thing of the past.

In conclusion, the October non-farm payroll report was a mixed bag, but it was enough to convince investors that the Fed's hiking cycle is over. The headline figure missed expectations, but the unemployment rate rose to 3.9%, which is a sign that the labor market is starting to cool. Average hourly earnings also remained sticky, which is a concern for the Fed. However, the ISM services PMI data came in below expectations, which suggests that the services sector is starting to slow down.

Thanks for your patience, this report came a bit later than usual— but nevertheless I had to send it out to you.

Until next time

Amazing read !