The Euro's Overbought Surge: A Closer Look at Market Dynamics

Delving into the Bullish Performance of the Euro Despite Weak Growth Across Individual Countries

Hey guys,

This one is going to be a deep dive, it’s about time.

I want you to focus on one crucial thing within the next few months: When interest begin to have a weaker effect on FX markets, what becomes the main driver?

Get your pen and paper out, take some notes.

Let’s begin!

Macro watch

Germany’s weakness has really taken the spotlight inside the Eurozone, which makes sense as they do control a heavy portion of the European Unions’ growth (c.25% of Eurozone’s GDP).

With manufacturing PMI’s across the Euro area dragging growth, Germany’s in particular at 40.6, there’s not a lot of positive sentiment from individual countries to provide support to the Euro.

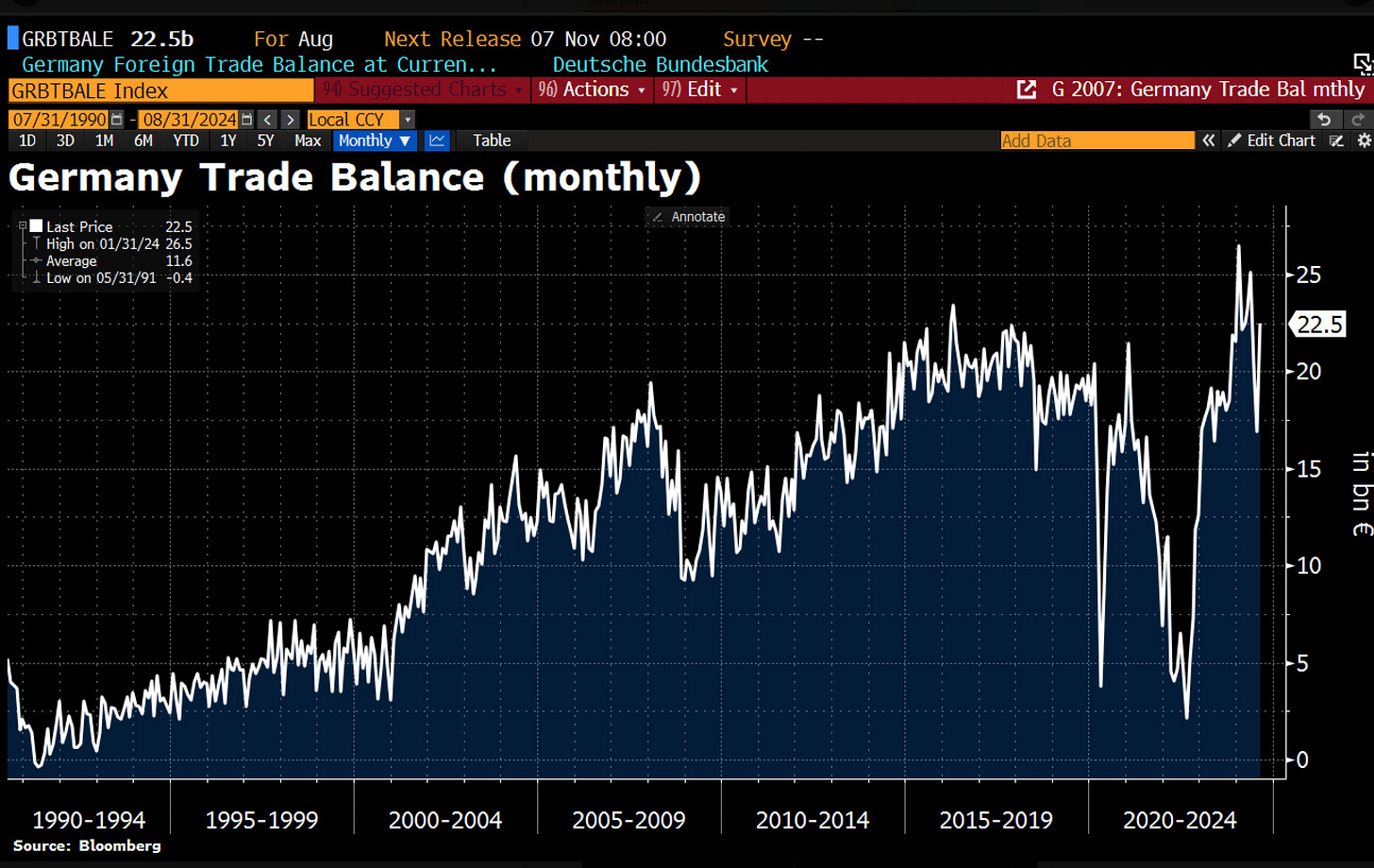

One data point this week that was interesting was Germany’s trade balance where the monthly trade surplus surged to €22.5bn in August, up from €16.9bn in July. This rise in surplus was driven by a surprising 1.3% monthly rise in exports, while imports fell harshly by 3.4%. 5.5% more goods were exported to the US than in July. Exports to China increased by 1.9% MoM to €7.4bn, while exports to UK rose by 5.7% to €6.8bn.

When monitoring trade balance, we can see shocks in supply chains before they become apparent in the real economy. Upticks in exports are further evidence that global demand is on the rise amid cuts, which leads me to believe there could soon be a turning point for the euro area’s (particularly Germany’s) manufacturing sector, maybe not enough to spark a bullish Euro though. However, I’m also cautious that imports declined so fast, it typically signals that domestic demand is weak, which is clear when we look at Germany’s retail deposits, which I discussed last week.

Everyone is saving their money!

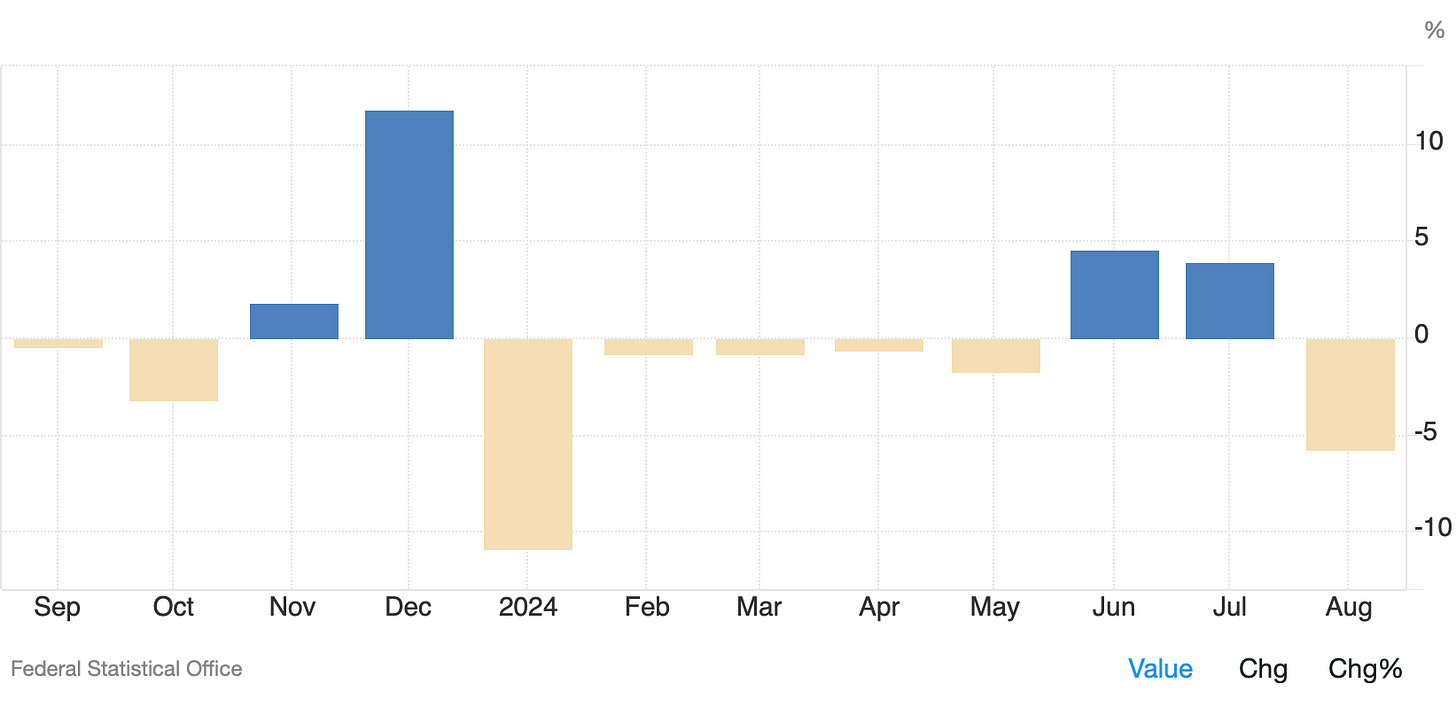

The spread between upside and downside risks in Germany are still so wide, with upside risks are not giving any fight against such a poor economic performance. Industrial production in Germany rose the fastest since 2021, largely due to a rebound in the country's key car industry. However, output only offset the fall in the prior month as the manufacturing sector continues to be a drag on the economy.

Market mover

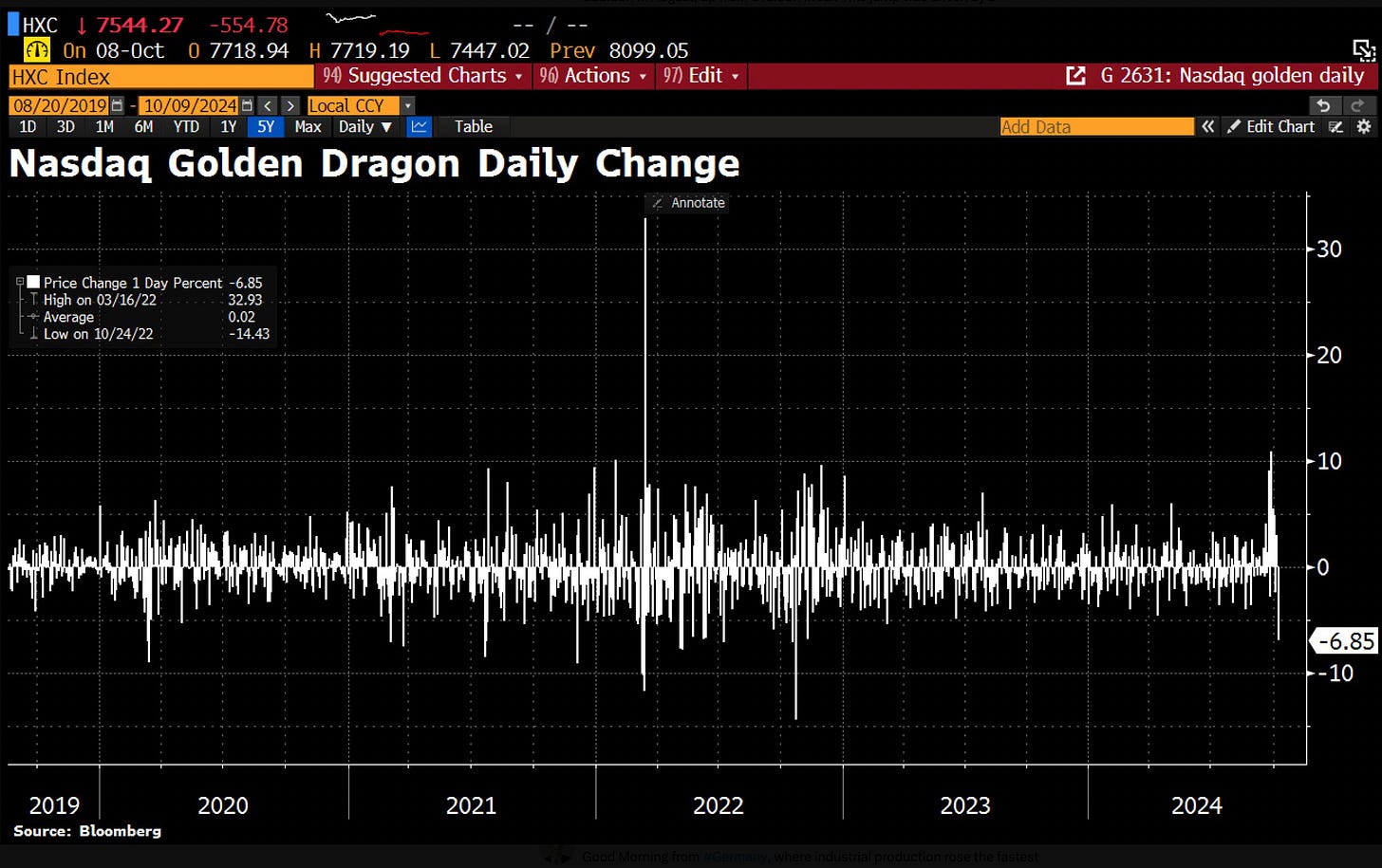

Chinese equities tumbled as Beijing stopped short of launching more major stimulus, disappointing the traders who were looking for more fuel to achieve a world-beating stock rally. The Nasdaq Golden Dragon Index plunged 6.9%, most since 2022, to c.7,544.27.

The world bank expects China’s growth to slow in 2025, doubting the recent stimulus. The expectations for growth in 2025 dropped to 4.3%, while the expectations for 2024 were revised upwards to 4.8%.

All large rally’s require a pullback otherwise markets would continuously be inefficient, so I don’t see it in a way where China’s stimulus is losing its power. There is large speculation that the stimulus inside China hasn’t finished, which leads me to believe that all of this excess liquidity could cause some extreme problems in the future, whether that’s short-term or long-term.

The overbought Euro

PMI’s across the main Eurozone countries have been hit hard in the recent months, particularly Germany and France. The data is driven by such extreme lows of new factory orders, hitting -5.8% in Germany in August alone. Simply put, less goods are being produced as domestic demand fails to pick up and key trade partners, like China, are only just beginning to see any optimism. The recovery from the damage caused by such tight global monetary policies will take its time to recover, while manufacturing sectors will continue to see the lag effect.

But why are services PMI’s seeing strength?

The reason for this is because there has been a large shift from goods to services, mostly seen since COVID-19. Since the world was “locked down”, we have seen shifts in consumer spending habits, from spending money on home-goods to spending money own travel, dining and entertainment (services). This shift in consumption patterns is the driving reason for such a spread in the two PMI’s across the European Union. Also, The services sector, especially areas like health care, education, and hospitality, tends to be more labor-intensive. The Eurozone has seen relatively strong employment in services, and wage growth in these sectors has supported consumer spending, which keeps demand for services high.

One more thing to take into consideration is that the manufacturing industry is hurt more by higher interest rates than the services sector because they rely so heavily on borrowing in comparison to any services-related sectors. Domestically driven services are ‘protected’ by slowdowns across the globe due to these higher rates.

Some explanation of the bullish Euro in the recent two quarters, despite such horrendous manufacturing PMIs, is that the services sector contributes to c.73% of the European Union’s GDP. Of course, we can’t ignore there fact that monetary policy expectations have contributed to a large amount of the Euro’s gains.

Now, to emphasise on my theory that the Euro is overbought, I question how long a weak economic environment in Germany can go on without severely dragging the Euro. China (Germany’s largest trading partner) have created a short-term solution to weak growth by introducing stimulus, but it’s really not enough to save the manufacturing sector in Germany (in my opinion) and I see a recession scenario, pressuring the Euro further in negative territory.

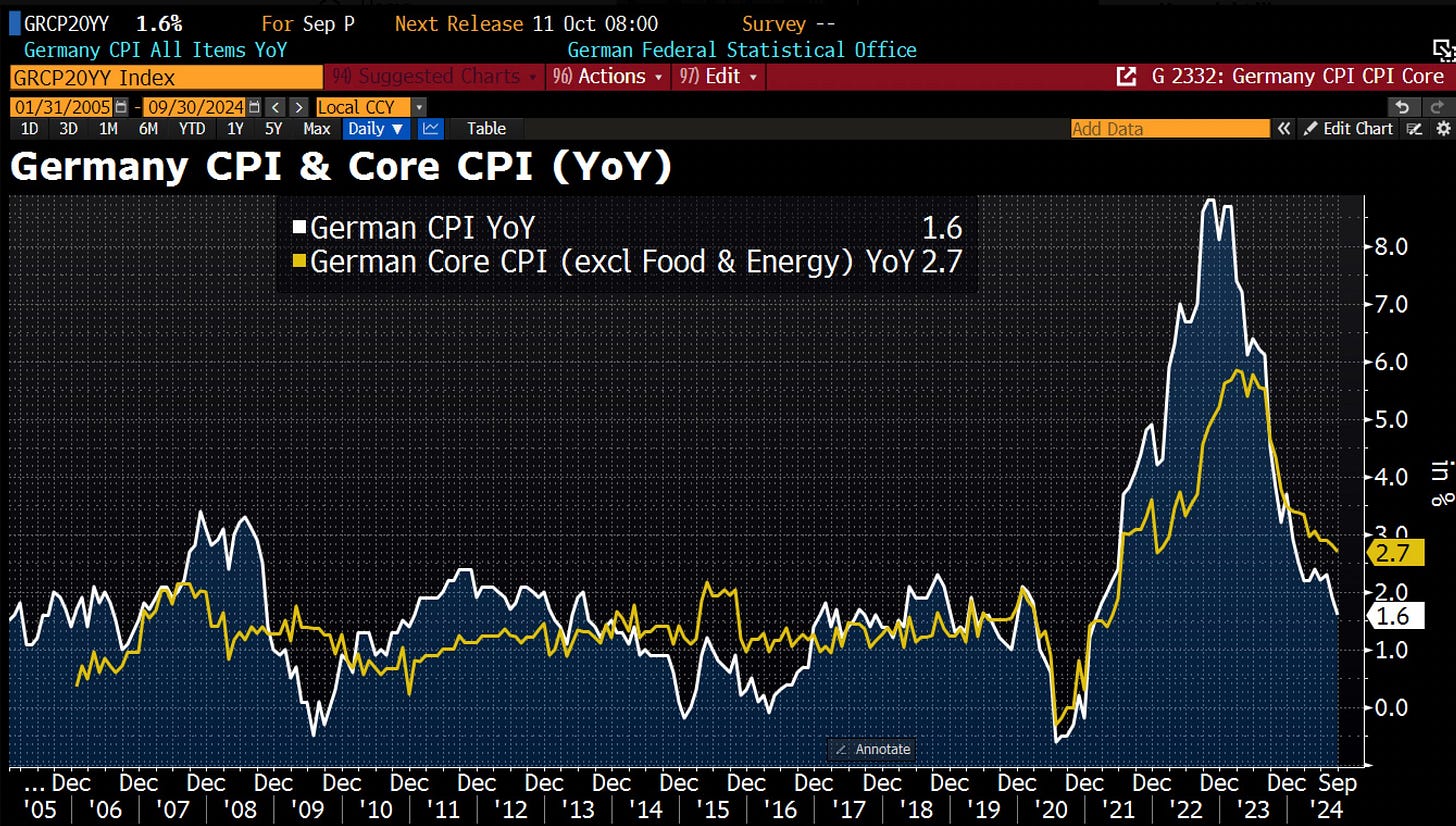

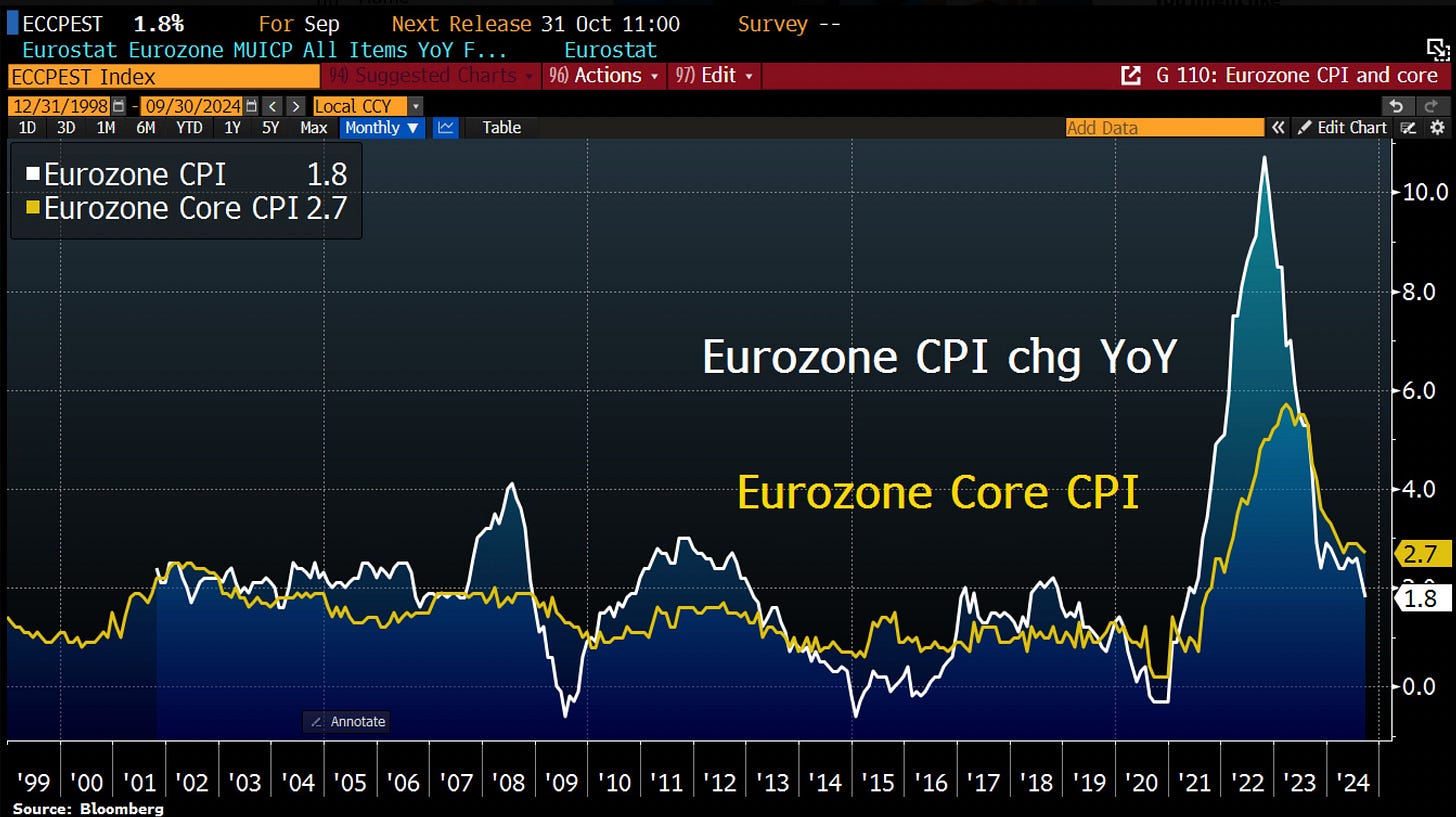

It seems as though the ECB has done a great job on taming inflation in Germany, but the core CPI really remains a red area in my opinion. For as long as the core CPI remains sticky, the ECB members will most likely be split when it comes to cutting rates, how many basis points do they cut and how often?

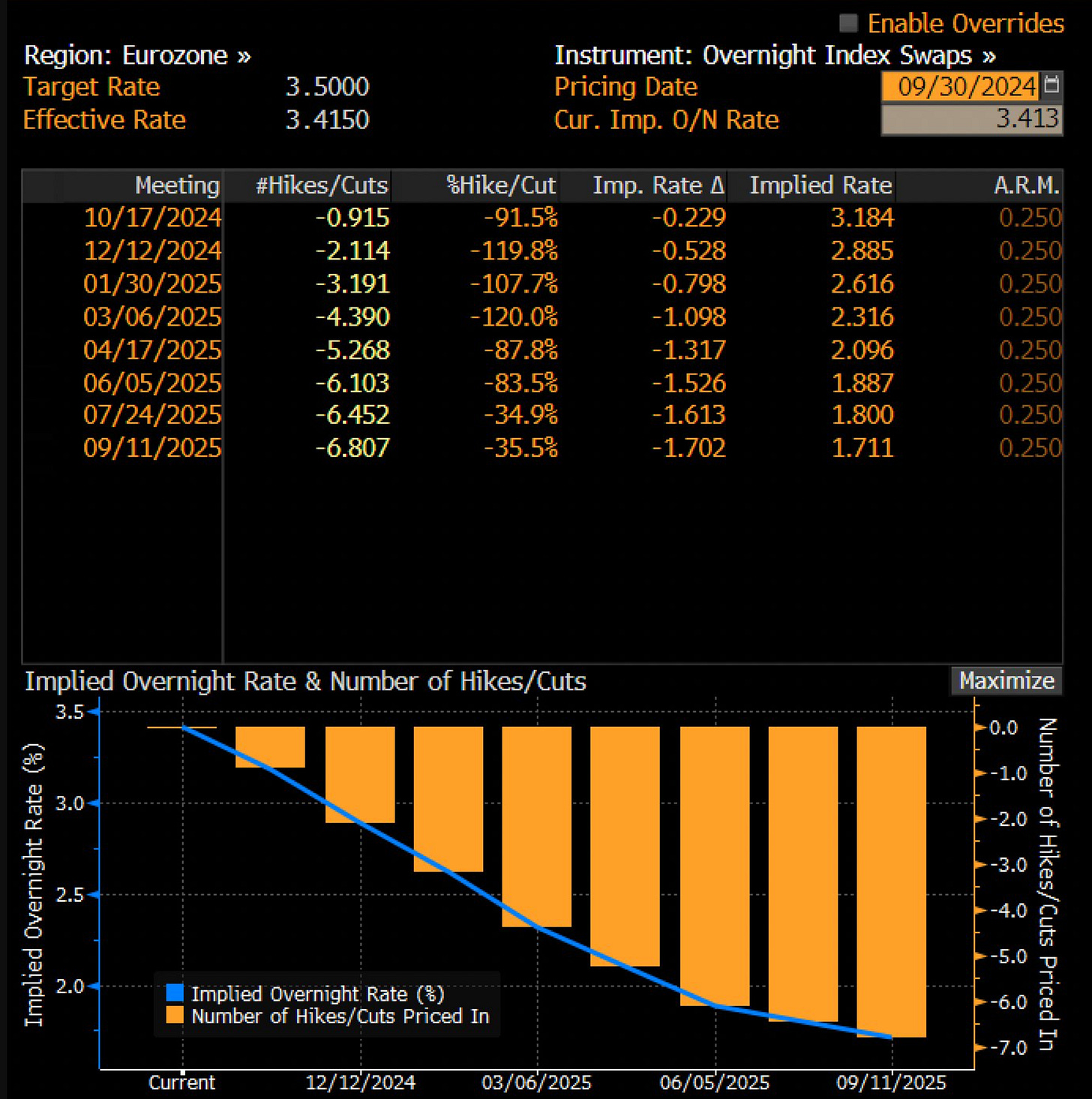

As I mentioned above, interest rate expectations are on of the only things that have propped the Euro up, but why are there only c.50bp of cuts priced in by the end of 2024 when Eurozone CPI (YoY) is 1.8%?

Simply because core inflation is causing too much of a tail-risk to the ECB, they have done such a great job of taming this inflation, now the battle is inflation VS growth. One has to give, I think they will sacrifice growth in favour of bringing inflation to sustainable territory, emphasising the potential downside risks to the Euro.

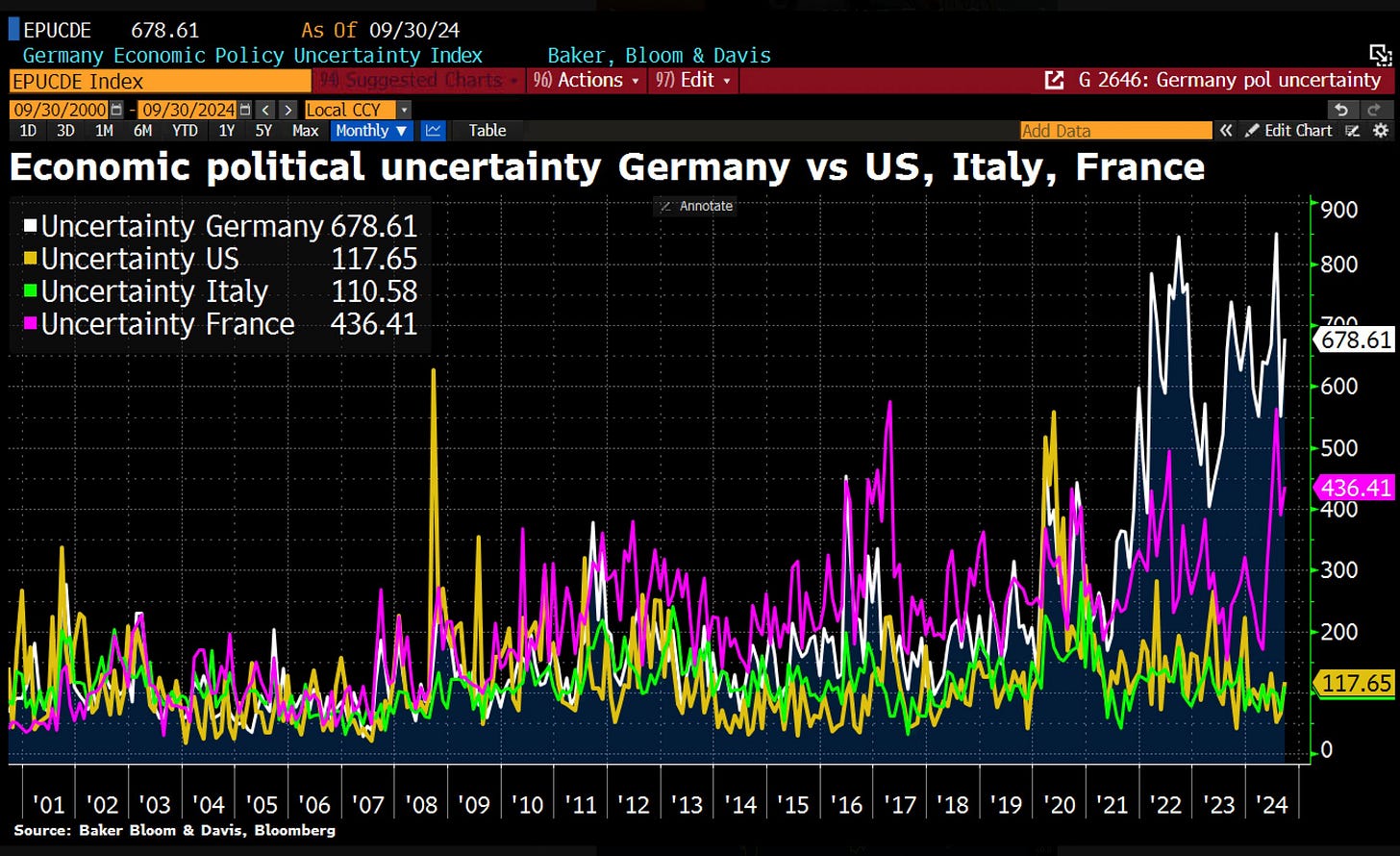

Let me add more evidence to my bearish Euro case. Just take a look at the chart below, Germany and the US typically have close correlation which it comes to GDP forecasts, but look at how much ground Germany has lost to the US since September 2023. Such a spread in GDP expectations creates large gaps in the competitiveness that Germany can offer. As an investor, where does your money look safer if you were to invest in a domestic equity market?

The government in Germany has abandoned hopes of achieving any economic growth in 2024. There are now expectations of stagnation at best, down from the previously projected growth of 0.3%. This new forecast is even below consensus of 0.1%. As a result, Germany is falling further behind the US, where economists expect the economy to grow by 2.6% in 2024.

Germany alone can potentially drive some trend in the Euro, but this bearish case for the currency is further supported by dynamics in France.

The left-wing New Popular Front coalition promoted the motion of no-confidence but it received only 197 votes in favour which was well below the 289 votes required to pass. Prime Minister Barnier’s government survived primarily due to the abstention of the right-wing National Rally party. The developments suggest that the National Rally party are unlikely to vote to bring down the government while it is attempting to pass a budget for next year. Prime Minister Barnier has already outlined that they plan to bring the budget deficit down from around 6% of GDP this year to closer to 5% of GDP next year. That would require a reduction of around 1 percentage point of GDP equating to EUR30 billion. He also outlined his plan to delay bring the budget deficit back below 3% of GDP by two years out until to 2029.

France must submit a fiscal plan to the European Commission by 31st October. The plan is expected to meet EU fiscal rules by bringing the deficit below 3% within the adjustment period while being consistent with the minimum adjustment of 50bp per year. One of the main risks to the government’s plans for fiscal consolidation next year would be weaker than expected growth in France with growth of around 1% expected next year. Higher taxes could act as damper on the growth outlook. So far the fiscal developments in France have had limited negative impact on Euro performance, but that’s not to say it won’t. It’s thought that the spread between 10-year French and German government bonds would need to significantly widen out beyond recent highs at around 80bp to weigh more on the Euro.

French government have introduced fiscal consolidation totalling EUR 60.6bn with just over EUR 40bn coming from spending cuts and a little less than EUR 20bn from tax increases. A temporary levy on profitable companies and a tax on maritime transport companies are some measures to lift tax revenues as is higher tax rates on 65,000 wealthier households. A delay to the indexation of pensions from January to July will also add to savings. This pension measure has been criticised by Marine Le Pen and her RN party but there has been little indication that RN will be willing at this stage to trigger a no-confidence motion in the government which would easily pass with the support of the Left Alliance.

Without these measures, the budget deficit was set to rise from 6.1% this year to 7.0% next year. Now the deficit is expected to fall to 5%. This consolidation will be done against a GDP growth projection of 1.1% next year. The sovereign ratings agencies may deem that the details lack credibility. On Friday, Fitch revised France’s outlook to negative while keeping their rating at AA-, which was downgraded first in April 2023.

Moodys will then provide its update in two weeks and finally S&P on 29th November. Moodys ratings is one notch above Fitch’s and S&P’s and hence there is a risk they could downgrade France on 25th October. Issuance of OATs will increase from EUR 285bn this year to a projected EUR 300bn next year to finance this budget, which was in line with expectations and hence should for now contain risks of a widening of the OAT/Bund spread.

Greater uncertainty + greater regulation = lower investment. I believe stagnation set in around 2014 due to increasing regulation. Now ideological politics is accelerating decline, Italy and Germany are in thick mud. A bearish Euro inbound.

That’s all for this week!

I loved this euro breakdown, I love when euro, pound, the dollar or Japanese yen, are broken down in a detailed format like thus, I learn so much