The Drivers Behind FX Trends

Taking a deep dive into the key aspects of macro driving FX volatility and movement.

What’s up everyone,

This will probably be the first of many reports that I’ll share with you breaking down the drivers behind FX.

This topic was highly requested in our private discord group so I thought no better time than now to explain:

What drives a currency’s appreciation or depreciation?

How to interpret a currency’s movement when both economies seem to have negative data coming from them?

Lend me your attention:

What Drives FX?

When trying to get your head around what factors decide whether a currency is bullish or bearish I truly believe it starts with a few fundamental high-level macroeconomic data points such as:

The country’s economic health, GDP YoY, QoQ.

The interest rate within the economy & inflation.

Domestic government bond yields.

Market sentiment on a currency.

The health of the labour market.

The domestic country’s central bank monetary policy (are they dovish or hawkish)

The government’s fiscal policy, are they running a fiscal deficit or surplus, is their fiscal plan complimentary of the central bank’s monetary policy

The above can be grouped into 4 fundamental pillars, being economic data, central bank policy, geopolitical events (presidential elections, wars etc) and market sentiment.

Economic Health

GDP as we know plays a crucial role within any economy around the world, providing us with a backward-looking hard piece of data to show the relative strength or weakness within the economy over a given time period.

Now GDP won’t dictate your day-to-day price movements, leave that to the more frequent data releases such as your CPI prints, interest rate decision, retail sales, housing-related data, non-farm payroll and so on.

It’s vital to understand that the less frequent data points like GDP, which gets released only 4 times a year on a quarterly basis, dictate the more significant macro picture trend for currencies such as EUR/USD for e.g; then you have your more frequent data points like the ones mentioned above (CPI, Home Sales, Non-farm) which are released more frequently on a monthly basis which has the ability to cause massive spikes in price and change the intraday or weekly price action for a given currency.

Take yesterday’s US CPI data for example. Here’s the EUR/USD chart.

CPI YoY came in at 4.9% vs 5.0% with the other CPI figures (Core) coming in line with estimates. BUT, this one soft print was enough to send the Euro higher. I’ll dive into why.

The Euro rallied 60pips after we received the soft print from the U.S. In as simple an explanation as you’ll get, the lower CPI prints reaffirm to the Federal Reserve that they have been effective and sufficient in tightening financial conditions in order to bring inflation back to their 2% target. Had we seen a hot CPI print investors would have been long the DXY as that would have added pressure onto the Fed to hike again at their June meeting forcing the market to reprice such an event. Whereas, a soft CPI print provides some form of consolidation that the current interest rate is sufficient to suppress inflation.

So, going back to my point the more frequent data releases such as CPI provide the intraday to weekly narrative and direction whilst the bigger data point GDP YoY provides the macro trend for a currency.

Precaution. This doesn’t mean that any positive GDP print you see means the long-term trend of the currency will be bullish as there are several other factors one will have to keep in mind such as, how well is the base/quoted currency’s economy doing? As the currency with the stronger economy, more attractive (in terms of bond yields and interest rates) will appreciate against the counter currency.

Case Study: Great Financial Crisis

GBP/USD

The Global Financial Crisis of 2008, although the actual problem started much earlier with shady subprime mortgages and garbage MBS securities, but we won’t go into all of that.

I’ve chosen this example as the GFC relates most to where we are within the global economy right now, high inflation, failures and collapses within the banking region, the Fed all out of options with monetary policy tools.

The blue line is U.S inflation YoY, the orange line is U.S interest rates.

Open the chart.

Prior to the GFC, the pound was trading at 2.00 vs the greenback! Let’s analyse this chart. Leading up to the huge sell-off you can see that the week of the sky-high 5.6% inflation print was the week in which markets last held onto the price handle of 2.000 for sterling. Immediately after, the sterling slipped 12%, just before the collapse of Lehman Brothers where the bank filed for bankruptcy which sent even more investors into a panic and frenzy as they all rushed for safety in the dollar and bonds.

Check this chart out.

Orange = US10Y

I want you to focus your attention on the marked regions, Jan ‘08 - Jan ‘09. During the GFC, bond yields collapsed due to an increased amount of bond purchases as funds, sole investors and the world re-adjusted their portfolio allocation for preservation purposes only; as a result, bond prices soared past the face value the government issued them causing bond yields do drop significantly.

The Dollar, on the other hand, rallied from a low of 70.750 to 88.500 in 12 months. What am I trying to prove here? Simple, in certain economic climates such as the one we’re soon to enter sometime over the next 12 months all that drives a currency is sentiment and perceived safety.

Was the UK economy in pieces before the GFC? No. In fact, in the years leading up to the GFC from 2000 to 2007, the UK was experiencing periods of sustained growth and low unemployment. Although similar to the U.S there were cracks such as high household debt and current account deficits, nevertheless, interest rates in the Uk were as high as 5.75% in November 2007. Shouldn’t that have attracted investors? Since investors look for high returns on their capital deposits wouldn’t ‘hot money’ have flowed to the Uk? Yes, you’re completely correct, the widening interest rate differential between the UK economy and the U.S economy was a major factor which contributed to the GBP/USD appreciating 26% from 2006 lows and 10% from the start of 2007.

But. Once investors smell fear, hints of a recession that hot money will flow just as fast out of the economy to the U.S economy regardless of how high-interest rates are on government bonds, and money market accounts, that’s the reason why emerging market economies perform extremely bad during periods of high volatility, market recessions and tight financial conditions.

This index goes to show the level of tightness the U.S market experienced during GFC.

So, you can see that for GBP/USD, prior to the 2008 decline of 33%, factors such as a healthy labour market, high-interest rates, and a hawkish central bank all played in the UK’s favour leading the currency to worth 2.0000 vs the USD 0.00%↑ . However, once a recession was on the table, you can see that the only thing on investors' minds was capital preservation.

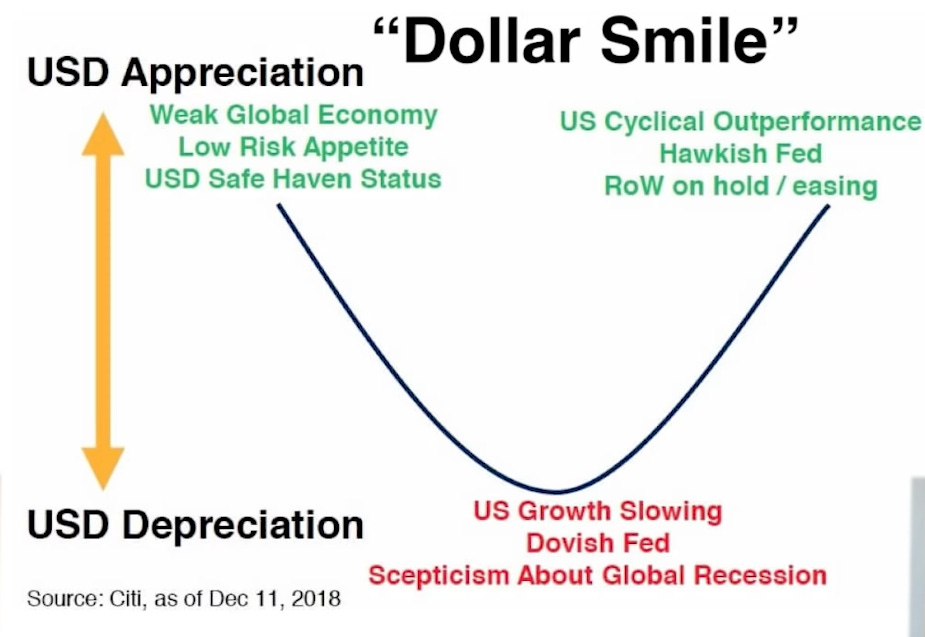

An important lesson, which is why I stress so much on understanding the dollar smile theory as that will simply provide you with a compass for navigating markets and understanding what regime we’re in and what narrative may be at play within markets.

The dollar smile theory is the basis for my short outlook on the dollar, keeping it super simple.

Now, for the day-to-day FX traders you might be looking at point number 7, the government’s fiscal policy and wondering what on Earth that has to do with FX movements; to tell you the truth, it’s got just as much importance as all the above.

The only example I should need to reference is once again on the pound but look no further than last year when Kwasi Kwarteng the Uk’s Chancellor of Exchequer, released his ‘mini-bugdet’ plan which was set to swamp the Uk in billions of debt.

It’s a late one I know…

Sometimes I get into the flow at late hours of the day and frankly, I kinda like it like that—pure flow, no distractions or notifications

That’s where I get my best work done.

If you liked this it would be great to hear your thoughts on the discord group and the comment section below, I’ll catch up with you guys soon!

You're the one, keep going Joe. Godliness in you to perform as efficient as you do!