The Dollar Death Myth & My Outlook

With global tensions rising we're seeing a call for nations to move away from the USD. Reviewing the underlying possibilities and my outlook on

Hey guys,

Check this.

I took a few days to rejuvenate, and boy, it was needed.

Now?

I’m sitting at my brain hub (desk), my work flow Spotify playlist rolling loud, watching WTI Crude fall out of the sky.

One lesson I’m forever learning is how unrelenting the journey to excellence really is.

Anyways.

By the time you read this FOMC would have already happened, if you ask me, this isn’t a do-or-die meeting, we already know what’s going to happen, hike, then pause…

What will be do or die, is what the Fed portray, and provide as forward guidance for the next June meeting— that’s what I’ll be watching out for.

I’ll release a full report on that tomorrow but for now, lend me your attention:

The Death Of The Dollar Myth

I’m always keen to challenge the status quo or the general consensus at a given time. It might just be the contrarian within me, but it’s important that we as traders and investors can separate logic from hype, hard to do when our human psyche tells us to join the crowd at every opportunity.

But that’s the differentiator.

BRICS.

If you didn’t know BRICS is the abbreviation for five major economies Brazil, Russia, India, China and South Africa. Their goal?

Increased economic and trade development

Political and security cooperation

Increased financial cooperation

The truth of the matter is simple, the dollar is not going anywhere, for a very long time.

Here’s my explanation.

When looking at the distribution of global fx reserves, it’s evident who the leader is, but most don’t truly understand why? Or understand what it takes to be a global reserve currency. That’s what I’m here to break down.

The dollar accounts for 58% of global fx reserves with the euro following second with 20%. These reserves are held with central banks.

Now, I’m no historian and trust me, I don’t want to be, but for context, it’s important that we uncover the rise of the dollar which starts all the way in WW1. When the reign of the sterling standard, (£) pound being the global reserve currency, came to an end shortly after WW1 in 1931, the dollar emerged as the next global fx reserve in 1944.

FYI, the sterling standard is also referred to as the gold exchange standard, so when the BoE abandoned the sterling-to-gold peg, the various currencies that were pegged to the pound decided to cut ties thereafter.

Here’s why the CNY, RUB(Ruble), INR (Rupee) or BRL (Brazilian Real) cannot replace the dollar:

In order to provide economies around the world with a reserve currency there first needs to be the right financial infrastructure and depth within the country. No BRICS country has an efficient, liquid debt market to start off with, the importance of this one component is a huge separating factor. Once countries trade in the global reserve currency (USD), their local central bank receives these dollar holdings and instantly becomes responsible for managing these reserves keeping them safe and liquid.

Now, when thinking of an economy with a liquid debt market, there’s only one outright winner, the U.S Treasury market. Boasting its $23.9T size, the Treasury market is the only feasible marketplace where corporations and governments can run to and issue dollar-denominated debt, and where other highly liquid markets such as the repo market exist for a near-to-instant turnover from securities to cash.

Although less relevant to the goal of the BRICS nations, one has to consider where the largest pool of investors play?

Definitely not in illiquid Chinese markets, neither on the sanctioned territory of the Russians and frankly speaking, you wouldn’t feel comfortable transacting with Brazil in the Real due to the large FX swings and recurring illiquidity issues.

If it was that easy, that simple to just switch and abandon the USD, don’t you think this would have happened already?

I’m not ruling it out— far from that, in fact, I believe we will see increased trade outside of the USD, but I’m not convinced that we’ll see a significant move away from the dollar like the media are portraying this to be.

Roll On The Commodity Shorts

Long commodities, one of the best reflation trades there is.

Why?

Let me first explain what is meant by a reflationary environment, this is an environment where global monetary policy aims to stimulate economic activity by increasing money supply, lowering interest rates and cutting taxes, (in some cases).

Post C-19 we were in a reflationary period, and in such a market regime, we go to our order of importance when it comes to driving economic activity. Starting with China, growth for China = increased demand for commodities across the board, so you’ll see indices like the CRB index (commodities index) rally.

Once the Fed and global central banks eased financial conditions, it was all highs until the Fed started tightening in June of 2022.

Now, we’re in a completely opposite regime, Fed tightening, a stagflationary environment (inflation decreasing but not negative), credit, liquidity and leverage all tightening with global growth set to flatten out.

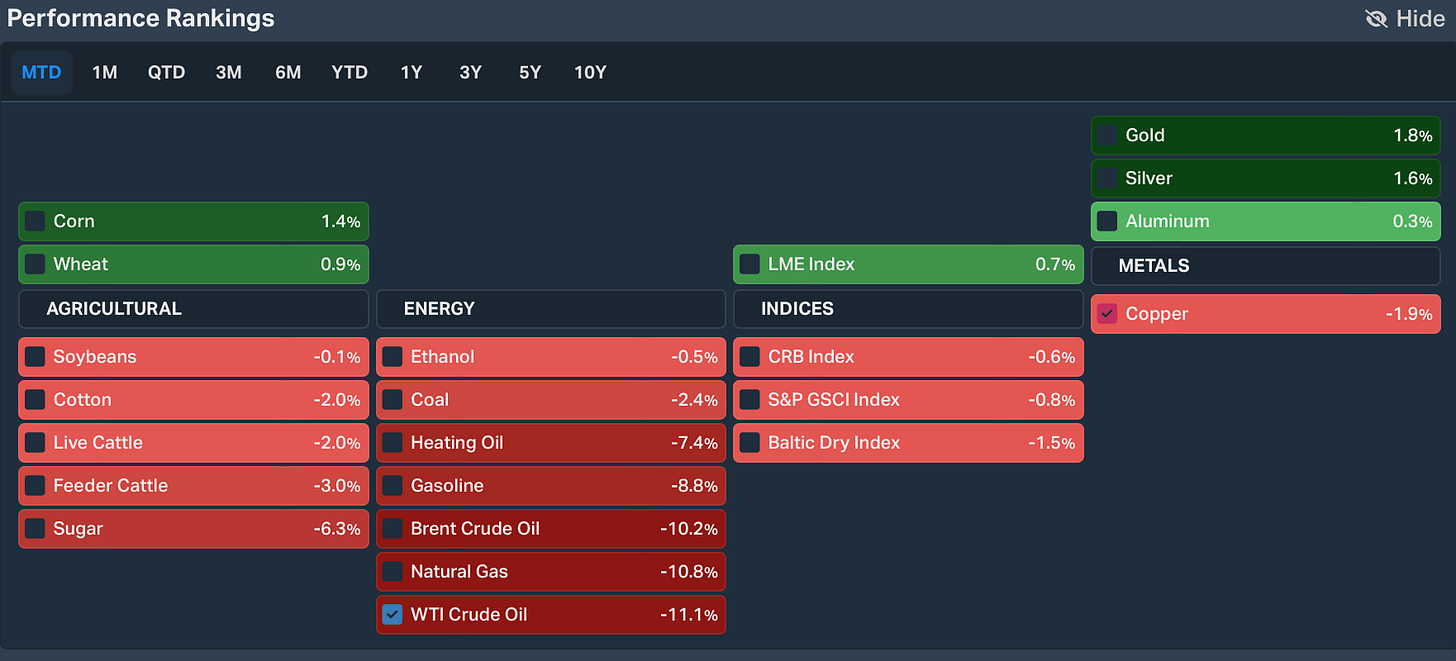

So the viable trade for such a regime would be shorts on such high beta assets like WTI Crude, HG (Copper) and other energy-based commodities in my viewpoint.

Personally, I will be exploring WTI Crude shorts, into the $62.00 per barrel handle, that’s my target and as economic data continues to roll out my conviction on this short-term trade may extend to lower targets dependent on data.

Macroclimate is leading us in one direction. the current data also is leading financial conditions in one way, the technicals align for a short opportunity as well so this for me is a high-level conviction position, I would like to see some relief first before continuing the bearish trend lower as WTI has not relieved or pulled back to garner further momentum to the downside.

A slowdown in U.S growth and economic activity is clearly being priced into WTI, recession fears are always ugly for Crude oil, now using our understanding of correlations, what currency has great exposure to WTI?

CAD.

So to reference the correlation map we looked at last time, we can see for the period dated Dec 29th 2022, the 100-day rolling correlation between the CAD and CL (Crude Oil) was 0.76 which is relatively high. Remember, the closer the number is to 1, the stronger the correlation, the closer the number to -1 the stronger the inverse correlation.

So a weaker crude price should add to the CAD weakness.

My bearish dollar viewpoint for Q2 remains the main play, Crude being my next conviction play as the global outlook weakens further.

That’s it for now, I’ll be giving my viewpoint on the Fed meeting yesterday and updating my viewpoint and OIL short viewpoint as we continue.

Catch up in the discord!