The Current Global Macro Picture

"Ultimately, nothing should be more important to investors than the ability to sleep soundly at night."

Seth Klarman - Hedge Fund Manager For Baupost

I don’t know about you guys, but sleep hasn’t been so good recently.

Let’s unpack what the current macro landscape looks like; I must say it is getting hard to constantly keep up with everything going on globally.

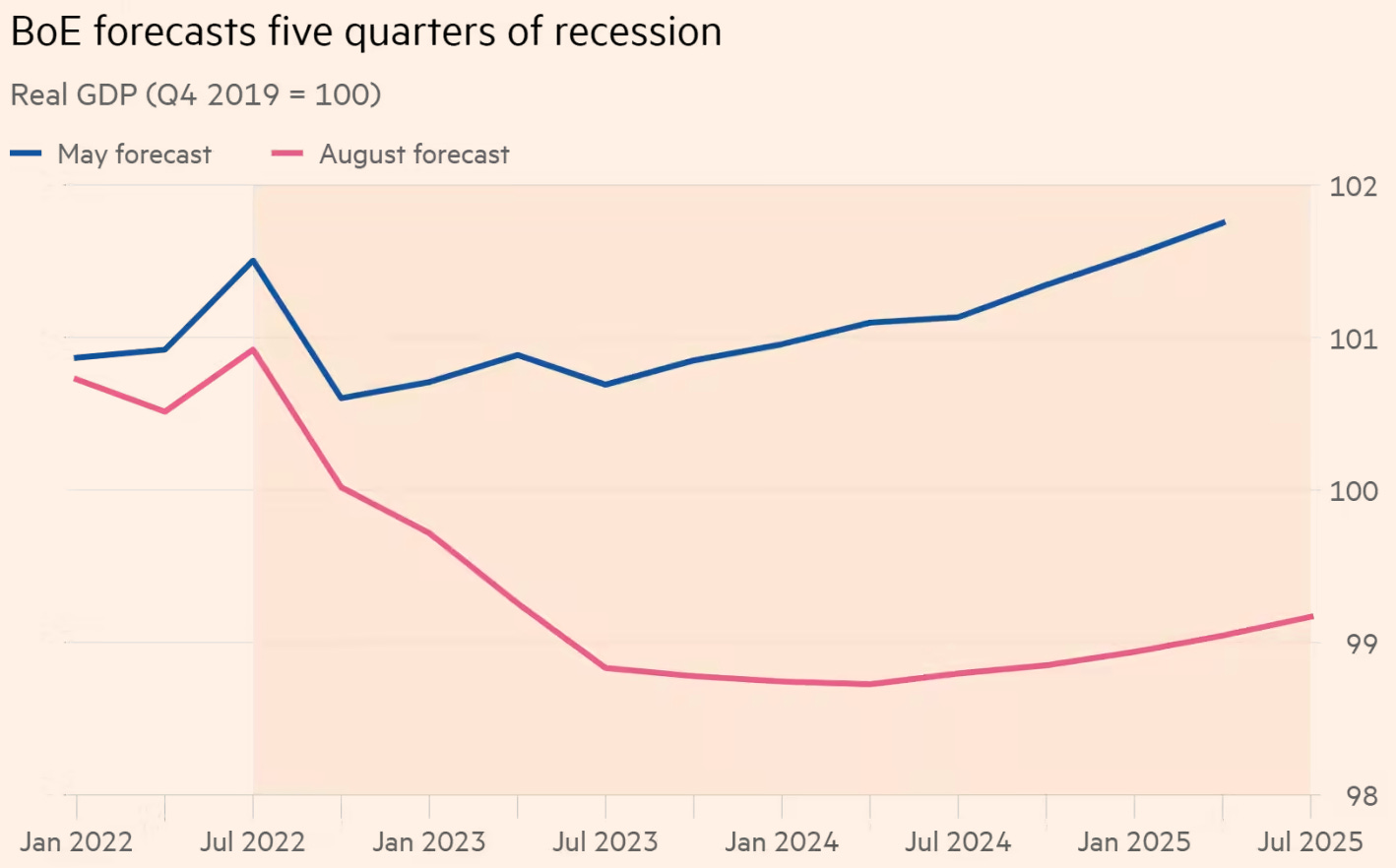

BoE “Five Negative Quarters To Come”

Last week we heard forecasts from the BoE predicting the Uk to enter a recession from Q4 ‘22. As we’ve all seen from the Fed, central banks rarely tell the truth when it comes to the reality of how bad things will get. “Transitory” and “temporary”, both terms we soon came to realise were lies from Jay Powell. However, the BoE is embracing the fact that the economy is going face-first into a period of prolonged turbulence.

As it stands right now, inflation is sitting at 9.4% and is expected to top 13% in Q4 of the year as gas & energy prices become evermore costly to Uk citizens. On the note of gas prices, we can expect the price cap to rise by around 75% in October compared to around 40% in the May report sighted from the BoE.

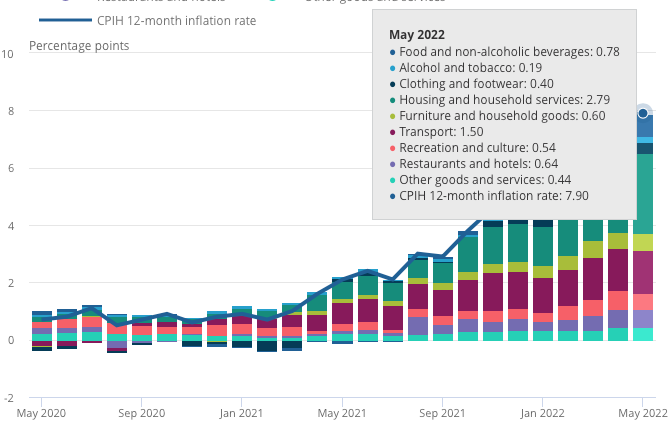

Take a look at the data for components contributing to UK CPI; you’ll see exactly where it’s all coming from.

I know it’s pretty difficult to read with the massive data label but you understand the meaning when seeing inflation broken down, component by component. The biggest factor at play, you guessed it, household services (gas & electricity). Now you’re probably looking at transport thinking what’s the reason it’s added an extra 1.5% to the annual inflation rate, well the reason ties back into the elevated petrol costs we’re experiencing at the minute. Such changes have ripple effects that aren’t susceptible to only one sector but the wider scale economy.

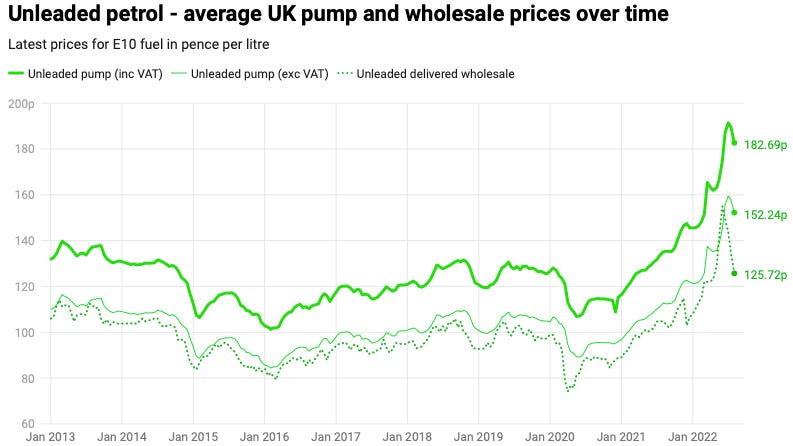

Just take at Chart 3 below to see how ridiculous things have gotten in petrol prices.

Historically we can say unleaded pump (the most popular form) has ranged between 110.00p - 131.00p. From the range highs of 131.00p until now unleaded pump prices are up 38.9%. That’s on the lower end… So from Jan ‘21 until now, petrol prices are up 56%.

Multi-decade high petrol costs, rapidly rising interest rates and a low/negative growth economy, a recipe for a disaster if you ask me.

The good thing is we can see what proceeds with every peak in prices, sharp decline.

Investors’ Risk Appetite Shifts Back To High-Risk Assets

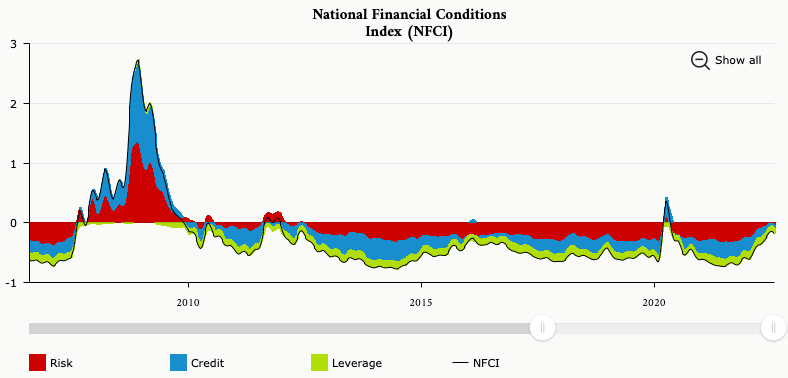

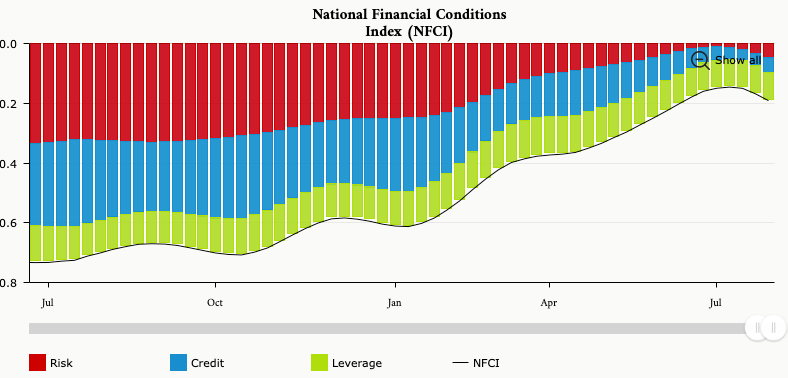

One chart that caught my eye after listening to a macro podcast was the NFCI, which is the National Financial Conditions Index created by the Federal Reserve Bank of Chicago; a release that comes out every week.

This index provides a weekly update on U.S. financial conditions in money markets, debt and equity markets and the traditional and “shadow” banking systems.

Now for a quick breakdown; the idea is that when the national financial conditions index is positive, as shown in 2008 & 2020, this is historically associated with tighter-than-average financial conditions. And for negative values historically this is associated with looser-than-average financial conditions.

So looking at chart 5, 2008 the U.S economy experienced tighter than average financial conditions which shortly declined to a financially looser than average period in markets. Then fast forward until 2020, the peak of covid where we had a sharp tightening in conditions mainly caused by fear/worries and panic over global growth.

Now if we are to take a closer look at more recent data, the past few weeks particularly the last two weeks have presented some very interesting messages to asset markets.

“It’s time to just go to a meeting-by-meeting basis and to not provide the kind of clear guidance that we had provided,”

— Fed Chair Jay Powell

“I guess I'd start by saying we've been saying we would move expeditiously to get to the range of neutral. And I think we've done that now. We're at 2.25 to 2.5 and that's right in the range of what we think is neutral”

— Fed Chair Jay Powell

*Mic drop

Now I hope you’re understanding the direct importance such press conferences have on financial markets/conditions. Over the past three weeks, we have seen financial conditions materially loosen which has sent investors seeking risk assets.

Look at equities over the past few weeks, names such as Coinbase and Uber are just a few to name who have felt the massive (short-lived) optimism of markets. Bear in mind Uber reported its first positive cash flow quarter ever and it’s up north of 40% this past month.

If you ask me Jay Powell is having another moment he might want to forget, although it’s always easier looking in from the outside.

What we’re seeing right now is a disconnect between what is actually happening globally, supply chain issues, energy prices set to push inflation to double digits, and even lacklustre growth and what investors are pricing in within asset markets. I won’t even go into what’s happening within bond yields but inversions across the 2s/10s yields are showing just that. The front-end yields are loaded with hikes to kill inflation, whilst backend yields are lower in anticipation of lower growth/lower rates.

All in all, there seems to be a bit of fog and smoke appearing. At the end of the day, as Seth Klarman said, the most important thing is whatever decisions you’re making, you’re able to sleep peacefully at night with them.

Thanks for reading through to the end. I put a bit more depth within this piece and would appreciate you sharing it with everyone and anyone; the Market Macro Hub community is growing rapidly and I can only thank you guys!

Until next time.