The Cost of Conviction: Lessons From a Trading Drawdown

How to Rebuild Conviction When Confidence Fades

Hey guys,

Today’s note is less structured, I just want to free flow a few thoughts that have been bouncing around my head about trading.

No big framework, no fancy charts, just raw observations on what’s been working, what hasn’t, and how the mindset shifts with the market.

Let’s begin.

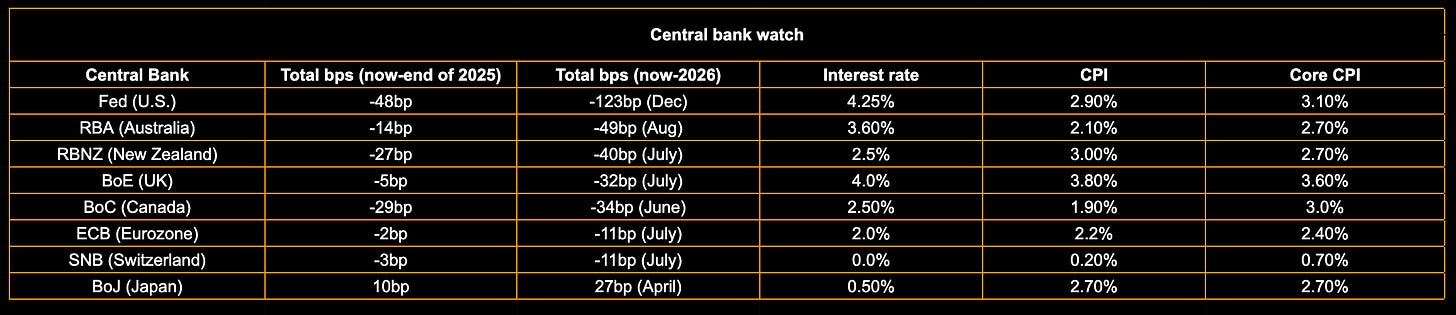

Central bank tracker

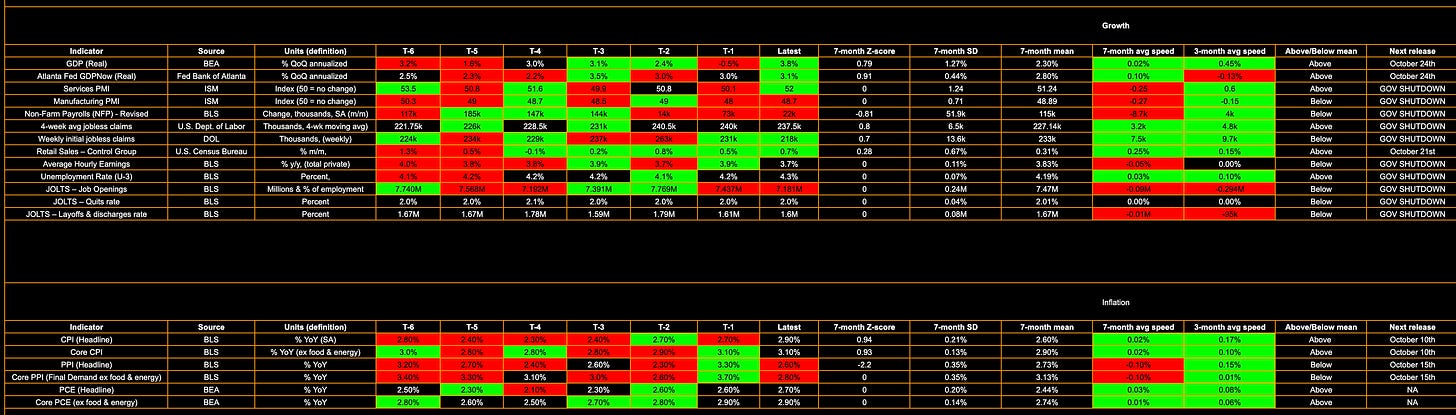

U.S. data tracker

(will be updated from next week when data is released)

The Other Side of Discipline: Navigating Rough Patches as a Trader

Guys as you’ve seen across the last few months the trade ideas have been great, but then from mid-October I’ve hit a rough patch and I want to talk on that because I think it’s a massive challenge that every trader faces no matter how far on you are in your journey.

Now, everyone will define a “rough patch” differently. Mine is currently around -6.12% from portfolio ATHs, which to me is significant (although I’m well up since I began giving ideas in April, 15.53% as I’ve shared with you all). Not a catastrophic drawdown, but meaningful enough to make you stop, think, and question. Especially when you’ve got things like track record audits in motion. Suddenly, a drawdown doesn’t just feel like a number, it feels like scrutiny. You start thinking:

“Will my next few trades pull me back to highs?”

“Or will they just dig me deeper?”

I’ve missed a few big trades that the models I run actually produced for me, clean setups, confirmed signals, but I wasn’t sharp enough to execute. I became complacent with the models and overly active with my macro. I wanted to shed light on this because I genuinely don’t see it discussed anywhere else on Substack.

Everyone loves to post when they’re in form. But no one talks about when you lose touch, when your confidence dips, when you’re trying to recalibrate while still showing up each day. We know that every great trader (literally every single one) has these periods. I like to face them head-on, write them down, dissect them, and extract the lesson.

When your mentors are running trades seamlessly, it’s easy to start doubting yourself:

“Should I scale down?”

“Is my macro framework off?”

“Am I being too patient… or not patient enough?”

That internal friction is part of the process. But it’s also one of the hardest things to navigate.

1. When Winning Becomes a Trap

One of the most dangerous parts of trading success is that it breeds expectation inertia, the idea that the next trade should work because the last five did. You don’t even realise you’ve crossed that mental line until something shifts.

The strange part is, the better your run, the worse the first losses feel. Because they don’t just hit your PnL, they hit your sense of rhythm. Trading is ultimately about flow, the ability to dance with uncertainty without forcing tempo.

But when performance dips, that rhythm breaks. You start to overthink small things like spreads, entries, timing, confirmation (all the details that used to flow automatically now feel mechanical). And once you lose that intuitive feel, everything feels uphill.

It’s not about fear of loss, it’s about fear of being out of sync with your own process.

2. The Subtle Drift of Overconfidence

After a few months of consistent performance, it’s easy to forget what grounded you. You start “optimising” models mid-run, adding filters that weren’t there before, swapping inputs, or second-guessing a perfectly fine structure because you “feel” the market changing.

That’s the silent killer: process drift. It doesn’t happen overnight, it happens through a thousand small tweaks justified by confidence.

You think you’re adapting, but you’re actually diluting your edge.

For me, I noticed it in my macro layer there were too many narrative inputs, too many variables. Instead of letting the model do its job, I was overlaying a discretionary interpretation that turned precision into noise.

A healthy discretionary overlay is about context, not correction. Once you start “correcting” your model because you think you know better, you’re stepping into a fight between discipline and ego. And ego will always rationalize risk.

3. Psychological Debt

Drawdowns don’t just create financial debt, they create psychological debt. The longer you stay in one without re-grounding yourself, the more mental capital you spend trying to “earn it back.”

That mindset creates a dangerous loop:

You start trading to fix a feeling, not express an edge.

You shrink risk when you should stay stable.

You press risk when you should stay patient.

What makes this tricky is that a 6% drawdown isn’t large enough to trigger emergency brakes, but it’s large enough to distort your decision-making subtly. You think you’re fine, but deep down, your subconscious is negotiating every entry.

That’s where traders spiral. Not from the big hits, from the slow leaks of conviction that go unaddressed. Key word there, CONVICTION.

4. The Audited Mirror

I’ve been open about wanting my track record audited, and that goal has introduced a new layer of reflection. It’s one thing to trade privately; it’s another to trade knowing every move will be transparent.

It makes you aware of how perception interacts with process. You catch yourself thinking:

“If I take this loss, it’ll show up on the audit.”

“If I sit out, will it look like I’ve gone flat?”

This isn’t vanity, it’s the collision between transparency and psychology. But it’s also a powerful discipline test. Auditing forces you to define what your real identity as a trader is.

Am I someone who bends under external pressure?

Or someone who still executes their process even when the scoreboard is public?

Auditing has made me realise that a track record isn’t just a marketing asset, it’s a self-reflection tool. It measures consistency of behavior under observation.

5. The Friction Between Macro and Models

Running macro frameworks alongside systematic signals is a blessing and a curse. The blessing is insight because you see the bigger picture. The curse is interpretation (you think the bigger picture gives you permission to override structure).

For me, I’ve noticed that when macro noise is loud (tariffs, geopolitics, policy narratives) I start anticipating my model instead of following it. I can sometimes subconsciously tell myself,

“This model is great, but maybe it doesn’t fully account for X.”

That’s the trap. You start defending your mind instead of defending your system.

The key lesson I’ve relearned here is that macro is context, not direction. It frames why a signal might perform, but it should never replace when the signal triggers. My edge comes from being structured.

6. Confidence vs Competence

It’s worth distinguishing between two very different things:

Confidence: how good you feel about your next trade.

Competence: how aligned your next trade is with your process.

In drawdowns, confidence evaporates first, even if competence is still intact. You can still be executing solid setups, but you’ll doubt them because they don’t feel as good.

That’s why journaling, logging, and even writing posts like this matter so much because they externalise your process. They remind you that competence isn’t measured in emotion, it’s measured in fidelity to your structure.

When confidence fades, your only anchor is the objective repetition of competence.

7. How I’m Recalibrating

I’ve slowed everything down. Not in terms of screen time, but in terms of pace of thought. A good friend told me that the best traders think critically, brilliantly. I’m rebuilding rhythm, not through avoidance but through deliberate practice.

I’m always sharpening my franework, clearing my mind and becoming a better thinker. The goal isn’t to rebuild confidence, it’s to rebuild clarity. Once clarity returns, confidence follows naturally.

This phase is about humility. A rough patch isn’t a moral failing, it’s a structural feedback signal.

8. The Deeper Lesson: Conviction Has to Survive Doubt

One of the hardest lessons I’ve learned this month is that conviction doesn’t exist because you believe in your framework, it exists because you test it through disbelief.

When everything is working, conviction feels effortless. But when you’re 6% down and every new entry feels heavier than it should, conviction is something you have to rebuild through data and discipline, not emotion.

In a way, this is what separates traders from strategists. A strategist can be right conceptually, but a trader has to be right behaviorally.

The market doesn’t care about the elegance of your model, it cares whether you can execute it when your PnL is in pain. Once again, conviction is needed.

9. What I’ve Learned from Mentors

When I look at the people I look up to (traders running multi-strategy books, macro PMs who’ve seen dozens of regimes), there’s one thing they all have in common: emotional velocity control and ultimate conviction.

They don’t avoid drawdowns, they manage the slope of how they move through them.

They scale risk before they lose composure, not after. They log errors before they rationalise them. They understand that losing rhythm is about being temporarily uncalibrated.

That’s something I’m internalising again. To be able to step back mid-drawdown and say,

“My framework isn’t broken, I’m just out of sync.”

That’s maturity.

10. The Long Game

I’ve realised that rough patches are not just interruptions but they’re actually essential intervals in the broader rhythm of compounding.

Every portfolio that compounds over years has internal drawdowns. Every trader who survives decades has internal recalibrations. You don’t skip these phases, you earn them.

The irony is that the better your process, the more boring the eventual recovery feels. You don’t notice the turning point because it’s gradual, it’s not one huge trade that fixes everything, it’s twenty small disciplined ones that quietly rebuild structure.

That’s where the real edge lives, in recovery behavior.

11. Where I’m At Now

I’m in a rebuild phase. Focused, quiet, not defensive. Letting the models lead, cutting discretionary chatter, and rebuilding rhythm brick by brick.

This isn’t about chasing highs again, it’s about re-grounding. If the models produce another 6% swing back up, great. If they don’t, that’s fine too. Because what matters now is realignment (knowing that my process remains durable through both sides of the curve).

If you’re reading this and going through something similar, whether you’re down 2%, 10%, or just mentally fogged, I’ll say this:

You don’t need to reinvent yourself. You just need to slow down, tighten structure. Trust that skill doesn’t vanish, it just gets buried under noise until you quiet things down enough to hear it again.

Closing Reflection

Every trader wants the equity curve that goes up and to the right. But the real growth happens in the dips, in the moments you start questioning everything and still choose to show up.

This business rewards conviction in winning periods and resilience in downturns, the ability to keep operating under uncertainty, to keep writing when you feel off, and to keep refining when no one’s watching.

If this resonates with you, drop a comment below, I’d genuinely like to hear how you handle your own rough patches. Because that’s the side of trading that builds character, and it’s the side no one wants to talk about.

this is good and needed, also going through this and your post just actually light a spark in what I needed to realise as per what I've been doing wrong and what I need to do rightly and consistently, what I need to change in my current attitude and behaviour towards the drawdown and bump in the journey and how I can navigate it to be better, more process focused

We have to keep moving forward step by step. When we feel off acknowledge it take a step back recalibrate and continue building momentum. You got this Alf!