S&P's Worst April in 52 years

“What is most important isn’t knowing the future—it is knowing how to react apporpriately to the information available at each point in time” Ray Dalio

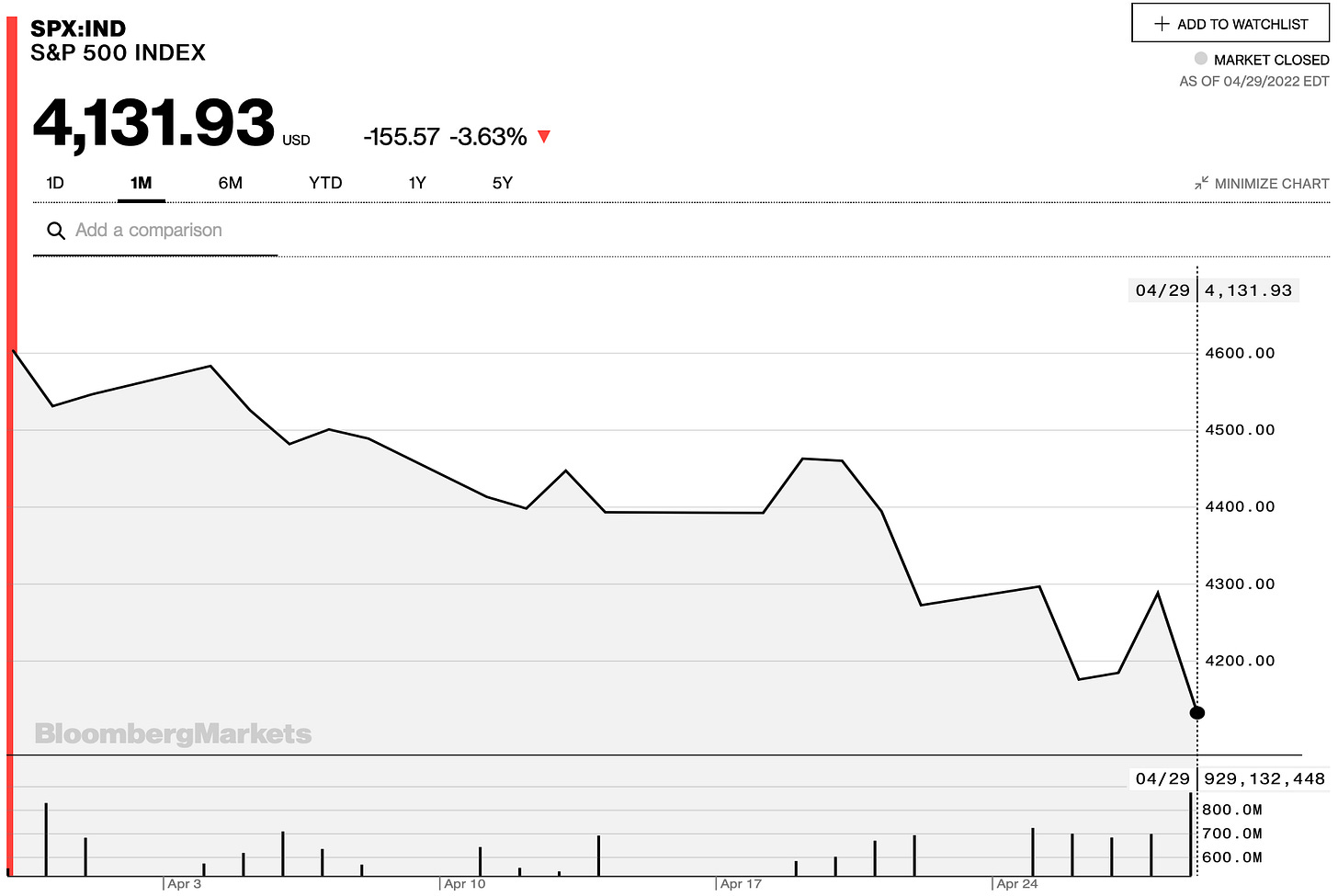

Red for Equities

The S&P closed off April with its worst performance in 52 years; the average performance for April being 1.4% the negative 8.8% has been the worst month since the Covid-19 panic of March ‘20. All around U.S equities faced a rough month leading into May which usually presents the old "sell in May go away” saying time and time again.

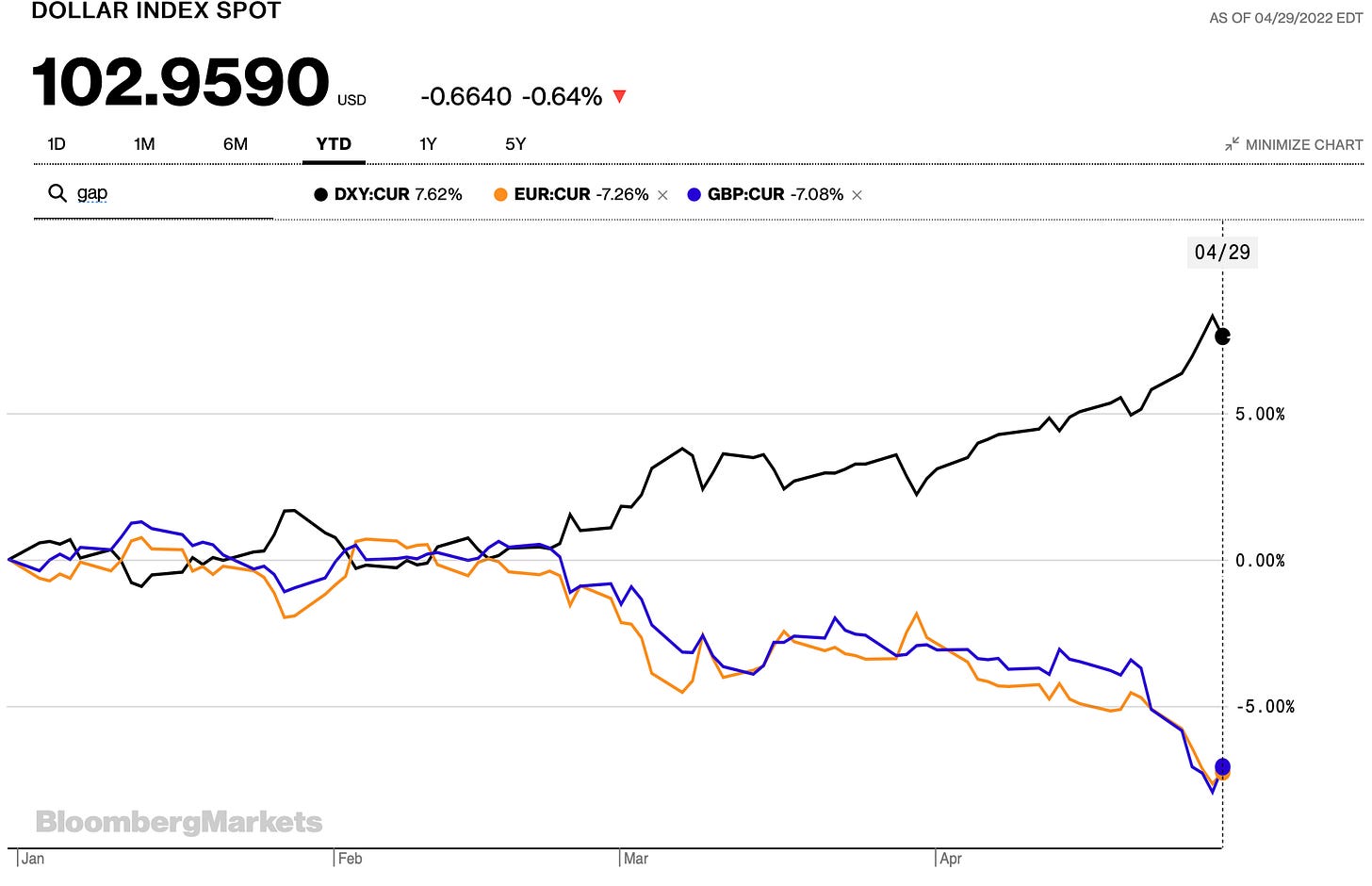

Dollar Surge & Corporate Earnings

Over the past month, we have seen the dollar reach a two-decade high fueled by a number of geopolitical and macro factors. In times of economic and geopolitical uncertainty, there’s one safe haven that investors flock to more than anything, and it’s not gold. The dollar has seen flows as the ongoing war in Ukraine escalates with more attacks on the country, a resurface of fears as Chinese major cities such as Beijing and Shanghai enter lockdown in attempts of reducing Covid figures.

Not only is a war and covid escalating the demand for the dollar but an extremely hawkish Fed monetary policy is widening the interest rate differential between the U.S and major central banks (BoE, ECB & BOJ). With back to back 50bps hikes forecasted for the Fed at 95%>, you have to think where are investors most likely to hold their deposits? That’s right, the dollar.

With opportunities to generate alpha in public markets dwindling, right now investors seem to be pulling out of risk assets and moving into cash positions with research showing investors withdrew $27 billion from the largest equities-focused ETF funds in April. U.S GDP contracting by 1.4% in Q1 only provokes the concerns that the Fed are on the route to leading the economy into a recession, which only requires two consecutive negative quarters.

As corporate earnings drag, we must remember that a strong dollar presents only further challenges for institutions to pull out good figures. A study case was Apple in 2015, where a strong dollar forced the company to raise prices in stores ranging in New Zealand, France, Canada, Australia, Denmark and Sweden.

Bank of Japan

If you haven’t seen dollar-yen rates you’re in for a shock.

For years now the Bank of Japan has been implementing a policy known as yield curve control (YCC) in hopes of stimulating its low growth economy by capping Japanese 10-year bond yields at 0.25%. Unfortunately, that has had little success in the country as low growth still remains the Achilles heel of the nation. BoJ Chief Kuroda reaffirmed his stance adding clarification that they “will offer to purchase 10-year JGBs at 0.25 percent every business day through fixed-rate purchase operations”. Now you don’t need to understand the full grasp of what his comments mean but rather turn to the Yen rates to see the true reflection.

The Yen weakened to multidecade lows against the dollar, the message understood by investors is simple, the BoJ believes the Japanese economy is too fragile to tighten monetary policy near to the pace of other central banks amidst the inflation crisis. The dollar-yen rate sits at 129.00 levels not seen since 2002.

I hope you have enjoyed this in-depth macro breakdown! I’ll be back with more material like this!

If you appreciate my efforts to deliver this material it would mean the world for you to share this piece within your network/social media!