Recession Fears & Demand Destruction

Once an economy reaches a certain level of acceleration... the Fed is no longer with you... The Fed, instead of trying to get the economy moving, reverts to acting like the central bankers they are and starts worrying about inflation and things getting too hot. — Stanley Druckenmiller

Where Are We Now?

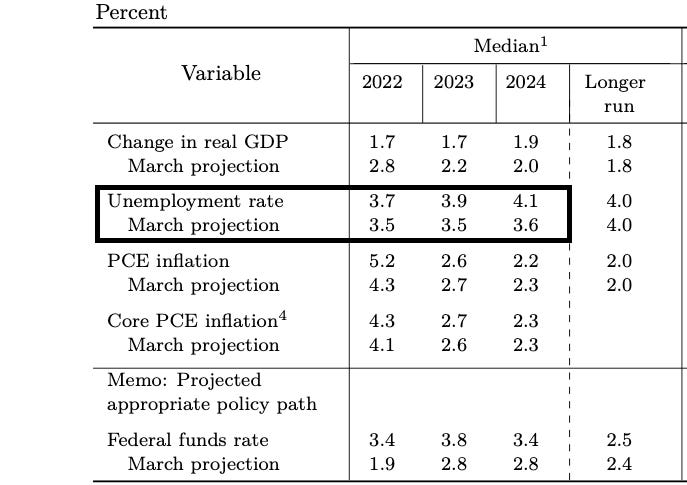

Starting off with the FOMC speech last week where we heard from Fed Bullard and Waller who both openly backed another 75bps hike in July followed by 50bps until the neutral rate of 2.4% is met. From this point forward they would want to see hikes reduced to 25bps upon review of economic conditions. Waller had this to say about the U.S economy:

“We need to move to a much more restrictive setting in terms of interest rates and policy and we need to do that as quickly as possible”

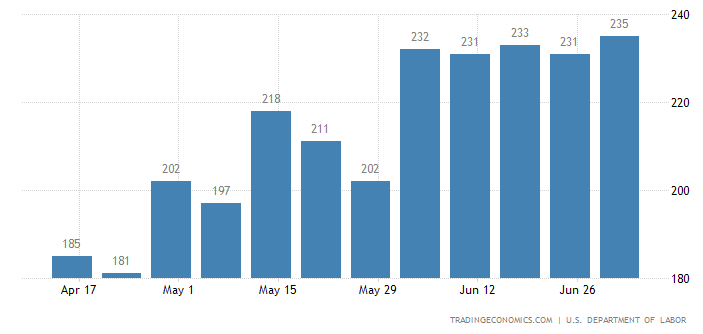

It seems like the Fed is viewing the economy with a completely different lens than what we’re currently seeing. As it stands the Fed seem to draw its conviction and hawkish tone from the present labour market NFP readings which beat the expectations of 268k by 104k totalling 372k over the month of June. Not bad I must say. But let’s take a look at the chart below; as you know I always prefer leading indicators over lagging data i.e (Non-Farm Payroll)

Jobless claims are a forward-looking indicator of the health of the labour market; from what we can see from the most recent reading, the amount of individuals filing for unemployment has risen to levels not seen this year; to add on, since June we have been at elevated levels compared to the period of Apr-May. So what is that actually telling us?

Very straightforward, the U.S has peaked in strength within the labour market and with the current pace of tightening within the economy, there has to be a trade-off. Either inflation or employment. We already know the Fed is willing to see unemployment reach 4.1% in 2024 so the next observation is to look at what happens when we get an unwinding of lay-offs and firings (something we’ve seen already in Tech firms thus far).

You guessed right, a recession. In this unique scenario that will be combined with demand destruction.

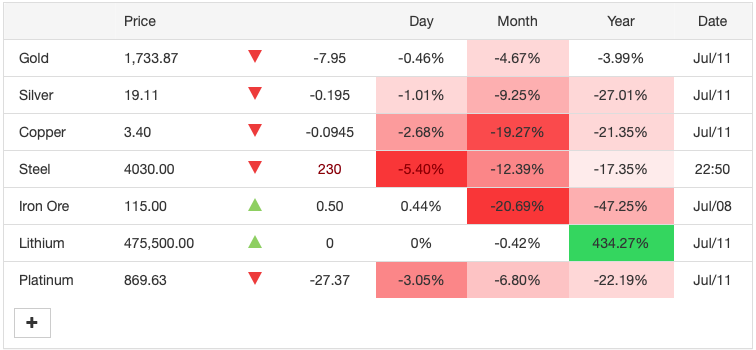

Let’s couple the view above with a look at the current commodity landscape and what message is being delivered.

When it comes to understanding global growth/cycles there’s no better commodity to look at than copper. With its multi-dimensional use cases, this commodity is a leading indicator of the current level of demand within the economy. When global demand is expected to pick up we’ll see a rally in commodities such as copper and even oil since these two are direct sources for fueling the growth cycle.

The same is true for global slowdowns, copper will be the first to let you know when demand is off, or in this case en route to destruction.

Not only is the aggressive tightening of the Fed sending market signals that demand is already being destroyed but further lockdowns in China due to covid cases is sending commodities to new lows for the year. Just take a look at the returns of Iron Ore, Copper and Silver. Painful. If you recall my piece where we covered China being the leader of global synchronised growth, you may be able to put two and two together to realise China is also the largest consumer of copper globally. So what happens when you take your biggest buyer and lock them down?

Copper alone is down -20% for the month!

The next topic to prove how demand is already being destroyed is consumer credit and the potential for us to start seeing defaults later this year as higher yields make it increasingly harder to finance debt. I’ll save that for another piece, the main thing to remember is that in the economy we live in today, credit is what drives the world. One man’s debt is another man’s asset and so forth, as credit increases, we have periods of great conditions (expansions) followed by over-leveraging which leads to our current positioning within the curve where credit is withdrawn and those overleveraged are left dancing to the tune of the easy-access-cash, yet to realise the music has stopped and the Fed is hiking.

Thanks again for your consistency in reading through! If you’re new, make sure to give some feedback and share with your macro-addicts!

See you soon!