Rate Hikes Galore

“

You must always be prepared for the unexpected, including sudden, sharp downward swings in markets and the economy. Whatever adverse scenario you can contemplate, reality can be far worse.

” — Seth Klarman

BoE’s Rush To Kill Inflation

Let’s talk markets.

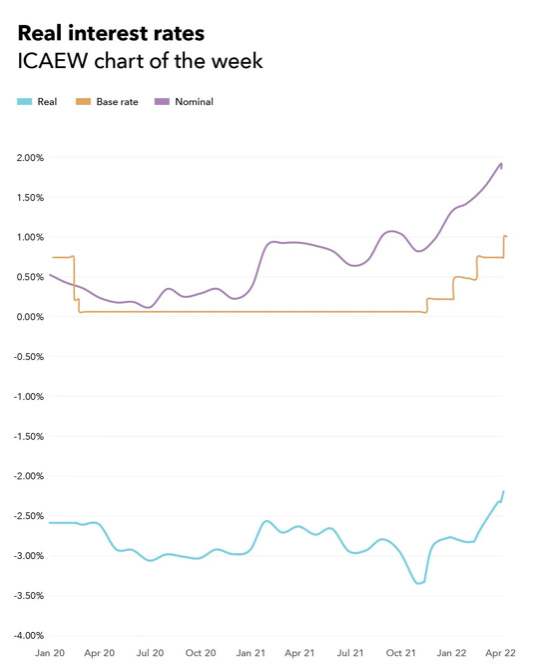

Up until now, the Uk has maintained an extremely accommodative monetary policy stance with rates at or just above 0%. So if we’re speaking about real interest rates (which accounts for inflation during a period of time) then we have really had negative rates since the GFC (Great Financial Crisis) in 2009.

For those who may not be familiar with real/nominal rates; let me quickly break that down.

Nominal interest rate refers to the rate of interest before adjusting for inflation; e.g if a bond is paying 2% per year then the nominal rate/yield would be 2% as we wouldn’t need to adjust for any other measurement.

Real interest rate as you can assume by the name refers to the rate of interest after adjusting for inflation. So with the same example if inflation across that one-year period was 3.5% then the real interest rate earnt on that bond would be -1.5%. Pretty straight forward right?

Negative real interest rates are considered to be accommodative to the wider economy, allowing credit to flow easier within the financial system. As Ray Dalio correctly said we live in a credit-centred economy where we bring forward tomorrow’s expenditure to today. And that’s exactly how we end up over-leveraging up until we fall into a credit crunch, but that’s not where I’m going for today!

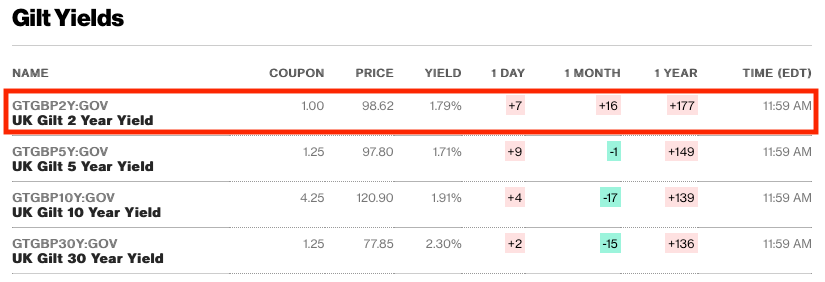

Currently, the base rate is sitting at 1.25% across the Uk with markets pricing in a hike of 50bps today at noon. Now, something I’ve been paying a bit more attention to is the bond market, mainly because it’s frankly a great forward-looking lense on where investors price rates to be in the future.

Now, I’m no pro on the bond market but it doesn’t take an economist to see a potential flattening in the yield curve as conditions continue to weaken in the economy, let’s put it at a 40% probability.

FYI, investors, banks & literally everyone pays massive attention to what yield curves are doing as longer-term yields should be higher than shorter-term yields due to the increased risk associated with holding a bond over a longer period of time things such as rate hikes, inflation etc make investors require a risk premia on such term investments.

From where we are now I see an ever-increasing chance of a curve flattening in yields, meaning the economy is entering prolonged stagflation/low growth which would force the central bank to keep rates low or even cut back on the hikes we’ve recently seen.

Unless we get a super-sized surprise from the BoE, which I doubt but do not completely rule out, the pound is probably well priced at 1.2100

RBA Goes All In.

A wise man once said “don’t hate the player hate the game” — That wise man may as well be this man right here, Philip Lowe. What a guy.

In response to a tonne of outcries for him to resign Philip Lowe presses forward with his belief that tighter monetary policy conditions are required to cut inflation at its knees.

As it stands rates in Australia have risen back to back, meeting upon meeting to 1.85% as of Tuesday morning where rates were positioned at 1.35% before an additional 50bps was added onto the base rate.

Now although the RBA may not be one of the “major” central banks everyone pays attention to it’s still equally important to have an understanding of what central banks globally are doing and how they are reacting to this chronic pain of inflation globally.

Thanks for reading all the way through! As usual share with your macro heads and I’ll leave you with this quote; that applies to life and investing/trading:

“You have to say to yourself, "If I'm right, how much am I going to make? If I'm wrong, how much am I going to lose?" That's the risk/reward ratio.”

Peter Lynch