Queue The Fed Tightening...

Here’s the key to understanding risk: it’s largely a matter of opinion

— Howard Marks

Anticipation of aggressive Fed policy

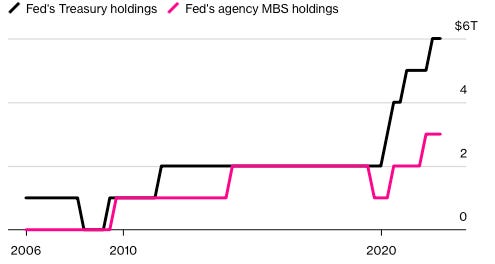

U.S10Y bonds slid to 3% escalating losses for the bond market as traders reposition in anticipation of a 50bps point hike by the Fed. U.S equities managed to close slightly higher for the day on Tuesday, however, the fears lingering around risk assets is what path the Federal Reserve will take to reduce its balance sheet, which sits at $8.9T.

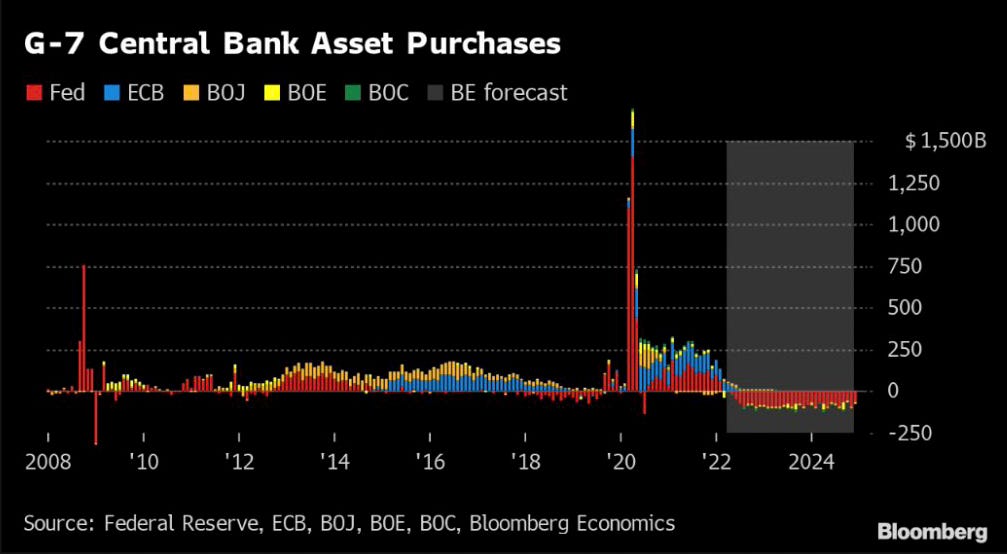

Leading up until now the markets have been graced with a period of massive stimulus from central banks, adding up to more than $22bn this past year. In this goldilocks environment, it really is hard to be wrong when the Fed is buying up everything including stocks, the real challenge is how to navigate markets whilst the Fed runs off its balance sheet. Markets are already seeing the ramifications of a slowing economy although major indices may not present this at the current time.

In the March minutes, we heard first news of the Fed planning to tackle its balance sheet run-off by a reduction of $95 billion per month. Investors fear the unknown as the Fed shrink liquidity in asset markets, particularly the bond market which drives all things from equities to general day to day financing on mortgages and loans.

Eurozone

Heading over to Europe today we will hear from President Lagarde on the state of their economic health and possibly any signs for their future policy meetings. As it stands the upcoming June ECB meeting is set to be the most important meeting thus far for the ECB as the end of their asset purchase program is set to come in the third quarter according to the central bank. This could then lead to a hike plan for the Eurozone which has fallen behind the tightening cycle of the Fed & BoE.

For now, sit tight and react to the Fed Press conference which is set to deliver all of the fireworks!

We’ll be back again tomorrow — Make sure to subscribe for more insights!