Q1 Market Recap & Q2 Forecast: Equities and the USD in Focus

Assessing Q1 Performance & Navigating Q2 Trends

Hey guys,

This report is near the email limit, so buckle up.

Q1 has produced the most volatile and uncertain market I have traded, thanks to Trump.

It’s in these times that you are often paid for sitting on your hands, I have learnt more in this quarter than I did in the two previous quarters because these market conditions are very unique.

From rally’s to downturns, it’s been very interesting to watch.

Some say trading is boring, but doesn’t uncertainty and prediction give you a thrill?…

Anyway, let’s get into forward thinking and take a look at what Q2 has to offer.

Q1 performance

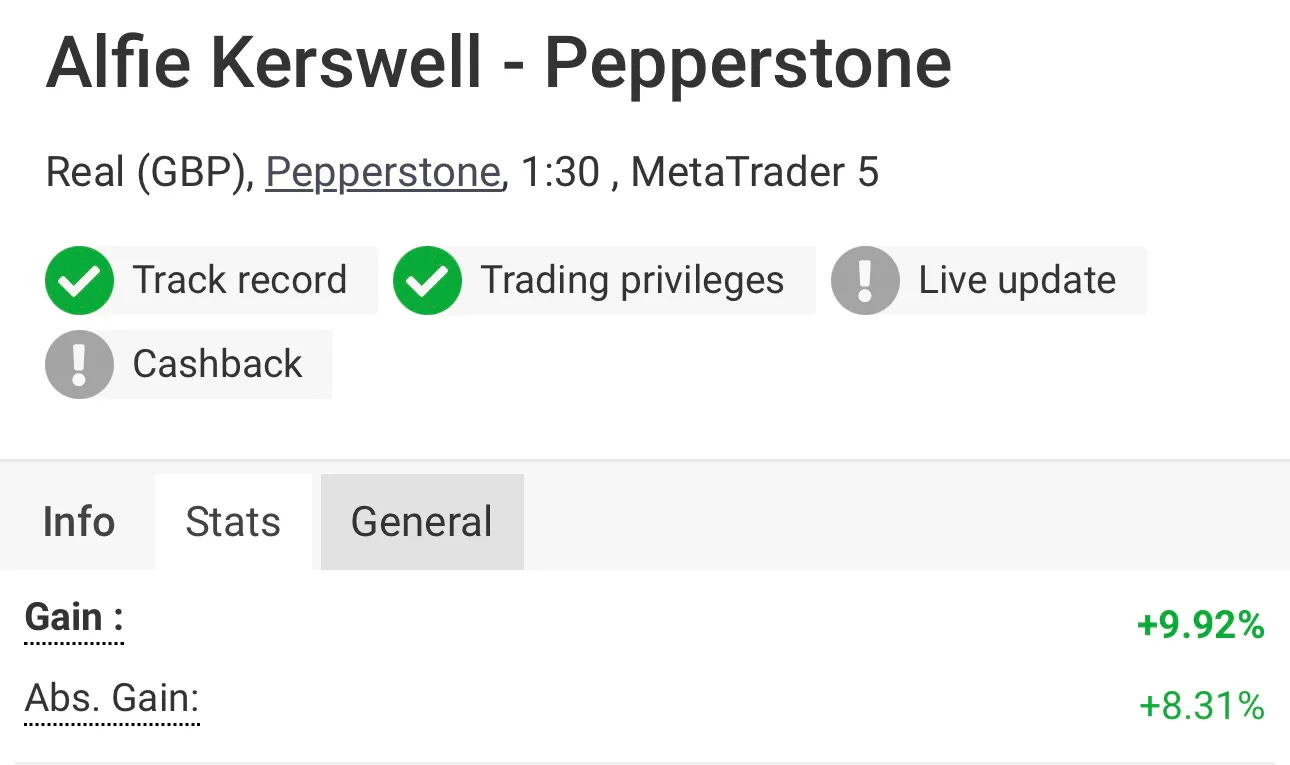

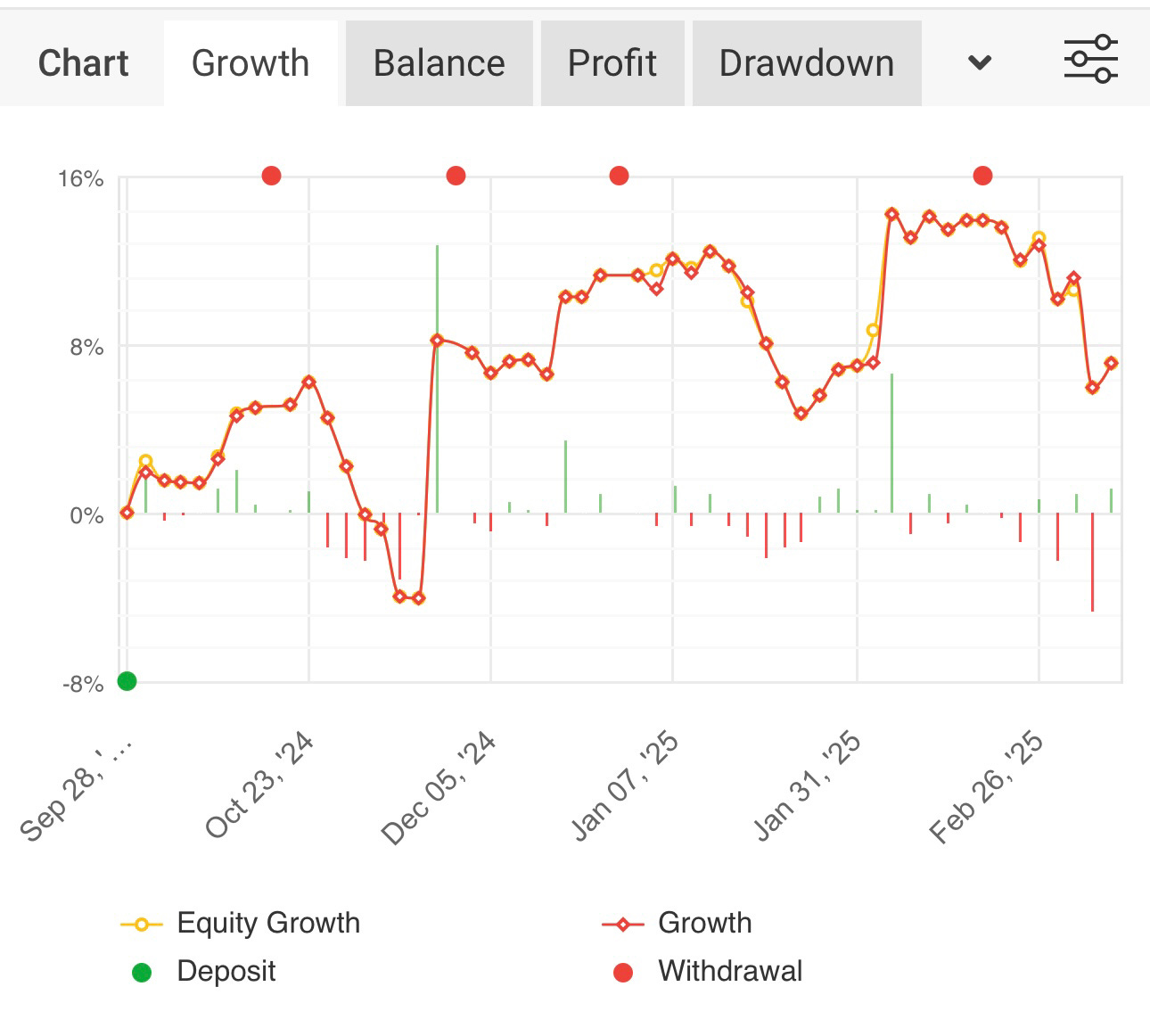

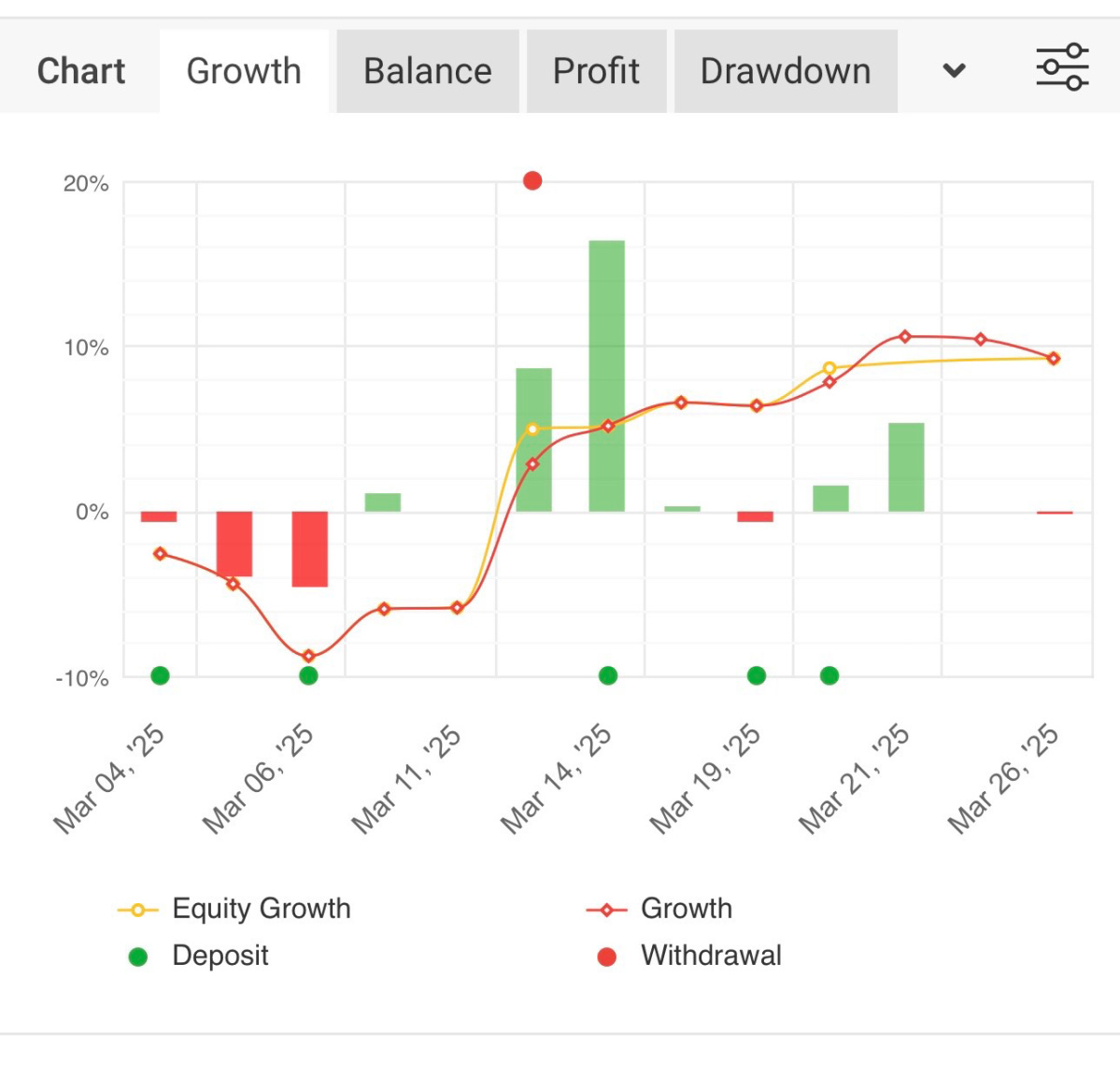

Q1 has been great, I finished it 9.92% in the green. You will notice from Figure 2 how January and February were very volatile for my positioning, this volatility led to a near breakeven two months which was then counteracted by an amazing March, a very good way to end the quarter.

From Figure 2 below, you will be able to see my performance from September-February, then March is seen in Figure 3. The reason for separation in charts is because I am now using a FCA regulated broker rather than a broker regulated overseas.

I’m expecting market volatility to be lower in Q2 compared to Q1, but still remain high. Uncertainty in markets should also decline as Trump’s policies become more concrete rather than words of mouth.

Q2 outlook

No market mover or macro watch this week because a lot of focus is in the U.S. which the report is about so I don’t want to repeat myself, let’s get straight into the business!

U.S. Dollar

My calls back in December 2024 for a bearish U.S. dollar for H12025 have been very fruitful (DXY is c.-3.9% YTD). See Figure 4 below:

there isn’t much reason to make me believe that this won’t continue for Q2. Firstly focusing on tariffs, if Trump imposes them at levels he discussed (and sticks to his word) next week, the dollar needs to be materially weaker if they want the word “recession” off of consumer tongues. Tariffs may give a brief support to the USD but it’s not going to be a driver higher. On the inflation side, there is only downside on the longer term projection (3months+) in my opinion because tariff front-running will be seen (if it has happened) in the next months print and higher prices will likely be temporary, so by June we could have stable disinflationary pressures.

This inflation outlook means that once again there is only downside to the pricing for the Fed’s rate, adding to my bearish dollar view. The great thing about my inflation view is that whether tariffs are imposed or not, I don’t see the upside to inflation being a game-changer for rates, so I’d say my highest conviction play for Q2 is that inflation will not cause rate cut expectations to decline.

As seen in Figure 5 above, there is c.13bp of cuts priced in for June. I’m very much expecting the 25bp cut to go ahead in June and this will likely provide support to most equities regardless of tariff implementations.

Let me just add to my weaker dollar idea…

The pricing of these rate expectations are based on the current tariffs (25% on aluminium and steel & 25% on all car imports & parts) and tariff expectations. The likelihood is that Trump will not overdeliver on these tariffs (again) so it creates an “only downside” idea to rates and inflation. Not only am I basing the under-deliverance of tariffs on history, but also based on the US’ mighty power. Nations are cornered by them, the EU and Canada initially wanted to form some sort of alliance against the U.S. tariffs. This now becomes too difficult to facilitate because Trump has warned that if this happens, he will be left with no choice but to impose harsher measures on both economies. So if nations are struggling to fight the U.S. with tariffs, Trump doesn’t need to impose them so hard on these countries.

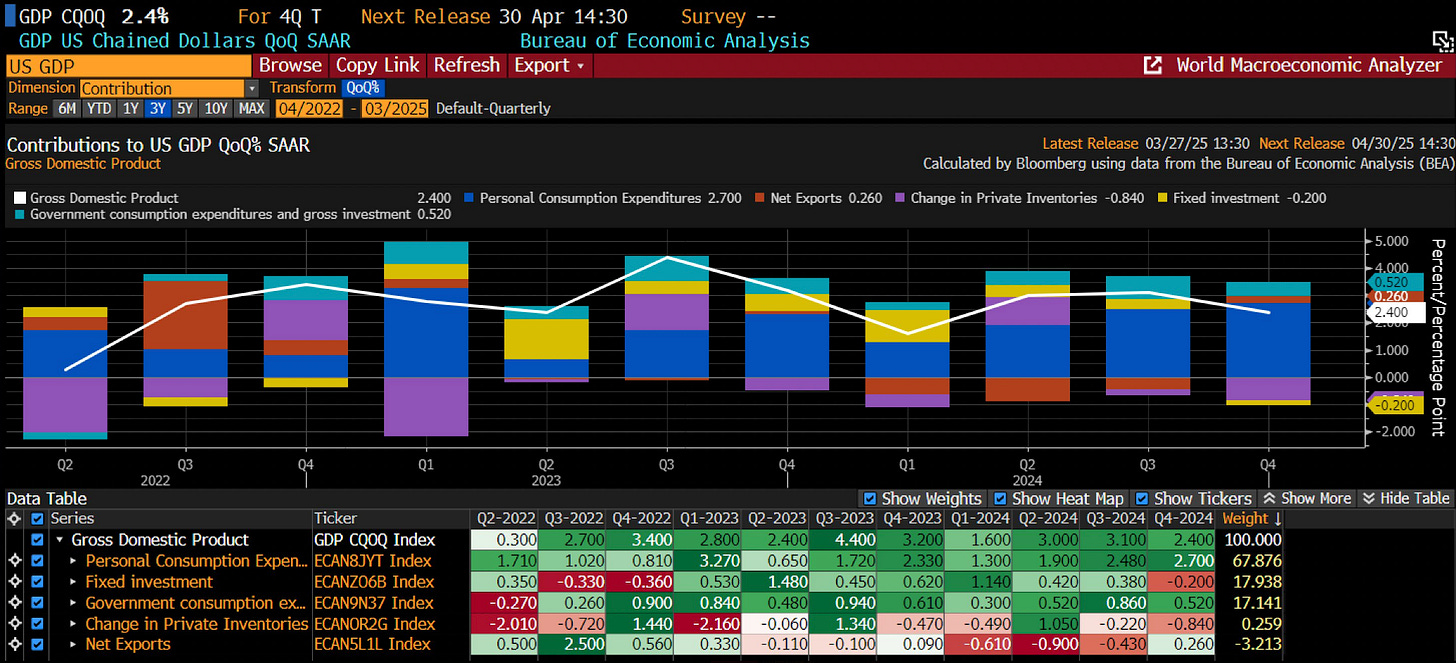

Away from tariffs, my outlook on growth is not all that bad. I think a lot of fear surrounding growth in the U.S. is based on tariffs only which is fair, but growth can be clawed back elsewhere. Q42024 growth shrank from 3.1% to 2.4% but is still not in the territory of severe worry for me. I actually suspect that Q12025 growth is not too far from Q42025’s numbers because tariff front-running is a theme that outweighs any fearful consumer spending (in my opinion). See Q42024 growth and contributors in Figure 6 below.

Recession probabilities for the U.S. on the day of releasing this report are 11.84% (seen in Figure 7). When we look at the previous times this figure has been reached, it may give a level of confidence that it’s much less likely to happen that some recession guys are screaming about. I believe that a weaker USD, weaker equities (average across the board) and weaker than expected tariffs will mitigate any weaker consumer scenario.

Equities/Indices

Not only have my calls on the USD been great in Q1, but the idea on shorting the S&P500 was greater, see Figure 8 below.

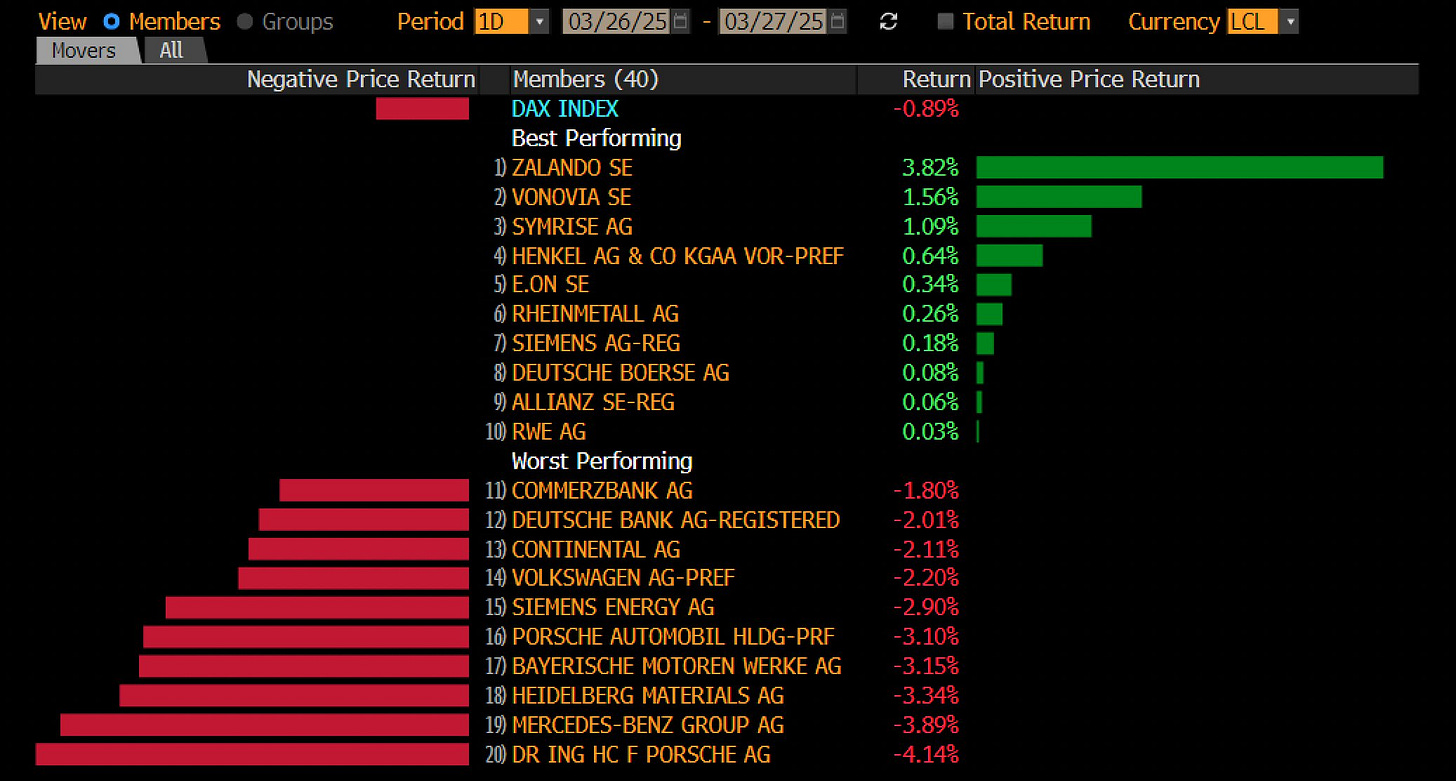

The impact of tariffs on equities has began. Automobile equities took a hit on Thursday after Donald Trump announced plans to impose a 25% tariff on car imports. Porsche and Mercedes are among the most brutal hit as there appears to be a significant gap between their U.S. sales and U.S. production. BMW is an example of a car company that has had more of a muted impact as they already build c.18% of its cars in the U.S.

This serves as a key reminder that no industry is out of the firing line. To bring manufacturing back to the U.S., these tariffs are essential because it will force companies who benefit from U.S. clients but build abroad to move their manufacturing to the U.S.

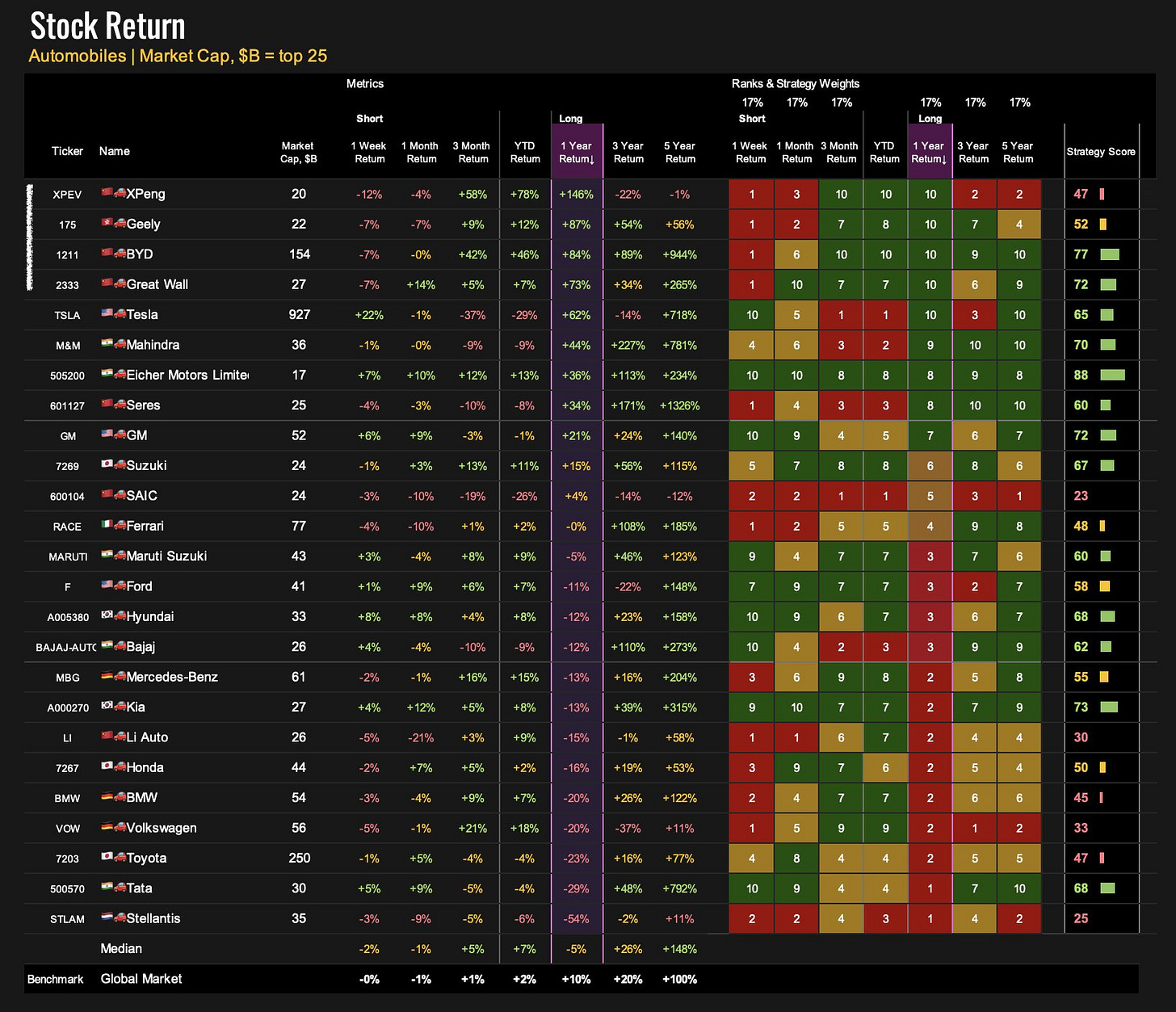

Meanwhile, Chinese automakers, who already had virtually no access to the U.S. market because they already had a tariff of 27.5% on car imports to the U.S. since 2018, are thriving. Annual returns are seen in Figure 10 below:

Some of these equities may be very good plays in the near future and are something my eye is on, depending on their reaction. In a scenario where these car import tariffs are likely to remain in tact for many years, I will be monitoring how companies respond in terms of their current manufacturing supply chain and a potential move over to the U.S., which will benefit them greatly long term. Remember, people aren’t going to buy cars just because the company isn’t affected by tariffs but they may be more tempted if prices between those cars and tariffed cars diverge, human taste will remain the same although the price of tariffs is likely to be passed down to the consumer. But if manufacturing is taken to the U.S., then those companies can likely sell at a discounted price in the longer-term.

Take Porsche and Mercedes, people like these cars on face value but prices can be a deterrent. If Mercedes took all of their manufacturing over to the U.S. to avoid high tariffs, then eventually they will be able to offer lower prices on their vehicles in comparison to Porsche who didn’t move over to the U.S. in this scenario. However, it’s not as simple as that, companies will weigh up the price difference between building cars outside of the U.S. and paying a tariff VS building in the U.S. (likely more expensive) and not paying a tariff.

Q2 is going to be a tough time for many equities in the face of tariffs, so it’s going to be best to trade sector specific rather than your traditional indices. The tech sector play seems to have too much downside to me for at least Q22025, competitiveness and such frequent innovation causes too much risk to have any meaningful position on them in my opinion.

A key sector I am keeping my eye on is the consumer goods sector, particularly those based in the UK with the benefit of the U.S. client. We’ve seen over the course of the last few years that consumer spending has remained fairly strong in such tight conditions, and I don’t think conditions are going to get tighter. A pretty similar story for the UK, I don’t see upside risk to tighter conditions so consumer spending can stay relatively strong in comparison to its global peers. The UK is also likely to benefit heavily from the lack of tariffs expected from the U.S..

This is the first trade idea for an equity that I’m sharing, this is not financial advice and is simply an idea I’ll be expressing. I am bullish on Associated British Foods (ABF) who are a company that own multiple different consumer goods stores (Primark (US & UK), Kingsmill (bakery), British sugar, Twinings (F&B) and many more). The companies owned by ABS are companies that rely on consumer spending and basic human needs, like necessities in the food and beverage department. Coupled together, I think the group of companies bring large upside with relatively low downside and ABF is my top equity pick for Q2. To summarise my reasoning:

Consumer goods sector can be resilient domestically and in UK-US trade terms

Products in ABF aren’t as closely associated with economic conditions, they represent low prices and essential needs

Net profit margin Y/Y = 51.08%

Operating income = 29.92%

Net change in cash = -91.56% (this represents the reinvestment strategy they have built, clear to investors where this is spent including expanding brand presence globally)

Gross investment was up 9% YoY, seen in the last reading (September 2024)

That is a wrap for the week, I’d love to hear your opinions on Q2 in the comments!

UK isn't getting much/any tariffs from US and since rates(global) are being lowered, consumer spending can be higher. Great. Although there's significant possibility tax hike in the UK