Pure Fear In Global Asset Markets

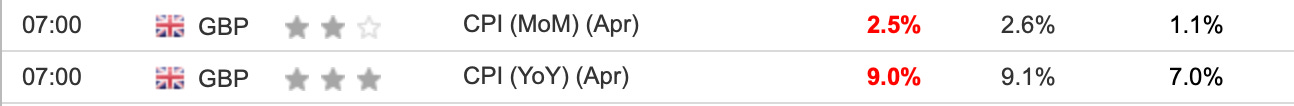

Uk inflation figure hits 40-year high

So yesterday this happened…

Surprised? Not at all. The current issue at hand is for starters both the Fed and BoE are behind the curve when it comes to inflation. The “transitory” message as we all know was the biggest mistake which now we are paying for. The BoE has hiked rates three times back to back, something that is not common for any central bank, yet inflation persists.

I mentioned in an earlier article, that the current inflation we are feeling is a result of a supply chain disruption, not due to demand. In essence, regardless of what the BoE do with rates their monetary policy tools simply won’t work in this scenario; to some extent reducing liquidity in the economy does prevent further overheating but the damage has already been done.

Now, remember this CPI reading is the reading they are telling us, but looking at everything from your day-to-day livelihoods we know the effect on our pockets is much higher than the 9% figure we’re hearing.

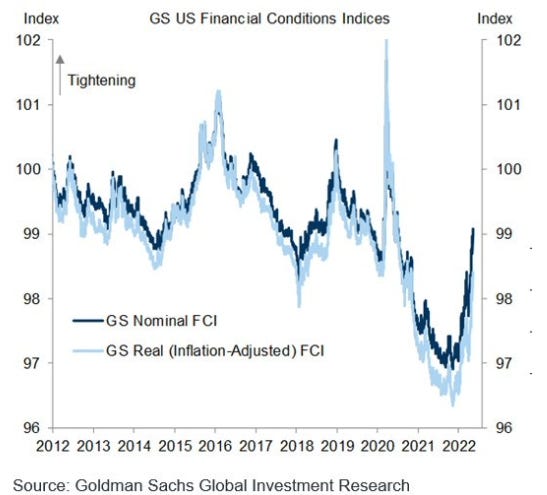

The tools each central bank control are restricted to interest rates and liquidity within the economy. As central banks tighten monetary policy, access to liquidity dries up so larger issues arise surrounding the ability of markets to sustain full functionality with lower volumes also arises.

U.S financial conditions & China

Goldman Sachs FCI (financial conditions index below) shows how we’re still in a historically loose landscape, but just from the chart alone, you can see where everything went up in flames. From the start of the year, we have been in a tightening phase within financial conditions, asset markets are down 20-30% from highs and quantitative tightening hasn’t even kicked in yet. That’s just the market’s forward pricing of the tightening cycle.

As conditions tighten the dollar gains value as assets have to be sold into dollars before moving elsewhere or holding onto cash, so a demand surge for the dollar is what we’re currently experiencing and have seen the past few months.

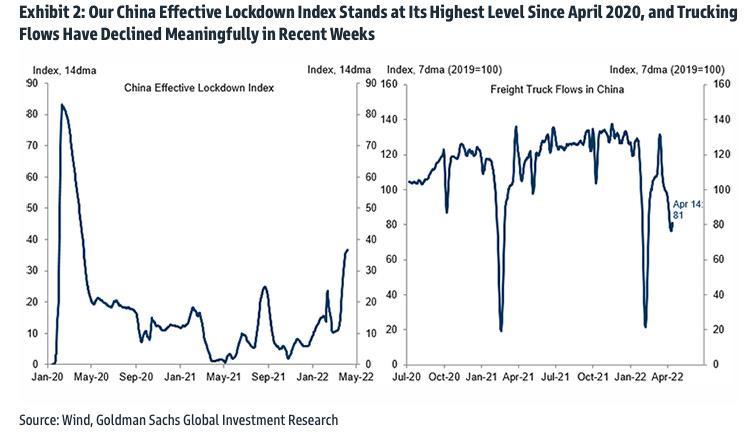

China & commodities

The continued spread of Omicron within China is causing some real concern with the already constricted supply chains.

The data speaks for itself really, every day Chinese manufacturers, shipments and freights are delayed the bill goes up. Year to date the Shanghai lockdown has cost global trade $28billion and counting. So tell me, will higher interest rates solve supply issues? Not in the slightest.

Now the next thing is commodities. Russia invading Ukraine amidst a supply chain disruption, it only spells trouble.

the Russian invasion of Ukraine has raised food, energy, and metals prices. Our estimate of the impact of commodity price changes on year-on-year core PCE inflation is now 10bp higher for 2022Q4 than when the invasion began

This comment from Manuel Abecasis of Goldman further reiterates the issue at hand. Food prices rocketing, and as Ukraine is currently restricted to harvesting a significantly lower portion of their usual harvest due to the war means two things. A shortage, so sooner than later we’ll see countries begin to run out of food and outrageous prices already seen in commodities such as wheat. 12% of the world's wheat, 15% of global corn and 47% of the world's sunflower oil. Yes, that’s 47%.

I’ll be back over the weekend writing a deeper article, hope you enjoyed this piece!

Once again I appreciate the support, re-shares and feedback