President Lagarde's Costly Mistake

Credit, credit, credit... reviewing the rate decision and net demand decline through Q2

Hey guys,

I’ve been invited to speak at the FX Connect event this Sunday.

I’m looking forward to it, I’ll be up there discussing the macro climate and much more stuff.

It’s always good to see you getting recognised for your skill.

So if you see me there, don’t be shy, come say hello!

Yesterday was a mess from the ECB, let me tell you all about it:

One Hike Too Far…

Last week in my macro report for the MMHPro clients I said this about the upcoming ECB meeting:

“I truly believe another hike would be a stupid move, speaking frankly” — Joe, MMH

After watching yesterday’s mess of a press conference I stand by this comment evermore, and it seems markets are in agreement with my rather blunt statement. On Thursday the ECB met to hike interest rates another 25bps across its three main lending rates, taking the main refinancing rate to levels not seen since the dotcom era of 2001.

There are a few reasons I’ll explore with you as to why I believe this recent hike might be the straw that breaks the camel’s back, for the Eurozone economy.

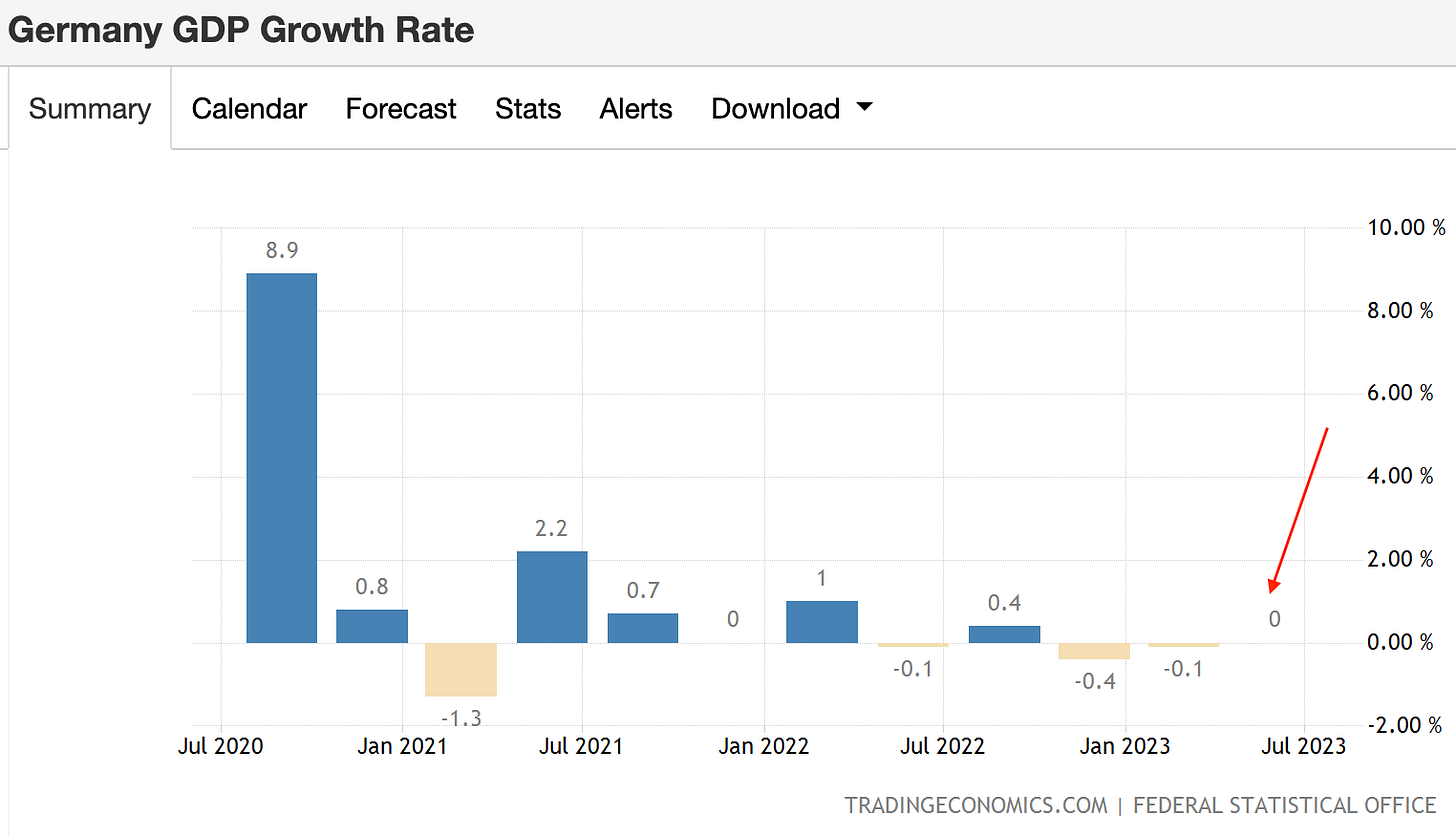

Germany, the heartbeat of the Eurozone economy hasn’t had a positive quarter of growth since Q3 ‘22, with the most recent reading showing the German economy stagnated through Q2 ‘23. Whether you choose to look at PMIs, be that services or manufacturing, these forward-looking data points signal a deep contraction in economic activity over the upcoming months and quarters for the Eurozone.

You’re probably thinking, “What made this rate hike a mistake?” let me answer that for you.

During Lagarde’s Q&A session, she was asked for her assessment on the pace and strength of the transmission of monetary policy. To which she replied,

“there is evidence that the current hiking cycle is transmitting to financing conditions faster than previous ones”

— Christine Lagarde, President of the ECB

For reference, the last hiking cycle which lasted more than 12 months was the GFC crisis, where inflation peaked at 4.10% in July of 2008. A faster transmission basically means the private sector feels the impact of higher rates much faster than they would in previous cycles, unlike the US where households don’t feel the impact of higher rates due to the duration of their fixed mortgage rates, households in Europe do.

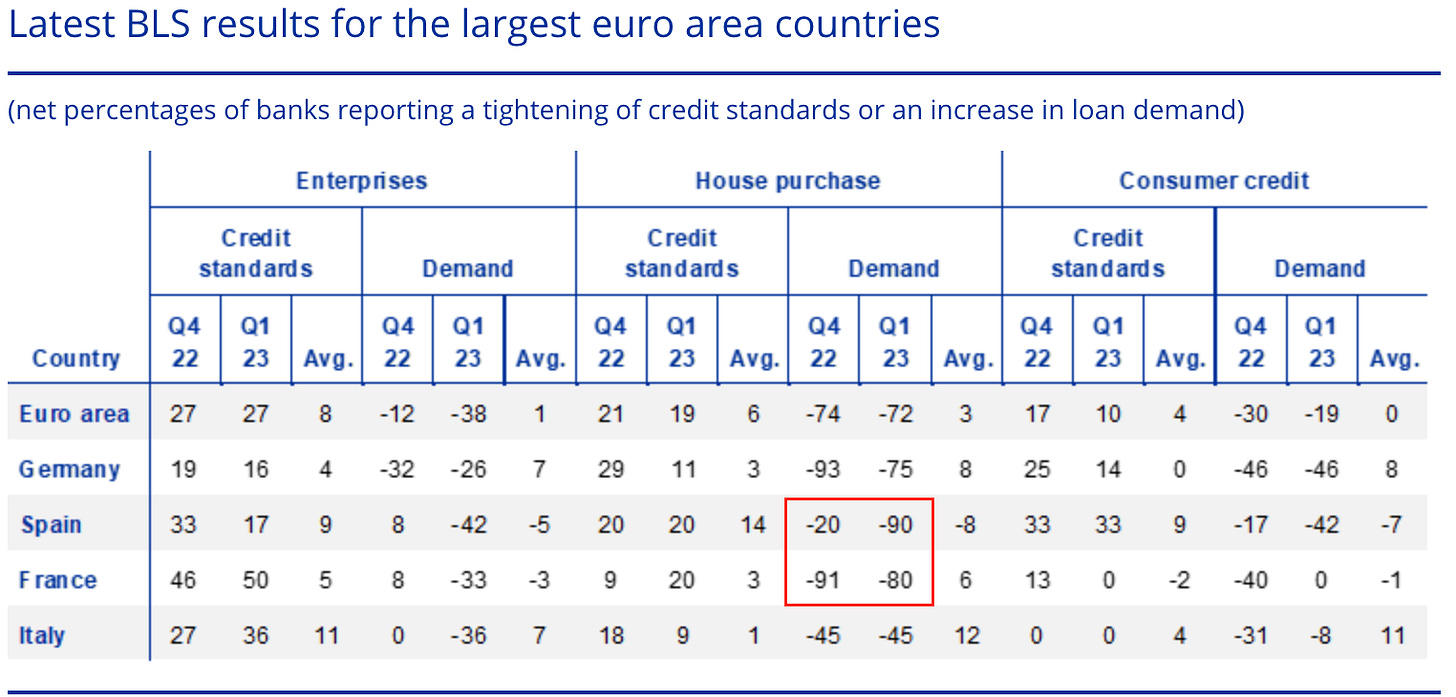

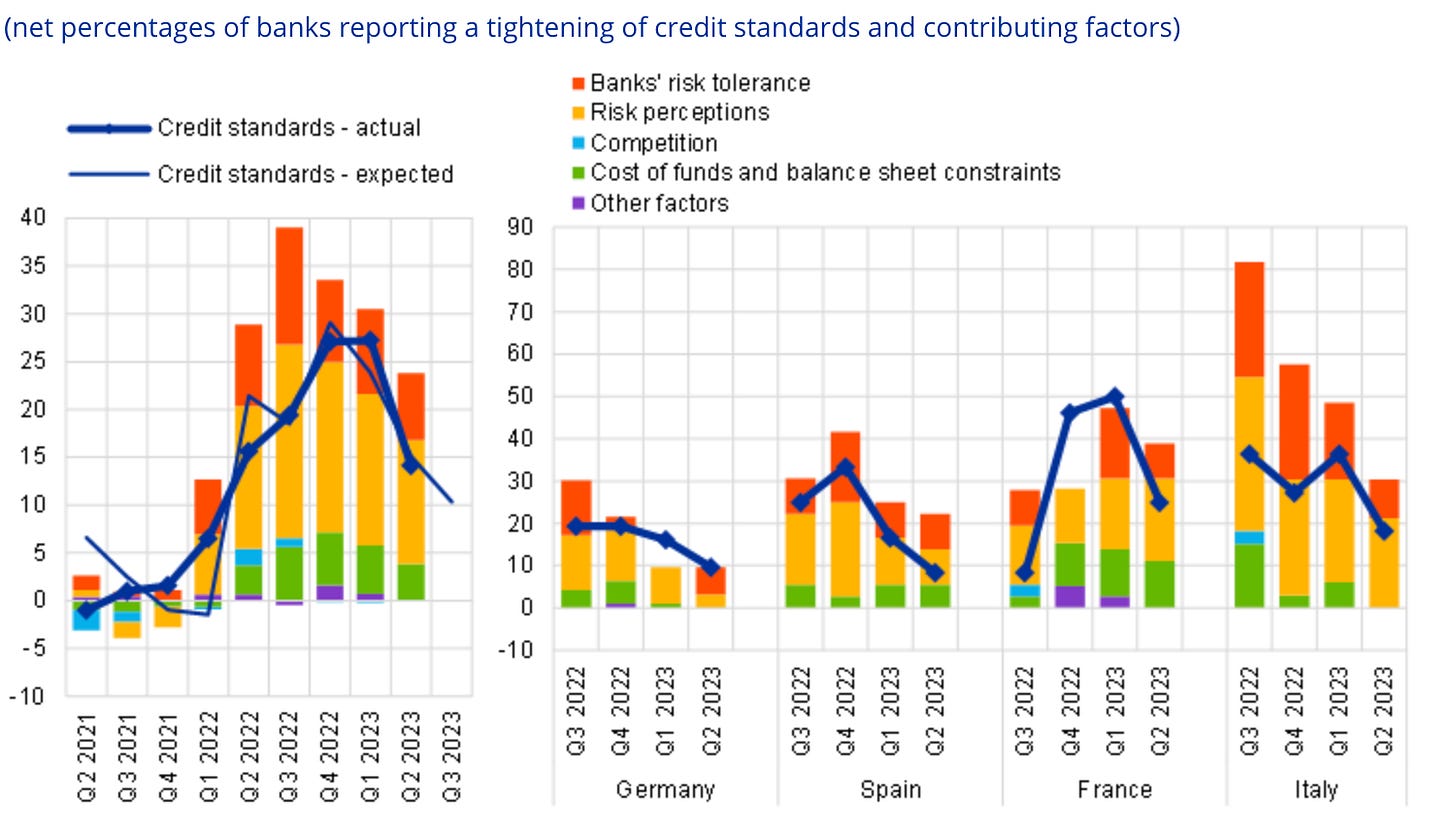

In the first quarter of 2023, the euro area conducted a bank lending survey to assess the credit standards for loans and credit lines. The survey was conducted between March 22 and April 6, 2023, and covered 158 banks. The results showed that the pace of net tightening in credit standards remained at its highest level since the euro area “sovereign debt crisis in 2011”.

The tightening was stronger than banks had expected and points to a persistent weakening of loan dynamics. Housing loans were a contraction point for credit standards, as banks had higher risk perceptions and lower risk tolerance.

House purchases saw the most significant decline in demand, with Spain and France experiencing decreases of 90% and 80% in Q1 '23. France's decline has been particularly steep, and has remained elevated alongside Germany. Italy's demand, on the other hand, has remained flat.

The euro area bank lending survey for the first quarter of 2023 showed that banks continued to tighten their lending standards. This was not a one-off event, but rather a continuation of a trend of tightening credit conditions across Europe. The most recent survey, conducted in the second quarter of 2023, confirmed this trend.

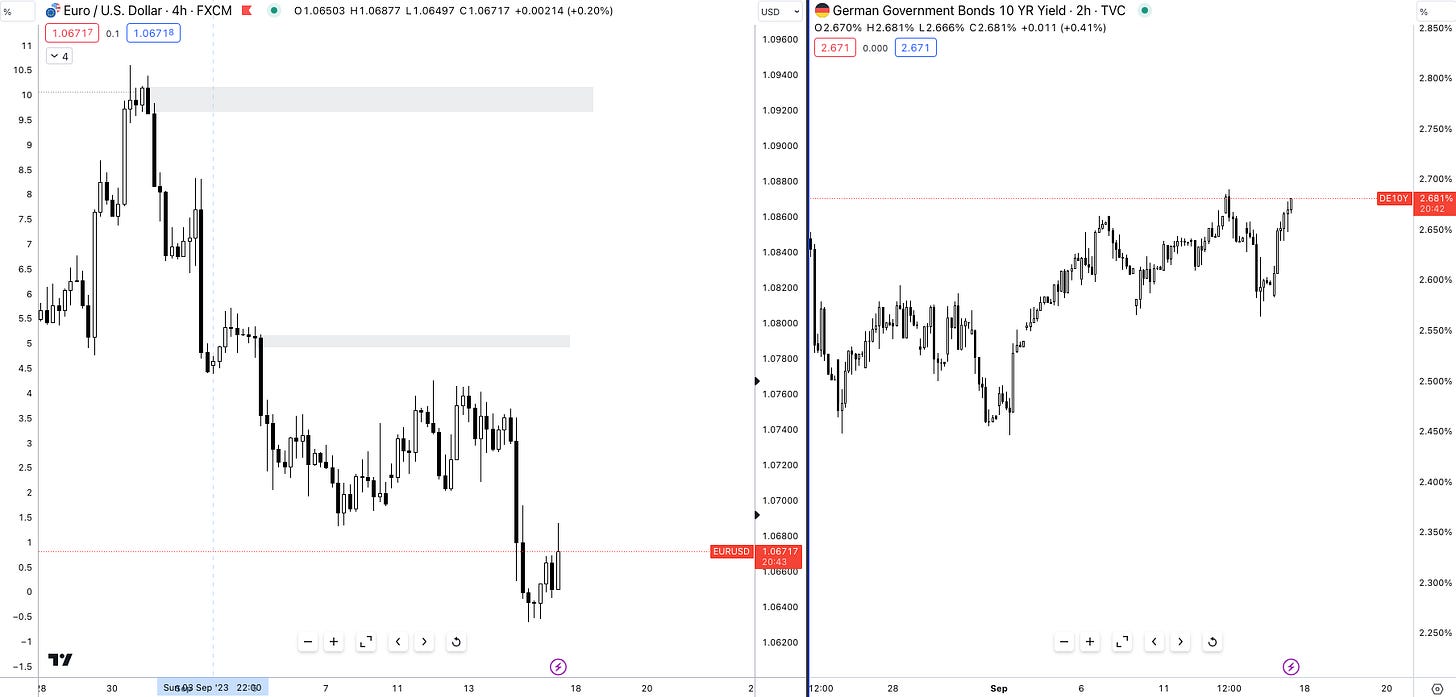

In the immediate aftermath of the ECB hike and press conference, 10y Bund yields sold off sharply, while the euro slipped by more than 1% in the following hours. A currency will only trade lower after a rate hike if the hike is deemed to be dovish. This is what we saw in the recent ECB rate hike, which was investors and traders caught onto resulting in the sharp decline.

Given the current level of fragility in the euro area and forward-looking indicators pointing to more of the same, I believe that the recent ECB rate hike is most likely the last in the cycle, and in the same breath, it could also be the catalyst for a recession in Germany and wider Europe.

A brief but detailed overview of my thoughts from the ECB hike, I’d love to hear your thoughts as always.

If you enjoyed this read, I’m going to ask you to do me one favour.

Copy and paste, forward or show this report to someone you know. It helps massively with our growth.

The more this newsletter grows, the better the insights get ;)

Until next time

An amazing piece. Love from Nigeria 🇳🇬During a recession is it advisable to hold stocks of the country involved?