Post Jackson Hole Clarity

JP the "Economist"

Happy Sunday crew!

Trading the “Trump markets,” it’s clear that outlooks can turn as quickly as policies themselves. It’s harder sticking to the conventional bull bear market without trying to game out opposing possibilities. It is a regime defined by whipsaws, where the edge lies in trading both extremes.

So as I draft this report, a recurring question lingers: what is the prevailing extreme that markets have collectively priced in?

Powell effectively capitulated in the eyes of risk allocators, and markets (FX, equities, bonds) seized the dovish pivot, aggressively repricing the rates across the curve. Yet, while much of the commentary is fixated on the brewing of a potential “policy error,” the door to optionality in our opinion remains marginally open.

Here’s our view

G4 FX Outlook

Political Noise, Fiscal Cracks, and Fragile Floors

USD: For us the U.S. Dollar bull ship has not been the easiest to sail this past month since closing our bearish positioning which paid off handsomely in Q1/Q2. It is not often you see revisions in payroll dominate the tape above main headline figures, this was indeed a fundamental shift with less fixation on the 73k miss, markets reacted to past misses.

Let’s quickly walk through it…

The BLS erased (258k) jobs from the previous two months, revising May's initially reported 144k jobs down to just 19k and June's 147k to a mere 14k.

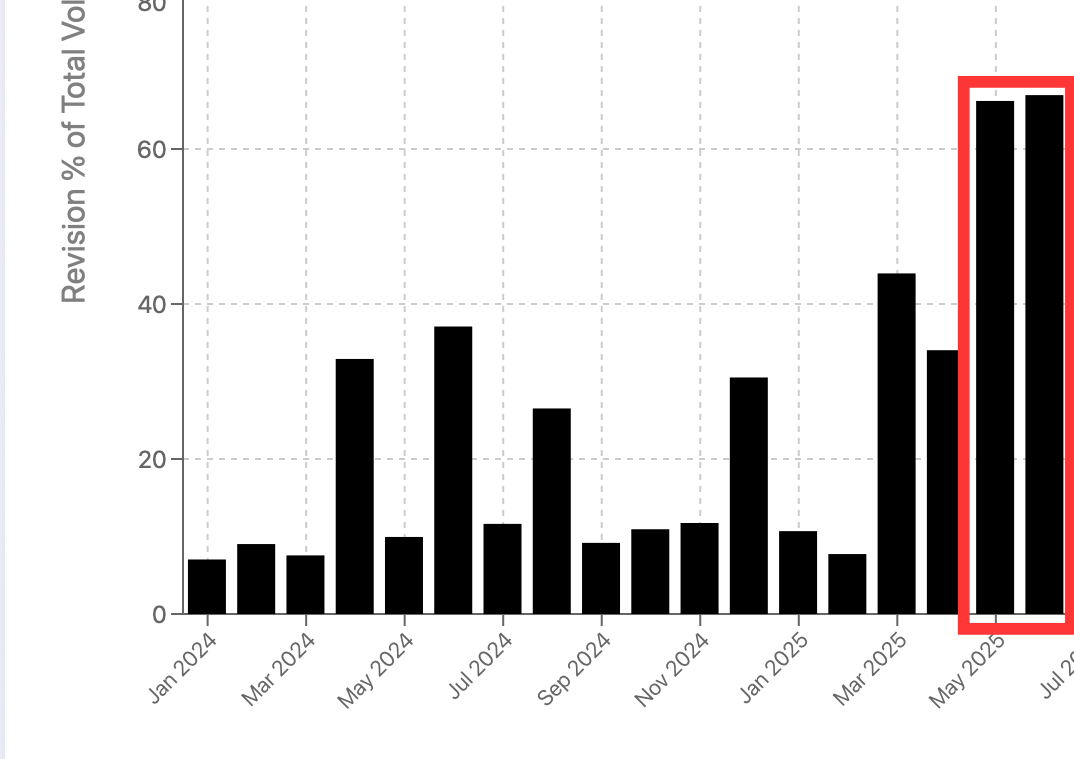

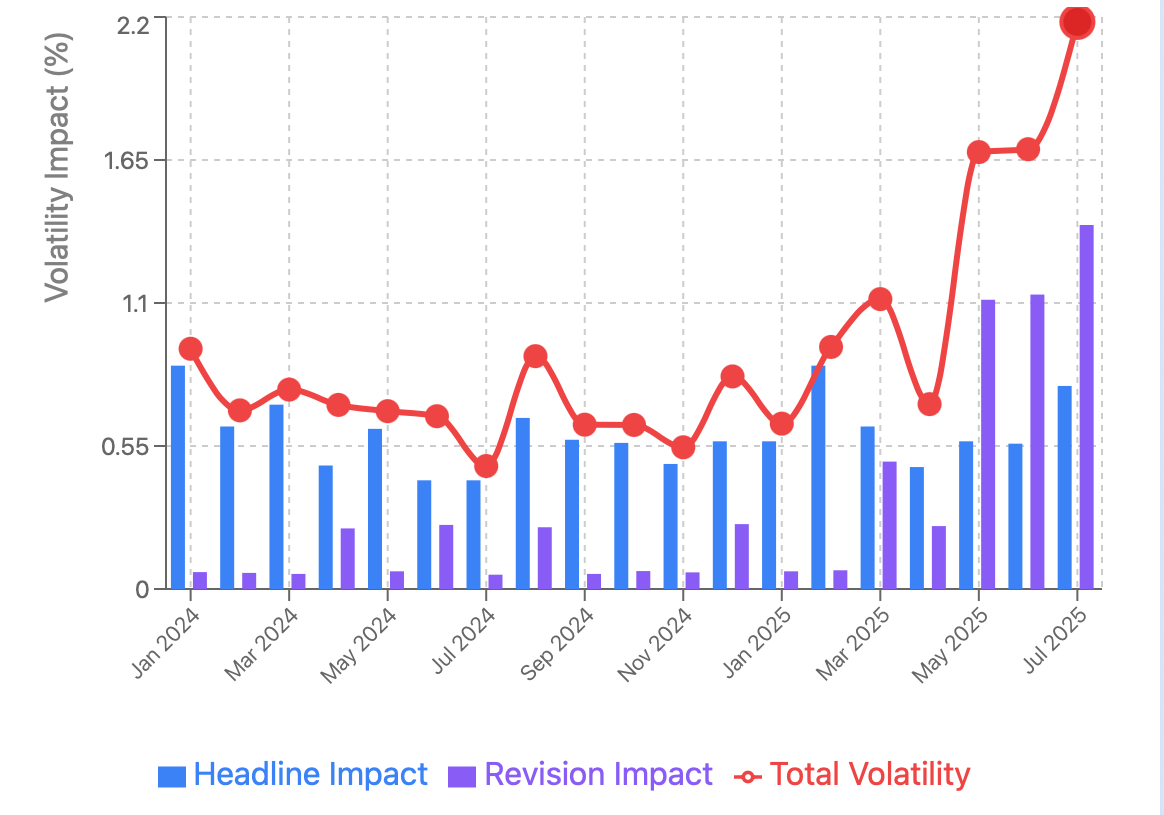

Our analysis of the last 19 months of Payroll data reveals that revisions drive < c.30% of average DXY vol around release day, however July's historic revision accounted for c.75% of the DXY's violent c.1.72% daily swing compared to just c.25% from the headline number. This represents a complete paradigm shift from traditional market wisdom that treated revisions as statistical housekeeping, creating a new reality where corrections of this magnitude can eclipse headline surprises in market impact.

In our vol decomposition model, headline surprises contribute an average of c.0.61% to daily DXY stde while revisions add c.0.24%, but when revisions exceed 100k jobs they become the dominant market driver entirely. July's (258k) combined revision obliterated previous models by completely rewriting the economic narrative from "291k jobs added over May-June" to "only 33k jobs actually added," forcing traders to reassess not just current Fed policy but the entire data-dependent framework that underpins monetary policy.

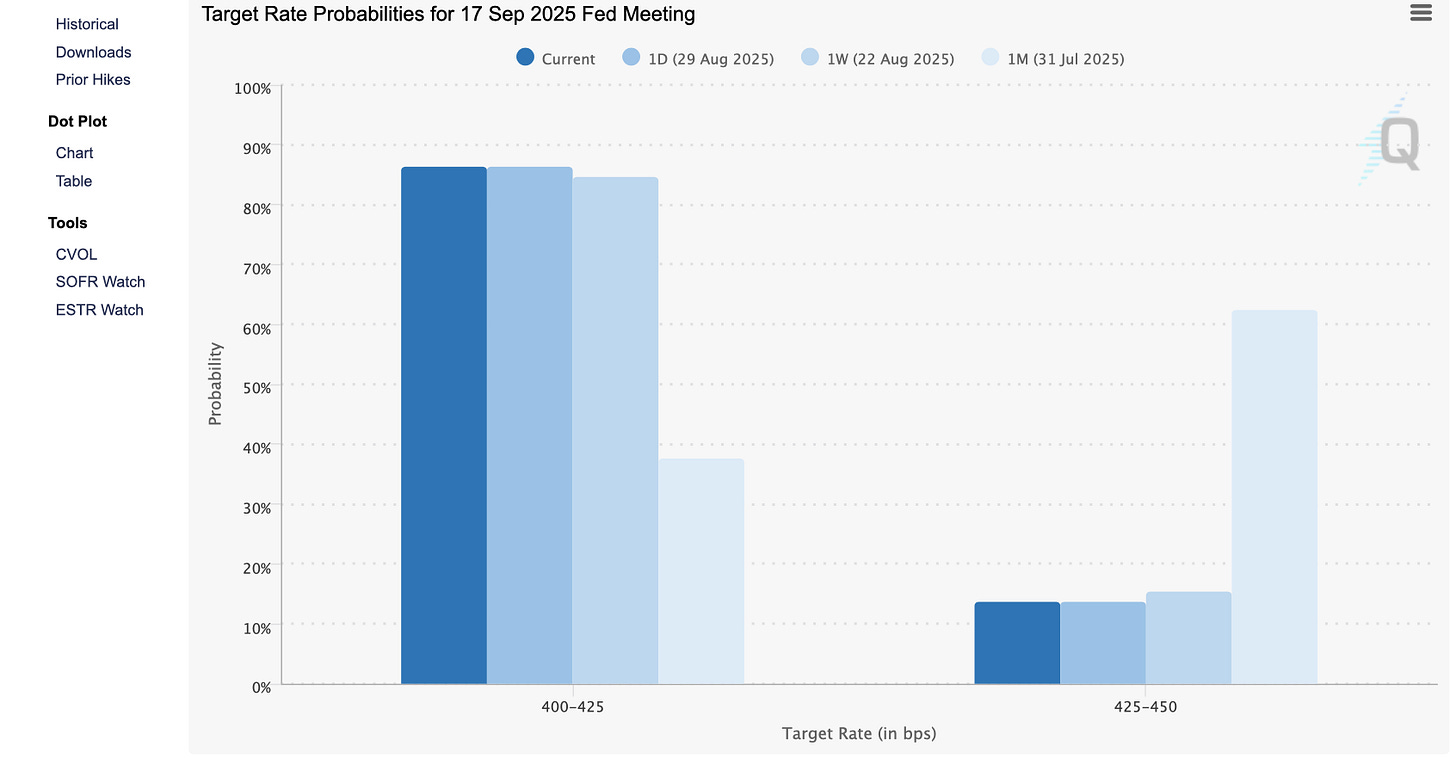

The Fed’s entire "data-dependent" framework suddenly looked “sus”. How can policy be data-dependent when the data itself is subject to such massive revisions? This was the catalyst markets on edge needed to commit to a september cut. Pr() jumping from 45% to 78% (now 86%) recaliberated understnading of this economic ‘slack‘

We could discuss the inflationary impluse but honestly with such move causing c.4 std in PA seems at the moment market concerns is entirely set on the september cuts and quiet frankly the political climate between the US adminstration ousting Fed governor Cook isn’t helping, however its encouraging dips were bought after breif sell on that announcement.

Despite the situation with labour market we find some comfort that index dipped beirfly below PPI release and has contionusly traded slightly above which set a temproary floor for the greenback.

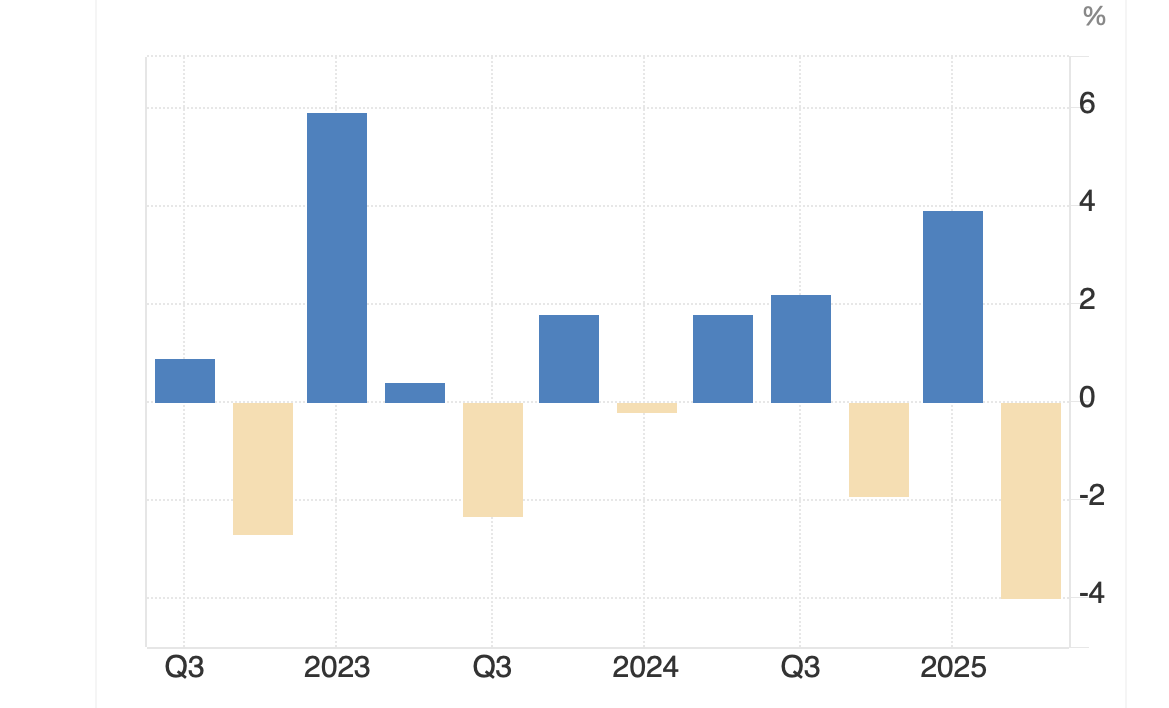

For all the criticism thrown its’ way the dollar has still surprisingly been fairly resilient this past week (figure1) and having gone unnoticed by many but we have set a bottom post Independence Day (July 4), the grind higher however has been a slow bleed. Away from the poor labour data, a whole cohort of domestic releases have beaten expectations (PMIs, GDP, jobless claims).

Within this backdrop an interesting observation this past week has been the marginal decoupling between short-end rates and the dollar. FX desk at CIB Agricole views the decoupling attributed to unhedged portfolio inflows from abroad on the back of US outperformance, month-end rebalancing flows dominated by USD buying and corporate FX hedging ,therefore may becomes less acute.

But keeping in mind the next risk event being the Fed’s preferred inflation gauge, upside risk to the greenback could live on. Hence we remain constructively bullish on the greenback.

EUR: Under normal circumstances and past weeks light calendar, the EUR should have rallied meaningfully as markets rode the Fed September cut narrative. Instead, EUR/USD remained largely range-bound, weighed by escalating political risks in the Eurozone, France in particular. The BTP/OAT spread narrowed to ~5bps, levels last seen during the early stages of the 2010s sovereign debt crisis, underscoring renewed peripheral risk.

The immediate pressure comes from the French, where PM Bayrou faces a confidence vote next month that could destabilise an already fragmented parliament. With the Eurozone’s widest public deficit and entrenched political divisions France is fast becoming a risk premium driver for the bloc. This was the main guage for the bloc stress this past week

Macro data offered little reprieve. August sentiment surveys (economic, industrial, services) missed expectations, French consumer confidence deteriorated and German retail sales fell c.-1.5% m/m. Inflation expectations remain broadly anchored, and the labour market is steady at historical lows, leaving the next ECB policy meeting sort of a nothing burger.

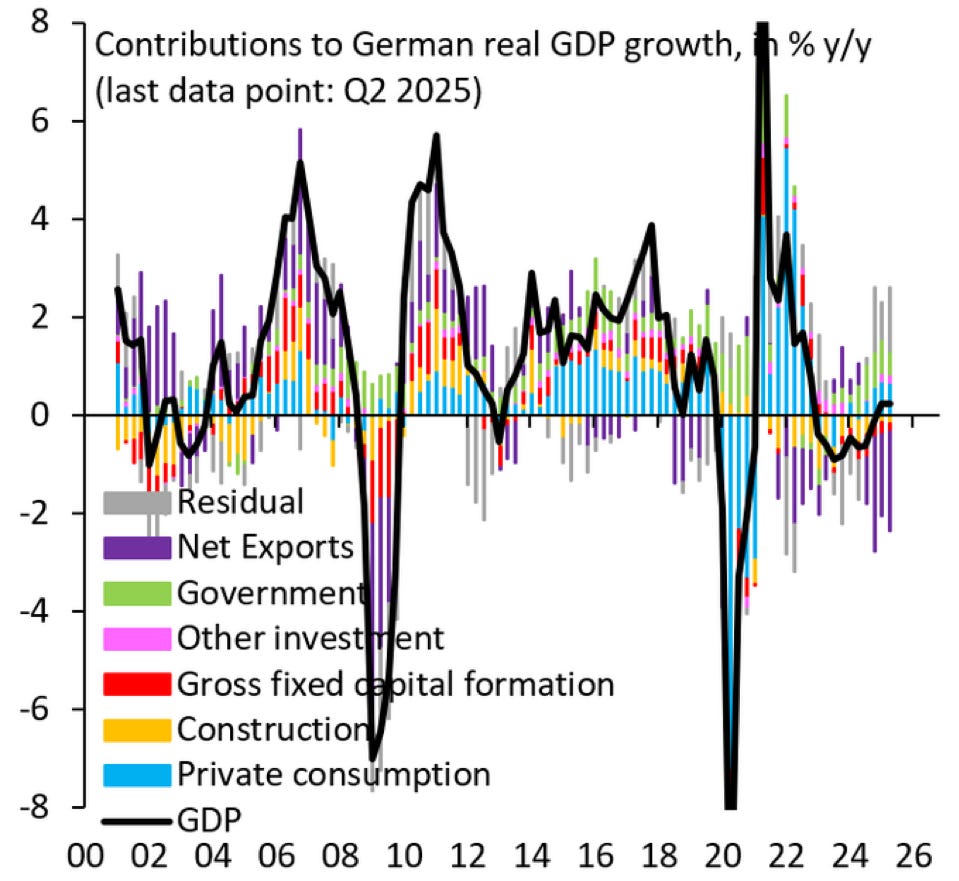

Maybe in another life I would be massively short the EUR. Despite the fiscal impulse theme since the start of the year the structural downturn post 2020 in Germany is still very much visible but for now the EUR is bumping its way up in the reserve status consolidating gains against more traditional safe havens like the JPY in cases of negative flows seeking capital flow protection across FX crosses.

In this new regime you would be better off playing longs on EURAUD vs the typical short AUDJPY pair in the face of risk-off signals… truly interesting times!

GBP: We are more pessimistic on pound sterling compared to the rest of G10, well maybe CAD (story for another report). Yes, this is even despite headline GDP figures for Q2 printing 0.3% q/q beating 0.1%q/q expectation. Behind the ‘encouraing‘ headline print the compostion was weak: consumer spending almost flat and business investment collapsed.

Government spending being the main driver we believe this only exacerbates the coming weakness for the UK economy considering the fiscal tightness on the way for corporations and households in the autumn budget as the finance minister Rachel Reeves tries to close the £50bn fiscal gap.

The main hurdle for the BoE and quite frankly markets seems to be the persistence of services inflation. However we argue given the underlying demand profile of fiscal tightening with taxes set to rise and real incomes under pressure tilting downside growth performance, policy warrants further future easing.

TLDR: short the pound!

JPY: Lastly, the bane of my existence, the Japanese Yen. At this point trying to do justice to the data coming out of Japan warranting policy commitment from the BoJ continues to seem not fruitful. With recent prints in both trimmed mean and CPI inflation coming in lower the BoJ is indeed in a place to remain observer on the path ahead of future policy hikes as Ueda continues to shy away from clearly providing tangible forward guidance on the bank’s deposit rate despite the worst of tariff headlines now past.

All told, without a firm policy commitment from the BoJ, we are less enthusiastic about holding JPY outright. However, given the political uncertainty in Europe and the US, and with most of developed markets leaning toward easing, a diverging view from the BoJ, the yen looks underappreciated. If US labour data surprise to the downside, JPY gains as a risk-off hedge. So as it stands it is more of a risk-off story than a JPY play towards policy normalisation.

Post Jackson Hole Clarity

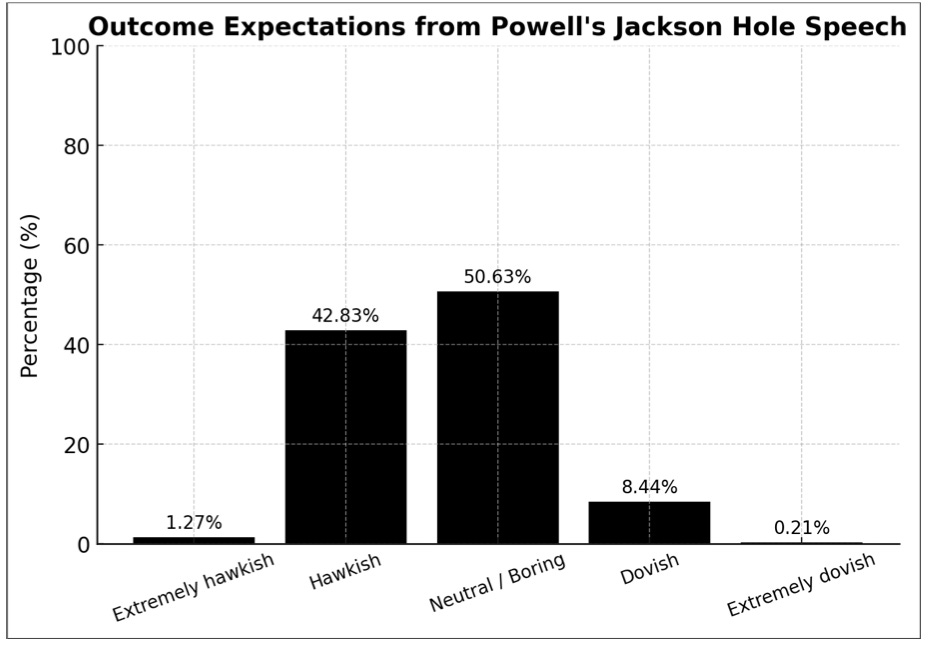

The above survey conducted by Brent Donnelly of am/FX research which was heavily skewed in outcome against a dovish forward guidance by the Fed chair now seems to justify the uproar amongst market commentators in fintwit championing chatters of a ‘policy error.’

But with opinions that skewed one must ask how much of it is due to solid underpinning vs positioning book bias.

Don’t get me wrong— the outrage is in someways valid. One would have expected, given a sympodium devoted to “Labour Markets in Transition: Demographics, Productivity, and Macroeconomic Policy,” that a discussion focused on the drag from current immigration policies: a ‘curious kind of labour market’ as JP describes it adjusting to both demand and supply factors garners that attention should have shifted to the usual textbook effect of the pass-through cost from factoring in the inflationary undertow of tariff-driven tax effects rippling through supply chains.

This is before even considering the potential tailwind from labour supply dynamics, with wage growth now appearing to have normalised above post-2020 levels. The latest personal income data showed a 0.6% m/m increase (7.2% annualised).

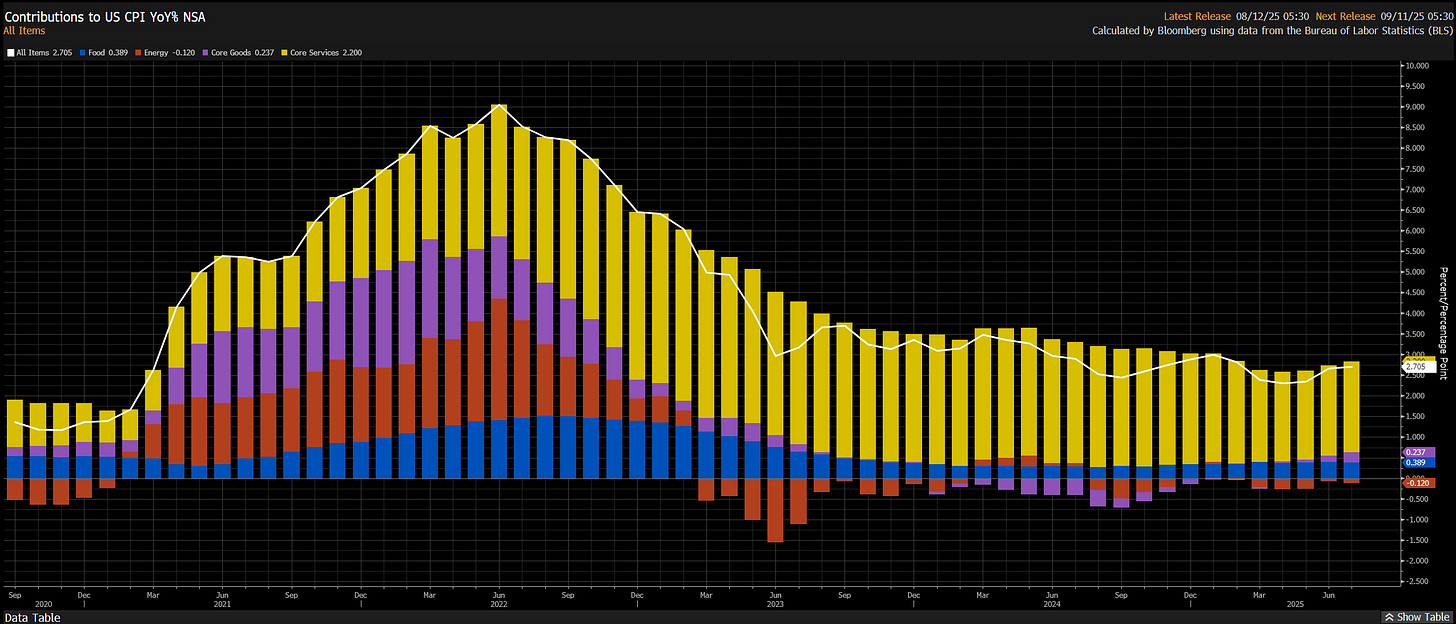

The doves see crippled employment force evident from recent revision in last two months reading (258k) as 3 months average hovers the 35k mark and the hawks argue UR at record lows validating the balanced view as the country and business adjust to immigration policies. Regardless of your view on the labour market it is getting increasingly harder to ignore that the inflationary impulse from the tariffs set in place Q2 of this year.

As inflation swaps head higher we are likewise beginning to see pass-through not only in goods but services (stickiest part of inflation). While we can continue to debate the speed of the pass-through of these tariffs, I think it is now time to bury the pandering by the administration that companies bear the sole cost.

Trade services of the PPI which measures the difference between the selling prices and acquisition cost was up c.2% validating previous reasoning of price push cost to end users.

So how do we aggregate the viewpoint in order to forecast a view of R* and whether truly the Fed is behind the curve?

Despite recent discussions around potential “policy errors” and concerns from some long-end commentators about a sharp move higher, the 10Y post-JH suggests otherwise. That said, we still see this as a “sell-the-rip” setup for longer duration, long term. The front end has room for a tactical bid given the pressure, but with Trump moving to unseat a Fed governor, politicising the committee and a Fed willing to cut into an inflationary impulse, holding duration offers little reward. We expect the steepener to remain the cleaner expression.

We covered this view extesively here:

Moving on…

A more constructive approach would be to view these interactions from the perspective of these elite bankers as they set the methodological framework on which we view their reaction function or lack thereof.

FOMC minutes:

“A majority of participants judged the upside risk to inflation as the greater of these two risks, while several participants viewed the two risks as roughly balanced, and a couple of participants considered downside risk to employment the more salient risk.”

“Several participants noted concerns about elevated asset valuation pressures.”

Then comes Powell’s JH speech where he inherently ranked that of employment risk higher citing “the balance of risk is shifting” and “downside risk to employment are rising.” Post FOMC minutes // Post (254k) revisions // Post Jackson Hole, the key takeaway is policy makers’ reasoning have moved from a combination of elevated inflation risk and balanced labour market to now a scenario where markets MUST without undeniable doubt prove it does not warrant policy easing given the summer volatility in jobs data.

On the other side of the Wyoming conjecture came a revision to the Fed’s monetary policy framework reviewed every five years. The experiment with “make-up” inflation is now over. The Fed has stepped away from its 2020-era flexible average inflation targeting (FAIT) and reinstated a more traditional, symmetric 2% goal. In doing so, they have signalled the end of an era defined by the lower bound policy rate and acknowledged a global pivot toward structurally higher inflation.

That said, we see little real change in how policy has been conducted in recent years. This shift looks less like a genuine regime change and more like a cover for what many observers view as indeed a policy error post-COVID response to inflation overshooting first labelled “transitory,” now reframed by abandoning FAIT altogether.

Furthermore it seems that Powell embodied the Waller thesis of tariffs being ‘transitory’ although he did a good job of staying away from that word but overall it was implied in his remarks of a ‘one-time shift in price level’ which is consistent with the framework at the Fed from its 2018 teal book analysis. For us the dichotomy seems to exist with markets’ pricing of inflation risk vs Fed expectation.

Breakevens have marginally moved higher even as expectations remain relatively anchored which is from our read indicative of a market that does not think longer run inflation will be much higher on average which speaks to the credibility of the Federal Reserve institution to tackle inflation if need be but at the same time the distribution of risks has fattened on the upside.

As it is in almost all cases it will be up to the next set of inflation Core PCE and August payroll next week to clear the hurdle and rubber-stamp a September live action for the committee. However we fear markets have once again skied ahead, pricing roughly 150 bps of cuts through FY26 and outright dismissing Powell’s constructive call to “proceed cautiously.” This stands in contrast to what remains a clear divide among voting members over both the need for, and the pace of, policy adjustment.

This was a lengthy one but the aim of this report was set out to frame the data in its entirety showing where the market is underpricing risk and where it’s running ahead of itself.

Thank you all for your attention & see you in the next one!