Portfolio Allocation Shifts, Germany's Elections Loom and Trump Pushes Bitcoin Rally

Exploring the Future of the U.S. Economy

Hey guys,

I have been absolutely flooded with global macro & trading related tasks, de-coding the history of markets, which is why I skipped a report last week.

Crypto is the topic of many discussions, it feels like a very familiar time…

When your Nan asks, “what’s this crypto thing?”, it may be time to exit the market.

The U.S. will drive global markets for a while now, so let’s dive into what is going on there!

Macro watch

Election season isn’t over..

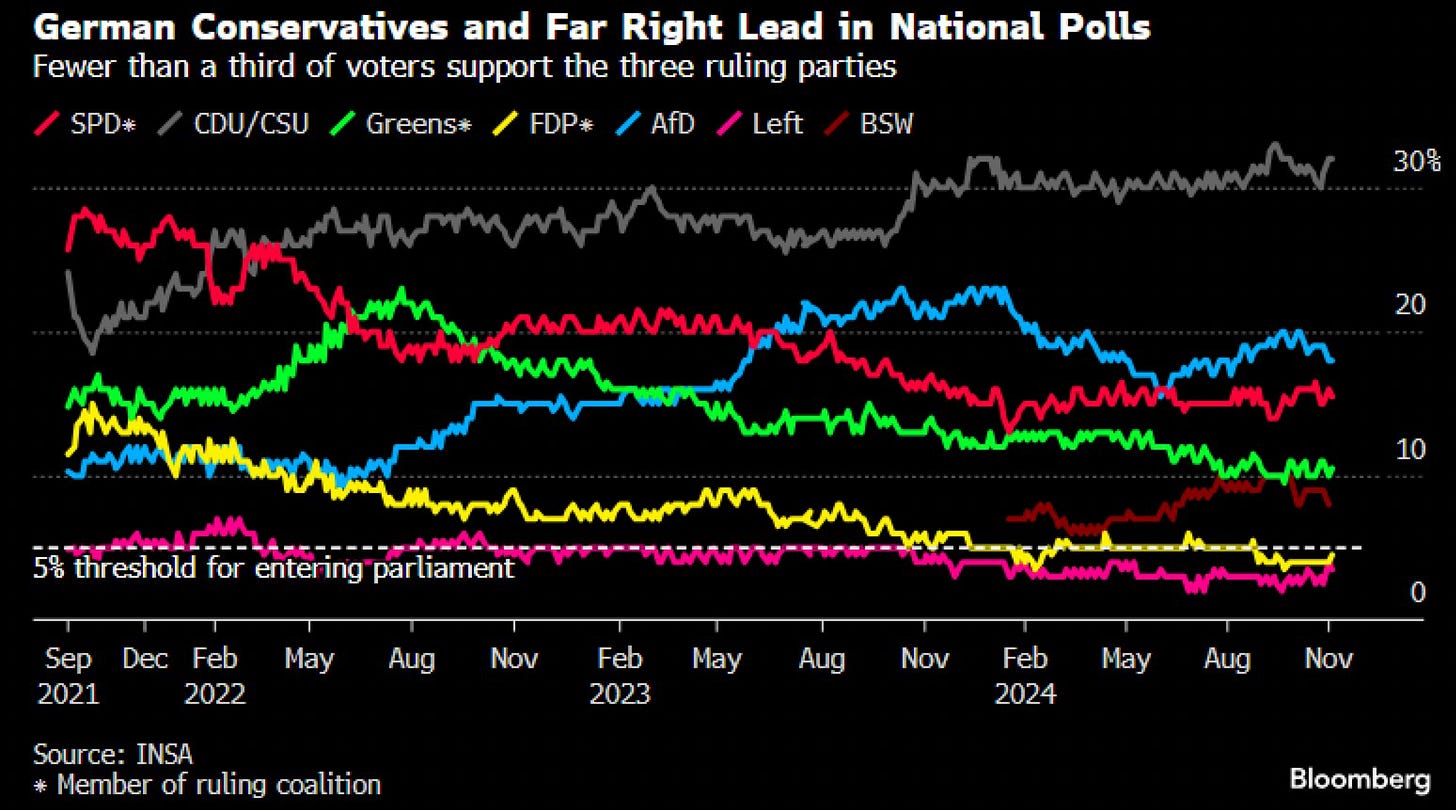

Germany is set to hold elections in February, following the collapse of the governing coalition. The country was plunged into crisis after Chancellor Olaf Scholz, of the Social Democrats, fired the finance minister and coalition partner, Christian Lindner of the Free Democrats, following weeks of internal tensions.

If Scholz loses, which is the expected outcome, the election date will formally be proposed to President Frank-Walter Steinmeier. He will then have 21 days to dissolve the German parliament, the Bundestag.

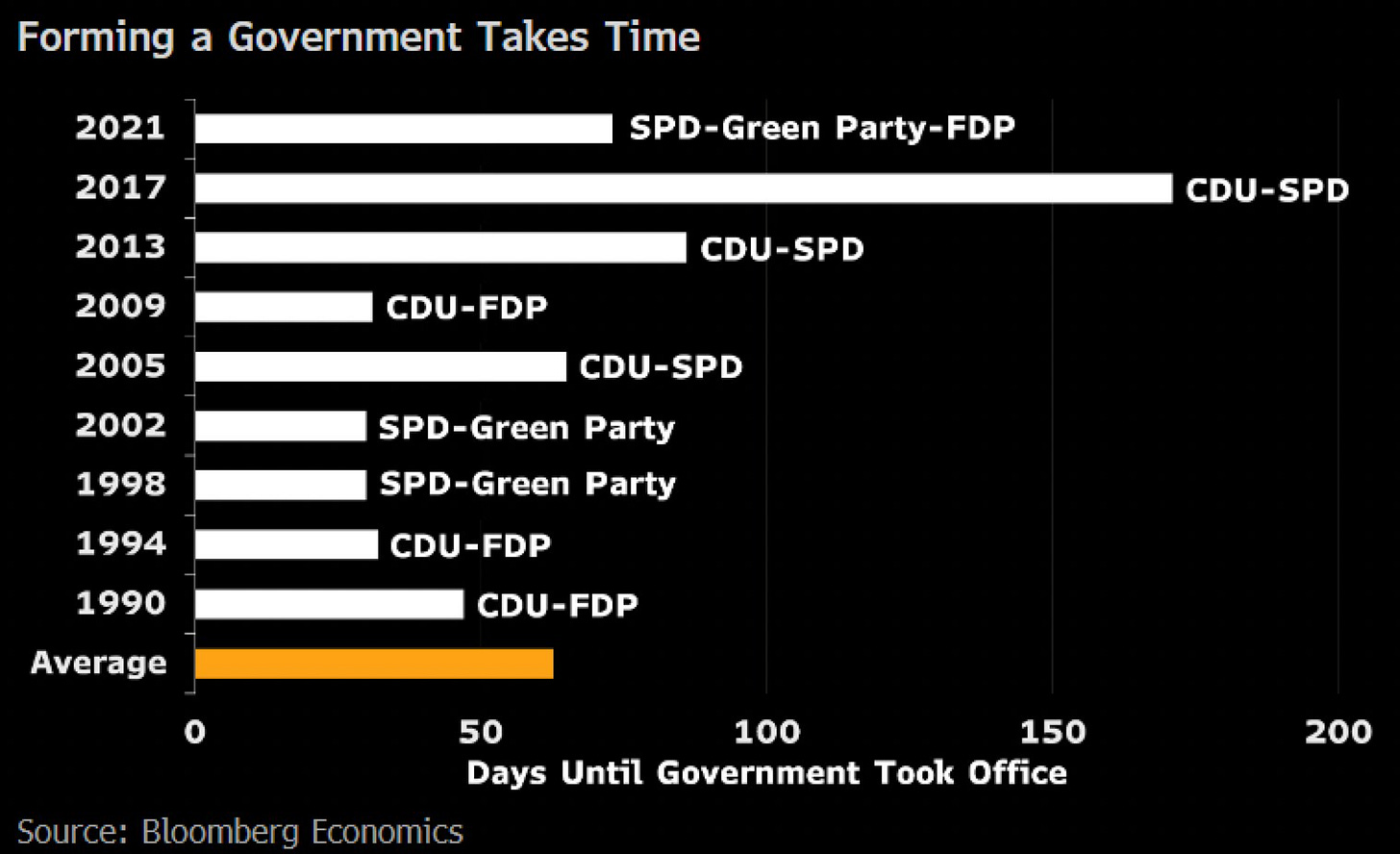

Chancellor Olaf Scholz said he’s open to moving up a parliamentary confidence vote to before Christmas, which could bring the early election forward to February. Germany could have a new leadership by April if a new government is formed in the usual timeline. This would leave the country without a fully functioning government for 6 months after the break-up of the traffic light coalition (the combination of all 3 political parties: SPD, FDP & The Green Party).

The reason I like to focus so much on Germany is because of their significance inside the Eurozone. Political decisions and policies will be decisive to their future growth, which has no room left to shrink, meaning that these elections are crucial to the future of not only Germany, but Eurozone trade as a whole. Markets don’t like instability. Elections, declining growth and high rates are all weighing on the Euro.

Market mover

It’d be hard to not talk about the c.32% gain in Bitcoin since Trumps election last Wednesday. The $93,000 level was breached, taking the Bitcoin market cap to c.$1.8trn as the rally in risk assets resumes on Trump optimism.

Bitcoin continues to cement its status as a major financial force, signalling a broader bullish sentiment for digital assets. This level of growth in crypto can spur innovation and investment in U.S.-based companies, especially in areas like blockchain development, financial technology (fintech), and crypto exchanges. Remember, the U.S. are tech giants. Although it may not be a main contributor, a Bitcoin bull market can mean capital gains taxes collected by the government will rise, providing a financial boost to federal and state budgets (to an extent).

Long U.S., short Germany.

Shifts in portfolios?

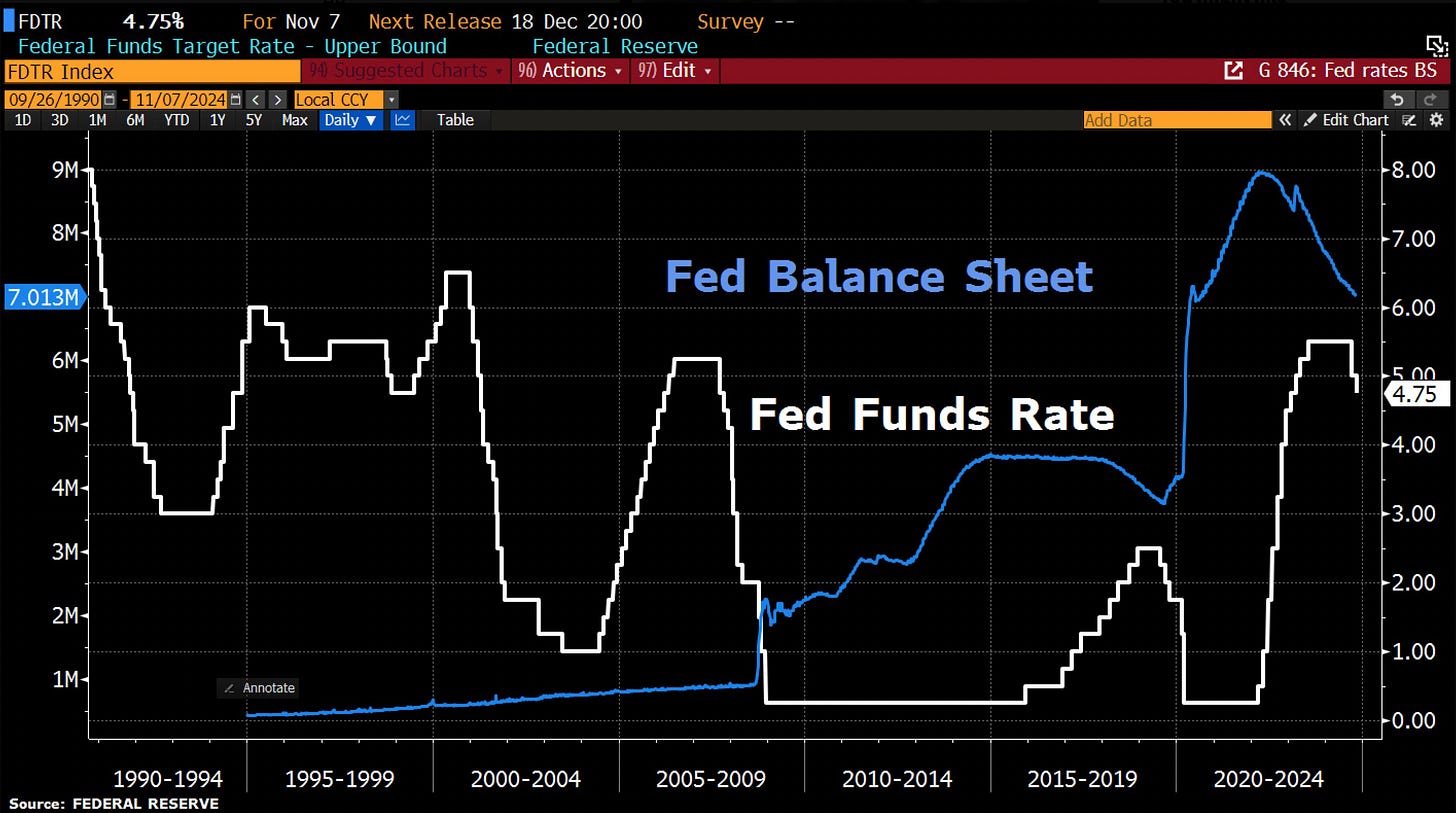

The U.S. OIS market has priced out well over 100bp of cuts in 2025, with the implied rate for September 2025 at c.4.00%. The Fed has a very good reason to skip a cut in December and instead cut by 25bp in January, these rate pushbacks simply coming from Trump’s regimes which are inflationary (tax cuts and tariffs).

The trade tariffs won’t be introduced until late 2025/early 2026 as it takes time to conduct trade investigations, but future inflation expectations are posing a reflationary risk to U.S., we will likely see some stagnation in the chart below. A risk-on mood from investors will prop up company’s revenue and business investment will rise, we know that growth typically equals inflation. Elon Musk, who Trump has hired as his efficiency boss, won’t be too worried about this as he’s evidently pro-growth.

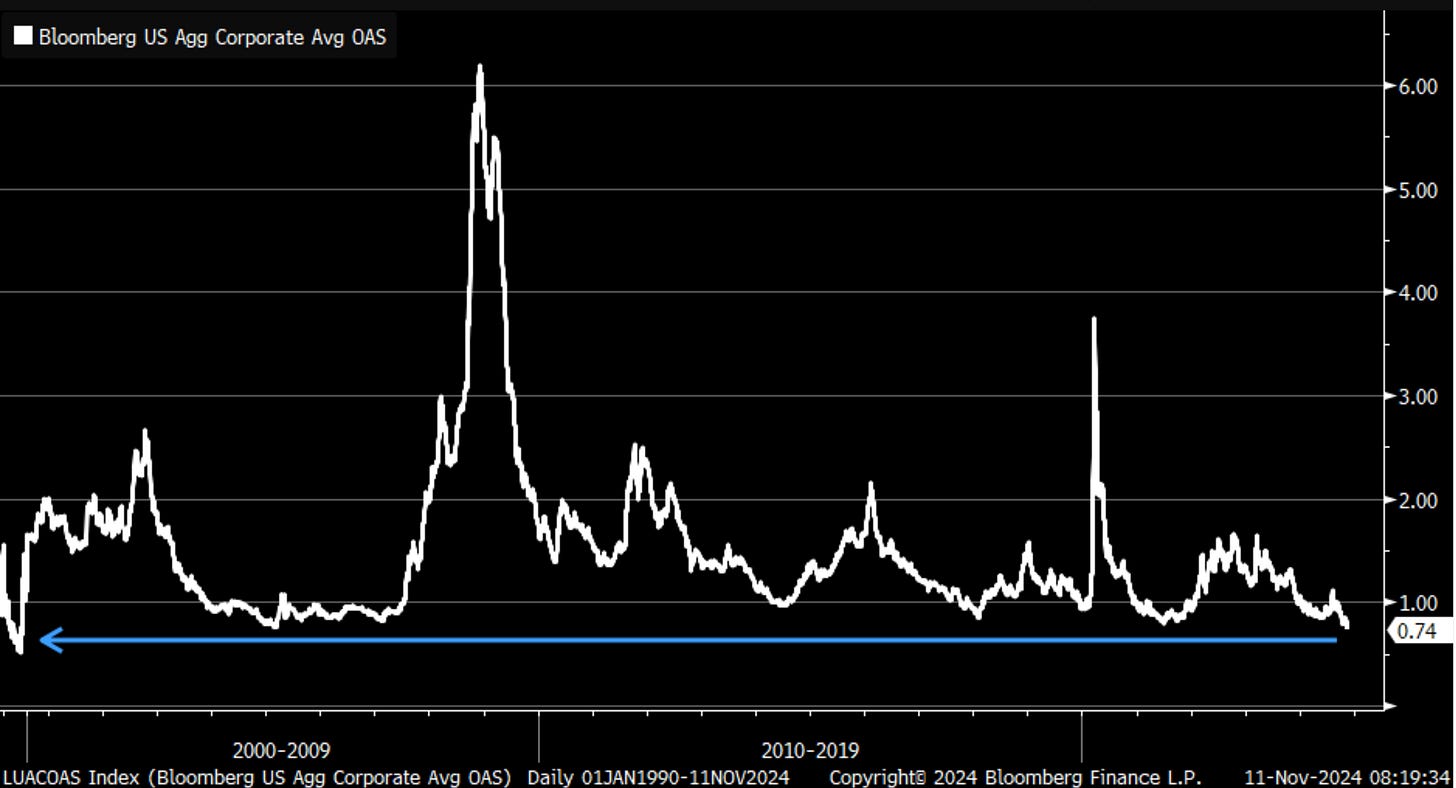

The most interesting part of U.S. markets right now is the bond market, IG credit spreads are at their tightest/lowest since May 1998. This is exactly what we want to see (in my opinion), wide spreads means high credit risks which is something we want to avoid. It’s a clear representation that there are strong corporate fundamentals, coming from balance sheets, profitability, and debt levels. Expected periods of economic growth is where investors become confident about the economy and corporations' ability to service their debt.

Is it that corporate bonds are so attractive, or is it that no one wants government debt anymore? Each will have their own opinion.

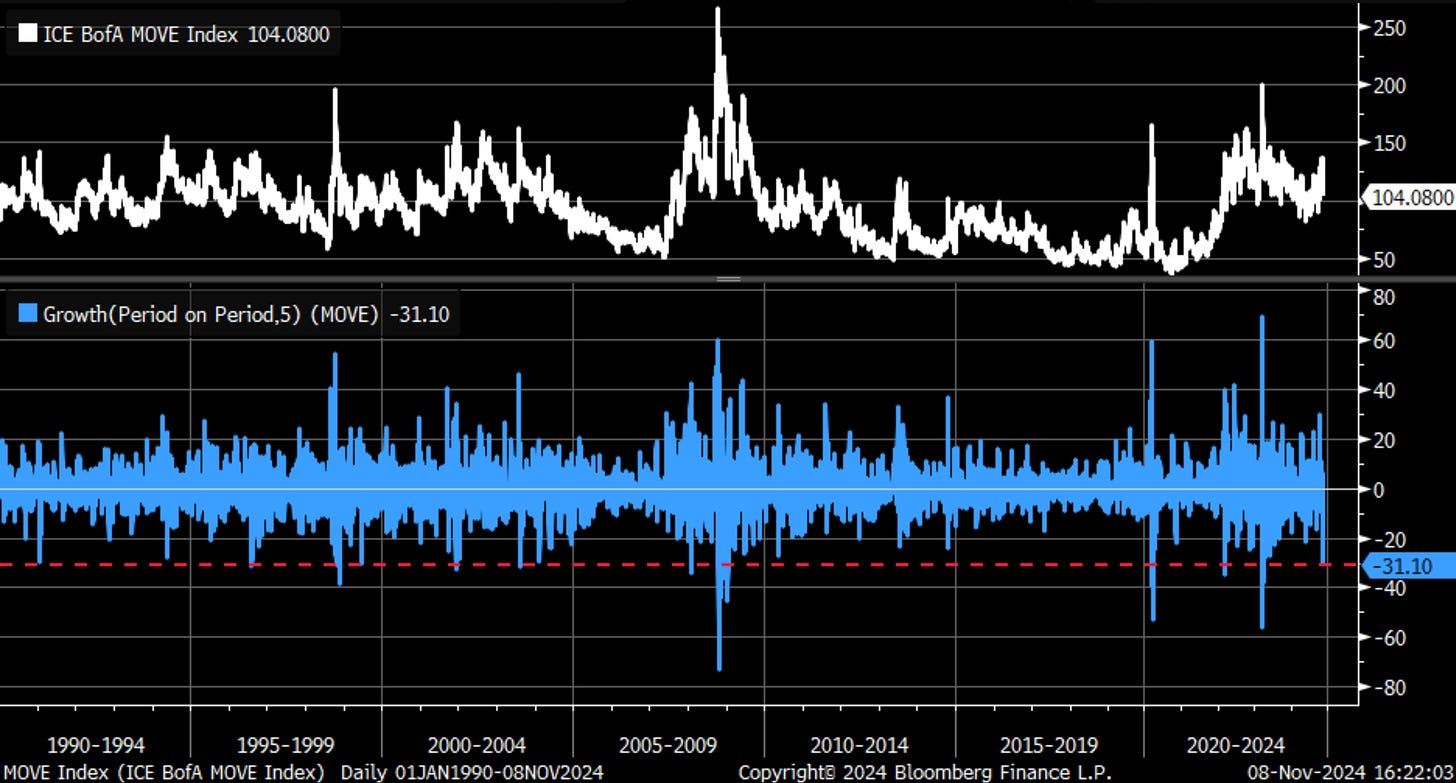

The MOVE Index has fallen by c.31.1 points over the past 5 days, that is one of the larger declines in history (going back to 1990). Of course, we expected a drop off in volatility once the dust had settled from the elections, but the decline is one of the largest in history. As mentioned in my last report, there’s a high probability that we’ll see continued upward pressure on yields as Trump’s inflationary policies take power. These higher yields will naturally shift sentiment and credit spreads will likely be tight for a while, signalling some great strength.

The main thing I’m emphasising here is not just a shift in risk, but rather a shift in portfolio allocation. Times are changing, say goodbye to the 60/40 portfolio (in my opinion), it often lacks direct exposure to inflation-protected assets like commodities, real estate, or inflation-linked bonds. Government bonds are no longer as attractive as they once were, outperformance in crypto and indexes become hard to argue with now that they are both supported heavily by regimes in America.

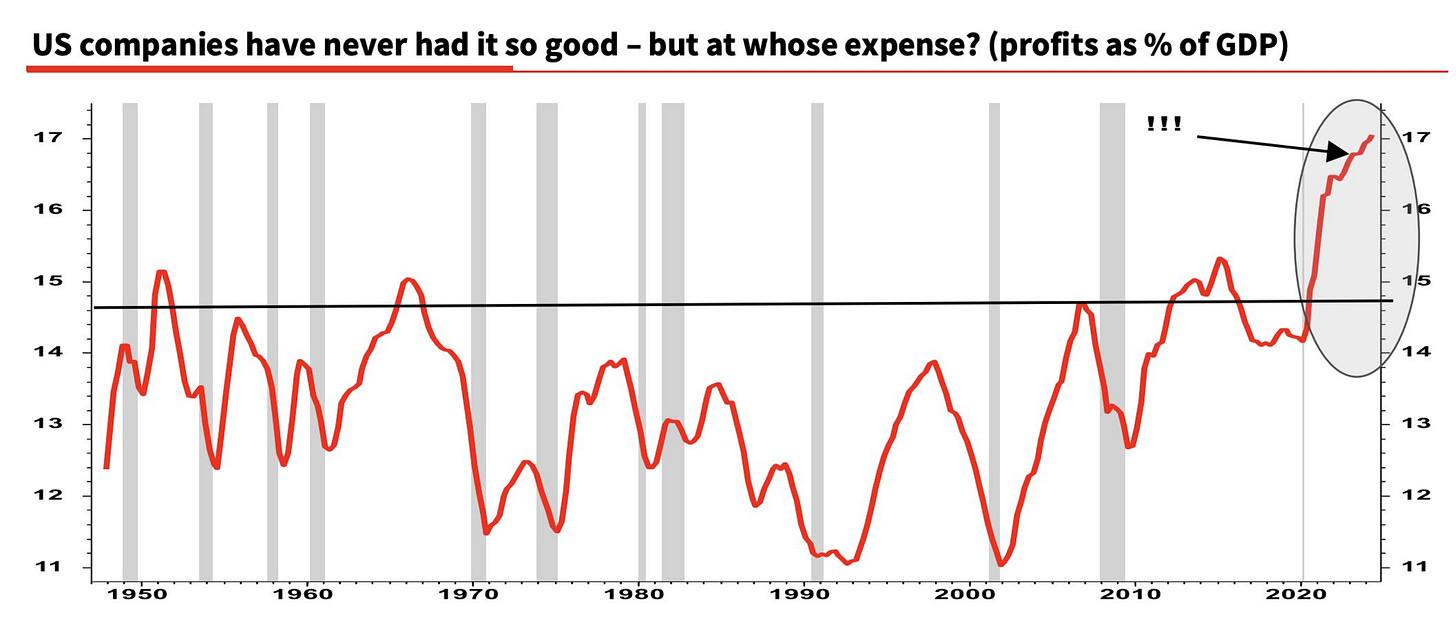

U.S. companies have never had it so good, the profit share of U.S. GDP has hit a record c.17%. This partly explains why the average American feels poorer today (to an extent, I’m not ignoring the fact that the U.S. has had mass money printing and high inflation which has contributed to a poorer-feeling American), than 4 years ago - c.40% of Americans don’t own any stocks. I think there’s going to be large fluctuations in portfolios across quarters, with extra risk taking being favoured because of the regimes in play. Ease of access to capital will further pump the trend of risk in portfolios, a defensive portfolio makes little sense in this times. Yes, rates are high, but once again it’s another thing that we may see a shift in - Investors taking the risk that they can outperform rates so significantly that borrowing at these levels is not detrimental to their returns. Accelerating growth and restrictive policy is the regime in play here, time to position.

Thanks for reading until the end!