Oil Slumps, Fragile Current Accounts and Trump's Tariffs on China

Delving Into the History and Potential Effects of Donald Trump's Tariffs on China

Hey guys,

This week I have really noticed how the sources of your information is so key. I read an article from a Bloomberg worker about UK Gilts, only to find out the whole ideology was correct.

Yes, everyone is human and we make mistakes but the lesson is to not take every article from someone respected in the industry as the ultimate truth, do your own due-diligence.

The US presidential elections are approaching fast, the impact that the polls will begin to have on global markets will kick in.

Let’s dive into what’s been happening!

Macro watch

Although tensions in the Middle East re-sparked when Hezbollah launched a big missile attack on Israel just two weeks ago (over the killing of its senior commander in Beirut in July), Oil prices have been subdued.

After a deal to restore supplies from Libya, traders’ attention turned back to concerns about fragile global demand for crude oil. Brent crude dipped below $74/barrel, which is the lowest since Dec 2023.

Commodities like oil are heavily driven by simple supply and demand dynamics. Like any other commodity, prices are also affected by geopolitical issues, however, these trends will only be fruitful if the geopolitical dynamics truly spark an effect to the supply or demand of oil. There is evidently slow growth in large oil consuming economies like Germany and China, the weak GDP’s in both of these economies are dragging oil prices as demand declines.

While tensions in the Middle East are still high, the market may perceive the risk of a significant disruption to oil supply as low. For example, if key oil-producing regions are not directly involved in the conflict, the immediate impact on oil supply may be limited.

It’s important to remember that China is the second-largest consumer of oil, the US being first. Now, if Trump wins the US presidential election in November and imposes tariffs on Chinese imports, the slowdown on Chinese growth could be intensified. The lack of demand from China will trickle into lower demand for Oil, the supply-demand effect will naturally drag prices even further south.

Market mover

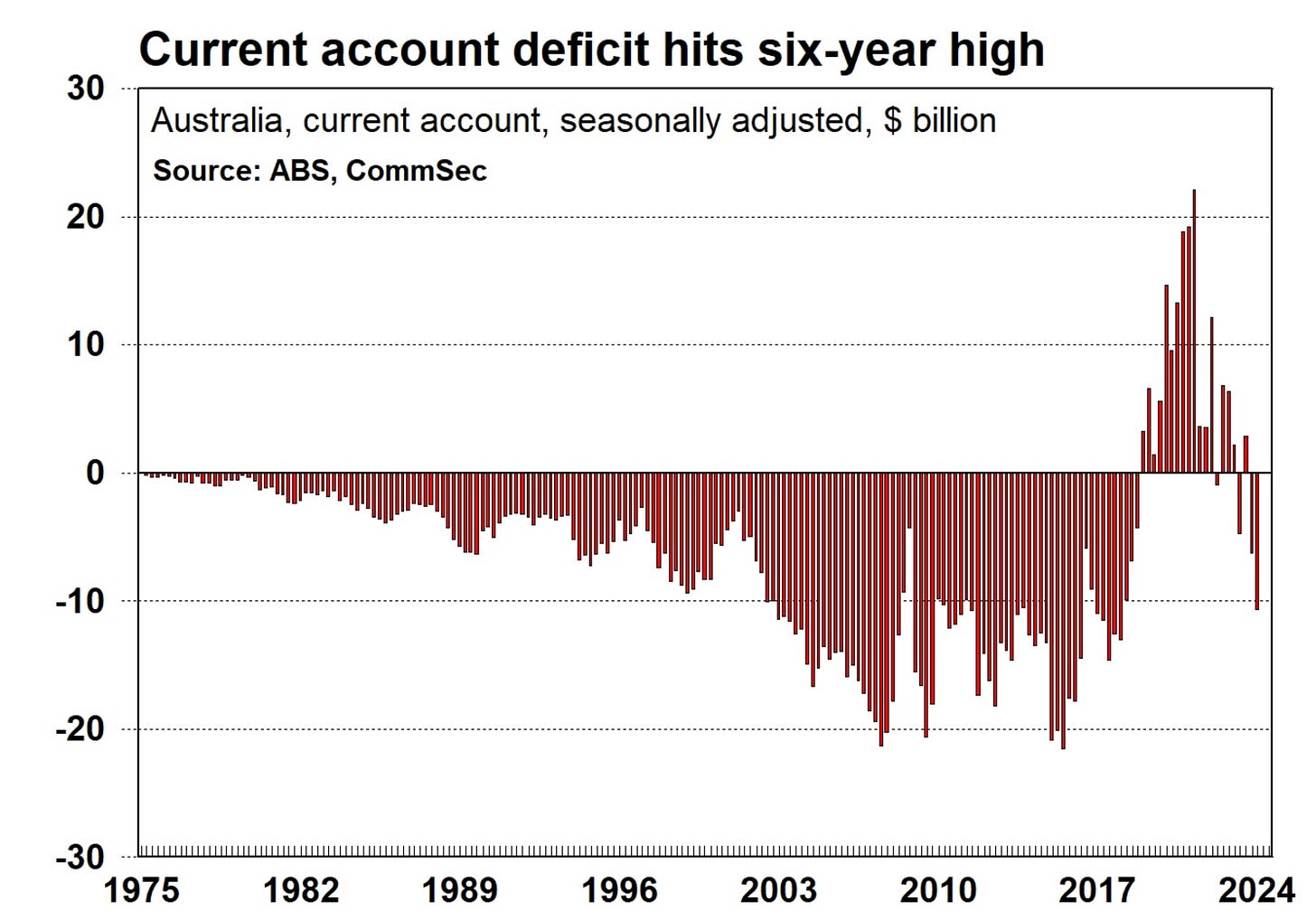

Australia’s current account data in the early hours of Tuesday morning came in at -10.7B from -6.3B the previous month. This is a six-year low for Australia’s current account and caused a c.-1.10% loss in the AUD/USD FX cross in just Tuesday alone.

A country's current account plays a significant role in influencing its foreign exchange rate. The current account is a component of a country's balance of payments and includes the trade balance (exports minus imports), net income from abroad, and net current transfers (like remittances). A surplus of foreign currency entering the economy increases demand for the local currency, while a deficit (meaning the country is spending more on foreign goods and services than it’s earning) declines it.

A negative current account also reduces the incentive for foreign investors wanting to allocate capital into the economy, while domestic and global consumer confidence declines. Although this component is not typically a trend-setter in any financial market, it can definitely be a contributor to one and is a key area to focus on when numbers are extreme, like we are seeing in Australia’s current account right now.

Another important market move this week was the reversal of the US 2s10s yield inversion.

The inversion of the 2s10s curve is typically followed by a recession, however, continued positive data from the US has dragged this yield curve from negative depths to a neutral point. The spread briefly rose to +0.5bps as the 2Y yields slipped below the 10Y yields.

Recent positive data in the US has been the driver of the dis-inversion of this yield curve, however, the final catalyst to drag the 2s10s into positive territory was another slow JOLTS job openings.

These job openings were the lowest since the start of 2021, when large job lay-offs in the US began. The figure of 7.67M was lower than all estimates in a Bloomberg survey of economists, who predicted c.8.09M.

If the labor market data on Friday continues in this direction, there will be solidification of the 50bps cut expected from the Fed in the September 18th meeting, the current opinions are mixed between a 25bps cut and a 50bps cut.

The losses seen in the Dollar index have been heavy and I see little reason for a continued sell-off with this momentum, I see a slower decline/prices stalling as a more likely outcome.

Trump’s tariff tail-risk

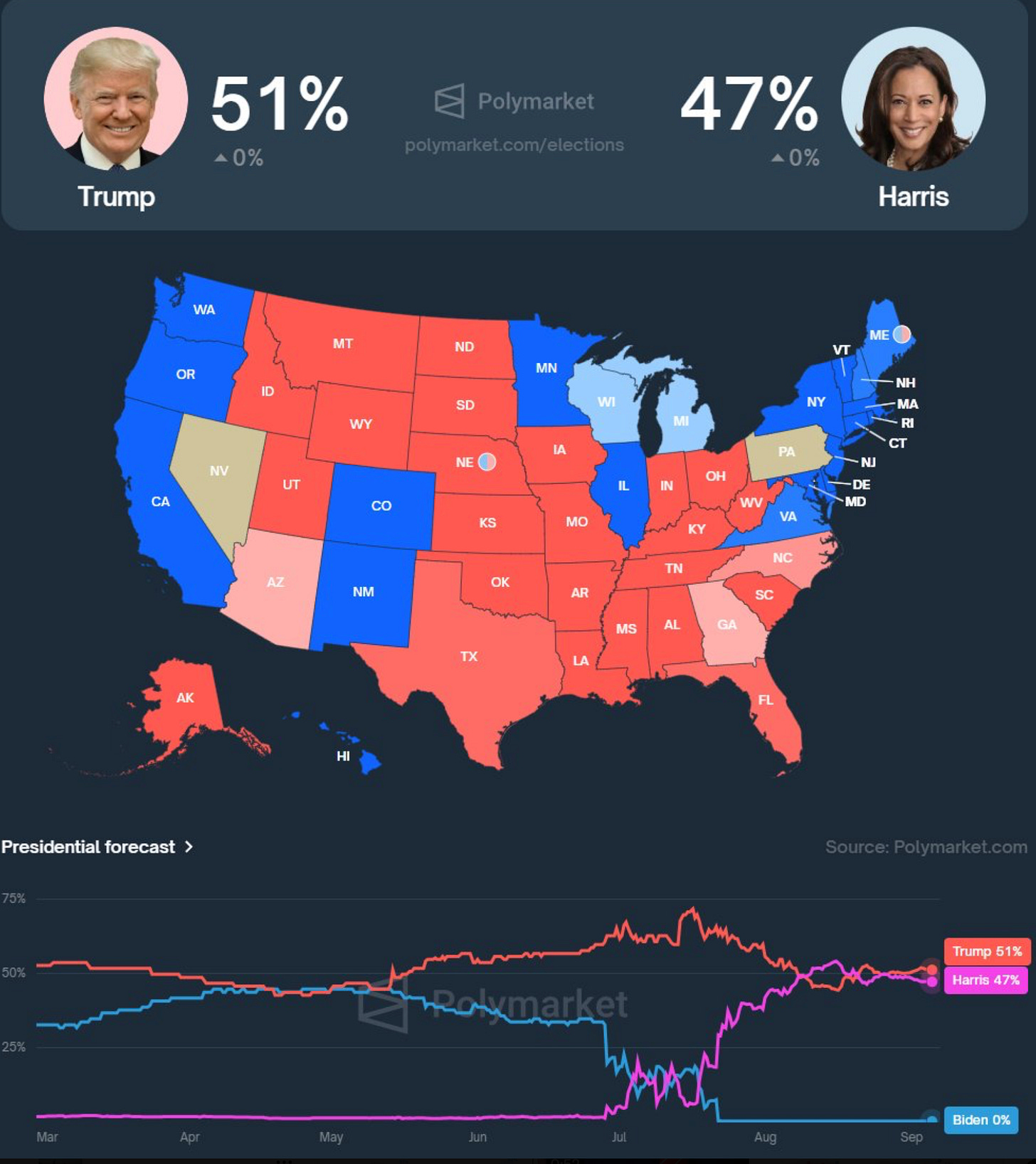

Donald Trump is favoured to win the US presidential election in November. A new president imposing new rules and regulations can create large effects in financial markets. If Trump does win, there will be a new party as well as a new president, the Republican Party, who will help to impose new rules and regulations. Donald Trump is now leading Kamala Harris by 4 percentage points according to political trading market, Polymarket.

Trump's tariffs on China, particularly those imposed during his presidency from 2017 to 2021, had significant and multifaceted effects on the global economy. These tariffs were a central element of Trump's "America First" economic policy, which aimed to reduce the US trade deficit, protect American industries, and address perceived unfair trade practices by other countries, particularly China.

So, what were the figures when Trump’s policy was in full force before?

Trump imposed tariffs on approximately $370 billion worth of Chinese goods, with rates ranging from 10% to 25%. These tariffs targeted a wide range of products, including electronics, machinery, consumer goods, and raw materials. The tariffs were part of a broader strategy to pressure China to change its trade practices, particularly concerning intellectual property theft and forced technology transfers.

These tariffs, as expected, caused noticeable slowdown in China’s growth as there was higher cost associated with their products going into the US. The tariffs escalated tensions between the US and China, leading to a prolonged trade war. This strained relations between the world’s two largest economies and had spillover effects on global markets, particularly in emerging economies that are heavily dependent on trade with China and the US.

The Hang Seng Index had significant losses across this period, but not all of the losses were down to these tariffs imposed by Trump, they were just a catalyst to negative data inside the Chinese equity market.

The main categories of tariffs:

Raw materials and intermediate goods - Steel, aluminium, chemicals and plastics.

Consumer goods - Appliances, electrics, toys and clothing.

Industrial and technological products - Semiconductors, telecommunications equipment and machinery.

So what can this mean for financial markets?

Volatility.

JPMorgan said US tariffs of 60% on Chinese products, as Trump has suggested, may reduce China's GDP growth by two percentage points from its current forecast of 4% YoY in 2025, excluding any policy responses. So, where would they position?

Firstly, let’s start on what they’d avoid, Chinese stocks. Supply chain disruptions, GDP slowing and low consumer demand have no positive effect on earnings for Chinese companies. Sector-specific positioning will be in focus, manufacturing and industrial companies will face higher costs and exposure to these companies poses little reward. Capital allocation will be determined on Chinese-based companies, it will be focused on Chinese-related companies.

US companies like Apple, who are dependent on Chinese supply chains, would be directly affected and would not have enough incentive for investors to position into their stock. However, industries immune to these tariffs, like real estate, banking, law and utility companies create an option for investment.

An area that investment firms will be diligent on is their volatility exposure, so hedging will be utilised more. The tariffs previously caused volatility in currency markets, it will be crucial for risk management purposes to hedge against this, positioning into safety assets. Safety and risk assets typically diverge from each-other which is why it’s seen as a hedge.

To also mitigate tariff impact, companies across the globe that are diversifying or have already diversified their supply chains will be appealing to utilise as a hedge to current exposure of Chinese-related companies. Remember, when these geopolitical issues (like Trump’s tariffs) are in focus, it doesn’t mean there is one set direction. Firstly, Trump may not win election and secondly, these tariffs may not come into play/have large effect, which is why hedging and being exposed to both sides of the market is crucial rather than being all-in on one side.

Tariffs make imported goods more expensive. If the tariffs lead to a significant reduction in imports, this could reduce the US trade deficit (the gap between imports and exports), which is net positive for the Dollar. Also, When tariffs disrupt global trade, businesses and investors might need more dollars to manage trade costs, currency hedging, or to meet obligations denominated in dollars, further boosting demand for the dollar.

In summary, Trump's tariffs were dollar bullish primarily because they led to increased demand for safe-haven assets, improvements in the US trade balance and pressure on other currencies. While tariffs can have complex and varied effects, the net impact of Trump's tariffs against China were generally supportive of a stronger U.S. dollar.

We can see this evidently below (bar the COVID-19 crisis):

Market dynamics are shifting and trends will begin to be driven by different factors. Currencies are heavily driven by interest rate differentials and monetary policy expectations, however, with such a large event like elections coming up and potentially shifts in global growth, US trade balance and demand for the greenback, we are likely to see equities, FX, yields and commodity markets be affected by the US election result.

Based on historic events, we are likely to see a bullish Dollar if Trump wins presidency, however, the significance of the move will be subdued if yield spreads continue to widen between the US and other countries.

There we have it, another report down!

Nice read Alfie. Australia seems to be in a policy contrast with the RBA still maintaining its OCR & the gov on the other hand ramping up spending making the inflation fight persist