Navigating Macro Trades with 3 Core Principles

A Trader's Perspective on Market Headwinds, Government Intervention, and Finding Opportunities

Hey Crew,

Two months into the new year.

Continue doing the work that moves the needle forward.

That’s it.

In this report, I want to open your mind to three core principles that help me with generating macro trades and managing positions:

Strong opinions, weakly held: When presented with new data, don’t revert to old decisions. Interpret the situation for what it is, not for what it was.

Don’t fight the house: When there’s a clear brick wall (central bank or a government) committed to supporting markets don’t fight. Wait until the environment has settled before re-evaluating.

Always look for the spread trade: Find two economies, one with high interest rates, the other with low rates, one with high inflation (UK) the other with low (U.S), one with strong growth (U.S) the other with low growth (EU/UK) and analyse the necessary data to build your macro trade. Spread trades present the most clear opportunities.

Currency Plays

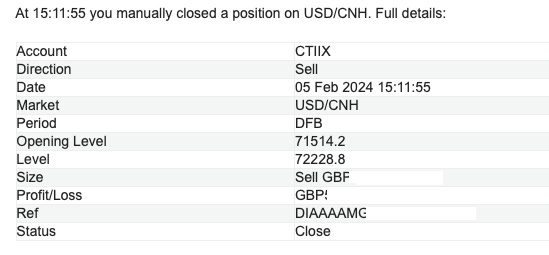

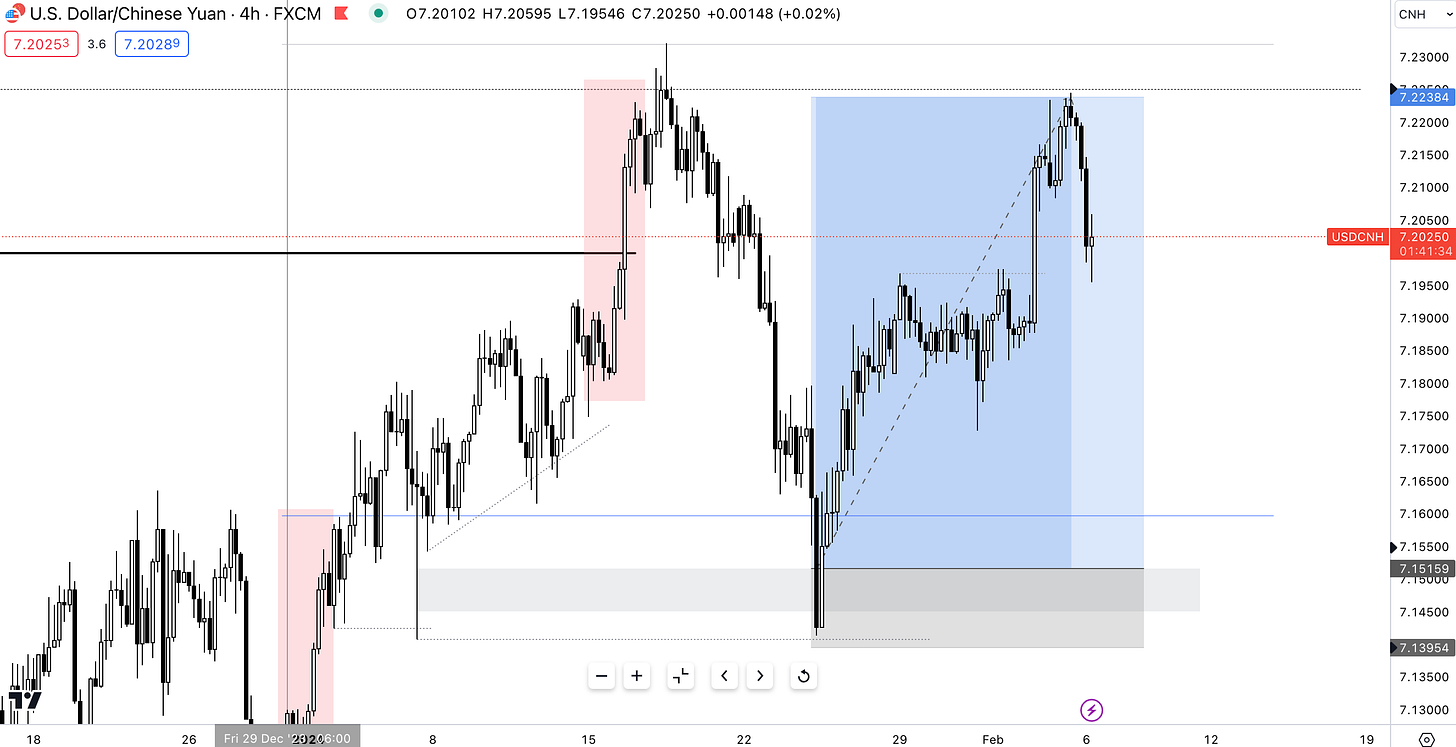

In one of my previous reports I mentioned my currency play on the Chinese Yuan, expressed through my long position on USD/CNH, earlier this week I closed out as a flurry of macro and non-macro factors affected the potential outcome of the position.

I exited the position earlier than anticipated due to the intervention of the Chinese government entering the equities market to backstop the short-selling seen across the HSI (Hang Seng Index) & CSI 300 (Shanghai Shenzhen).

The Chinese government continued to tighten trading restrictions on domestic institutional investors as well as retailers in a measure to prevent widespread panic in its equities markets. This extensive red tape on short selling has prevented top quantitative hedge funds in China from gaining access to selling small-cap stocks or any Chinese listed equity. If you’re wondering what’s the cause behind this extremely negative sentiment surrounding China I summed it up into four points in this article:

Currency Plays: Cable Shorts, Yuan Shorts

Hey crew, Glad to be back. It’s been a hectic but very fruitful start to the new year. The macro universe is large in swing, geopolitics driving the headwinds of markets as well. As I’ve said in previous reports, I want to make my research actionable and truly educational for you all.

Recent economic data from China paints a concerning picture, suggesting the weakest post-pandemic performance in several years. Key indicators released today reveal a continuation of deflationary pressures, with CPI falling 0.8% year-over-year in January (although showing a modest 0.3% monthly increase). This, coupled with the first annual decline in exports since 2016 (a 4.6% drop compared to 2022) and a 5.5% decrease in imports, dampens optimism for a swift economic rebound.

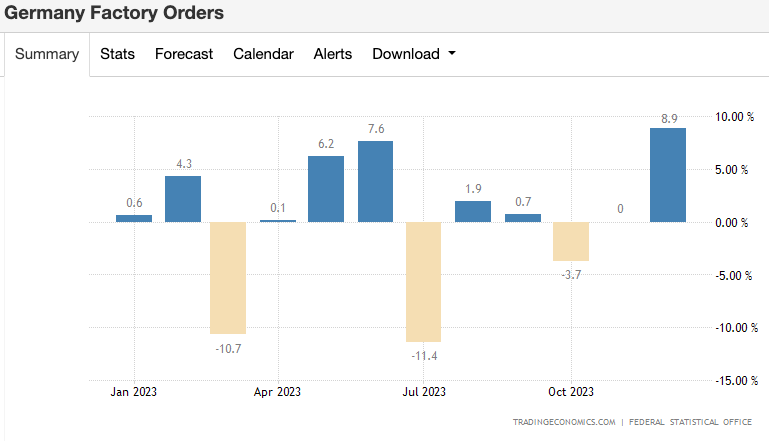

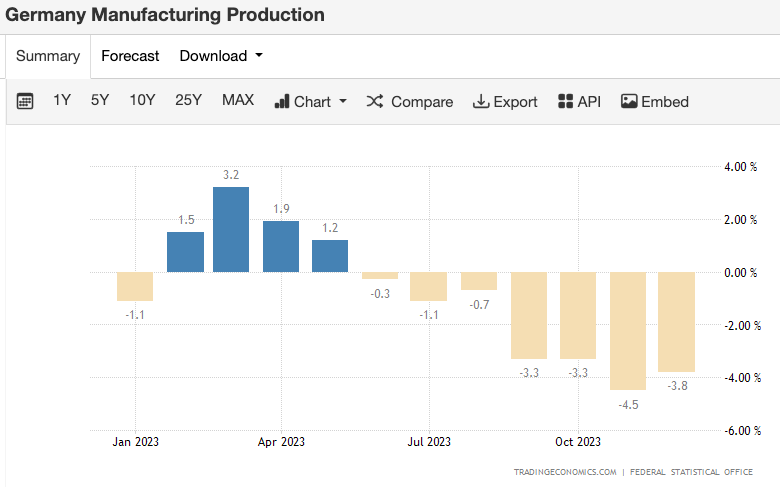

When receiving such data points I like to interpret them as this. “What effect does this have on markets right now and what effect will it have on markets tomorrow?”. I then look to take it deeper, “What are the second-order consequences of weaker import data from China?” Weak demand for German factory goods, decreased demand for Saudi Oil subduing crude prices and as a result weak demand for Chinese capital markets resulting in capital outflows.

Now don’t be deceived, although the December ‘23 factory orders report showed a large unexpected 8.9% gain, this doesn’t represent a bounceback within the German industrial sector. This large increase was a result of unusually large big-ticket orders for aircraft. For the whole year of 2023, incoming orders fell 5.9% sharing a similar story to that of China’s exports.

Through Q3 & Q4, Germany’s main manufacturing arms (mechanical engineering and chemical engineering) saw a contraction in orders which further dragged manufacturing production lower for the automotive economy.

Such economic headwinds are how I aim to piece together different parts of the economy.

Chinese Yuan Short - Understanding Headwinds

As I always share via my reports, no one has a crystal ball, not even your idols on Wall St, but what they do have, is a gut instinct, cultivated over years of experience and trial and error. Swiftly exiting this position required a similar set of tools one can’t develop from just reading reports. So I’ll share with you the factors I considered that would affect my trade and the ability for me to maximise my return.

The Chinese government, although unclear as to the exact amount, has pumped equity markets with over $288bn in an effort to stop the chain of margin selling from continuing. If you’re unaware of this chain of events let me explain its importance to you.

China’s corporations often use their equity as a financing tool to access more capital from banks, meaning a heavy element of their economy/capital financing is based on collateral lending. When the domestic stock market crashes, these firms get margin called as the value of their collateral (stock) declines. This means the corporations must put up more cash or collateral to secure the financing. In most cases, the bank ends up selling their collateral on the open market which further increases the selling pressure on Chinese equities which starts the whole chain of margin calls → collateral being liquidated by banks → high selling pressure → lower Chinese equity valuations.

This is good for a currency short on the Yuan because when a country’s stock market is experiencing large sell-offs from domestic and international investors that leads to an exchange of capital for international investors selling out of their Chinese positions. To pull capital out from Chinese markets and remit their money to their domestic portfolio they sell the Chinese Yuan to purchase their domestic currency putting downward pressure on the Chinese Yuan.

However, since the Chinese government intervened to backstop all equity sales, this added a temporary sense of stability back into the economy which strengthened and stabilised the Yuan. The intervention from the CCP for many investors is interpreted as a signal of support, and a strong commitment to economic stability which can alter investor’s perception of the economy. Although the sentiment remains rather meek, being in a currency play with a nation-state on the other side of your short is never a wise position to be in. All it takes is one headline and continued buying from the CCP to affect the swing in its FX rate, which allowed me to decide to exit the short.

Hopefully from this report, you’ve been able to highlight the three main processes I use to build my edge in not only finding but managing macro positions.

Remember this:

Strong opinions, weakly held: When presented with new data, don’t revert to old decisions. Interpret the situation for what it is, not for what it was.

Don’t fight the house: When there’s a clear brick wall (central bank or government) committing to support markets don’t try to go against them. Wait until the water has settled down before re-evaluating

Always look for the spread trade: Find two economies, one with high interest rates, the other with low rates, one with high inflation (UK) the other with low (U.S), one with strong growth (U.S) the other with low growth (EU/UK) and analyse the necessary data to build your macro trade. Spread trades are the most clear trades presented.

I hope you enjoyed this report, as always I’d love to hear your thoughts. Next week I’ll be sharing some trade ideas I’m exploring that you can also execute on yourself.