Gold. The Macro Outlook Pt.2

Exploring the final report on where gold is positioned and my projections for the metal.

Hey crew,

I’ve gotta say.

Greece was a movie.

The villa was hidden in the mountains.

Views stretched across the whole island.

Beautiful…

If you needed a reminder let this be it, we work to live, not the other way around. Work as hard as you can, but don’t forget to live, you only have one shot at this life thing.

Make it count

Anyways, glad to be back, I truly am.

In this piece we’ll explore:

My current outlook for gold

Factors which oppose my gold views

A look into central bank activity in the gold market

As always, lend me your attention:

A Macro View of Gold

From the last macro report on gold, I hope you were all able to understand what affects the movement of gold prices.

Real interest rates

Global growth & Inflation

Fear & uncertainty in markets

We reviewed how gold performed during the global central bank hiking cycle of 2022, where gold peaked at the start of the hiking cycle in March ‘22 and troughed just before financial conditions loosened in October ‘22 due to reasons such as the fears of a bond market contagion risk stemming from the UK gilt crash.

Let’s review what happened in October ‘22 and the current trend we’re seeing with gold now.

October marked the peak in the NFCI (national financial conditions index) when financial conditions were the tightest, unsurprisingly as a month prior (Sept ‘22) UK’s chancellor announced the most irrational budget plan for the UK which would have pushed debt levels and issuance to new highs. That resulted in the BOE being forced to intervene in the gilt market in early October to prevent a widescale collapse and further contagion risks spreading to other global bond markets.

As pension funds and insurance firms were margin called, a flee to safety led to the sharp turnaround seen in gold’s price action. It’s worth noting that although the Fed and global central banks were tightening monetary policy gold continued to rally, most people can’t figure out why, mainly because we know that gold is inversely correlated to real rates.

So here’s an explanation. The basics of hiking interest rates are to tighten the money supply, increase the cost of accessing credit and to slow down economic activity.

Now, from October 2022 financial conditions were softening even though rates were rising, credit, leverage and risk were becoming more accessible through lenders, practically invalidating the purpose of the Feds’s hikes. So in essence, conditions in the U.S were not getting any tighter, adding to that a record-level central bank purchasing of gold across Q3 and Q4 of 2022. Notably, the PBoC disclosed that it had been buying gold in November 2022, adding 120t in gold reserves.

Increased central bank demand and an easing in financial conditions were two consistent themes we saw amidst the gold rally.

So the question arises, where do I see the yellow metal going throughout 2023?

My conviction play behind gold would be to hold any bets until we have a final sell-off into the 1800s region. From this region, I would want to be long gold both from a technical aspect and a macro point of view.

As always, these are my views, not investment advice, so here’s my reasoning behind this macro play.

We are now very close to if not already at the end of the central bank hiking cycle with the exception of the Bank of England and ECB, however, those two central banks have very little effect on the yellow metal compared to the Fed since Gold is priced in USD 0.00%↑ . Although very premature, the market is pricing in Fed cuts from March 2024 with expectations the Fed have one more 25bps hike left for this year. So, in retrospect to gold, little scope for further tightening in credit conditions and an environment where financial conditions are loosening presents the perfect opportunity for gold to have another leg to the upside and revisit ATHs of 2075.00 last seen early 2022.

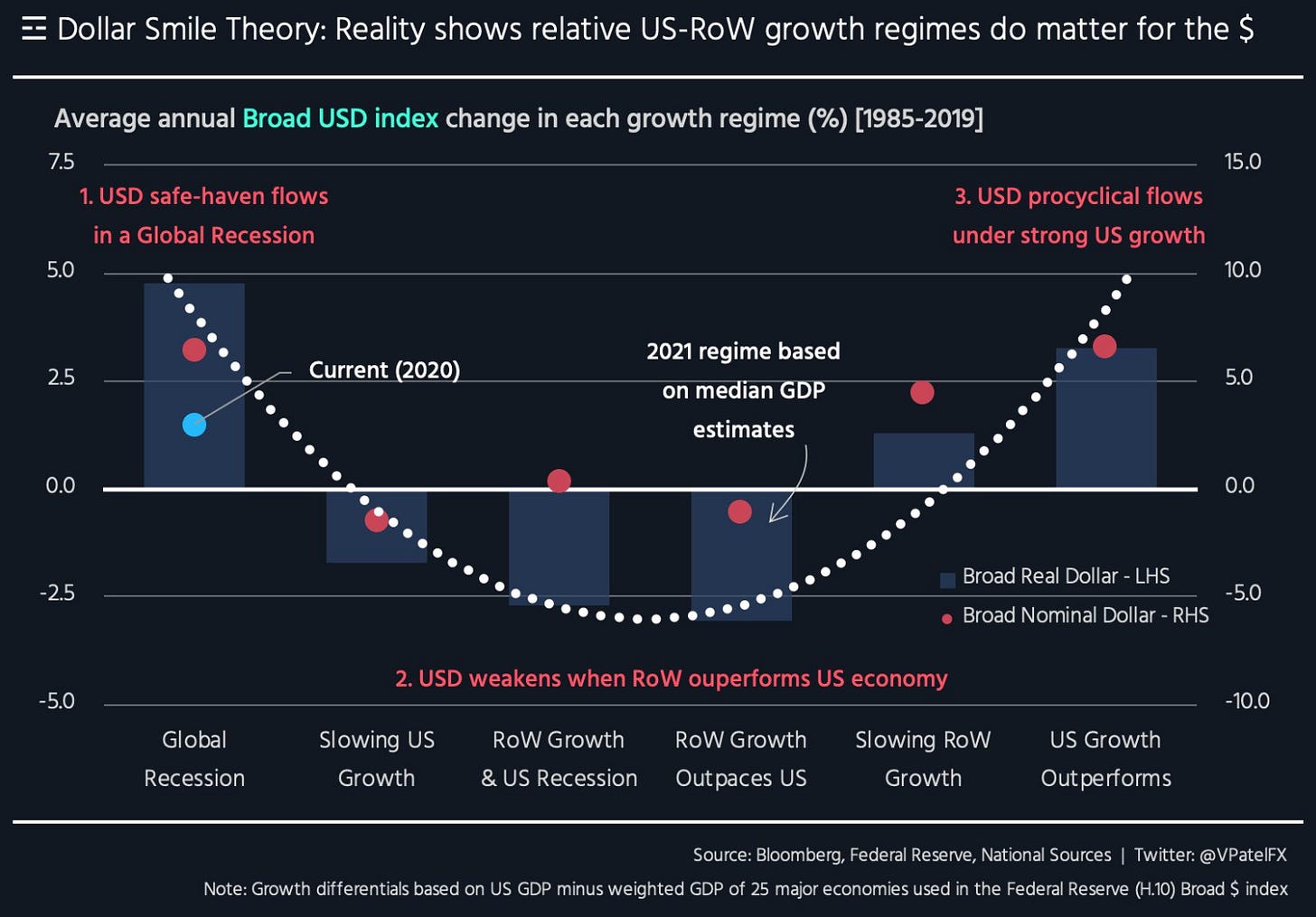

Another confirmation is non-other than the dollar smile theory I’ve shared with you all, as we know we’re currently sitting in the middle of the dollar smile where the U.S economy is neither outgrowing the RoW (rest of world) nor acting as a safe haven flow in times of uncertainty.

Right now we are currently moving towards the left, a global recession. I recall reading a tweet shared by a PM at a large hedge fund which said “the plane engines are already off” referring to the U.S economy, “the recession is already here for the real estate industry”. Take that with a pinch of salt, everyone has their opinion on where markets are and where they are headed, but I found this individual’s interpretation of the current state of markets interesting. Due to the housing market’s extreme sensitivity to interest rate changes, the real estate industry alongside construction and manufacturing is usually the first to show signs of reduced activity and contraction before the rest of the economy feels the squeeze.

In such an environment, gold is always seen as the destination for capital flows.

Why could I be wrong?

It’s equally important to explore why you may be wrong and be prepared for certain circumstances that may discredit your confirmation for a position. So here’s a brief of what could make my macro view invalid.

Higher interest rates. A tail risk is that we have a resurgence in U.S inflation as a result of softer financial conditions forcing the Fed to hike. If real rates globally continue to rise, and financial conditions tighten an asset which yields no coupon would be the first out of any portfolio.

Rebound in global growth. Although this looks very unlikely, you can never rule out anything in markets. In the event that we begin to see U.S CPI slow, housing data stabilise, and the Chinese market rebound in activity, trade and consumption there’s a possibility that we could avoid a global recession once the global financial mechanism is back in full motion.

A shift in risk appetite. This follows on from point no.2, if inflation settles down close to the 2% mark and parts of the U.S & global economy like real estate, GDP, and labour show signs of normalisation without a severe contraction as expected bets would shift away from positioning for a recession to seeking the best return relative to risk.

Further central bank gold sales. Thus far this year, central banks have been net purchasers of gold, a trend which stretches back to 2010 when central banks commenced gold buying making them net buyers. However, as you can see, there are always a few central banks that may sell their gold, reasons can vary from raising money to finance government spending and strengthening balance reserves to meeting market demand. A pure example would be Turkey, the central bank in Turkey sold over 81 tonnes of gold this year to meet local demand from its citizens seeking to protect themselves from inflation.

For me, those are the four standout reasons why my view to be net long Gold would be invalidated.

Conclusion

I maintain my hold outlook on the yellow metal until the position presents itself to be more favourable for a worthwhile risk-reward play. Global rates are significantly high with possibilities of a Fed pivot at the start of Q1 ‘24. The inflation tail risk persists particularly within Europe and the UK posing a threat to global growth and central bank activity.

Central banking buying and or selling also plays a crucial role in ensuring demand for gold remains strong throughout Q2-Q4. On the other hand, weak Chinese industrial output, fixed asset investment and economic data pose a threat that demand may drag unless we see additional fiscal stimulus from the PBOC.

If we have an extended period of softening within financial conditions then one can expect gold prices to see some uplift; my focus will remain on the upcoming Fed meetings to garner any extra confirmation of what the situation may be for gold’s price action throughout the year 2023.

Staying within the realm of commodities I’ll be doing a deeper dive report next week on commodity currencies, trends, cyclicalities and some more nuances behind commodity-correlated currencies.

As always I appreciate and look forward to hearing from you guys, so let me know your key takeaways from this report below and in the discord group!