Mount Rushmore Of Macro Investing: How Hedge Funds Democratised Monetary Power.

Adaptation Of Monetary Policy In Pioneering Exceptional Returns.

In the early 20th century, Wall Street had little reason to think about monetary policy. Inflation hovered below 2% for much of the period, the gold standard still anchored the dollar, and central banking felt like a distant, academic concern rather than a market-moving force.

Equity investors stuck to the basics: earnings, dividends, and the quality of management. Monetary dynamics were largely irrelevant to stock picking.

It was into this complacent landscape that a handful of iconoclasts began importing monetary thinking into investing, laying the foundations of what we now call macro trading.

In the 21st century, names like George Soros and Stanley Druckenmiller embody that philosophy, but one of the earliest and most overlooked figures was Tony Ciluffo, a money manager at the legendary Steinhardt, Fine, Berkowitz Fund (SFB). His work there quietly marked a turning point in financial history.

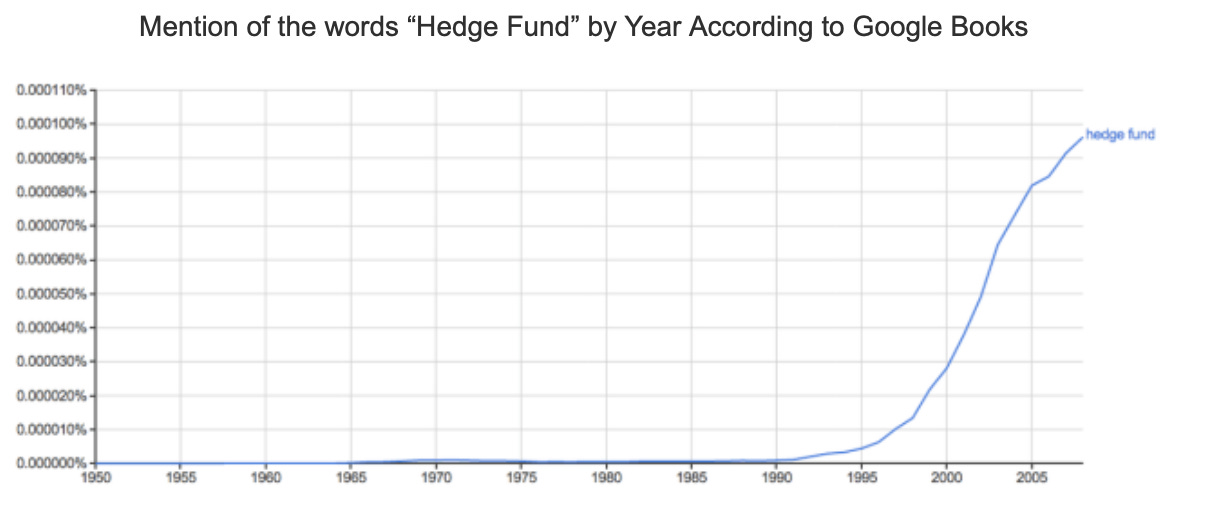

Back then, hedge funds themselves were dismissed by many economists as a zero-sum game, inconsistent with their die-hard Efficient Market Hypothesis (EMH) mantle. The irony is that it was precisely “speculative” investing, the kind pioneered by Ciluffo and his peers that forced monetary policy into the mainstream of market thinking.

Now, forecasting central bank decisions, managing liquidity, and even shaping policy expectations are as much the domain of HFs as they are of the men in suits (central bankers). What once emerged only from the marble halls of the Federal Reserve and the WH now unfolds daily on trading desks and macro pods across New York and London.

So breaking it down in layman terms, what did Tony Ciluffo see and how did his approach change the game?

the Cliuffo model

He’s apprroach was simple. He used the oldest but simplest trick in the book, “follow the money“

monetary comditions drive liquidity, liquidity drives asset allocation and lastly asset allocation drives prices. The framework was simple: if we could track mometary dynamics ahead of market, we could see turns coming before anyone else.

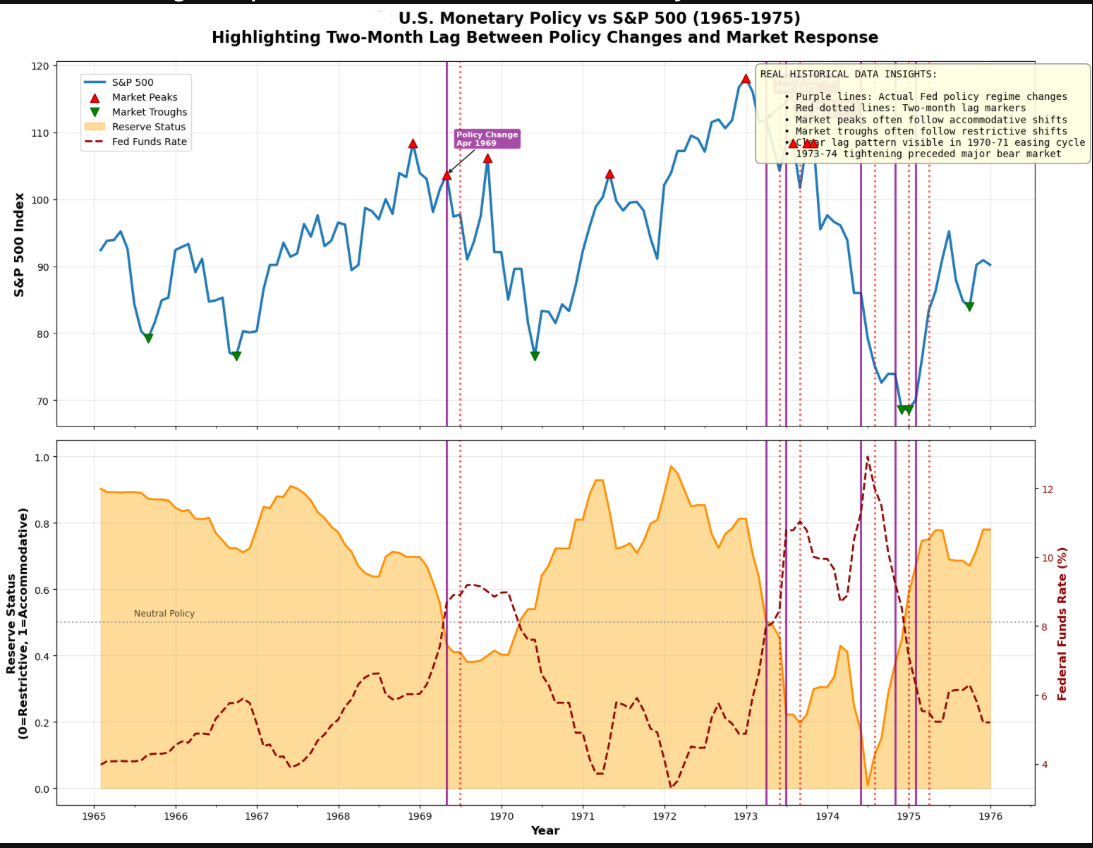

Beginning in the mid-1960s, he built a simple but remarkably effective framework around a single datapoint: bank reserve status. Each week, Federal Reserve member banks reported whether they held “free reserves,” meaning excess capacity to lend beyond required minimums, or “borrowed reserves,” meaning they were tapping the Fed just to meet those minimums.

Periods of free reserves signaled an accommodative stance and expanding liquidity, while a shift to borrowed reserves signaled tightening, scarcity of liquidity, and an impending slowdown in monetary growth.

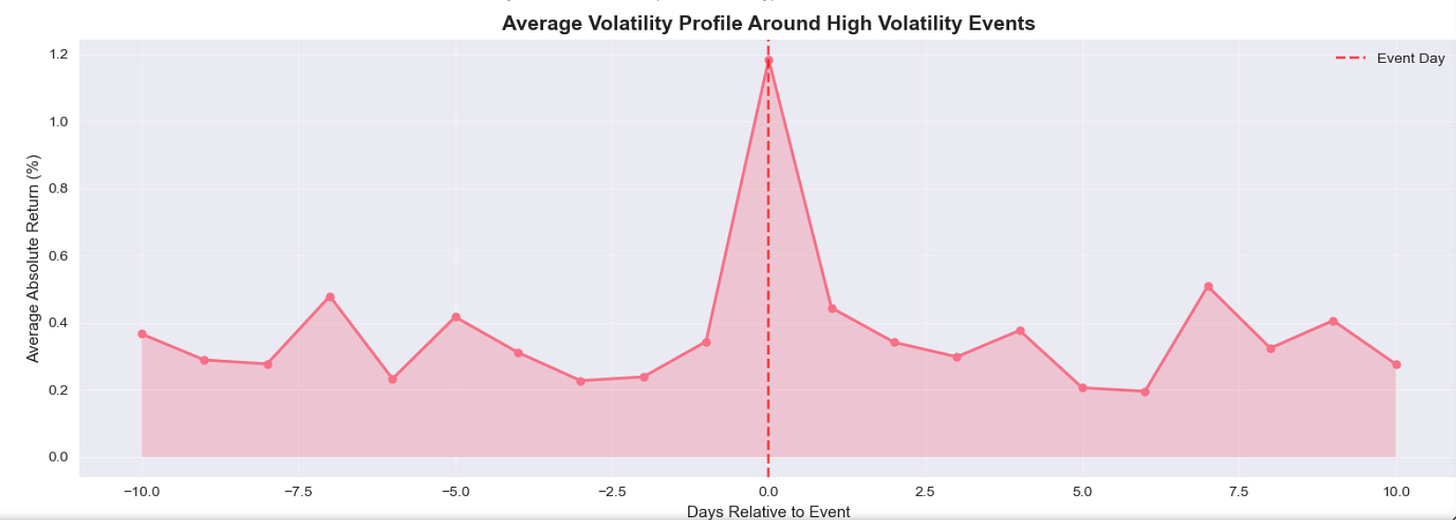

This was an important distinction to highlight in the model because historically, equity markets peaked roughly 2-4 months after banks moved from free to borrowed reserves and bottomed about two months after the reverse occurred. This lag, illustrated in chart above, was Cilluffo’s tactical edge. It allowed Steinhardt, Fine & Berkowitz to position ahead of major market turns by shorting cyclical stocks into tightening cycles and buying back in as liquidity began to return

Cilluffo anticipated the 1973–74 market collapse, allowing SBF fund to profit from one of the most severe equity drawdowns of the postwar era. The firm built a major short position in Kaufman & Broad, then the largest homebuilder in the United States. As rising rates and tightening liquidity hammered housing-related equities, that single trade generated roughly $2MM in profit.

Macro investing in foreign exchange market

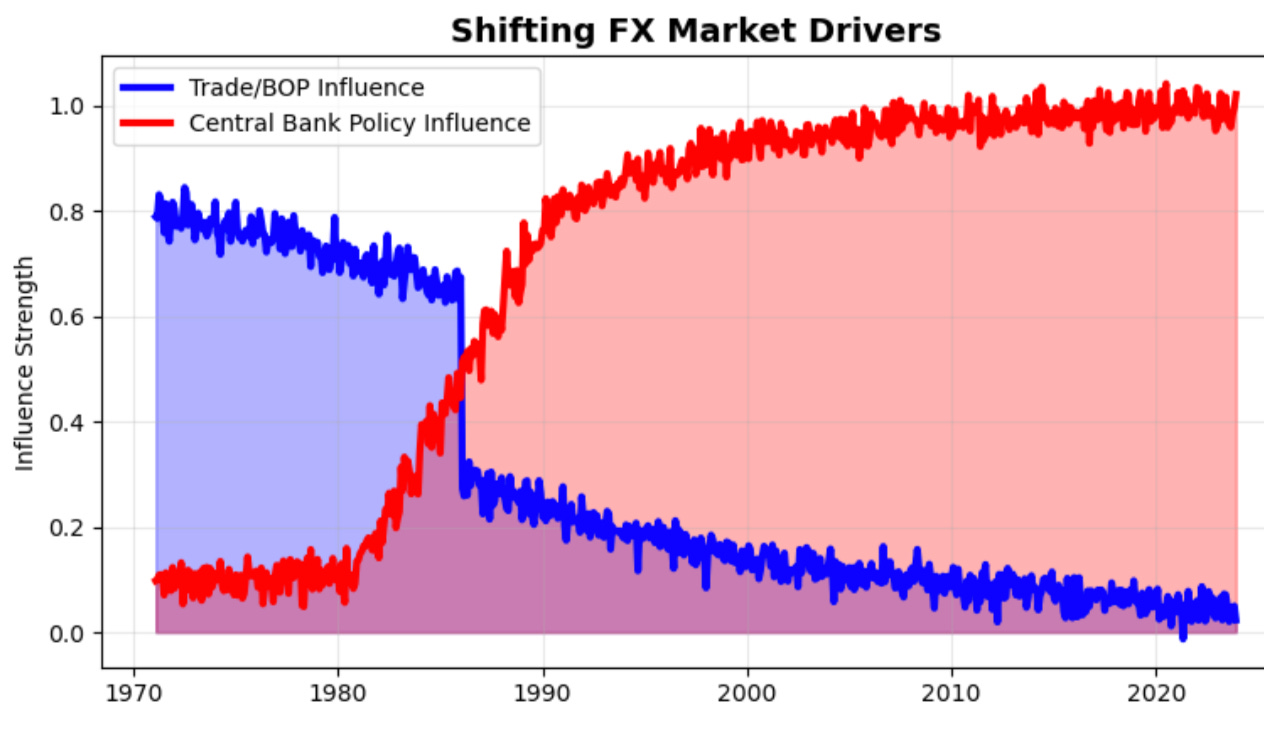

FX did not previously entertain CB policy framing exchange. For most of the Bretton Woods era, CCY moves were interpretable as slow adjustments to its current account (trade and payments), surpluses and deficit. That world changed when capital became mobile and the macro levers that actually move cross-border became interest rates, central-bank balance sheets and the market’s read of policymakers’ reaction functions.

*BOP - Balannce of Payment

The task for macro traders became clear. if you can model the policy problem (what a central bank must do, given inflation, unemployment and exchange-rate politics), you can size and time FX positions with an edge away from decade long movement defined by a countries current account to now where central banks held policy rate at the same time navigating the risk on/off profile sponsorred by globalisation.

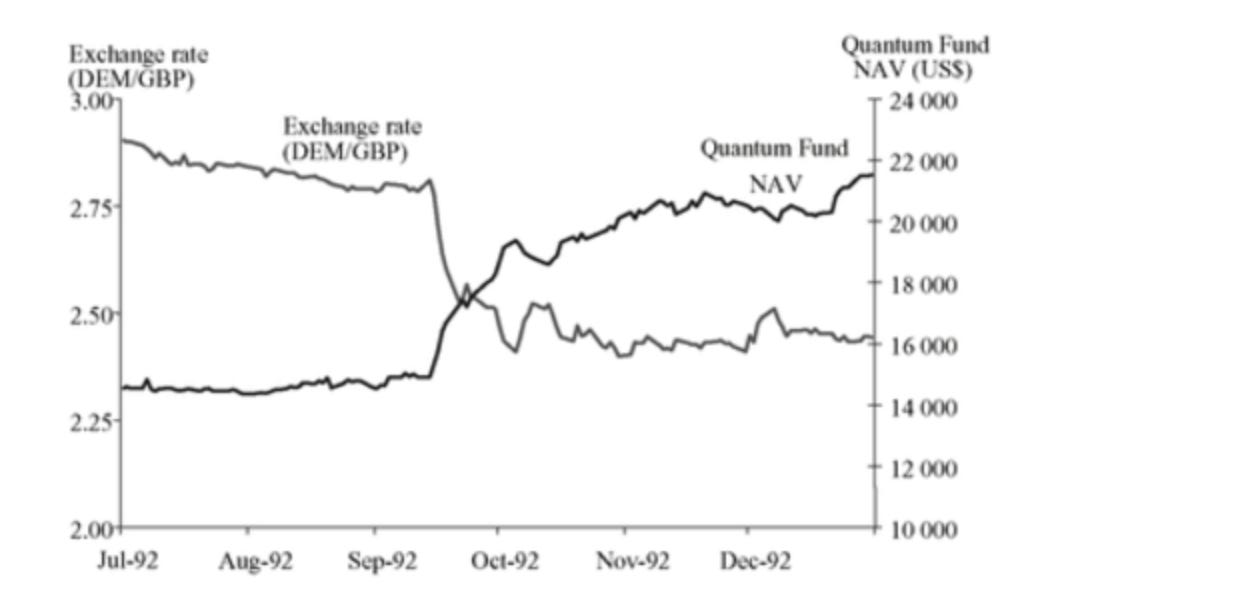

The canonical demonstration of policy-driven FX trading is Black Wednesday in September 1992. Britain’s ERM commitment meant the pound’s value was a function of a political promise as much as of trade fundamentals; Germany’s post-reunification fiscal and inflation pressures forced the Bundesbank into a higher-rate stance that was simply incompatible with Britain’s recession.

The Soros Quantum Fund’s 1992 short on the British pound was a macro trade built on identifying and exploiting a policy inconsistency. The UK’s entry into the ERM fixed sterling at 2.95 DM within a ±6% band, constraining monetary policy to support the peg and Soros identified three critical vulnerabilities in the Bank of England’s position:

The economic cost of defending sterling exceeded the political benefits of ERM membership. British manufacturing was collapsing under the weight of high interest rates and an overvalued currency.

The BoE’s foreign reserves, while substantial at $3.5 billion, were insufficient to defend against a coordinated speculative attack.

and most crucially, the German Bundesbank showed no inclination to lower rates to ease pressure on peripheral ERM currencies.

The trade: borrowing sterling, converting to Deutschemarks (DEM) in trading lingo basically short DEM/GBP.

As was with the state of the british economy where unemployment was rising the position had an intrinsic asymmetry which shielded further pound upside synonymous to an economy battling with stagflation.

“On 25 August, for example, Reimut Jochimsen, a Bundesbank council member, issued a speech saying that there was potential for realignment within the ERM. Sterling weakened. On 10 September, an unnamed Bundesbank official was quoted as saying that a devaluation of sterling was inevitable. The pound fell.”

This remark from Bundesbank triggered a shift in expectations, prompting Quantum to scale its short from c.$1.5C to c.$10B.

The result was a c.15% depreciation of GBP against the DM and c.25% against the USD, generating over $1.4B in profit. The episode illustrates how concentrated capital can exploit the friction between democratic policy objectives and fixed exchange rate commitments. Hedge funds, unconstrained by political considerations, can deploy leverage to pressure policy regimes, effectively testing the credibility of monetary authorities in real time.

The example of black wednesday as speculators opposed the tried and failed narrative the bank in further rraising rates from 12% to 15% in the hopes of attracting “hot money” is an example of these hedge funds learned to embody monetary policy in trade.

This wasn’t the only time private capital squared off against policymakers or profited by seeing further down the road than the “men in suits” tasked with defending the status quo. A few notable examples include:

Julian Robertson (Tiger Management): Systematically borrowed yen at 0.5% to fund dollar investments yielding 6-7% from ‘95-’98, exploiting the BoJ’s ultra-loose monetary policy and structural deflation, generating an estimated c.$600MM annually until the ‘98 crisis.

Paul Tudor Jones (Tudor Investment Corporation): Shorted $30MM in S&P 500 futures before October ‘87, anticipating that the Fed tightening from 5.75% to 6.75% would trigger forced selling through portfolio insurance programs, returning c.62% ($100MM+ profit) when markets crashed c.22.6% in one day.

Stanley Druckenmiller (Duquesne Capital): Shorted the EUR and bought CDS on peripheral European debt from 2010-2012, betting that the ECB’s institutional constraints would prevent effective crisis response until market pressure forced policy evolution, earning an estimated c.$260MM before Draghi’s “whatever it takes” intervention.

The emergence of macro hedge funds as significant players in global monetary affairs represents a fundamental shift in the balance of power between markets and central banks. These legendary trades shouldn’t be glamored alone on the profit profile merit but recongnised for democratising monetary policy by subjecting central bank decisions to immediate market validation.

The foreign exchange market, a $7.5T-a-day behemoth began life as a reflection of trade balances and cash flows but now represent a real-time referendum on monetary policy and revolving global risk. Hedge funds and asset managers parse every basis point of yield spread, every nuance of forward guidance, every expansion and contraction of balance sheets. They trade not just on what is, but on what central banks must do next.

we see this is betting markets, implied curve, OIS pricing, the list goes on…

this democratisation has created an ecosystem of capital from algorthmic macro funds to retail traderrs all all reacting to risk events, and increasingly anticipating, monetary signals.

As central banks worldwide grapple with unprecedented challenges from global trade restructuring and geopolitical fragmentation, the lessons from these legendary trades remain more relevant than ever. The democratization of monetary policy through market forces continues, ensuring that no institution, however powerful can indefinitely ignore the collective wisdom and disciplining force of global capital markets.

Hope you enjoyed this brief yet informative run down!

MMH