Monetary Policy's Effect On Currencies

Focusing On How Central Banks Influence Exchange Rates Monetary Policy

Hey crew,

Today’s report is a special one.

For one main reason. It’s showing the growth of MMH.

For the past year I’ve been training and working with Alfie, he started as a young hungry MMH subscriber, just like most of you reading this, he even purchased the Four Foundations of Macro FX which helped shape his understanding and framework for macro.

But he didn’t stop there.

He always had a question, wanted to learn and more than anything showed qualities I knew would be of huge value to all of you as the MMH community.

After an intense period of iteration, development and learning he developed his skill in understanding the interconnectedness of monetary policy and FX.

The report you’ll read today was written by him, so I want you all to welcome him Alfie as a research analyst.

The aligned vision is growing in MMH.

So, without further adieu, enjoy the report:

The Relationship Between FX & Monetary Policy

Prior to delving into the relationships between monetary policy and currency exchange rates, it's important to establish a foundational understanding of monetary policy itself. Essentially, monetary policy is a toolkit employed by a nation's central bank to achieve key economic objectives. These objectives typically include price stability (controlling inflation), maximising employment opportunities, and fostering sustainable economic growth.

To achieve the goals of monetary policy, the tools used by the central bank are:

Interest rate adjustments - Adjustments to a nation's benchmark interest rate offer a significant influence on both the cost of borrowing and the management of inflation. Lower interest rates incentivise borrowing, making credit more accessible and consequently stimulating consumer spending. This increased spending can potentially fuel inflation and accelerate economic growth. Conversely, when interest rates are elevated, borrowing becomes more expensive, leading to a decline in consumer spending. This, in turn, helps to moderate inflation and decelerate economic growth.

Open market operations (OMO) - Central banks engage in open market operations by buying and selling government securities. When the central bank purchases securities, it electronically credits the seller's bank account, injecting new reserves into the banking system and expanding the money supply. Conversely, when the central bank sells securities, it debits the buyer's account, thereby absorbing reserves and contracting the money supply.

Reserve requirements - Central banks establish reserve requirements, which dictate the minimum proportion of deposits that commercial banks must hold as reserves. These reserves function as bank money and primarily facilitate interbank transactions. A higher reserve requirement restricts the amount of funds available for credit creation, potentially slowing economic activity. Conversely, a lower reserve requirement expands excess reserves, enabling banks to offer more credit and potentially stimulate economic growth.

Quantitive easing/tightening (QE/QT) - Quantitative Easing (QE) involves a central bank purchasing assets, such as government bonds and mortgage-backed securities, from commercial banks and other financial institutions. This action injects new reserves into the banking system, expanding the money supply. Subsequently, banks have more funds available for lending, potentially leading to lower interest rates. Borrowers then benefit from these lower rates, incentivising increased spending and potentially accelerating economic growth.

Here’s a visual look at what happens to the balance sheet of a central bank during QE.

You can find the full mechanics behind QE below here:

Conversely, Quantitative Tightening (QT) represents the opposite approach. In this scenario, the central bank reduces the money supply by selling assets from its balance sheet back to banks and financial institutions. This process absorbs bank reserves, limiting their lending capacity and potentially triggering an increase in interest rates.

With a more restricted credit supply, borrowing becomes more expensive, potentially dampening economic activity.

It's important to acknowledge the potential for confusion between Open Market Operations and Quantitative Easing/Tightening, particularly for those new to these concepts. To clarify, let's explore their key differences.

Frequency: OMO is employed more frequently as part of a central bank's regular monetary policy toolkit. In contrast, QE/QT are typically implemented during abnormal economic circumstances to achieve specific objectives.

Scale: OMO typically involves smaller transactions of government securities, aiming for precise adjustments in the money market. Conversely, QE/QT involve large-scale purchases or sales of various assets, aiming for broader economic effects.

Objectives: While both OMO and QE/QT influence interest rates, their primary goals differ. OMO primarily focuses on fine-tuning short-term interest rates and managing liquidity. Conversely, QE/QT aim to achieve broader objectives like stimulating economic growth (QE) or curbing inflation (QT) through manipulating both interest rates and the money supply.

It's worth noting that various interest rates are employed by different countries. To gain a clear understanding, I'd like to briefly explain some of the key ones.

USD:

Federal funds rate - This is the benchmark interest rate set by the Fed. It’s the rate at which banks lend to each other overnight, which directly impacts short-term interest rates.

Discount rate - The rate at which the Fed lends reserves to banks on a short-term basis.

EUR:

Main refinancing rate - This is the rate at which banks borrow reserves from the central bank (ECB).

Deposit facility rate - This is the key interest rate set by the ECB. It’s the rate that the ECB pays to banks when they deposit overnight reserves with the central bank.

Marginal lending facility rate - This is the rate charged by the ECB to banks for borrowing overnight funds as a last resort, typically a higher rate to disincentivise this last resort option.

GBP:

Bank rate - This is the benchmark rate set by the monetary policy committee (MPC) of the BoE. This is the rate at which banks borrow reserves from the central bank (BoE).

Deposit rate - The rate paid by the BoE on reserves deposited by banks overnight.

Discount rate - Charged to banks for borrowing emergency funds from the BoE.

China:

LPR rate - This is the rate for bank lending, this rate varies depends on the loan types and maturities.

Deposit rate - Rate for emergency borrowing by banks from the PBoC. This rate fluctuates depending on market conditions.

The Effect On Currencies

Monetary policy has a significant influence on currencies, primarily due to its impact on international capital flows, often referred to as 'hot money' (which is short-term foreign investment that capitalises on high returns).

Hawkish monetary policies, characterised by rising interest rates, can attract short-term investments seeking higher returns. However, they can also simultaneously reduce overall liquidity within the financial system.

Higher domestic interest rates can attract foreign capital seeking advantageous investment opportunities. These investments may be driven by a combination of attractive returns and perceived lower risk. In such scenarios, yields on government bonds and other fixed-income instruments typically rise, incorporating a "risk premium" to compensate investors for the additional risk associated with foreign investing.

The influx of foreign capital seeking these higher returns increases demand for the domestic currency, potentially appreciating its value against other currencies. This dynamic highlights the intricate relationship between monetary policy, capital flows, and exchange rate fluctuations.

Monetary policy can give an even more pronounced influence on safe-haven currencies compared to other currencies. Safe-haven currencies, such as the US dollar, Swiss franc, and Japanese yen, are typically sought by investors during periods of global uncertainty due to their perceived stability and resilience. These currencies often originate from economies characterised by robust economic fundamentals, ample liquidity, and credible central banks.

The impact of monetary policy on safe havens is amplified because of "risk-off sentiment." During periods of heightened uncertainty, investors prioritise capital preservation over maximising returns. This drives them towards safe-haven currencies, even if they offer lower yields compared to other options. A country's hawkish monetary policy, characterised by rising interest rates, can further increase this demand for safe-haven currencies as investors seek additional security and stability.

A dovish monetary policy, characterised by measures like increasing the money supply and lowering interest rates, typically has opposing effects on safe-haven currencies. In such scenarios, the lower returns offered by these currencies become less attractive compared to potentially higher yields available elsewhere. Additionally, dovish policies may be perceived as potentially weakening long-term economic stability, further diminishing the appeal of safe-haven currencies for some investors.

During periods of dovish monetary policy, the returns on domestic savings accounts and government bonds typically decline. This can incentivise capital outflows as investors seek higher returns elsewhere. The absence of a risk premium on domestic investments further motivates this shift. Consequently, the demand for the domestic currency weakens, potentially leading to its depreciation.

Dovish monetary policy can further incentivise capital outflows beyond reduced domestic returns. When investment returns within a country decline, the perceived yield-to-risk ratio becomes less attractive, prompting investors to seek alternative options internationally. This shift towards risk-on currencies aligns with investor preferences during periods of robust global economic activity. Risk-on currencies, typically associated with growth-oriented, export-driven economies and often major commodity exporters, tend to outperform during such periods. Examples include the Australian and New Zealand dollars, with some considering the Canadian dollar as well.

However, the correlation between monetary policy and currencies isn’t always direct.

The attractiveness of a currency for hot money flows is significantly influenced by real interest rates, which account for inflation. Even if a country offers a nominal interest rate of 8%, a high inflation rate of 20% would result in a negative real rate of -12%. This effectively negates any return and discourages investor appetite for such an investment. Therefore, analysing the impact of monetary policy on currencies includes considering factors like economic stability and real interest rates, as nominal rates alone might not entice investors.

The impact of monetary policy on currency exchange rates is not always immediate, as market expectations can significantly influence current prices. This means that even before a central bank announces a change in interest rates or other policy measures, the foreign exchange market may already have factored in the anticipated effects, leading to some degree of price movement beforehand. This is often referred to as "market expectations being priced in”.

"Priced in" refers to the degree to which market participants have already incorporated anticipated future events, such as policy changes, into current asset prices. In the context of currencies, if investors expect interest rates to rise from 2% to 5% by year-end, they may buy the currency now, pushing its price upwards in anticipation of higher future returns. Conversely, if interest rate cuts are anticipated, investors may sell the currency, leading to depreciation. This dynamic highlights the data-driven nature of the foreign exchange market. Economic indicators like inflation, employment, and economic growth regularly influence investor expectations, leading to price fluctuations and rarely exhibiting purely linear trends.

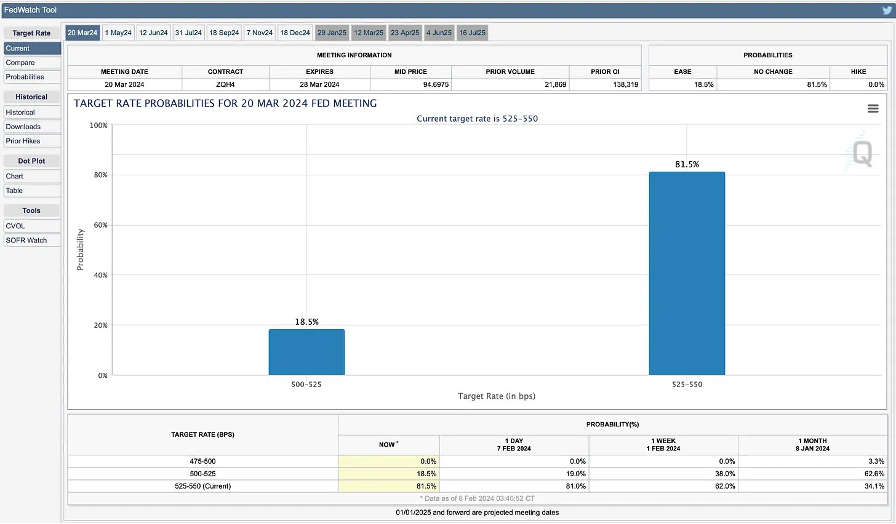

A great tool to see what’s being priced in for the Dollar is the CMEfedwatch tool, which updates regularly and allows us to see what interest rates investors are pricing into the market.

In Figure 4, you can see that investors have priced in an 81.5% chance that interest rates will be kept the same by the Federal Reserve at the next FOMC meeting. Being up to date with what investors are pricing, is one of many tools we can use to get into a potential trend early.

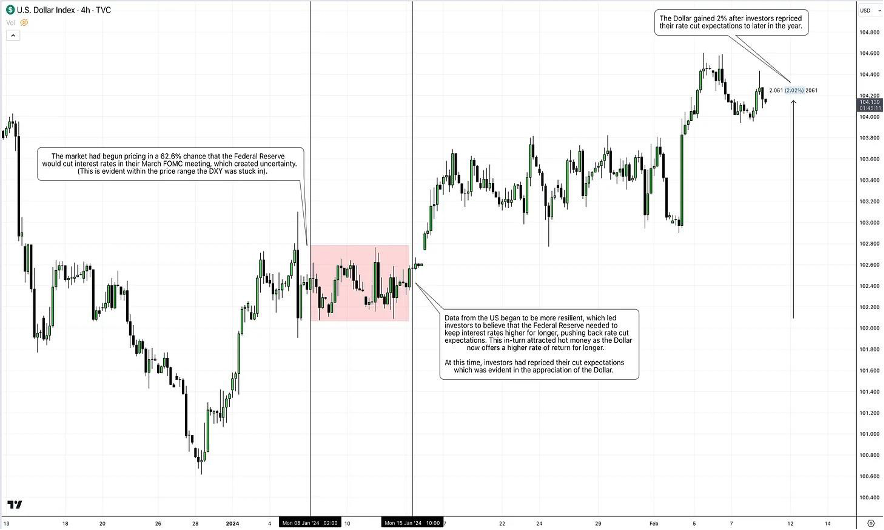

A recent example illustrating the impact of monetary policy expectations on currencies occurred with the US dollar around January 8th, 2024. According to the CME FedWatch tool, market participants then assigned a 62.6% probability to a 25-basis-point interest rate cut by the Federal Reserve to 5.25%. This prospect initially induced some uncertainty in the dollar, reflected by its lack of appreciation during that period.

However, releases of robust US economic data, including a declining unemployment

rate and persistent inflation (YoY), prompted investors to revise their expectations. Recognising the potential "stickiness" of inflation, they concluded that the Federal Reserve would likely maintain higher interest rates for an extended period, leading to a shift in market sentiment.

Market participants' revised expectations regarding potential interest rate cuts significantly impacted the pricing of US dollar assets. Following the release of robust economic data, the probability of a 25-basis-point cut by the Federal Reserve at its next meeting, as estimated by the CME FedWatch tool, declined from 62.6% to 18.5% within a four-week period. This dramatic shift highlights the data-driven nature of foreign exchange markets.

That’s a wrap for this week guys. Let me know what you’d like to read about next!

— Alfie