Markets vs Mandates: Rethinking the Easing Cycle

Labour risk, inflation risk, & the reality of a dual mandate.

She’s not your girl FED, it’s just your turn

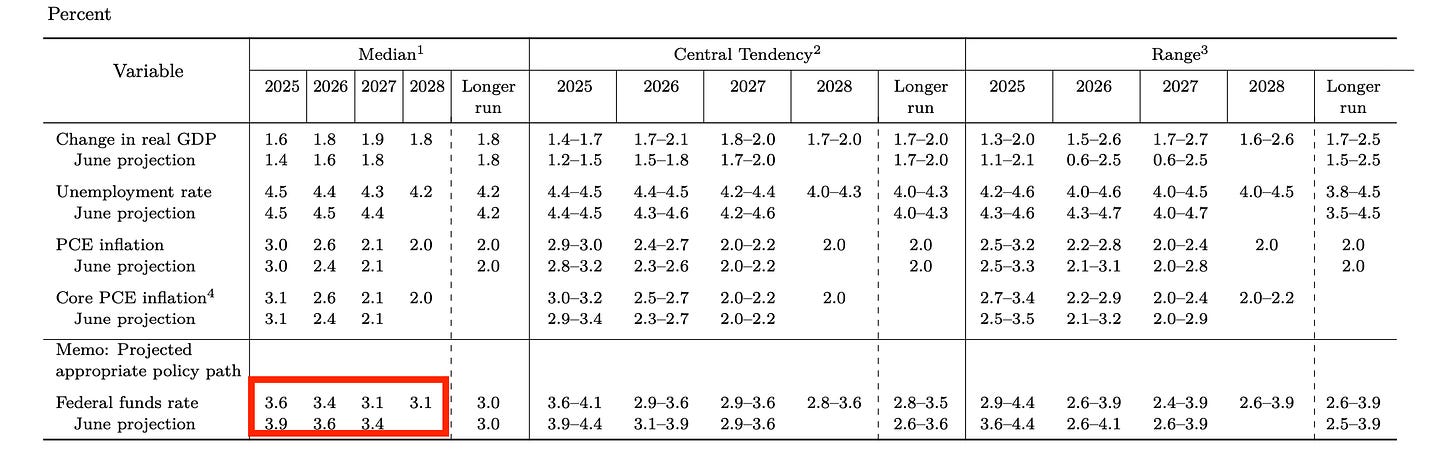

For all the noise about the Fed losing its independence, the reality is very much so different. Yes, this was a dovish projection on the surface, risks around unemployment were highlighted, the median EFFR moved lower compared to its June forecast and the messaging leaned towards accommodation.

But to stop there would miss the point.

JP’s whole shtick as we’ve gone through this rollercoaster of a ride which is the easing cycle is to mostly frame the totality of monetary policy in the balance. Hawkish projection, dovish commentary/speech & vice versa.

This time, the 25bps reduction in rates was cast as risk management. Elevated inflation risk was flagged alongside past months labour market weakness and the policy path reiterated by the chair embedded risks in both directions. The messaging therefore reads: while the committee has eased favouring growth concerns, it continued to see sizeable risks on either side of its dual mandate warranting markets to price the balance rather than a one-way train to ‘dove’ville.

See that? Balance…

As expected this surface dovish outlook was not enough to satisfy markets, which tells us just how detached pricing had become from reality. This isn’t a victory lap for us as the path to travel is still muddy, but it does validate the line we’ve been reporting thus far, which is markets being overzealous in their assumptions about the policy path ahead, particularly as far out as 2026.

Commentary from Central Bank Fiasco

“Adopting this narrative, the Fed is easing into a reflationary environment, which would lead markets to reprice rate expectations (signals policy normalisation over emergency easing).”

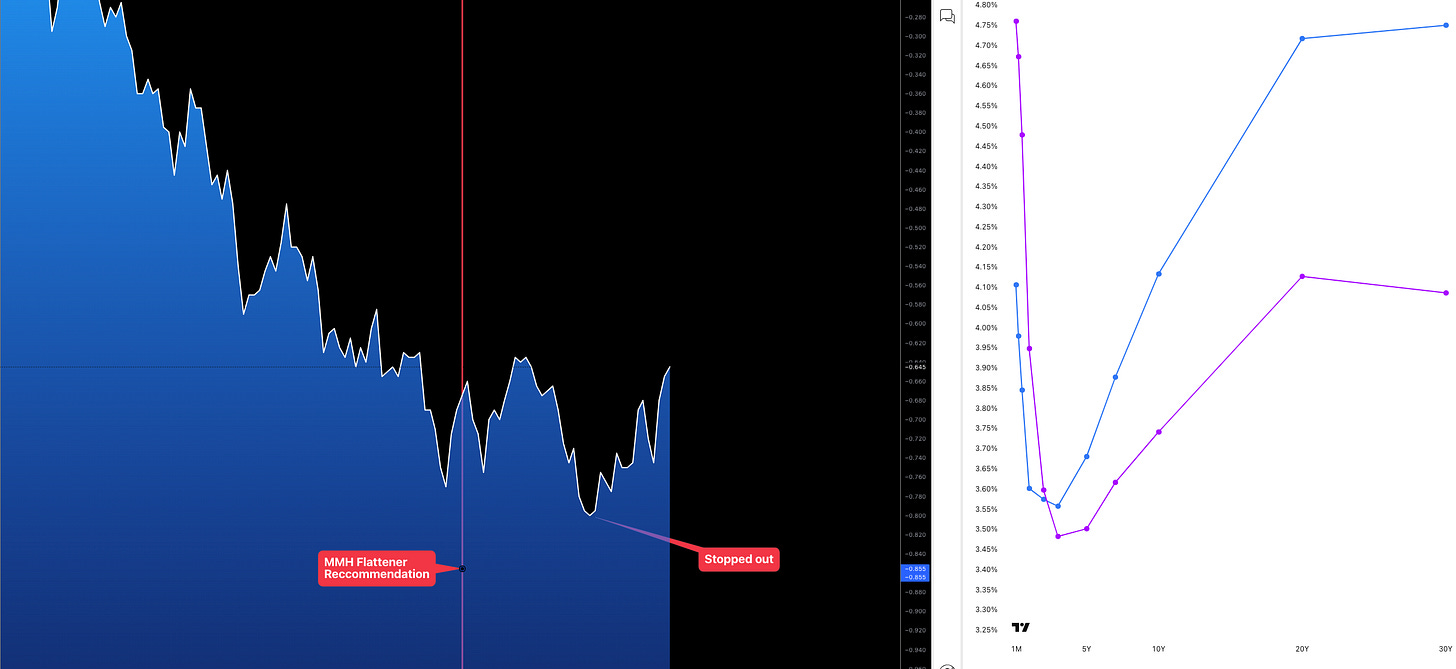

Our piece on Fade the FED Hunt? hunt also highlighted this worry

Right thesis, wrong trade timing :(

The SEP saw upward revisions to growth outlook and a slower glidepath back to 2% inflation. This signals from the committee an openness to lean on one mandate at the expense of the other, a skew in the dots confirms this as 9 voters opted for 0-1 cut for the remainder of the year.

Okay let’s play devil’s advocate here for a bit. When the chair was asked the implications on labour path from this singular cut he emphasized the trajectory of labour dynamics and growth in relation to monetary policy, not just the timing of the first cut. That hints to us, at a Fed preparing for continued easing however bringing us back to the modal distribution and forecasted delivery of easing it holds more weight and conviction in our view of a longer run projection less worried about economic activity than it is about inflationary risk.

So for the doves and political Fed authoritarians alike, this isn’t a victory lap.

It’s just your turn…

Building a bearish case for EUR/USD

THE MOST CONTRARIAN THING IS NOT TO OPPOSE THE CROWD, IT IS TO THINK FOR YOURSELF

-Peter Thiel

Amongst a cohort of factors anchoring on the dollar, it managed to finish trading higher this week amongst its G10 counterparts. A lot of that you could merit to position squeeze from massive shorts accumulated but we think given direction of policy adjustment and US growth profile there is room to move higher from here.

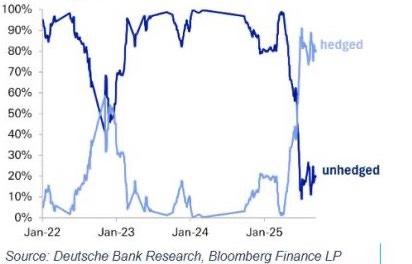

Market commentary on the bearish dollar view seems to deviate from flows as RM and HF are trimming short exposure on the greenback however for the first time this cycle, hedged inflows into US assets are outstripping unhedged allocations which granted in hindsight holds merit given the current political climate and uncertainty around Fed diplomacy. Nevertheless foreign investors are still buying America, but at the same time stripping out the ccy risk that comes with it. The mixture of pressure on the short end and unhedged flows are leaving the dollar under pressure.

If we’re correct to see more capital flows into US equities sponsored by the AI boom and capex spend as the Fed navigates to neutral and fiscal impulse from the OBBB beginning to materialise 2026 then we expect risk allocators and investors to embrace more USD risk.

Stronger momentum means the Fed will cut less than expected, causing real rates differentials across other markets to reprice which increases hedging cost, bringing back the carry positive for USD. Crowded hedging positions would have to reconsider, with some reducing ratios and others accepting unhedged exposure outright.

At the other helm in the euro area the ECB kept rates UNCH, no surprise there so as expected the message carried more weight than the decision. Lagarde declared that the “disinflationary process is over” and painted the euro area as “in a good place.” With tariffs blowing over a new source of external shock would be needed to warrant additional policy move. The problem however in our view is the numbers don’t support the narrative. Growth was revised higher for this year, but only on the assumption that Q2’s weakness was a soft patch. By 2026, projections fall back to a meagre 1.0%. Inflation tells the same story, core is expected to undershoot target at 1.8%. That hardly looks like an economy where disinflation is “over,” or a central bank with the luxury of ruling outright additional easing.

Fiscal expansion remains the euro area’s supposed backstop, with sizeable support expected into 2026. Yet recent German data paint a sluggish picture as industrial competitiveness is waning, and a stronger euro only compounds the export drag, especially as euro bloc struggles to compete with China in global manufacturing demand.

In our view markets appear to be pulling policy expectations in opposite directions for both economies, demanding more cuts from the Fed while pricing near none from the ECB. The euro has front ran the fiscal impulse in the start of the year and much of the euro’s appreciation has ridden on dovish US rate expectations, away from hard prints and underlying domestic fundamentals.

From here, the famous 1.20 call continues to lose its appeal. The asymmetric risk here is that markets recalibrate to underlying fundamentals and that recalibration runs against the EUR.

Thank you for your attention!

MMH