Markets Rally to Record Levels, Trump Win Speculation, & Germany’s Risks Mount

Exploring the Potential Outcomes of a Donald Trump Presidential Victory

Happy Sunday guys!

The week just gone was great, I attended a Lloyds Corporate Client Event, The Markets Summit 2024.

There were lots of things I took from the event, the most important was the fiscal risks inside Europe and the U.S. in the upcoming months.

Capital allocation trends will begin to shift, as will consumer spending habits and other metrics.

This week I want to dive into the potential outcome of a Trump presidential victory.

Let’s begin!

Macro watch

The U.S. is Germany's most important export market. Over the past year, Germany has exported goods and services worth €160bn to the US, accounting for c.10% of its total exports.

The exports to China have declined because of the domestic issues that they face, while France and the U.S. begin to have a larger portion of Germany’s exports. The chart is one I’m focusing on at the moment because we already know how much Germany’s manufacturing industry is struggling, any downside risk in either France or the U.S. will have a domino effect into Germany’s export market. Downside risk…

An even weaker export market in Germany will add pressure onto the ECB as risks shift from inflation to growth, potentially forcing them into a more aggressive easing cycle, which comes with tail-risk to inflation (especially core, which is already sticky).

Both France and the U.S. are facing fiscal shifts, which brings some risk to Germany. France’s fiscal issues are deeper and more alarming than the U.S., however, I won’t ignore the fact that if Trump is elected, we may see some extreme tariffs on Europe which will hurt Germany’s export market.

Away from Germany, cash funds just had their biggest outflow in 12 weeks, with c.$17.4 billion pulled. On the flip side, bond funds saw their biggest inflow since October 2020 at c.$23.2 billion, stocks c.$21.4 billion, gold had biggest inflow in 12 weeks at c.$1.2b, while crypto drew c.$1.6b.

All this shows to me is a change in investment appetite once again. Risk-on?…

Market mover

S&P 500 bulls extend the longest weekly winning streak of 2024. On the 37th anniversary of the "Black Monday" market crash, the S&P 500 has risen for the sixth consecutive week. No surprise as the U.S. consumer begins to become more optimistic about fiscal and economic future conditions, helped partially by a new presidential cycle and also strong data amid such high rates.

The risk-on environment could well be among us. Many investors are shifting portfolios and allocating capital to higher risk markets such as crypto, which reminds me very much of the 2020 appetite for risk in portfolios, although we did experience a black swan event back then.

Trump victory scenario

It’s becoming evident that Donald Trump may be re-elected as President of the U.S., which has been known to be bullish for the dollar.

Trump is recognised for his assertive trade policies, particularly his "America First" approach and trade conflicts, notably with China. In his first term, tariffs and trade tensions fuelled uncertainty in global markets, occasionally causing large fluctuations in the dollar's value. In a scenario where Trump reintroduces trade wars or enforces tariffs (which he has said he will), the dollar could strengthen as global investors may seek the relative safety of U.S. assets during periods of uncertainty. The only tail-risk this part of Trump’s policy may run is that ongoing trade wars could hinder economic growth, shrink trade volumes, and possibly weaken the dollar over time if global confidence in the U.S. economy diminishes. Also, if U.S. global leadership is seen as destabilising (another tail-risk to tariffs), it could erode confidence in the dollar over time, especially if the U.S. is perceived as unreliable by major allies and trade partners.

Let’s not forget that during his first term, Trump’s fiscal policies featured significant tax cuts (such as the 2017 Tax Cuts and Jobs Act) and increased government spending, both of which contributed to the rising national debt. On the other hand, in the short-term, tax cuts which lead to increased government spending can prop up weak domestic demand and provide support to any soft-landing/no-landing scenarios (which seem equally likely at this point).

A re-election could lead to the continuation or intensification of de-globalisation policies. Trump's focus on bringing manufacturing back to the U.S., limiting immigration, and decreasing dependence on foreign countries could produce mixed outcomes. If businesses repatriate funds or global companies choose to invest in the U.S. due to protectionist policies, the dollar could experience short-term gains. However, in the long run, de-globalisation might decrease international demand for the dollar by reducing global trade flows and undermining its role as the world's reserve currency.

While the Federal Reserve is an independent entity, Trump's public criticism of the Fed's monetary policy in his first term—especially pushing for lower interest rates—was notable. If Trump were to influence the Fed to keep interest rates low, this could lead to a weaker dollar in the medium to long term, as lower interest rates generally reduce the attractiveness of holding dollar-denominated assets, adding pressure onto the Fed. Expansionary fiscal policies combined with a low interest rate environment could raise inflationary pressures, which might also weigh on the dollar’s value.

However, it’s key to remember that Trump’s previous policies didn’t involve much pressure towards the Fed, he actually found a great balance between an expansionary fiscal policy while keeping a lid on excess inflation, which is why I see that tail-risk as weak. However, there are always tail-risks, which are important to focus on when allocating capital in your portfolio.

In my opinion, I see a Trump victory sparking large risk-on environment. However, I think the policies he will introduce will be delayed until the Fed truly have inflation tamed, because they will be less effective if the Fed needs to keep such high interest rates.

Trump victory portfolio:

Crypto: BTC/XRP/LTC. I believe these all have enough utility to offer large gains inside Trump’s presidency, with his consideration to crypto, unlike Biden.

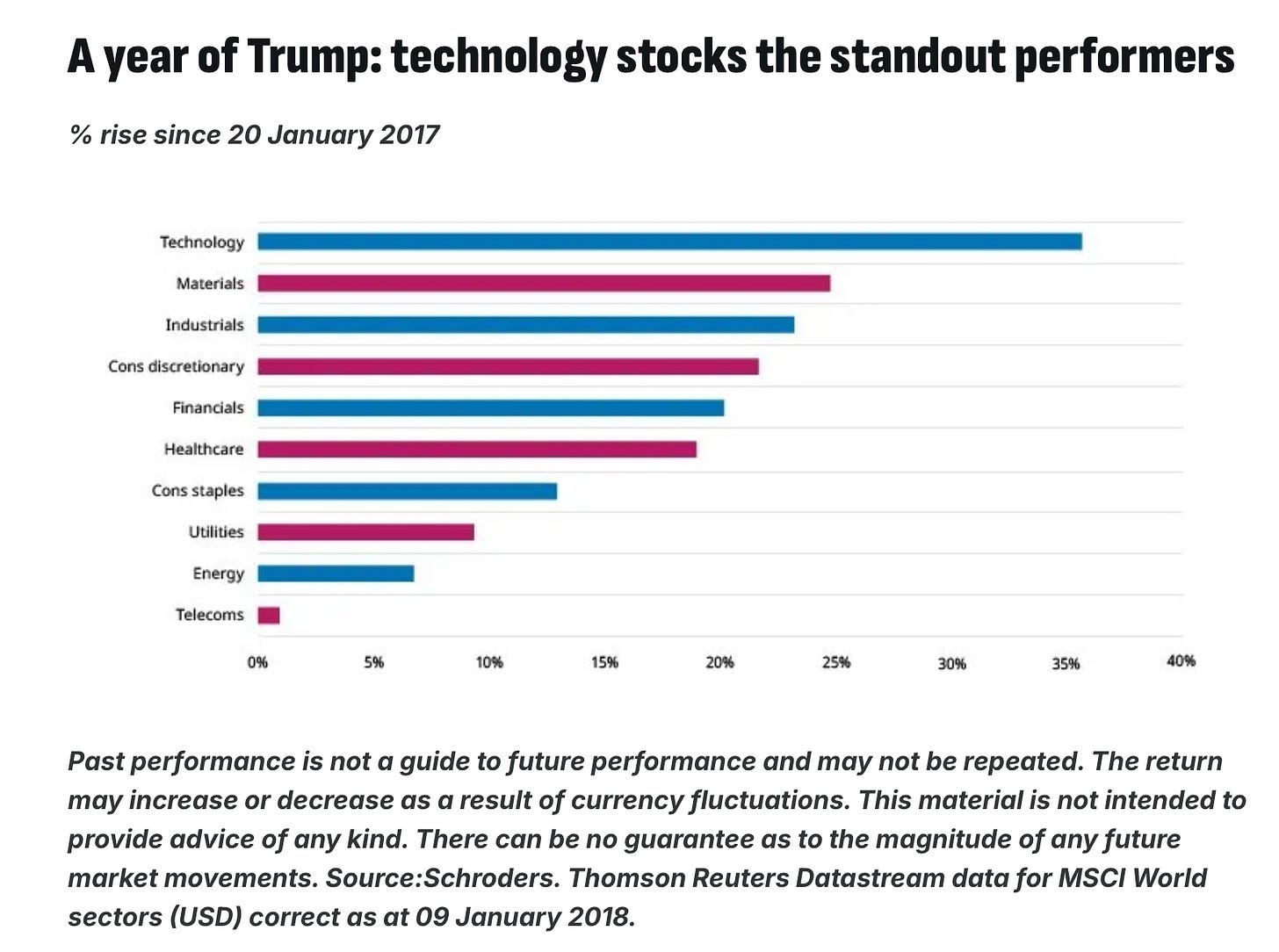

Stocks: Manufacturing & technology stocks inside the S&P 500. With Trump’s policy favouring companies who produce goods in various industries, these have large upside potential in my opinion.

U.S. dollar: I have a short-term bullish bias on the dollar, I think it’s tough to foresee how these extreme tariffs will be detriment to U.S. trade relations. However, based on Trump’s previous reign, I do see upside potential in the U.S. dollar.

Not the longest report guys, but there’s no value in unnecessary speech. I truly believe the portfolio listed above will be a low risk, high reward allocation. A Trump presidency definitely brings large upside potential to all sectors inside the U.S.

See you next week!

Agree! Trump win, long USD for about a 4% move, long BTC for at elast 80k, long S&P500 for 6100.