Market Open: Behind The Curve

When you combine ignorance and leverage, you get some pretty interesting results — Warren Buffett

Bear Market Rally

In what seems to be one of the best weeks equities have had month to date, U.S equities were up north of 6% before closing higher on Friday just passed. Are these signs of the bulls coming back? In short, no.

As you already know a bear market occurs once the price of an index, instrument or individual stock declines more than 20%, now considered bear territory. Within this macro-climate where investors begin capitulating amidst a bleak growth outlook for the world, we occasionally get a bear market rally also known as a ‘dead cat bounce’. This pullback in markets usually gets two reactions from traders and investors; 1. Is the sell-off over? What can I get at a discounted price? Then you have the second persona; What else can I get rid of in my books?

Tighter Conditions, Lay-offs & Fed Waller Speech

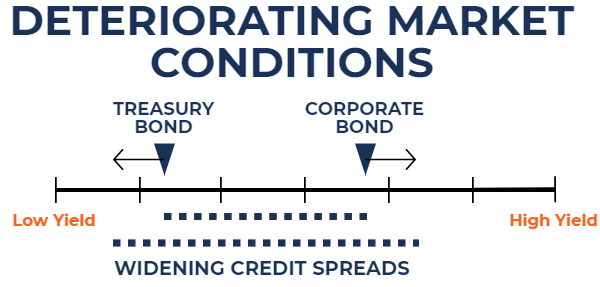

As I search and study more it’s clear that the proxy used by most investors to judge financial conditions is the state of the bond market. Particularly credit spreads (difference between the yield on a risk-free U.S treasury and corporate debt of the same maturity).

During periods of weakening conditions within the economy investors flow into Treasury securities across different maturities (2y, 5y, 10y etc) according to their liquidity regulations in order to seek safety. As this happens the yield on Treasury securities decreases due to the increased price as a result of greater demand.

During the same period you see capital outflows from corporate bonds, so issuance of new debt becomes increasingly hard as we’re seeing in this climate. As a result of worsening conditions, you see firms rush to increase free cash flow and cut down their workforce in order to support their ‘survivability’ during such times.

Now you can imagine when conditions are improving, such as in 2020, credit spreads tend to tighten allowing corporations to access credit easier. This is due to investors seeking more yield in a positive risk environment so capital reverses flowing from safety to risk in hopes of better gains. As the demand for corporate bonds increases, yield decreases and so forth.

This is only one part of the debt market, I will look to do a basic bond market 101 at some point in the future.

Unsurprisingly, we’re seeing that expected loosening within the labour market with a number of firms listing their layoffs for the year so far. As the Fed continue to push its feet on the tightening pedal this will become the norm with 4.2% unemployment, post the current inflation crisis, considered a ‘masterful performance’ according to Fed Waller; a well-known hawk.

From Fed Waller’s speech yesterday the main discussion was his eagerness to address all upcoming meetings with a 50bps hike stating:

"I am advocating 50 (basis point hikes) on the table every meeting until we see substantial reductions in inflation. Until we get that, I don't see the point of stopping,"

Can markets handle all those hikes with QT? Expectations are set for the federal funds rate to sit at 2 - 2.5% by year-end. For now, it’s only right to leave markets to decide what it can or can’t handle.

Thanks for reading all the way through! Continue to share, like and support! It costs nothing but goes a long way