Macro Misfires: Fragile Talks, Fragile Tech

Deal Doubts, Nvidia Bears the Brunt and Powell Getting The Kick?...

Happy Easter readers!

This quarter has started with a big BOOM (again) for MMH, which I’ll get into at the beginning of this report.

I had a discussion with a family member yesterday about what the next step is in this game, I’m sure many get to this crossroad and honestly speaking I don’t know just yet.

To answer this you need to determine what things you value most. That can be your freedom, time, risk tolerance, mental capacity and even legacy.

The issue for me? I want them all…

It’s a good problem to have.

Now, let’s get into it!

Trade idea update

In my Q2 outlook report, I gave our first equity idea on Associated British Foods (ABF) and that trade is currently running +13.4%. The equity has nearly outperformed my price target for this quarter and we’re not even one month into Q2. I’m not personally here to catch every inch of every move and I’d recommend closing out some profits at these levels, which are sitting at a total of +13.4% for anyone who managed to get into the position when it was recommended. I will tag the report below and the current ABF chart.

The report below is where I discussed the buy idea for ABF:

Fragile Talks, Fragile Tech

The week began with the US imposing new restrictions against China importing Nvidia’s H20 AI chips. As of Monday (14th April), Nvidia must now obtain a US government licence to export the H20 chips to China. These export controls are designed to prevent China's advancement in AI and supercomputing technologies that could be used for military purposes. The US aims to maintain its technological edge and national security by limiting China's access to cutting-edge semiconductor technologies.

Nvidia kept some Chinese customers in the dark about the new US chip clampdown. They did not warn at least some major customers in advance about new US export rules it was told about a week ago requiring it to obtain licenses to sell its China-focused AI chip.

Nvidia shares dropped c.11.2% this week as they expect the new restrictions to cost $5.5bn in the first fiscal quarter alone.

You can see in Figure 3 below just how much Nvidia relies on China for revenue. There may be some relocating for Nvidia but for the near-term at least, it will be painful. It’s clear to see Trump is doing anything in his power to sideline China from having tech/AI dominance over the US. I definitely think the selloff we have seen in Nvidia this week is just the beginning, remember that this restriction is just one of many challenges the company faces in terms of hindered revenue (heavy tariffs on China). I see lower prices for Nvidia in the coming weeks unless there is major U-turns in restrictions and fiscal policy.

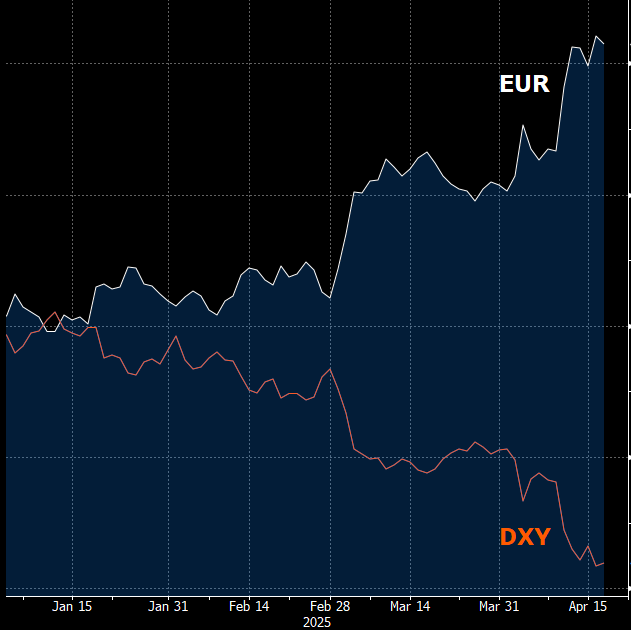

On the interest rate side of things, its clear to see that rate differentials have taken a back seat in driving markets (particularly FX). The ECB cut rates for the seventh time since June, lowering them to 2.25% from 2.5%, amid tariff concerns. Focus shifted to "downside risks" in growth. Markets now expect the deposit rate to hit 1.58% in December, down from 1.71%. Normal capital flows would mean a weaker Euro but safe haven flows have provided support to the Euro, however, most gains seen are predominantly due to the fact that it is the 2nd most liquid currency to the dollar.

The decoupling in normal trends, as I mentioned in last week’s report, see interest rate differentials having almost no impact on markets. The market is built on many pillars and at any given time one pillar drives the market more than another. Right now, the pillars of geopolitics and growth are key drivers.

This week, Powell helped prove my point about how markets are lacking any reaction to interest rate differentials after he delivered a hawkish speech yet the dollar sold off… again. Key takes from his speech are below:

Powell said he expects higher inflation and a weaker jobs market due to tariffs, but that the Fed is primarily focused on the inflation aspect.

Powell now refusing to throw a lifeline if Trump’s policies implode the market.

The Fed will not be influenced by political pressure.

Under normal market conditions, Powell’s hawkish stance would have led to a stronger USD. However, the greenback is still reacting to concerns over US asset underperformance and growth, which are likely being worsened by the Fed's hawkish policies. There’s c.3bp of cuts priced in for May meaning there’s almost no pricing for one, which gives them more time to review. By the time the June Fed meeting comes we should have more clarity.

So the market either doesn’t believe that Powell will actually keep rates higher for longer, they think he’s incorrect about inflation or both. Can times really get more uncertain for US monetary and fiscal policy?

Ermmm, yes:

Nasdaq 100 actually plunged c.3% after hawkish Powell remarks. He even warned that tariffs are “significantly larger than anticipated.” Powell tried to then show a calm nature by saying that markets are functioning and orderly. He pushed back against the idea of a "Fed put" to bail out stock markets. Equity markets usually selloff on hawkish remarks, but I think this selloff was driven by uncertainty rather than basic hawkishness.

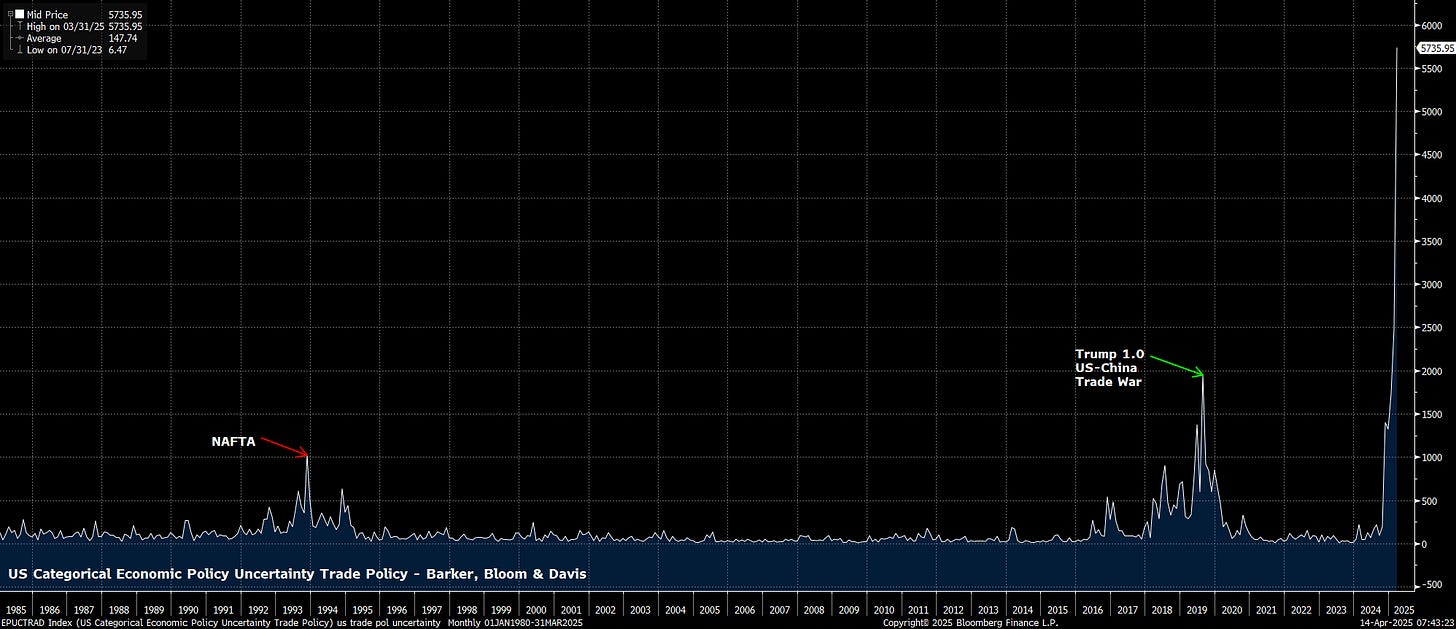

I know we are in a market right now which can be reversed at any given point by one man and one decision, really unprecedented times. However, I also know that Trump wants to follow through with his plans to “make America great again” and reshore industries meaning the chance of that one man making that one decision to reverse all markets is pretty low. That being said, I think there’s still a lot of pain to be felt in markets, particularly US equities. US trade uncertainty alone is at levels not seen in at least the last three decades. I think there is lower prices to come in the S&P500.

By many respects, the US is much more dependent on China’s exports, than China is on US exports, although there is no doubt a negative impact on both sides from a tariff and trade war.

Data shows that for around 40% of US imports from China, China supplies over 70% of total US demand for those products. In contrast, only about 3% of China’s imports from the US meet that same threshold. For example, the US sources 76% of its smartphone imports from China, which itself controls 70% of global smartphone exports. Similarly, 88% of US Christmas decoration imports come from China, which holds an 89% share of the global export market for that category. In short, it’s unclear who truly holds the upper hand. Aggressive trade moves could backfire, potentially strengthening China’s global standing if it's seen as the more stable trading partner.

So let me reemphasise again, more pain is to come globally (in my opinion). In terms of trade talks this week, there’s not been much progress. China said they are open to talks if the US shows more respect and wants Trump to reign in some cabinet members. Beijing also wants a more consistent US position and a willingness to address China’s concerns around American sanctions and Taiwan.

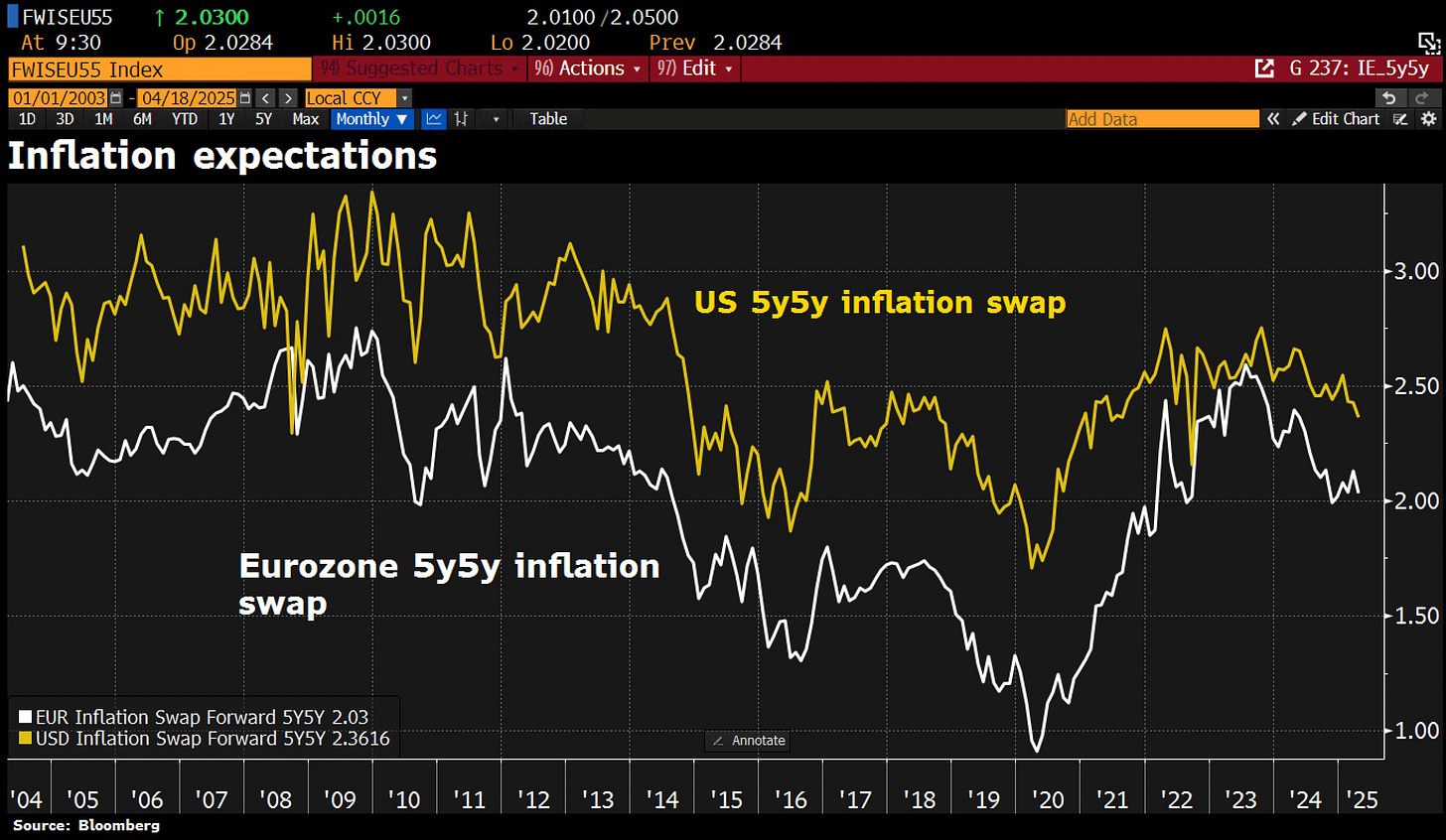

Despite all the talk about tariffs, long-term inflation expectations have stayed stable. If you’re a regular reader of MMH, you’d know that I’ve been calling the lack of damaging inflationary pressure tariffs will have. That’s because even after all of the front-running, we haven’t seen any meaningful rise in inflation, coupled with the devaluation of the USD and the fall out of bed of oil (which Trump made so clear that he wanted to do). The 5y5y inflation expectations are currently at 2.03% for Europe and 2.36% for the US.

How’s investor sentiment you ask? It’s not been this bad in 30 years…

To make my stance clear at this point, I’m still short on US equities and the USD. I know everyone is eager to catch the bottom in US assets but you really need to ask yourself, what is the catalyst to reverse markets and how likely is it to happen?

I hope you all enjoy this Easter weekend and remember why we’re celebrating (if you are), all glory to the highest!

You killed it on the ABF trade