Macro Lags.

Analysing the trends in macro lags as central banks globally come to the end of their tightening cycle.

Hey crew,

I’m getting there.

Back to my flow state of mind.

My work playlist is subtly playing in the back as I search the macro universe looking for new intel.

It’s an 8-hour-long playlist, so I’m certain it’ll get me through this report.

I’ve made it public, here you go.

Onto more pressing information, we’re heading into the timeframe where macro lags start to shift into markets, so I thought it would be imperative to walk you through this in a simple view.

As always, lend me your attention:

Macro Factors

Macro narratives have been dominated by four major themes this year.

Liquidity re-entering the global financial system

Higher treasury yields across the curve

A hawkish Fed

Rebalance away from China amidst economic stresses

I could go into more detail be that banking reserves, corporate credit spreads and loose fiscal policy spending but that feeds into the umbrella theme of liquidity. Yes, even the loose fiscal spending of the US government has an immediate effect of pumping liquidity in the economy, particularly within the private sector. When the government runs a deficit whether through the Inflation Reduction Act, suspension of student loans or any other legislation, it provides the economy, namely the private sector, with a greater supply of liquidity which can then be spent in the real economy. It’s worth noting that the US government has been running a large deficit throughout 2023 with the Treasury expected to borrow an additional $2 trillion over the next two quarters.

The budget for the US Treasury was $1.7 trillion for FY23, they’re going to borrow that in just under two quarters…

Fortunately or unfortunately government fiscal deficit time delay to the real economy is minimal, meaning that the private sector feels the money created from expansionary fiscal policies.

We’re now 18 months into the tightening cycle from when the Fed first raised rates in March ’22. This is where the effect of tightening, 2s10s inversion, and 3s10s inversion start to manifest in the economy and we’re starting to see the signs of it across the global economy, whether you observe weakness in Europe, stemming from Germany and Italy, or the rate sensitive housing market of the UK, or the balance sheet recession occurring in China cracks are appearing on both sides of the glass.

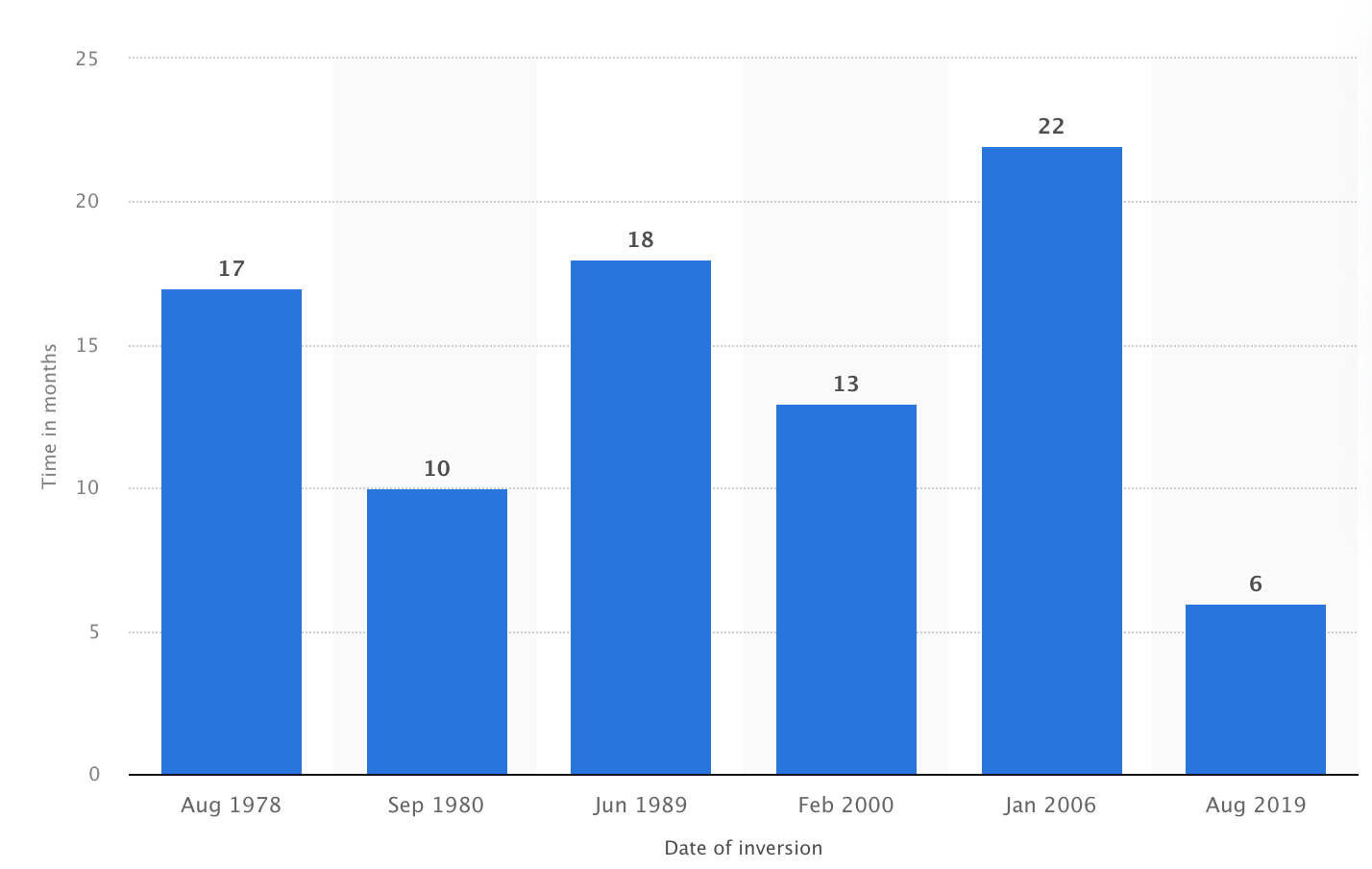

On average the yield inversion across the 2s10s carries a macro lag of around 12-18 months, I’ve heard the range of 15-18 months being discussed as a more accurate figure, you can see the number of months between yield curve inversions and the start of a recession since 1978 and 2022.

The August 2019 yield curve inversion, which preceded the COVID-19 pandemic, is an anomaly given that the 2020 recession only lasted for an outstanding two months. Talk about a V-shaped recovery. As this chart shows, the effect of tightening policy is never immediate or realized instantly, but it does eventually take hold and the 3s10s curve is already in negative territory (spread between the 10Y bond and 3m T-bill).

The most recent 3s10s inversion occurred in October 2022, marking the macro inflection point where liquidity re-entered the financial system, as evidenced by a halt in the declining Fed liabilities. As we have just entered the eleventh month of the inversion, both data and history suggest that the lag on the effects of the tightening cycle will begin to take hold from December leading into Q1 ‘24, when consumer sentiment returns to normal after the seasonal Christmas period, during which retail sales and spending are likely to remain resilient.

So where does that bring us?

The end of the tightening cycle. Jay Powell and the Fed are very much aware of the macro lags from interest rates to the real economy, and that seems to be what the market is in alignment with.

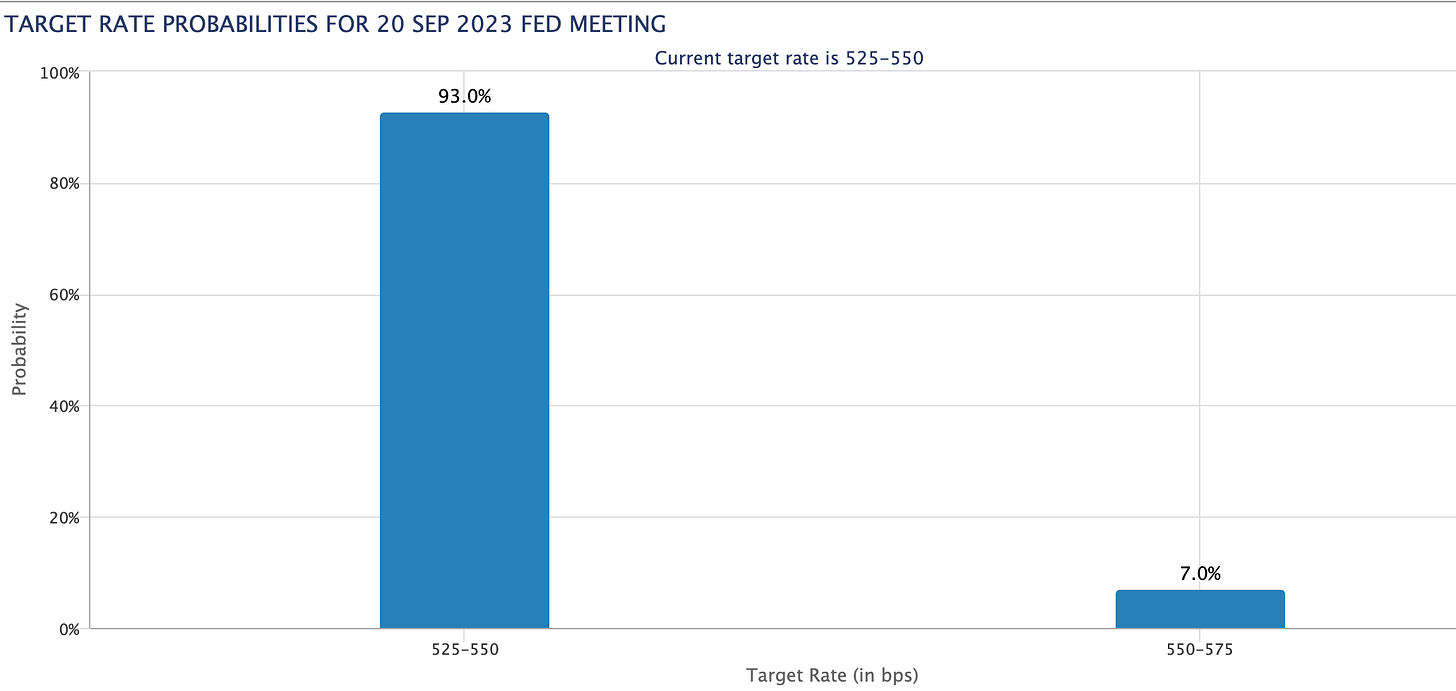

There is a 93% probability that the Federal Reserve will hold interest rates between 5.25% and 5.50%. Elsewhere in the world, central banks like the Reserve Bank of Australia (RBA), the Bank of Canada (BOC), and the Reserve Bank of New Zealand (RBNZ) have held rates at 4.10%, 5.00%, and 5.50%, respectively, for the second consecutive meeting. This suggests that interest rates have reached levels sufficient to subdue inflation and encourage further disinflation. The European Central Bank (ECB) and the Bank of England (BOE) are expected to raise interest rates by another 25 basis points, with the BOE likely to raise rates further due to inflation remaining above 6%.

If you were watching closely during the Central Bank summit in Sintra, Portugal, you would remember Powell being asked if central banks communicate with each other and the answer was a clear yes, so the pivot to hold and wait is upon global central banks.

If you’re reading this, thank you.

I value your readership.

Lastly, if you enjoyed this why not share it with someone?