Macro Conditions Tightens...Are We in 2008 Territory?

Earnings don't move the overall market; it's the Federal Reserve Board... focus on the central banks, and focus on the movement of liquidity... most people in the market are looking for earnings and conventional measures. It's liquidity that moves markets. — Stanley Druckenmiller

It’s been a while but glad to be back! My last article gave a deeper insight into how bonds and spreads may affect currency movements.

Today we’re taking a look at the current mess we’re in, and that starts with the GFC (Great Financial Crisis) inspired by the All-In Podcast; highly recommended.

Housing Bubble, Real Rates & Fed Printing

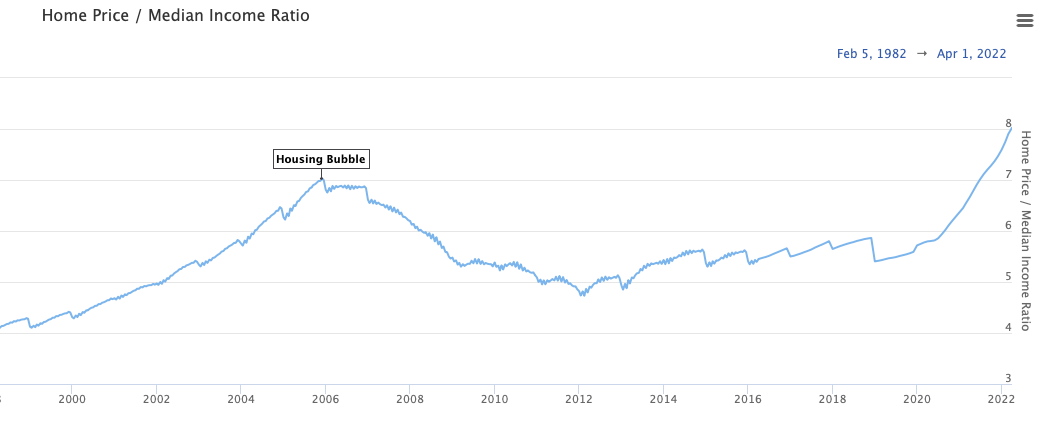

Now from the chart below, you can see that when it comes to home prices against the median income ratio we’re already above the levels seen in 2008. To break this down further, historically the ratio between home prices/median income for a household is 5. This indicator is heavily influenced by interest rates as a low rate environment increases the affordability of housing which pushes the home price higher.

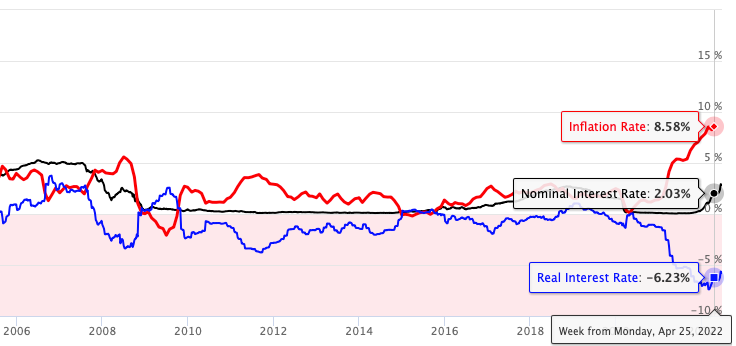

Now, let’s circle back a minute. Let’s take a look at real interest rates from 2006 (pre the GFC) until now.

Since the GFC, real interest rates have been below 0% so borrowing/access to credit was fairly easy to get which feeds into the graph above where we can see house prices accelerate. Particularly 2019-2020 (Covid-19) where cash was being printed, rates were at 0% the house price/median income really took off aggressively and hasn’t slowed down.

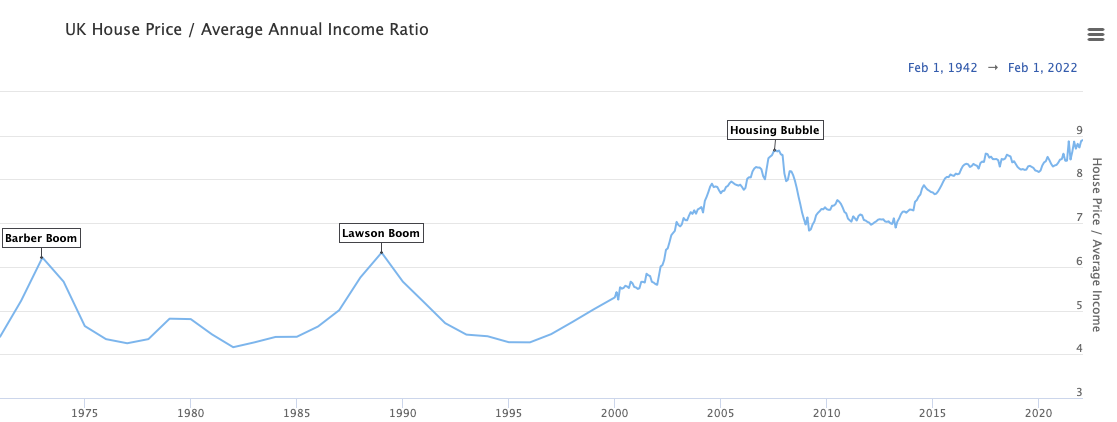

Unfortunately, this isn’t something just seen in the U.S. It’s even worse here in the UK on a ratio basis. So we’re already in an overextended housing market on this basis.

Needless to say, it’s a very grim picture we’re painting. To add on, both consumer sentiment and recent home surveys show there’s little buying activity going on in the real estate market at the minute.

This is where the problem started. The Fed were present during the 2008 crisis and for the first time in its history took a leaf out of the Bank of Japan’s book by implementing quantitative easing. The issue isn’t the implementation of quantitative easing, it’s the fact that it didn’t stop there. Up until this year, the Fed continued buying bonds, stimulating the economy with so much liquidity even though GDP growth was firm, the labour market was recovering, ISM, retail sales and many other lagging and leading indicators were pointing upwards.

Sidenote, you probably see why recently I’ve begun paying a lot of attention to the BoJ, they’re years ahead of most major central banks with their monetary policy tools; they are credited to being one of, if not the first implementors of quantitative easing. Always keep an eye out for them.

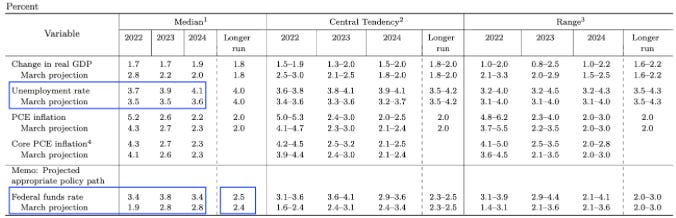

Moving forward. If we’re looking at the Fed’s current monetary policy stance, something I touched upon last week, it’s pretty difficult to see how we’re going to get the federal funds rate to 3.8% without seeing an immense amount of wealth and capital destruction.

Up until now, we’ve seen deep sell-offs in equity markets mainly tech and growth companies bearing the brunt of the losses but as conditions get tighter, from credit to liquidity in markets, liquidity being something we haven’t yet seen, it’s going to be hard to see the Feds hiking into such weak conditions.

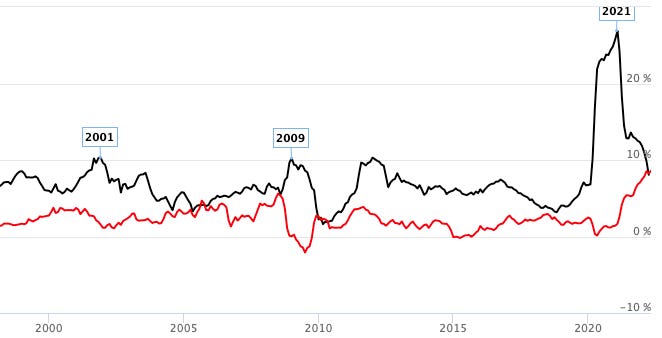

I know I’ve bombarded you with graphs and charts today so thanks for bearing with me; below we can see the money supply in the U.S economy against inflation. Historically as you can tell the higher inflation, the greater M2. What should strike as concerning to you is the difference between 2021 when the Fed printed north of $13trillion, and the inflation rate in 2021. That’s on top of all the QE, this amount of money and sudden wealth creation is what we’re paying for today and what I believe will have to be wiped out of markets.

Do I know everything? No. Far from it. But it’s pretty clear to see when there’s a dislocation in markets and policy as Druckenmiller would say.

Thanks for reading all the way through! Continue sharing and supporting—always appreciated!

Until next time