Liquidity Matters: The Business Cycle

As we approach an inflection point in markets it's important to know exactly where we are in the business cycle.

Hey guys,

You ever realised how there’s little difference between sports and macro?

I mean, literally no difference.

Except for one thing, there’s no off-season for us.

Winter, Spring, Summer…

The markets never relent.

So give yourself some recognition for the hard work you have to do keeping up to date with a forever-evolving puzzle.

With a looming government shutdown imminent, the Fed will lose key data points like CPI, unemployment readings and other vital metrics; that will impact the Fed’s upcoming meetings this year.

For now, let’s get a bearing on where we are.

A Pulse Check on the Business Cycle

It’s been a while since we reviewed the current business cycle and where conditions are headed. In this report we’ll dive straight into the business cycle, market regime we’re in and a snapshot of global financial conditions.

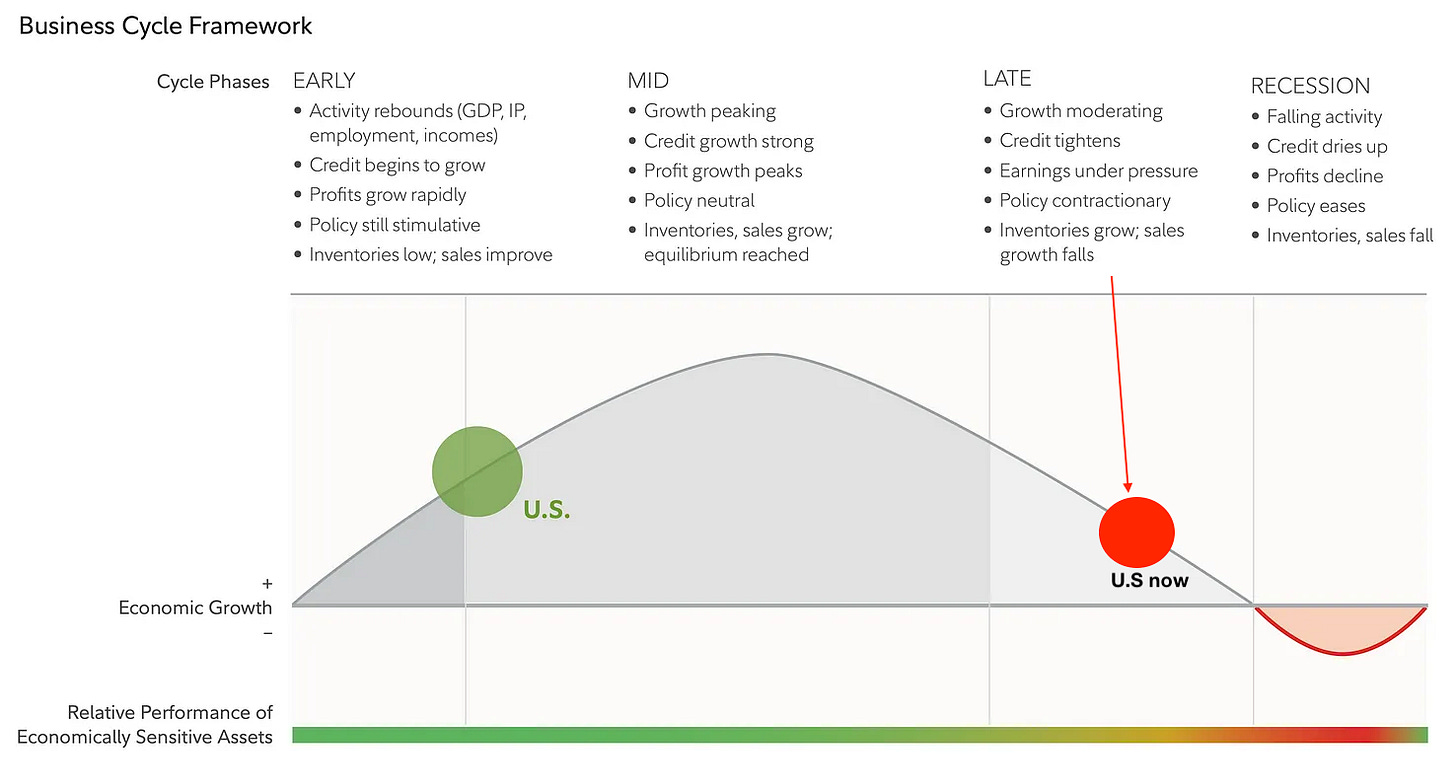

First, let’s define the different stages of the business cycle:

As most of you would remember from studying, reading reports or just general knowledge, there are four stages within the business cycle and one theme that can always be used to depict the cycle is credit. Credit and liquidity are the building blocks of market expansions and contractions.

David Tepper, the hedge fund manager of Appaloosa management famously said this in regard to liquidity within markets after Russia’s sovereign debt default in 1998:

“It was definitely the biggest screw-up of my career. We had huge emerging market and junk positions that we sold down to avoid disaster, so we were able to act fast. Our biggest mistake was not realizing how illiquid markets could get so quickly.”

— David Tepper

Now if you recall Russia's sovereign default blew many funds out of business, mainly LTCM (Long Term Capital Management) which also had a large position in Russian government bonds; Tepper however, ended up scooping the distressed Russian bonds after the default to make a profit recovering his loss.

Point being?

Liquidity matters. In markets, and especially in the business cycle.

So we know we’re in the late stage of the cycle, where growth begins to moderate as it’s already doing within the U.S, credit tightens, corporate earnings get squeezed and central bank policy tightens even more. Next, we want to understand what regime is at play within markets, now for those not familiar with the term macro regime, let me explain how to know the predominant regime in markets.

Macro regimes are periods and states within the economy characterised by different economic conditions, such as growth, inflation, and mainly interest rates. So if the components required to know what regime we’re in are GDP, CPI, unemployment and interest rates we can grow the different possible regime outcomes.

Here are the 4 different regimes markets can be in:

Expansion, contraction, stagflation and disinflation. This can be simplified by the following.

Growth is accelerating and we have an accommodative central bank

Growth is decelerating and we have an accommodative central bank

Growth is accelerating and we have a restrictive central bank

Growth is decelerating and we have a restrictive central bank.

US growth for the second quarter came in at 2.1% YoY, with the September SEP projections forecasting growth to slow to 1.5% in 2024 before rebounding to 1.8% in ‘25. So we’re left with options 2 & 4; straight away we know the Fed is set to continue tightening meaning regime 4 is the only viable regime.

Voila!

Now we know where we are in the business cycle and the regime we’re in. Next, what does this mean for markets?

Before we continue, I've heard some discussion of a potential "easing" of Fed policy in the future. However, I want to make it clear that a Fed pause is not the same as a pivot or dovish sentiment. In fact, by removing 50 basis points of cuts from the 2024 pipeline, Jay Powell has effectively raised interest rates by 50 basis points without having to move the Fed funds rate. This is because of the transmission of real interest rates. Headline inflation is currently at 3.7%, with core inflation at 4.3%. Next year, inflation is expected to settle around 2.5% (core PCE), while rates remain unchanged. This means that the real interest rate will actually increase as inflation subdues.

The predominant macro regime heavily influences the flow and direction of both capital and asset markets. The dollar has been a huge beneficiary of soaring Treasury yields as investors continue to price higher long-end rates into the market forcing the price of existing bonds lower.

A member of the MMH Pro community asked me a solid question, which was this:

“If yields are so high, why isn’t that attracting a huge flow of capital resulting in the decline of bond yields”

My response was this. Although bond yields are at historic levels, investors are both reacting to higher neutral rates and a longer period of higher interest rates meaning they’re expectations for yields on Treasuries is still rising. As a Barclays spokesperson perfectly said this morning:

“There is no maging level for yields that, when reached, will automatically draw in enough buyers to spark a sustained bond rally”

Barclays

No More Easy Money

When an economy becomes reliant on easy monetary policy two things tend to happen when that phase is broken.

The private sector is forced to realise the large debt bubbles it accrued.

Risks within the financial system are brought to light and present imminent vulnerability to the stability of markets.

Both of which we’ve seen happen this year. The first relates to the balance sheet recession manifesting in China and the second with SVB, FRB and many other small lenders.

In the FX market, the normalization of tighter monetary policy causes high-beta currencies, particularly emerging market (EM) currencies like the BRL (Brazillian Real), to struggle to attract capital flows. The majority of EM countries use dollar credit lines to finance nationwide operations, so an appreciating dollar decreases the availability of credit for EM entities, as large lenders flock to high-yielding Treasuries, which have no credit or default risk. In such an environment as we’re in now, the question is where does capital flow to?

Going into 2024, my view is cash and bonds.

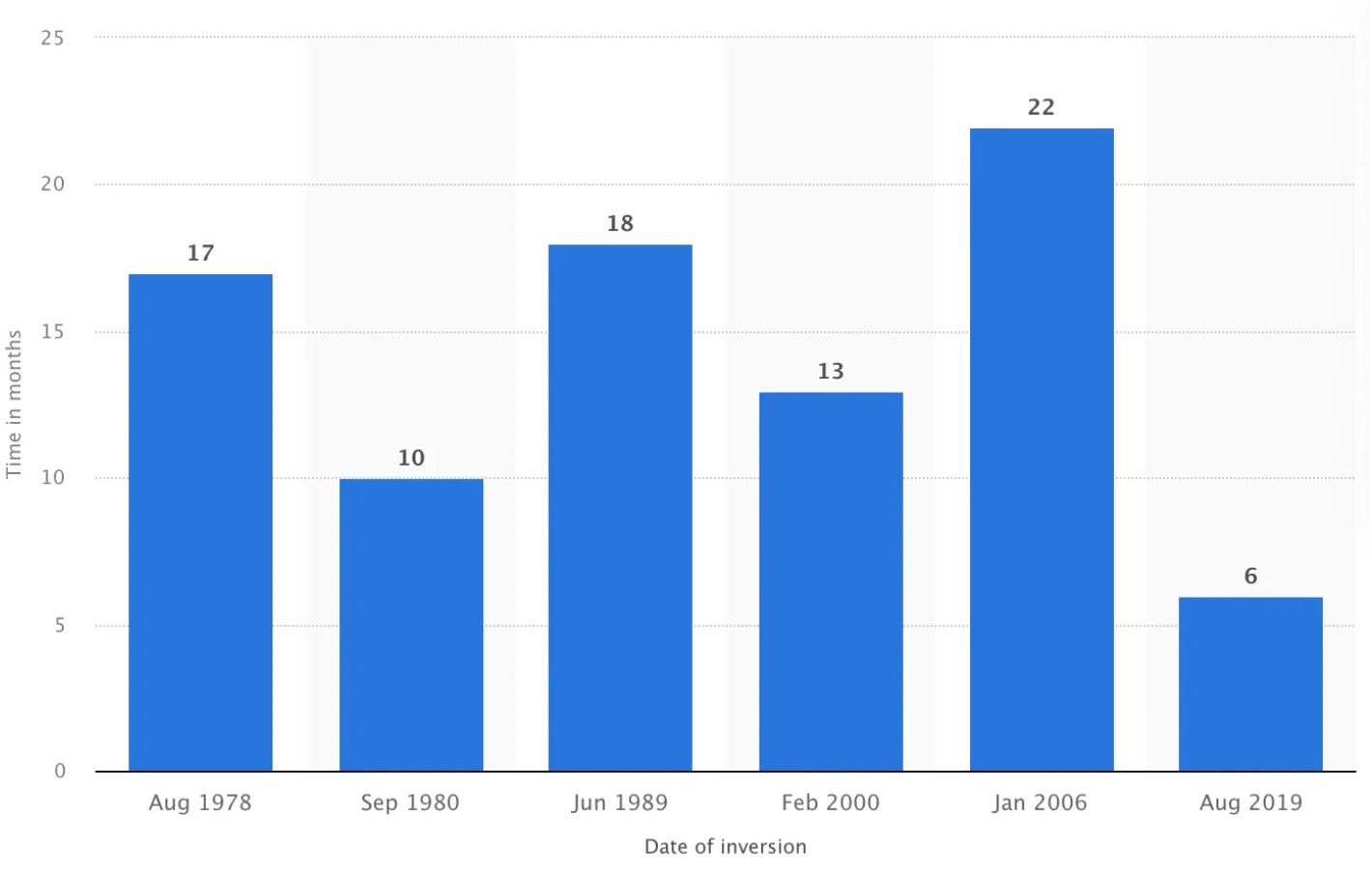

The macro lags of the tightening cycle are about to set into the real economy. The fiscal spending of the US government throughout ‘22 and ‘23 has massively delayed the transmission of Fed policy. As mentioned in previous reports, the delay in time from a yield inversion to a recession lies anywhere between the 16-24 month period, so with us only being roughly 15-16 months into the tightening cycle we’ve just entered risky grounds where markets could tip.

The image above confirms my expectation that we are now in the waiting game for a recession. I anticipate that the delay until the recession will be closer to that of 2006, due to the additional drag that fiscal policy has played in delaying the transmission of monetary policy. Once the refinancing cliff kicks in for the US economy and globally in Europe, that’s when we’ll truly see the macro lags become present within the economy as credit flatlines, something already manifesting in the US.

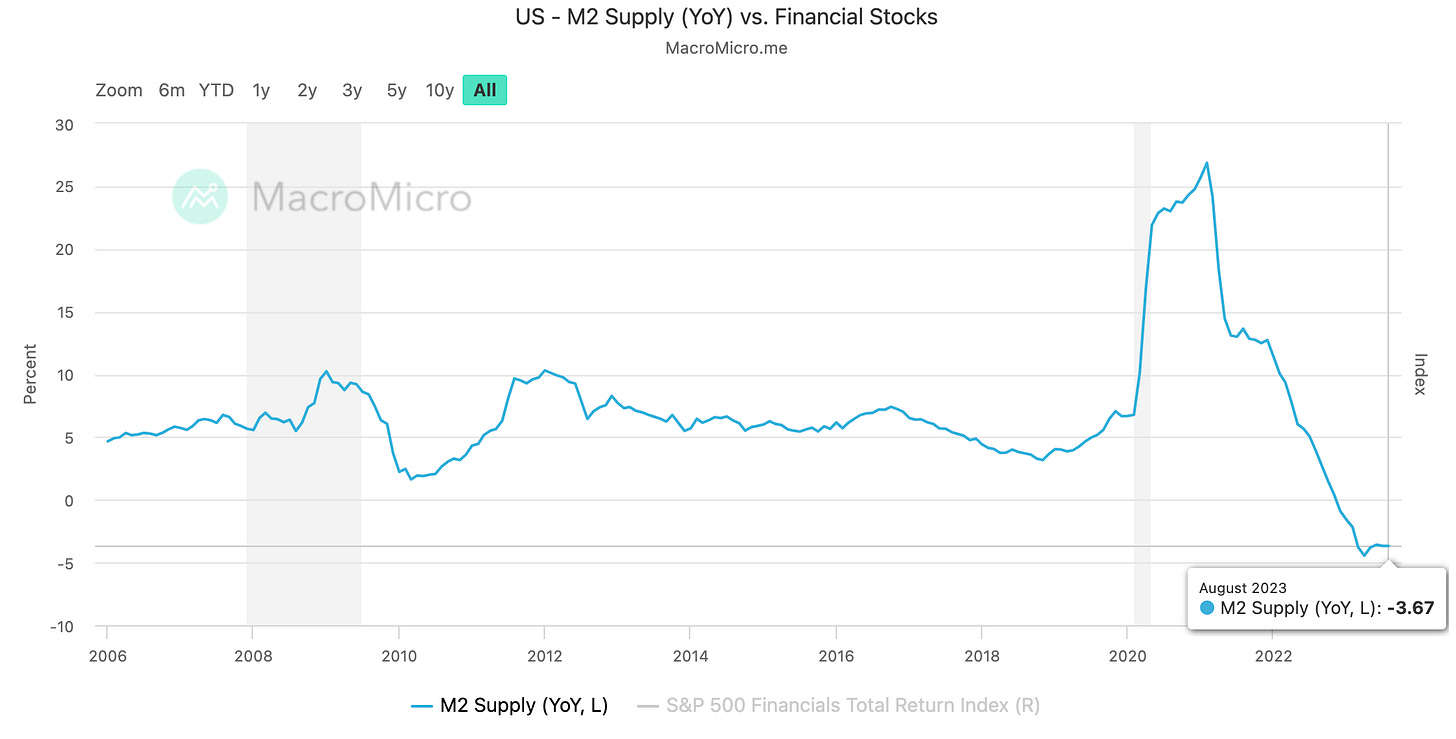

This is the deepest level of contraction in the M2 growth in over 20 years, worse than that of the 2007 recession.

The US economy will inevitably have to face the macro data staring at it in the face such as M2 supply growth and refinancing costs. Credit is the building block of market expansions and contractions, and we are poised for a volatile period in the world of macroeconomics going into Q4 ‘23 and 2024.

That’s it for today crew, I hope you took away some value from this report.

Let’s talk below!