Let's Talk Eurozone Economic Conditions

At our upcoming meetings, further normalisation of interest rates will be appropriate. The frontloading today of the exit from negative interest rates allows us to make a transition to a meeting-by-meeting approach to our interest rate decisions. — President Lagarde

Ok, it’s final. They’ve moved from their negative stance on all three key rates, about time…

So let’s dive into what’s really going on in the Eurozone. For the first time in 11 years, the ECB hiked their interest rates by 50bps, taking its rates out of negative territory. Now the hike came at somewhat of a surprise considering markets were pricing in a 25bps hike after hearing from the ECB that they would ideally like to ease into the interest rate normalisation process.

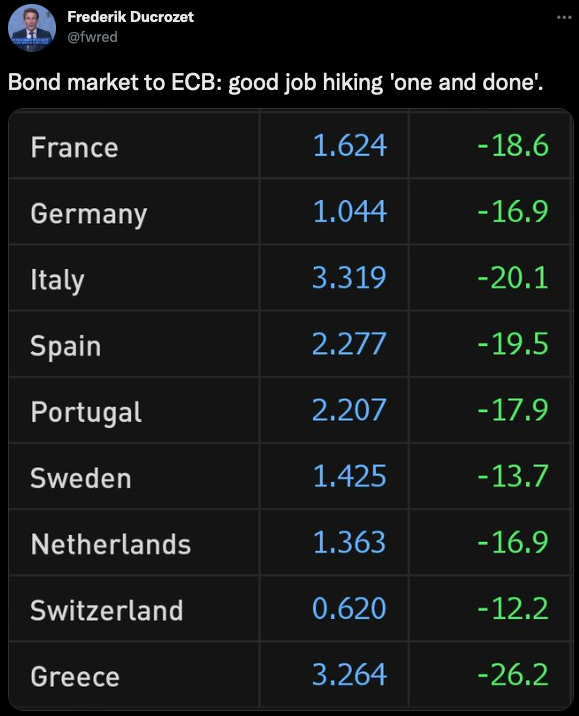

Now, although the hike we saw from the ECB was more than what we expected it’s clear to see that markets, particularly bonds didn’t agree.

When a central bank tightens its monetary policy, usually we see spreads on bonds decrease/tighten. However, in this particular scenario, we had a widening as shown above. Now, this is simply telling us that the bond market doesn’t believe in the ECB’s ability to navigate this hiking cycle until the point where inflation is no longer a problem.

I listen to quite a few good macro voices in the space and the common message is that we’re seeing a curve flattener in Eurobonds. To just clarify, this is why a flattening curve is a bad thing for the economy and sentiment:

Before I define what a curve flattener means for the economy let me just say this; bonds are forward-looking instruments, 5y bonds reflect investors’ expectations for the interest rate in 5years.

A normal yield curve should have a nice upwards slope, meaning that longer-term yields should be higher than shorter-term yields as taking a loan over the long run incurs more risk due to inflation & interest rates; therefore the lender must be compensated for this increased risk.

An upward slope is a sign of a healthy market.

This also shows that investors expect growth to continue into the future, a sign of optimism in a healthy economy.

On the other hand, a flat yield curve means that you pay the same amount to borrow for a term of 5 years e.g as you would for 10 or 30 years.

All in all, that shows that investors see economic conditions to be sluggish for the medium-long term as rates will be either lower or the same. So in the case of the ECB, investors aren’t fully believing what Lagarde has to say to us.

With the Euro hitting parity against the dollar, it’s pretty hard to see things brightening up for the Eurozone as a whole.

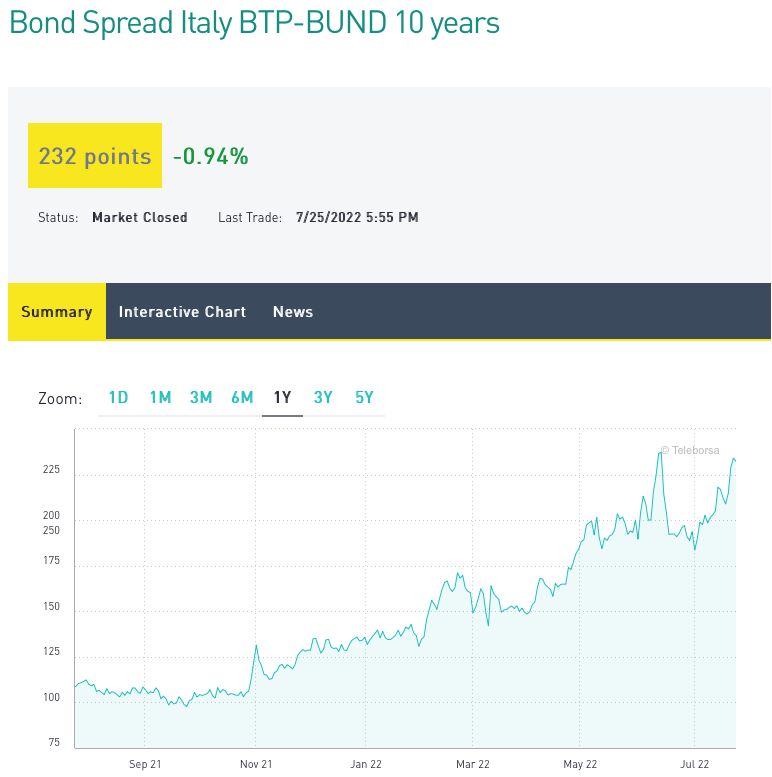

Now the ECB has also implemented a new tool called TPI, which in laymen's terms has been introduced to prevent the widening of borrowing costs across the Eurozone, particularly in countries such as Italy, the main culprit, Portugal and Spain, and even Greece.

What this tool will aim to do is prevent further widening of spreads between countries such as the ones mentioned above; however, with turmoil politically in light of President Draghi’s resignation, the ECB will not be able to stop the uncertainty spilling over into the credit market.

I know, it sounds all grim for the Eurozone doesn’t it?

On a mixed note, Russia and Ukraine have agreed to release millions of tons of grain piling up on ports since the invasion began. As we know, here in the UK alone food prices have rocketed 9.1% already! That’s based on what we’re told, so we know the figure is already double digits. So with this agreement hopefully we can see a reduction in food prices over the next 6 - 12 months as there’s a delay in how these circumstances evolve into our financial system.

Although this was already a signed deal at the time, Russia thought it worthwhile to attack (bomb) the Odesa port after the agreement to resume the trade of grain globally.

Remember, 40% of global wheat(grain) comes from Ukraine alone, now looking at the recent CPI figures (9.4% in the Uk), what has predominantly been an issue alongside fuel and gas costs; is food prices. If supply chains can get going in full motion we should hopefully start to see a gradual decrease in the food element of inflation over the next few months; my worry is as we approach winter the true force of fuel prices will show its strength cancelling out any reduction we have in other inflationary entities such as food.

Now, a quick sidenote and alert that by the time you’re reading this the Bank of Japan would have already met; if you recall my previous article touched on the importance of the BoJ; so expect me to highlight a few things from the meeting.

I’ve had a few good weeks to settle other work but feel glad to be back to some sort of routine with my articles; I will be back this week for sure!

Thanks for getting through as always! — Any recommendations on pieces or topics send them my way