Let's Cut The Crap.

Non-farm payroll, Jay Powell's testimony before Congress & recession risks

Hey guys,

Always a pleasure to be back sharing insights with you.

Quick update:

It’s finished.

“The Four Foundations of Macro FX is done, and it’s loaded…

4 pillars. 4 themes. Out in less than 4 weeks, March 31st, mark the date.

But seriously,

What a week in markets.

Jay Powell stepped up his hawkish tone in-front of Congress members late on Tuesday, forcing markets to reprice everything and we had employment data out.

So let’s take a look.

As always, lend me your attention:

Higher Rates Until Something Breaks?

Tuesday afternoon, Jerome Powell testified before Congress members, (the group of people who make laws in the U.S), as part of his semiannual monetary policy report.

It’s safe to say that Jay Powell did not hold back, and neither did some of the Senators, particularly Senator Elizabeth Warren, who was overly critical of the effect higher interest rates would have on unemployment, we’ll get into that later.

A few comments Powell made shook the markets and caused investors to reprice key forecasts. Before we go into the reaction from markets, let’s take a step back. We often talk about what has been priced into the markets but never discuss what has been priced out of the markets. As early as a month ago, even two months ago, investors and traders, including me, were expecting to see the last and final interest rate hikes by May/June 2023. With expectations pointing towards interest rate cuts by Q4 ’23 or Q1 ’24.

That is no longer the case, markets have priced out any possibility of interest rate cuts this year and now expect rate hikes to run through the June meeting.

Here’s one statement that’s worth exploring:

"The ultimate level of interest rates is likely to be higher than previously anticipated," — J Powell, Fed Chair

As a result of this meeting, bond yields across the short and long-end both rallied hard!

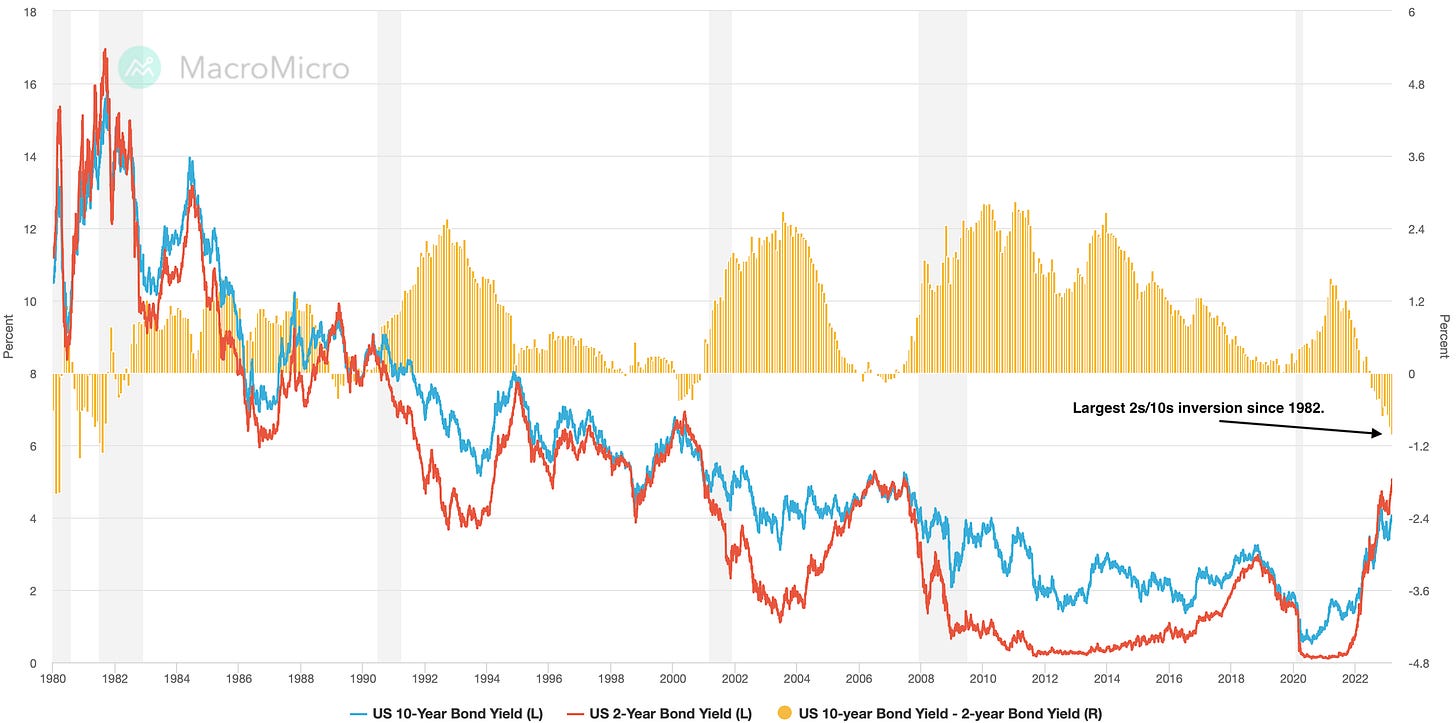

The 2s/10s bond inversion is a key indicator of a recession within the U.S economy, and historically speaking, the time delay to a recession once the 2s10s invert varies anywhere from 6 months to 24 months. The 2s10s curve inverted back in July of 2022. Meaning, we could see the U.S tip into a recession anytime over the next 12-month period. I know, it’s a wide time range but adding to the fact Jay Powell isn’t slowing down the pace of rate hikes but rather “prepared to increase the pace” adds additional pressure to the U.S economy already facing slow growth and stagnant inflation.

The 2-year treasury peaked past 5.00% and the 10-year note was back above 4.00%. The expected terminal rate for Federal Reserve is 5.50% - 5.75%;

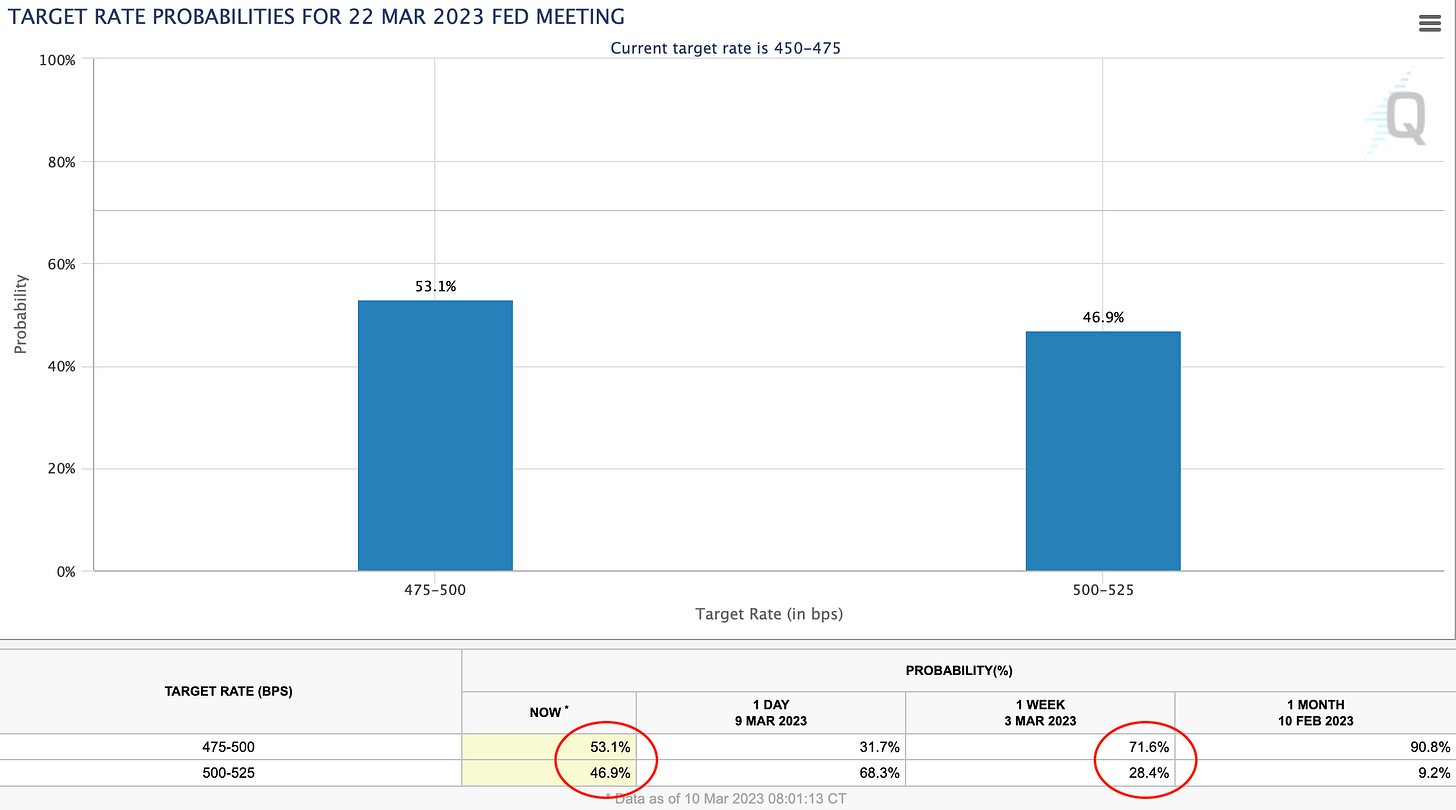

For the upcoming FOMC meeting in 12 days, the latest probabilities of the rate hike show traders are re-assessing their bets of the Fed moving towards a 50bps hike instead of a 25bps hike.

Just 1 week ago, markets had put a 71% probability that the Fed would hike into the target range of 475-500bps meaning a smaller 25bps hike, fast forward to today, and markets have it at an even stalemate. Compare that with the data from the 9th of March where the probability of the federal funds rate reaching the 500-525 range was close to 70! It’s clear to see that the non-farm payroll data we just saw shifted this possibility back a notch.

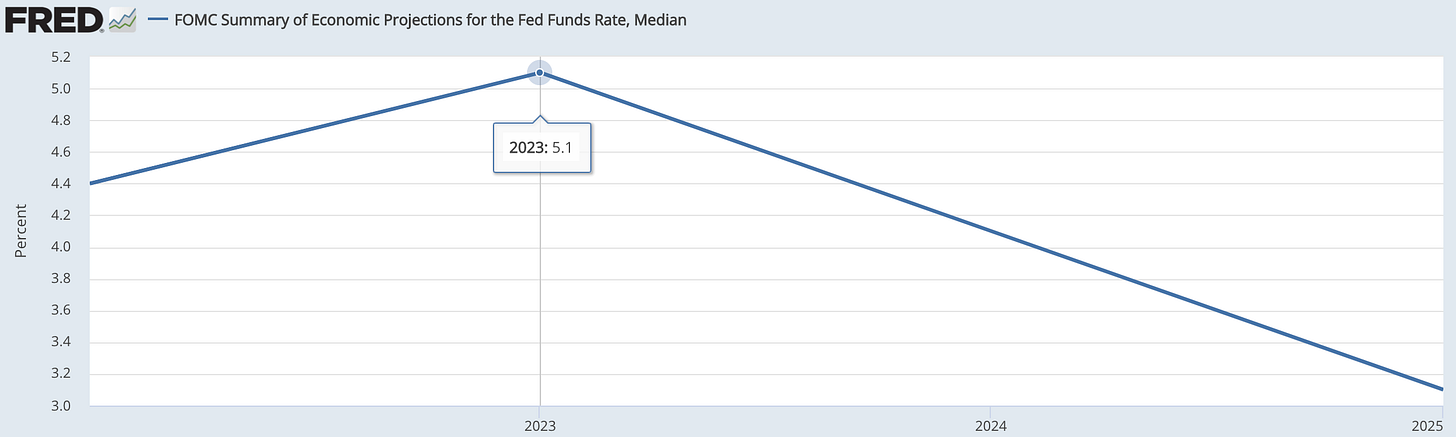

If we just take a step back and look at the SEP projections for the fed funds rate released in December 2022 for this year; you’ll realise just how much of shift markets and traders are having to make.

5.1% —that’s what we were all expecting to see from the Fed.

Now back to Jay Powell’s meeting with Congress; Sen. Elizabeth Warren questioned Jay Powell’s strategy to bring inflation sub 2% by hiking rates saying:

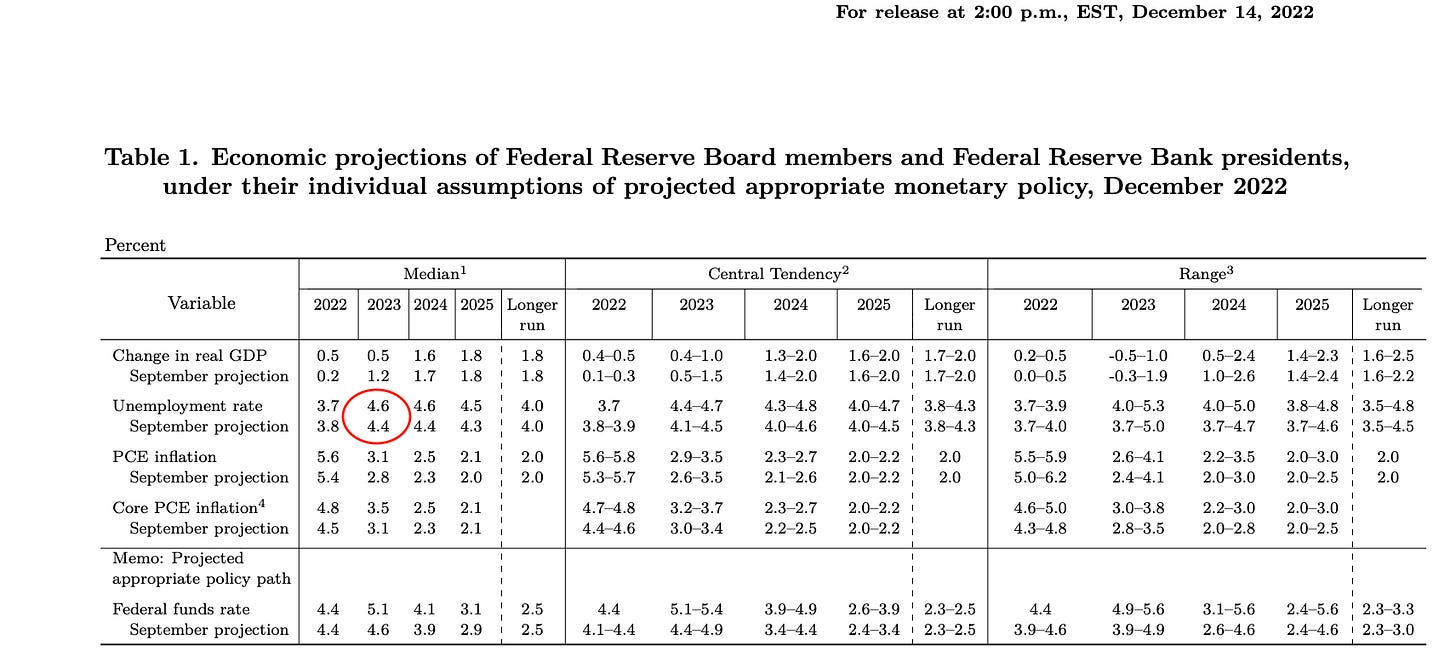

“According to the Fed’s own report, if you continue raising interest rates as you plan, unemployment will be 4.6% by the end of the year, more than a full point higher than it is today.”— Sen. Elizabeth Warren

Now the significance of this statement ties back into our title, higher rates until something breaks. Because that’s exactly what Jay Powell is intending to do; over the past 74 years, the U.S has only avoided a recession once when unemployment moved up by 1%.

So if you recall the SEP (summary of economic projections) released Dec 14th,

this rise in employment from the recent unemployment print today of 3.6% solidifies Jay Powell’s strategy.

Cue the non-farm results.

So although the non-farm payroll data came in above expectations, what the Fed would be happy in seeing, is some slack in the labour market with the unemployment rate climbing to 3.6% in Feb.

Looking forward we have the March FOMC meeting where I see the Fed hiking 50bps, but more importantly markets; conditions will begin to tighten up especially after the Fed hike, with liquidity drying up, equities trading lower and credit creation to continue tightening ultimately leading to lower inflation prints.

Both bonds and equities are trading lower, usually, this would warrant the typical, ‘risk off’ flee to safe haven statement, but this doesn’t seem like the case as the dollar is also on the backfoot with gold being the only outperformer.

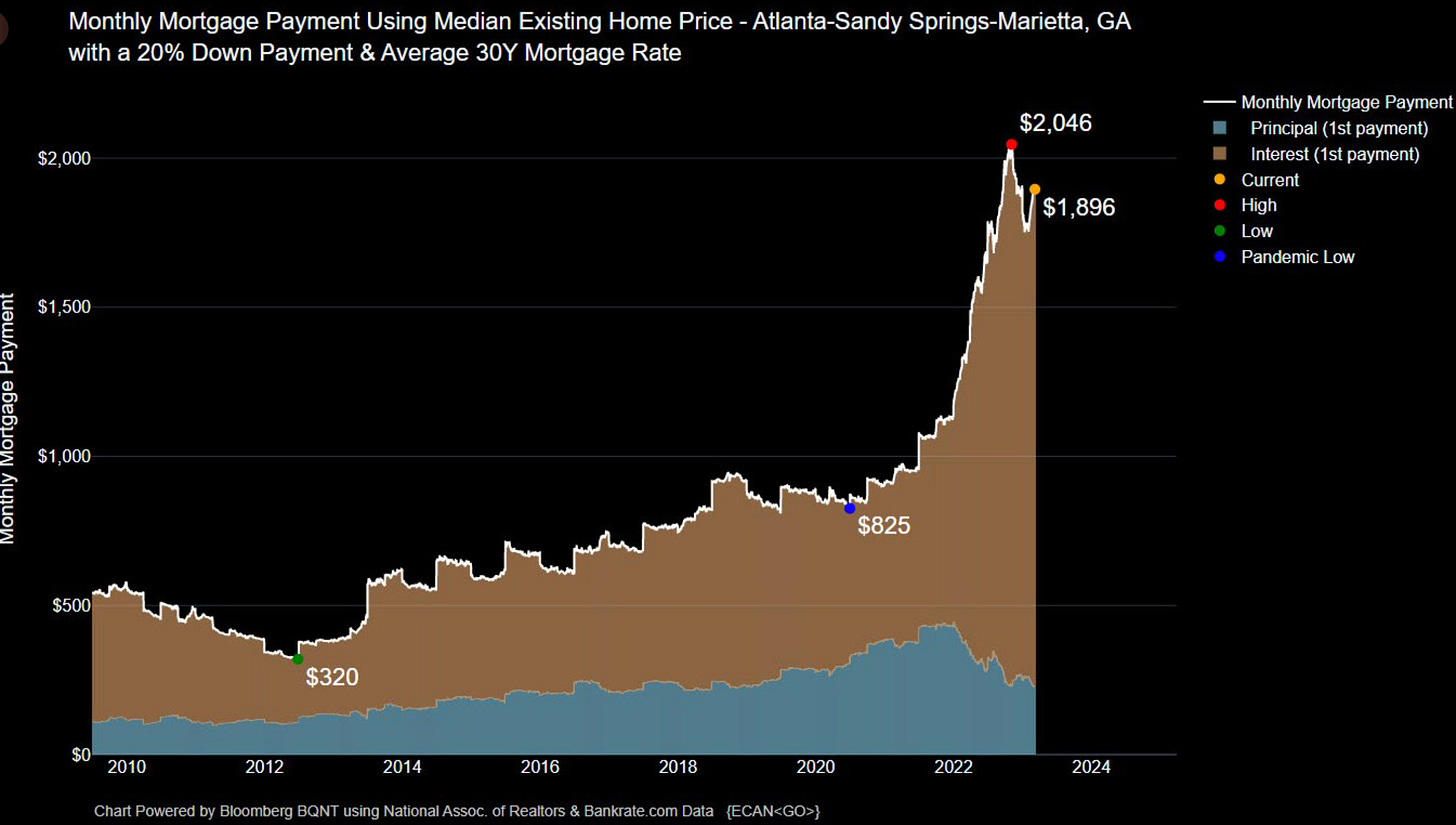

I’ve recently begun thinking about U.S rates differently, we touched upon this briefly in my last note, where we explained how interest rates affect the only asset class bigger than both the bond and equities market put together.

The housing market.

Higher rates in the States do not affect existing homeowners as their mortgages are fixed for 30 years, but, when looking at the wider economic ecosystem created by the housing market, roughly 16% of all U.S jobs are supported by the housing industry, both direct and indirect jobs. Direct jobs are those related to the construction and maintenance of homes, like electricians, plumbers and indirect are those in manufacturing, real estate etc.

So, when looking at the wider ecosystem created by the housing market and observing how rapidly monthly payments on homes have increased, a slowdown and contraction only seem right in this case. Something that I believe will play into unemployment data in the upcoming releases.

And that’s a wrap.

If you enjoyed this macro note, and are feeling generous, why not share this?

My macro guide will be coming soon so stay locked in, I’ve put over 100+ hours into this for you.