Lessons From Hedge Funds

A dive into the lessons from the world's most sophisticated money managers

Hey crew,

As we wrap up the year it’s a time which calls for reflection.

This year might not have been what you would have expected but one thing is certain, there’s a lesson in every moment, whether good or bad.

In the spirit of lessons, today’s report is different. No thematic trade ideas or ‘global outlooks’ today I want to delve into four key lessons and practices shared by some of the world’s best hedge fund managers.

As always, lend me your attention:

Adapt or Die.

In the world of investment management, hedge funds are often referred to as “smart money”. Hedge funds are believed to have the ‘crystal ball’ of markets when in reality, they just employ a rigorous amount of processes, analysis and strategies put together by the best minds in the space to deliver alpha. They demand premium fees from their clients, and in most cases still underperform broad indexes whilst charging hefty fees of 1.5% management & 17% performance fee. The traditional 2 and 20 fee structure has faced increasing scrutiny with the rise of passively managed index funds, which offer comparable returns and the significant advantage of lower costs.

$5.2T. The total AuM of hedge funds globally and that figure is only set to increase heading into another financial year. Throughout 2023, the key trend within the hedge fund space has been the rise and dominion of multi-strat funds since the pandemic. Multi-stat funds, short for multiple strategy funds, such as Citadel, Point72 and Millennium management have received the largest share of attention, and as a result, allocation from large institutions and endowments. Multi-strategy funds employ a number of strategies which makes these investment firms much more desirable due to their low volatility and wide range of investment/trading strategies ranging from; macro, L/S equity, relative value, event-driven and many more.

If we’re pinning the rise and success of multi-strat funds down to one thing, it’s their ability to produce a consistent stream of returns that is not correlated with traditional market performance. Absolute gains (Abs) as some of you may know. In 2022, the year of mass outflows and redemptions from L/S equity hedge funds totalling $37.6b multi-strategy funds were one of only two strategies to record investor inflows, up $5.8b. This theme has followed through, as recently as November ‘23 where equity funds experienced $4.8b in outflows whilst multi-strategy funds attracted net inflows of $500m for the month.

This is not to say that a certain strategy is dead, but rather to highlight the emergence of new trends and strategies within the alternative management space that are taking the industry by storm.

Scenario Testing

In a recent interview, Ken Griffin shared how Citadel approaches the art of risk management and this was what he had to say:

“We look at a variety of historical scenarios and how that impacts our portfolio. When there are events that are being talked about by geopolitical analysts, we will start to run stress tests”

Ken Griffin, Citadel founder

Ken continually asks the question, “How will our portfolio perform if X unfolds?” and I believe there’s a distinct lesson in this mental framework. That lesson, simple yet overlooked, is preparation. Always alert to potential risks and scenarios that would put his portfolio’s return profile at risk. Such scenarios he would test for would be:

Recessionary environment

Second tailwind of inflation

Higher long-run Fed funds rate

Geopolitical escalation between China-US

Middle East involvement in Hamas-Israel

Liquidity risks

Black swan events; e.g Covid-19

I’m certain these are just the tip of the iceberg of what Ken and his team at Citadel test for to ensure they are ready regardless of the macro/geopolitical environment they’re faced with.

This idea of stress testing one’s portfolio or ideas is not unique to only Ken Griffin, founders of Avenue Capital Marc Lasry & Sonia Gardner, a hedge fund focused on distressed debt investing employs a similar framework to Ken. Avenue Capital always looks to identify worst case scenarios and specific risks to every investment. In their case by testing all possible scenarios, in the event of a firm they’ve invested in going bankrupt, they’re first in the capital structure to get paid minimising their risk. Whilst most retail and institutional traders tend to calculate their reward, gain & future Pnl, the top money managers look to minimise the downside whilst maximising their opportunity. Hence fund managers emphasise having low volatility & risk relative to their returns (i.e focus on Sharpe/sortino ratios etc).

The question is, how can we take a leaf out of one of the best money managers?

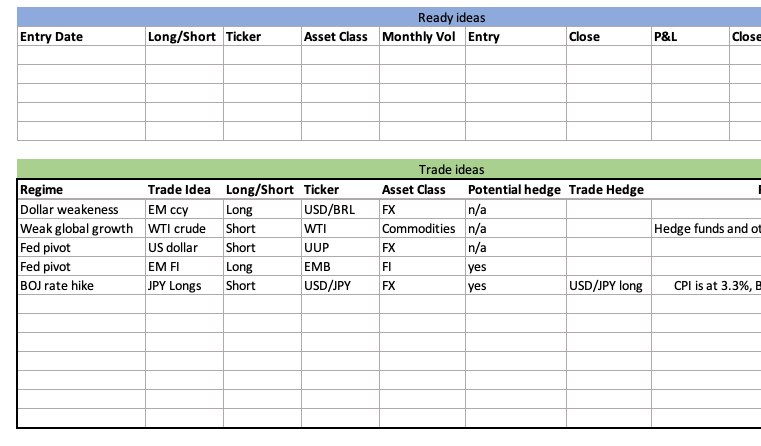

This is an excerpt from my Excel sheets on potential ‘regimes’ that could be at play in 2024, as you can see I’ve got a few scenarios with trade ideas, one of which is already in play. These are regimes that could influence asset prices, particularly FX/FI and commodities. A lot of these ideas that will turn into active positions will be held for a number of months, as part of my strategy this is how I’m able to express my macro view in the markets by letting my thesis and analysis play out over a quarter or more.

There are many ways to take advice from Ken, this is an example of something I use which compliments Ken’s mental mode of always being prepared. For short-term traders, this is equally as important. Knowing what effects a recession, weak growth or a risk on environment will have on a currency from a macro perspective will allow you to move with the long-term fundamental trend, adding further evidence and reasoning to your position.

That’s the premise for my 2024 currency projection report I did last week, a very insightful read for all of you, factoring geopolitical and macro to conclude on the house view for ‘24.

Currency Projections 2024

Hey crew, This report had me banging my head against the wall trying to word my views, we got there in the end ;) This report will be focused on taking a macro viewpoint on the USD, EUR & JPY detailing my projections with the backing of macroeconomic data.

Aggressive Patience Is The Game

Take it from me.

I hate waiting.

But when studying some of the most successful managers in the world such as Ray Dalio, David Tepper and many others, patience is a trait they all seem to advocate for.

The best way to describe this sense of aggressive patience is understanding that you won’t achieve your big goal next year, or probably in the next two—but in the midst of that, being overly aggressive towards your daily tasks, your micro goal is how you ensure the macro goal takes care of itself.

This is applicable not only in your life but your investing and trading career. Being overly aggressive and impatient will lead you to lever up on positions you believe can’t go wrong, or make certain decisions out of impulse because of the instant gratification involved.

This is evident in Ray’s investing approach:

“Bridgwater has historically kept it’s leverage low by industry standards, about three to four times assets over equity over the life of the firm”

— Ray Dalio, Bridgewater founder

Although this may seem a ‘standard practice’ it’s far from it. In the world of alternative asset management, everything is fine until it’s not, when your risk management process is put to the test many funds and banks fall short. Archegos Capital being a prime example, the hedge fund run by Bill Hwang, blew $20bn over 10 days. How? Leverage. Whether you’re a bedroom trader or a Wall St manager no one is above risk management, key principles that can be extracted by playing the game with patience.

So, is leverage a bad thing? No. Certain strategies run by these funds must employ a certain amount of leverage to create significant alpha, such as relative value treasury trading which in simple terms is arbitrage trading in treasuries. This strategy exploits the small discrepancies between similar assets, with leverage, these discrepancies can produce attractive alpha.

Last but not least independent thinking.

This is a trait that can bring one great success in markets and life. The ability to go against conventional wisdom and bet against the herd is where the real alpha lies. Developing a mental framework where you question everything, test common knowledge, exploit inefficiencies in markets and most importantly, be comfortable with making mistakes. There have been times in my journey when I felt the pull to join the ‘consensus’ view on macro trades because it’s being plastered all over financial media but found myself choosing to listen to my internal system on whether it’s the right move. In most cases, it wasn’t, the most recent example being my short call on US Crude Oil amid every Wall St bank calling for Oil to top out at $100+ per barrel.

In a world and industry full of high-pressure moments, these four principles can lead us to the highest level of performance and achievement. Adapt, or face the consequences, test out every possible scenario, employ aggressive patience to your life goals and trading and remember to lean into your voice for decisions.

Thanks for getting to the end, I hope you enjoyed this report— a dive away from all the macro data to long-lasting principles that if employed can be life-changing.

As always, let me know your thoughts

Really enjoyed this read, particularly when it comes to the importance of independent thinking when viewing macros. It's sometimes a tricky one interpreting data logically and also through the lens of how the markets would price it (last series of Powell comments on early cuts followed by the December FOMC meeting taught me that lol) but i guess this develops with more exposure and experience. appreciate your simplistic approach to conveying complex global and financial macro. great work Joe, happy holidays!