Key Macro Trends Shaping The U.S & Europe

Dollar Surprises, Europe Shivers: A Deep Dive into Macro Mayhem

Hey crew,

When preparation and opportunity meet it’s blissful.

This past week has brought that to life.

Anyway, I’ve got a deep dive report for you all covering the US macro/geopolitical conditions and why I’m bearish on the European economy.

Enoy

The US Macro Picture

At any given time, a million and one data points harmonise to reveal the pulse of the US economy. The challenge is, that the data is moldable to the eye of the analyst. If I choose to look at the US economy from a negative, bearish standpoint, I can easily find the data points to suggest a crash is inevitable, and vice versa. Optimists can scramble through the data points to provide reasons to be net long.

In this report, I aim to uncover the current and future conditions of the US economy as we approach the most important period post-tightening, where we see whether the Fed tightened policy too much or just enough.

Dollar Strength To Kick The Year Off

YTD the dxy is trading +1.01%. There’s a multitude of reasons why the dollar isn’t on the backfoot as I expected, they can be summed up into:

A repricing on dovish Fed bets

US outperformance relative to G7

Rising spillover risk from geopolitical tensions

Let’s discuss the FX outlook.

The BLS released CPI data for December which surprised to the upside.

CPI (MoM) (DEC) - 0.3% vs 0.2% consensus

CPI (YoY) (DEC) - 3.4% vs 3.2% consensus

Core CPI (YoY) (DEC) - 3.9% vs 3.8% consensus

Core CPI (MoM) (DEC) - 0.3% vs 0.3% consensus

Initial jobless claims - 202k vs 210k consensus

The uptick in inflation raises the concern that the Fed’s rhetoric will be slightly firmer, leaning away from their previous December message which sent asset markets higher. The contribution came primarily from the shelter index, which contributed over half of the monthly all-time increase of 0.3%. Despite the hotter-than-expected CPI print, market participants still expect to see a Fed cut commence in March.

Post the CPI print, both yields and the dollar caught a bid, as the assumption of a longer wait time till the Fed cut settled amongst investors’ minds. The 10y pushed 5bps higher before returning to 4.026%.

Geopolitical strings

In 2024, I don’t think we will be able to talk about macro without talking about geopolitics. It matters, across all asset markets there are implications so don’t disregard this.

The ongoing war between Russia-Ukraine, the territorial disputes in the South China Sea, the confrontation over Taiwan and the unresolved Red Sea conflict, involving US military intervention against Houthi attacks on Suez Canal vessels, are contributing to a stronger dollar amid broader geopolitical and economic uncertainties.

As it stands, the dollar hasn’t experienced the flurry of deposits one would expect in the rise of several escalated geopolitical situations with potentially critical impacts on global stability. Nevertheless, the flock to safety trade would be in motion in the event of significant escalations in any one of these situations, until then the direction of US monetary policy leads the direction for the dollar.

The one thing to remember, and consider when evaluating the impact of such geopolitical events, is the ‘impact on the US’ factor. The greater the impact, the greater the ramifications on global asset markets as US capital markets create the base for all other markets to thrive.

US Macro

On Tuesday the Federal Reserve Bank of Atlanta released their GDPNow estimates for Q4 of the US economy. The GDPNow model estimate for real GDP growth (GDP adjusted for inflation) came in at 2.2% for Q4 ‘23. The GDPNow model is a “running estimate of real GDP growth”, so instead of having to wait for the delayed release from the Bureau of Economic Analysis. Looking further back to Q3 ‘23, real GDP rose at an annualised pace of 4.9% reiterating the state and strength of the US economy. There is a caveat to that statement, however, in a year where many were expecting US markets to experience a downturn, some even pointing to a recession, the impact of the Biden administration’s fiscal largesse (substantial government spending) proved to be the singular catalyst for the US economy.

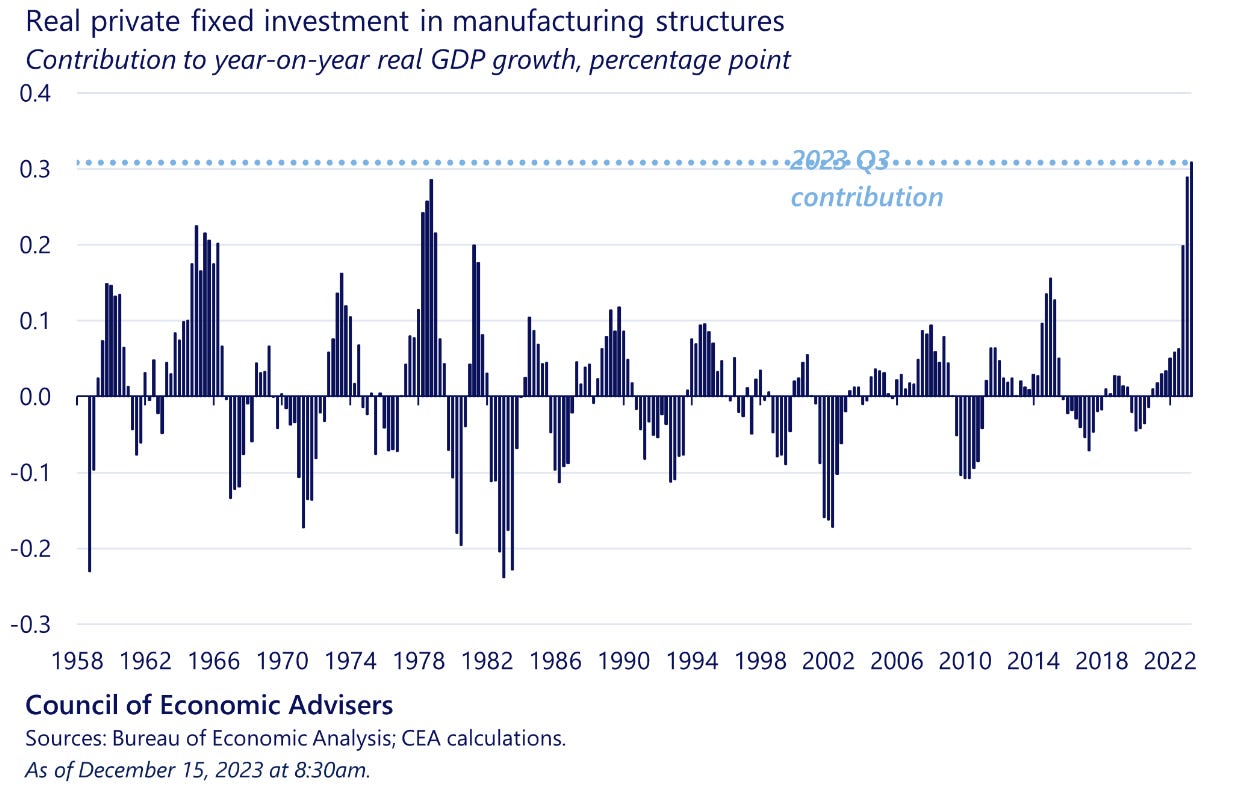

Since 1900 until 2022, government spending has contributed 25.66% of total US GDP. Within the fiscal channel, it’s evident to see the source of growth. Particularly manufacturing, manufacturing investment reached historic highs and contributed 0.3 percentage points to the YoY real GDP growth for Q3 ‘23.

The CHIPS and Science Act signed into law on August 9th 2022, included $39 billion in subsidies for chip manufacturers on U.S. soil, along with 25% investment tax credits for the costs of manufacturing equipment. The bill added another $13b for semiconductor research and workforce training. This bill in particular is in alignment with the predominant theme of detachment and re-shoring of trade supplies from China.

So, returning this to the wider US macro picture, the largesse of fiscal stimulus the US received during 2023 offset the impact of monetary policy tightening. If I were to visualise this, the net result would look similar to that of a person with floats on their arms in the sea. Regardless of the real factors at play, (the person’s ability to swim), they remain at ease with the support of the floats, which represent the fiscal element of the US economy

Looking forward

To save us all the time of reading a heavy paragraph here are my key things to watch:

Continued downward inflation prints: Over the last six months, the core PCE index rose at a 1.9% annualised rate, which suggests we will continue to see disinflation despite the recent uptick in inflation.

Points of escalation in Israel-Gaza, Taiwain-China & Iran/Houthis Red Sea: Needless to say the escalation of such conflict raises the volatility of commodities such as gold, crude oil as well as currency plays across the Yen and Dollar.

Fed signalling & comments on monetary policy: With the Fed cautiously loosening its grip on rates, neighbouring central banks gain breathing room to consider potential interest rate cuts. This shift in the global monetary landscape could trigger ripples through yields, FX markets, and equity valuations, as investors reassess risk profiles and currency relationships.

Weakness In Europe

European Economic Outlook: Bearish

European Currency Outlook: Short “Underweight”

Given the challenging economic outlook and downward trending inflation in the Eurozone, the currency forecast is tilted towards bearish. The declining trend in the S&P PMI, the technical recession expectations, and Germany's economic setbacks paint a gloomy picture for the Euro.

Economic Outlook:

Eurozone S&P PMI continued its declining trend for the 7th consecutive month to 47, both manufacturing and services alike showed contraction. The bloc is expecting a technical recession. The narrative amongst the ECB is rather firm on waiting for continued downside prints in inflation before moving towards a dovish stance.

Vice President of the ECB Luis De Guindos said this in his speech on January 10th:

“Soft indicators point to an economic contraction in December too, confirming the possibility of a technical recession in the second half of 2023 and weak prospects for the near term.”

De Guindos highlighted “manufacturing” and “construction” as two sectors where the slowdown appears to be dominant.

Germany, the largest economy of the Eurozone, with a shrinking in industrial production, saw an unexpected decline of 3.8% in manufacturing orders in October, followed by a 0.3% expansion in November vs expectations of a 1.1% gain. This further confirms the low growth narrative in the country. In addition, the constitutional lift on German government borrowing puts the fiscal position of the country even worse, signalling a more restrictive stance in the future. The underwhelming performance of the German economy is likely to percolate to other Eurozone countries.

I can’t help but tie the current performance of Germany and Europe to the slowdown in China.

China's November CPI contracted by 0.5% year-over-year, marking a concerning deviation despite ongoing stimulus efforts from the PBOC. This raises concerns about deeper structural issues within the Chinese economy, with potential ramifications for its interdependent partners like Europe, particularly in the manufacturing and industrial sectors.

I will save further points on the Chinese economy for a report I’m working on.

Employment, on the other hand, managed to stay strong. The unemployment rate in November stood at a historical low of 6.4%. This is largely a result of broadly unchanged total hours worked and a decline in average hours worked in the European economies.

Going forward, economic growth is expected to remain subdued owing to weak German economic performance and weak demand from China.

Price Level Outlook:

The inflation level in the Eurozone trended downwards, as expected. The minor uptick in November was a result of the base effect. This largely reflects the removal of government support for energy cost reduction. In addition, energy inflation, which has been deep into negative territory, remains a big contributor to disinflation.

Core inflation and service inflation, which are all more entrenched and “stickier” by nature, are also on the decline, though more slowly. This reflects the falling energy cost, easing of supply-side conditions globally and a pass-through of monetary policy.

I expect inflation in the Eurozone to trend lower towards the ECB’s target, with the guidance of the ECB as they remain rather hawkish in the face of an economy lacking any growth prospectus. However, the bigger picture is that inflation, given the current environment, will stay under control while the ECB aim to foster growth within the region.

That’s it for today guys; the support on the last report was immense.

It means a lot MMH crew, I value your feedback and thoughts so continue sharing them!

Oh yeah, if you liked this, why not share MMH with a friend? (takes 2 secs)