It's Not The End - Market Snapshot

Reviewing the current macro climate and how markets are positioned for Q2

Hey guys,

Hectic.

One word to describe the last 8 days.

IMF meeting with the Mission Chief of Sri Lanka, talking about their debt, restructuring, and GDP targets, you get the gist.

I’m no EM specialist I must say, purely an area of fascination.

Then had a tonne of ideas to re-map and organise, it’s been crowded mentally recently, but it is the beauty of pursuing a goal.

Anyways, markets are reacting to a number of things from earnings season for financials in the U.S to UK’s obscene 10.1% inflation print again!

We’re now 2x the inflation for the U.S and the only G7 country in double digits, I guess you could say we’re an emerging market at this point the way things are headed…

For now, lend me your attention:

Where Are We?

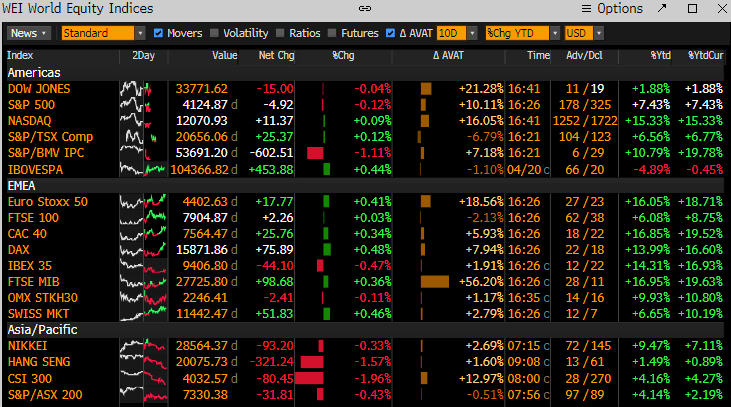

Taking a look at the market’s performance YTD you would think things are rosy, aren’t they?

I mean, just look at it.

All green, I mean, all green basically everywhere…

It’s easy to get caught up in the negative narratives in macro and the news, but when you actually look deeper into what’s happening behind the surface you realise the truth lies in your interpretation of markets and business cycles.

The most important thing for me isn’t ‘where we are’ it’s ‘where we’re headed’ and why. My background doesn't originate from a typical analyst role in a bank or blue chip fund, so I tend to deviate from the conventional approach and reasoning.

The way I see things, globally we’re approaching an intersection in market cycles and regimes; four different cycles, and asset prices behave differently during all four. MMH Pro members you would understand this reference when looking at the dollar smile theory, which is a great concept for understanding how the dollar performed in different regimes.

The trajectory we’ve been on is non-other than the recessionary regime. I speak about credit a lot, and that’s mainly because, at the end of the day, the building blocks of productivity, growth and a well-functioning financial system are predicated on widely available credit. I mentioned last week, how crucial credit is, and now as we approach the last stage of the business cycle we’re seeing growth moderate showing signs of falling activity, and earnings seasons for corporations under pressure. Although 76% of companies reporting earnings have beaten analysts’ estimates, stocks failed to gain momentum off of that with concerns over disappointing profits.

With the debt ceiling in America raising even more eyebrows, U.S fiscal policy is bound to tighten up as the $31 trillion debt ceiling is expected to be raised.

You have to remember, the level of interest rates currently, would make the interest payments on U.S debt, extremely painful and unsustainable.

So, what does this mean?

Generally, that would trigger an immediate risk of mood with investors. Even if the U.S doesn’t go under extreme pressure to resolve the debt ceiling, which it will, conditions are headed towards a contraction and a shift away from risk regardless.

I expect that the bullish gains behind equities will run dry on fumes, you wouldn’t want to be long risk when the fundamental drivers behind this rally have faded and have been priced in such as the China re-open and the expectation of an early Fed cut.

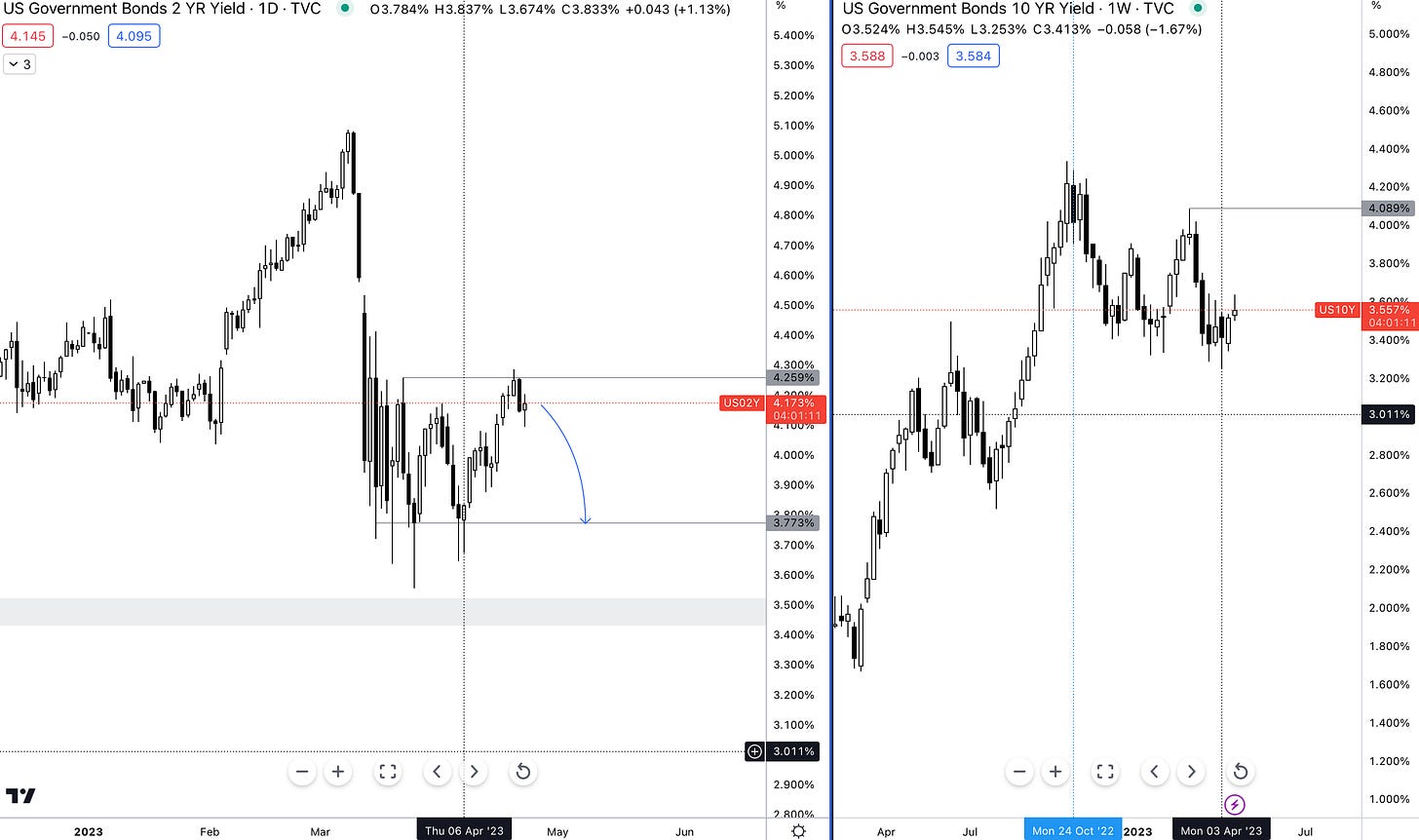

As a result, I would expect bond yields to reflect the sentiment and also move lower with the 2-year falling towards the ambitious 3.773% target and the 10y to bring the dollar lower in the near -3 month term. Once again, strong opinions, weekly held!

Rates, Yield Curves & Bank Borrowing

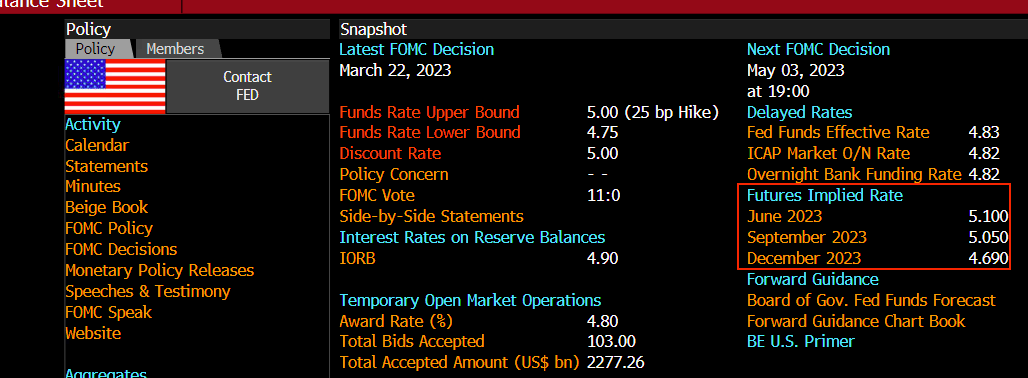

4.6%.

That’s the magic number, futures implied rates expect the Fed to cut around 25bps post the May hike of 25bps.

It’s simple, we need softness within the labour market, now. The only way to really put inflation to be, and I mean really, is to prevent the stickiest part of the Core CPI component, services from having another jump up, even if it’s the slightest.

Before we call it a day, I want to share one chart and one thought with you.

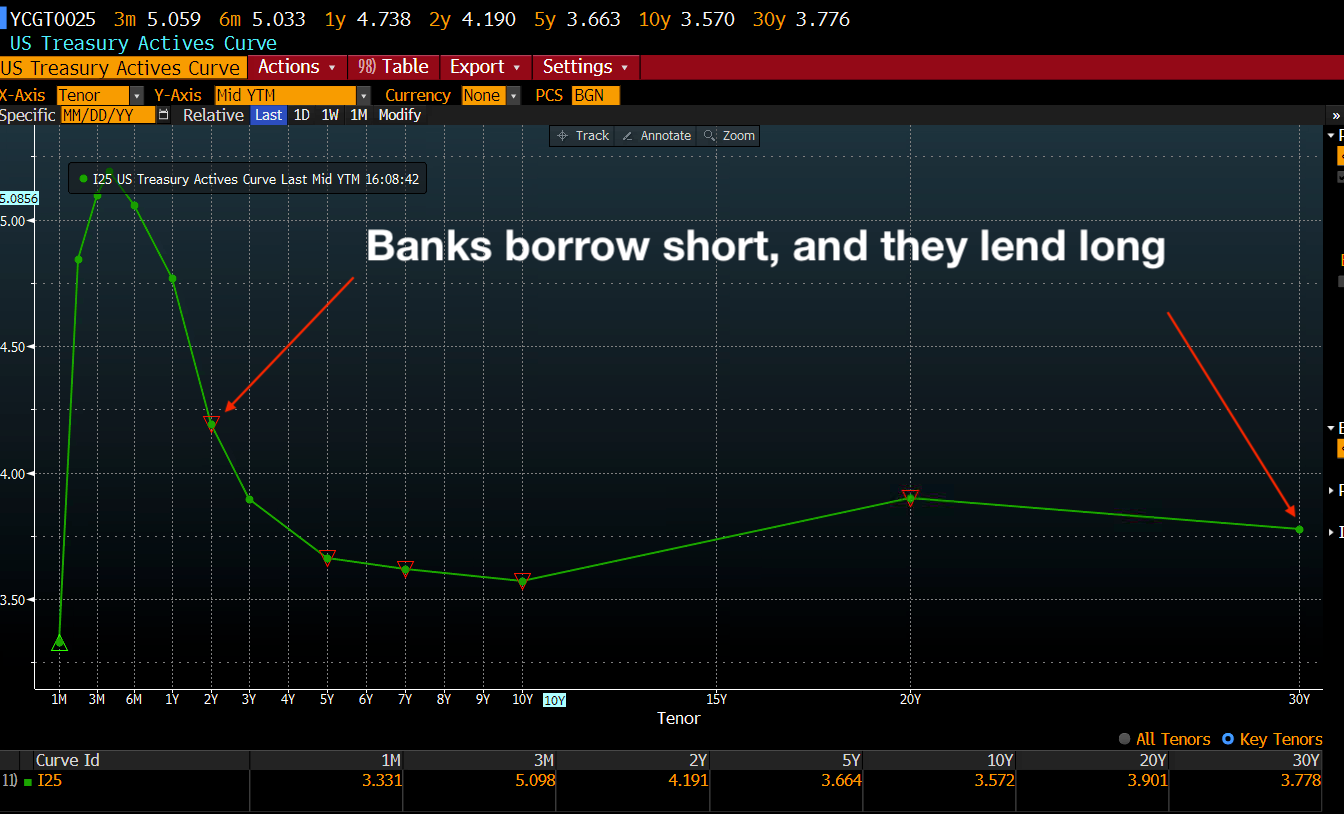

Borrow short, lend long. The fundamental playbook of all banks, shadow banks and lending institutions.

It’s a simple transaction, bank stocks perform well with a steep yield curve, meaning the rate of borrowing increases over time, so the 30Y rate would be higher than the 5Y rate and so forth. Currently, we have an inverted curve, the higher the cash rate and short-term borrowing rate, the more difficulty a bank has extending credit since their framework for borrowing relies on positive net interest margins, which in this environment is no longer a thing.

An inverted yield also presents another risk, which is lower demand for credit & loans, banks add a risk premium to all loans, so on top of the 5.00% Fed funds rate, there’s the banks ‘credit risk’, but when rates are so high you have to imagine that there won’t be as much demand for mortgages, loans and other long term debt.

Once we see the front-end yield curve begin to retreat and the yield curve flattens that’s when it’ll be time for a fresher look at where the opportunity lies.

Thanks for reading the full report.

It’s currently 6:17 pm on a Friday.

My window’s open, birds are chirping, and the sun is still beaming.

Not so gloomy after all.

If you enjoyed this piece, I’d appreciate it if you could share this with someone, it helps me grow this newsletter into an informative and educational powerhouse.