It's All Under Control...Right? (Inflation)

There are two main drivers of asset class returns - inflation and growth.

— Ray Dalio

Now, depending on what side of the political party you’re on the most recent CPI figure was either 8.5% or 0%.

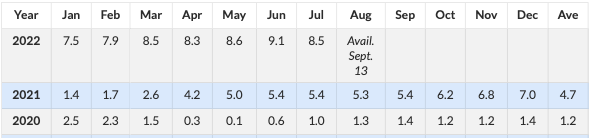

Let’s take a trip down memory lane; otherwise known as a period where inflation wasn’t north of 3%. We can see where it all started from, April ‘21 was the first reading where we saw a huge print relative to the previous decade of sub 3% inflation prints.

Now, this was the time period when the word “transitory” became a term widely used by members of the Fed (Jay Powell). As we know, CPI is a lagging indicator and also a measurement that is heavily manipulated by the BLS, due to them regularly swapping items within the “basket of goods” used to measure the MoM & YoY change of inflation.

What I want you to start thinking of, is how the current macro landscape will shape the upcoming inflation readings for September all the way till year-end both in the U.S and globally. And for us Brits, here in the Uk.

Questions such as;

How will the energy price cap hike in October affect the Eurozone and Uk CPI reading?

Where is inflation transitioning to? What sectors, services, goods etc?

How long until we see interest rates having a significant impact on demand?

What are the root drivers of this inflation?

These are the types of questions that will develop your ability to recognise trends in the macro world and begin creating somewhat of a narrative. Trust me, it’s a long game.

Back to the topic, inflation. After seeing what seems to be the peak in inflation we’ve now got risk assets booming as if we’re back to the golden ages in economic conditions.

Just take a look at Chart 2 to get an understanding of how financial conditions have materially loosened since the inflation print.

Looking at the previous week just further re-emphasises the fact that conditions are loosening when in actual fact, conditions should be getting tighter as the Federal Reserve hikes interest rates.

So if financial conditions are loosening that means we’ll be seeing credit spreads tightening, making credit widely accessible once again. Something you would not want if the economy is already overleveraged and inflation is at multi-decade highs. So leading on from my previous article you can now begin connecting the dots on how markets are disconnected from reality. A period many call Goldilocks within financial markets.

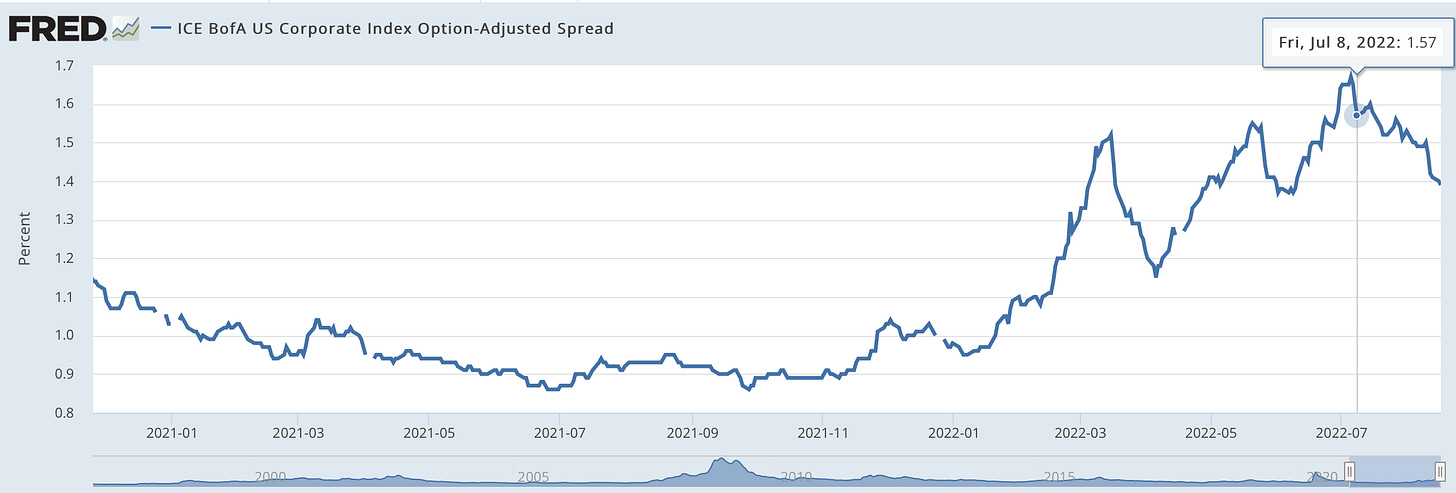

Chart 3 will bring to life this statement:

Now, the above chart calculates the spread between an index of all bonds in a given rating category and a spot Treasury curve. (Bonds rated BBB or better). You can see credit spreads peaked at the start of July and since then have been dwindling rapidly. The current tightening in credit spreads & sudden excitement within high-beta stocks (high risk relative to the S&P) just goes to show how markets are perceiving this to be the beginning of the end for high inflation. Is it?

In short, no. Far from it.

It’s pretty clear that the way we kill off inflation can only be through a recession; just to provide some context the manufacturing industry is always the first to get hit when a recession starts, along with housing.

And that is purely due to loans being so expensive and the cost of capital running high fees, all these factors make it difficult for a business to start new projects.

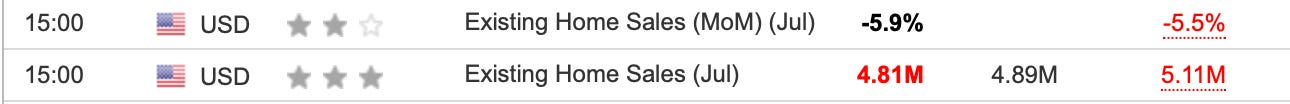

This prime lending rate is the average rate of interest charged on short-term loans by commercial banks to companies. This is what makes it harder to pursue and fund new projects, and moving onto the housing market yesterday we saw the sixth consecutive decline in existing home sales.

With mortgage rates in the U.S peaking at around 6% in the U.S you can imagine why home sales would be running such low figures.

Double Digit Inflation, Uk…

It would be completely wrong of me to disregard what we’ve seen this past week with inflation data from the Uk.

Does this 10.1% reading come as a surprise to me? Not at all.

If you recall my previous note on the “5 negative quarters” we’re expected to see here in the Uk you’ll remember the BoE’s prediction that inflation would reach as high as 13% this fall.

So let’s lay out the facts; we know exactly what is contributing/leading the inflation figure higher, we know CPI readings are only going to get worse as we enter winter and we know that the Bank of England is positioned to continue raising rates. It’s pretty much the same story in the Uk as it is elsewhere around the globe, see how high you can push rates before something breaks.

As of today, cable rates sit at 1.19, at the start of the year rates were around 1.37 which is a massive 18% depreciation in the pound, mainly due to sentiment and other factors such as interest rate differential when compared to the U.S. The first thing that comes to mind in these situations is a carry trade, between a low rate/yielding country and a higher rate/yielding country as that presents the best opportunity for this type of trade. With the pound, although the opportunity is there it wouldn’t be the strongest of trades for one to look at moving forward. As the inflation figure continues to rise and conditions materially weaken in the Uk we’ll see how the BoE position its stance on further rate hikes. If you ask me? We’ll see them slow down and cut rates sooner than what’s expected or been said.

Thank you for reading, for those who have been sharing thank you as well, we’re seeing an influx of new macro heads! As usual, share this with everyone & let me know what you want to see in the articles!

Until next time