It's All Red: Europe's Collapse

Uncovering the cost of free capital and Europe's weakening economic climate.

Hey crew,

I want to go straight into today’s report on the sensitivity of the European economy, recent PMI data and the risk of inflation resurging across the region.

Enjoy.

Goodbye Free Money

When an economy becomes reliant on easy monetary policy two things tend to happen when that phase is broken.

The private sector is forced to realise the large debt bubbles it accrued.

Risks within the financial system are brought to light and present imminent vulnerability to the stability of markets.

We have witnessed both significant events this year: a balance sheet recession in China and a series of failures among small lenders, including SVB and FRB.

In the FX market, the normalization of tighter monetary policy causes high-beta currencies, particularly emerging market (EM) currencies like the BRL (Brazillian Real), to struggle to attract capital flows.

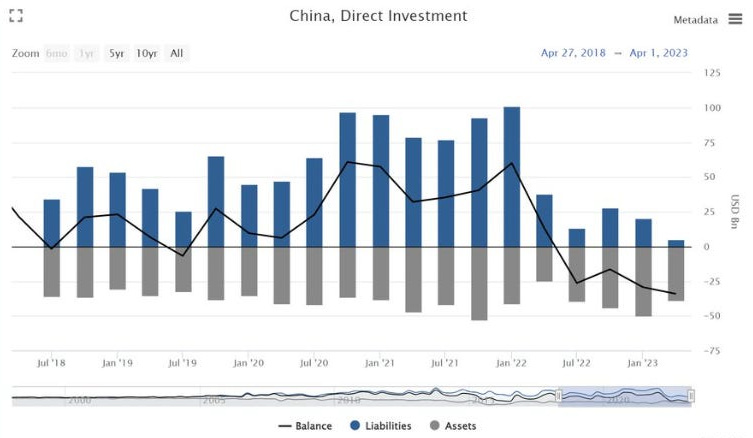

This is true for the other EM markets and currencies such as China. I explored this angle in my report yesterday as the nation recorded its first-ever FDI deficit.

To help you understand this chart clearly, the liabilities (blue bar) represent the total value of foreign direct investment China has received from foreign investors, and the assets (grey bar) represent the total value of Chinese direct investment abroad.

Many factors have contributed to the decline in FDI for China, to avoid repetition you can read more on the economic and structural reasons here:

The Trade Disconnect: US-China

Hey guys, Over the past few weeks, I found myself engaging in thought-provoking conversations with some of the brightest minds at industry events in asset management from the night at Schroders to the night at the Luxembourg Fund event and many others. There’s one common theme that seems to reappear when discussing major macro changes, the deglobalisation of China and its detachment from US trade.

Here’s another reason why EM IG & EM FX struggle to attract capital during policy normalisation. The majority of EM countries use dollar credit lines to finance nationwide operations, so an appreciating dollar decreases the availability of credit for EM entities, as large lenders flock to high-yielding treasuries, which practically speaking have no credit or default risk. The US can’t default on its own debt (in theory). I say that with a pinch of salt, recently we have seen the budget deficit in the US become an increasingly difficult topic around Congress. That’s a report I’ll have to save for another day, the point being with risk-free rates on treasuries retreating slightly from highs of 5%, taking on the additional risk simply isn’t worth it for investors.

Europe To Pivot First

Over the course of the past quarter, I have emphasised the importance of understanding the ‘transmission of interest rates’ and how each economy reacts differently to rate hikes due to the composition of its capital markets structure.

For the new readers, this simply means, that an economy such as the US appears to be relatively immune to the recent hikes, due to its duration structure on mortgage rates (private sector borrowing costs). Whereas countries like the UK, Australia, Germany, and the wider euro area all have greater sensitivity to interest rate changes since the average fixed term on private sector debt (household mortgages e.g) is between 2-10 years in most cases.

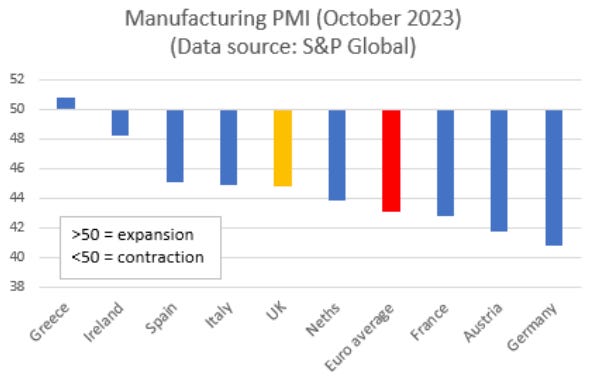

Earlier this week PMI data was released for the euro area and UK.

While Europe may not have experienced two consecutive quarters of negative GDP, which is the technical definition of a recession, the realization is that the European economy is already underwater. This is evident in the recent PMI releases, which have all consistently printed below 50, indicating a contraction in economic activity.

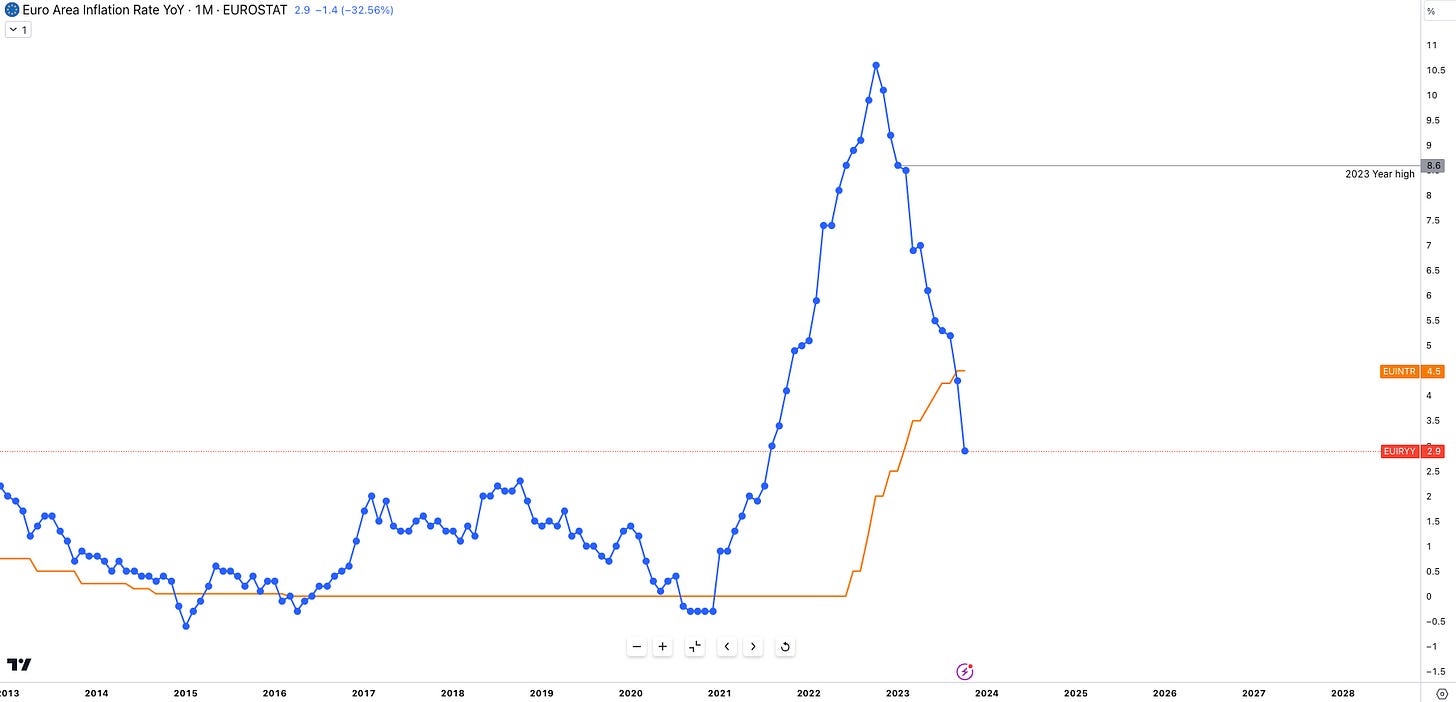

Despite the ongoing meltdown in the manufacturing sector, the ECB remains focused on inflation, which slowed to 2.9% YoY in October but remains elevated at 4.2% YoY for core inflation. President Lagarde made it clear at the FT global boardroom conference that the ECB will not be cutting rates over “the next couple of quarters”. Disregarding President Lagarde's comments, the market probability of an ECB rate cut as early as April 2024 stands at 75%, up from a 30% probability early in October.

It was only this year in September that real rates in Europe turned positive as the recent CPI prints have shown large MoM downticks compared to readings reported through Q2. The prospectus for growth within the euro area continues to diminish adding to the overall consensus of an ECB policy adjustment by H1 2024. I say H1 (first half), mainly because President Lagarde will want to stand by her statements of not cutting too early at the first sight of economic contraction but rather key policy conditions unchanged until the inflation story is a story of the past as energy markets still pose a risk to a second tail of inflation within both Europe and UK.

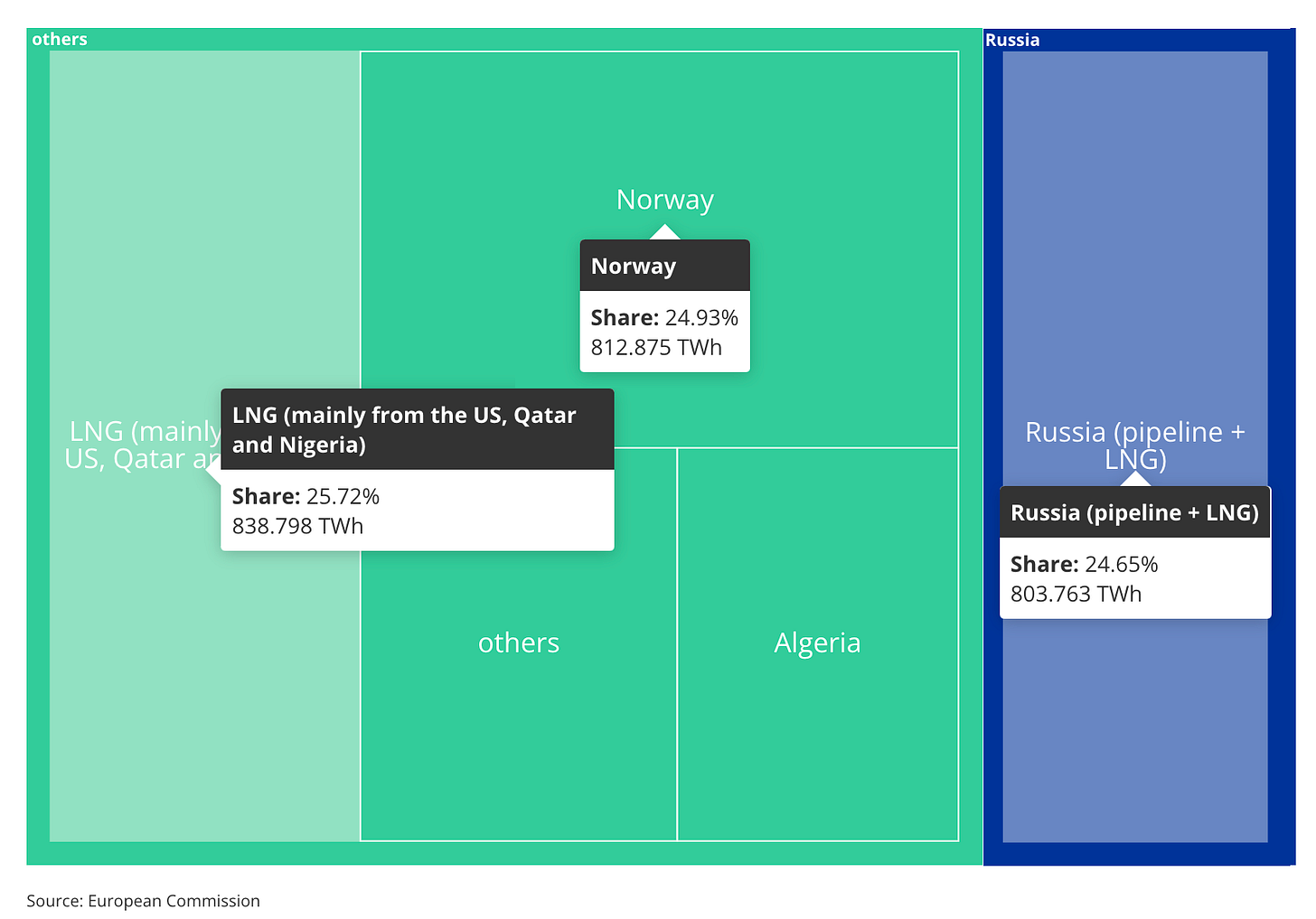

Energy markets remain Europe’s main exposure to importing inflation— the majority of its gas and LNG imports are imported from the US, Norway, Qatar, Russia and Nigeria.

So when looking at geopolitics any escalation in the Israel-Gaza war poses an imminent threat to Europe’s energy market, hence why the war is of utmost importance for the European government as it aims to help influence both counterparts towards a ceasefire and de-escalation of what has already been a costly war.

Right now we’re in the middle of a regime shift, from signalling the terminal rate to observing signs of reversal in its monetary policy tightening. Going forward I expect further continued weakness on the Euro reflecting the weakening picture of the European economy, something I’ll cover in another piece with you all, for now thanks for reading.