Is Everything Connected In Markets?

Pay attention to extreme sentiment, you could be approaching an inflection point. Too many bearish views on an economy can springboard an economy faster than if people’s views were more balanced.

As you may already know I love looking at the interconnections between different economies; the majority of the time it all starts with China.

I was listening to a podcast with Rebecca Patterson of Bridgewater earlier and she mentioned something that I have kept in mind, covering 2nd order thinking in global macro/investing. Something as simple as understanding how China drives global synchronised growth. E.g, a slowdown in China’s services sector can affect the future ISM readings for the U.S connecting directly to S&P 500 earnings/performance. Now, this isn’t 100% like anything in markets, but a strong trend can be sighted with positive data coming from China and positive data prints over in the U.S and the wider global economy.

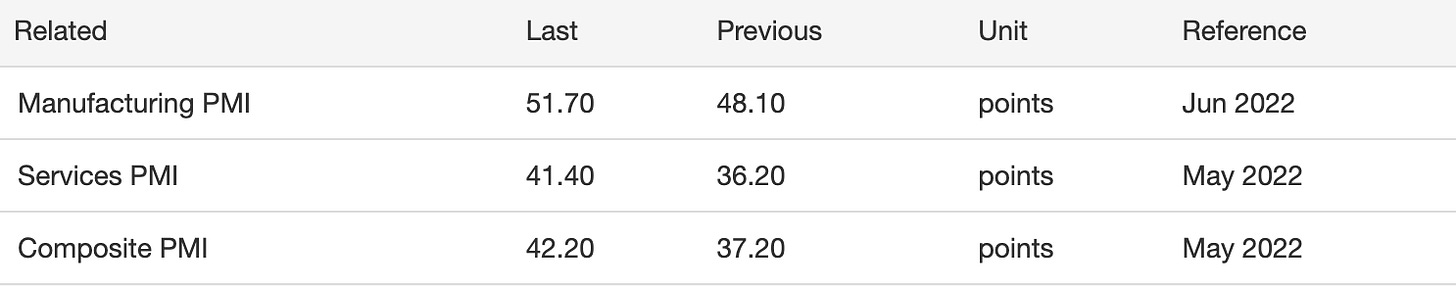

Take a look at the data below:

I’ve chosen to specifically look into China’s services PMI release as the services sector accounts for 53% of total GDP in China; showing the importance of this one reading. April was the lowest reading we have seen since 2020 Covid levels where services data dropped to as low as 26. Many factors contributed to this reading, including China enforcing a zero covid rule which put halt to many parts of the economy that would contribute to the services sector. Now let’s take a look at the U.S new orders reading.

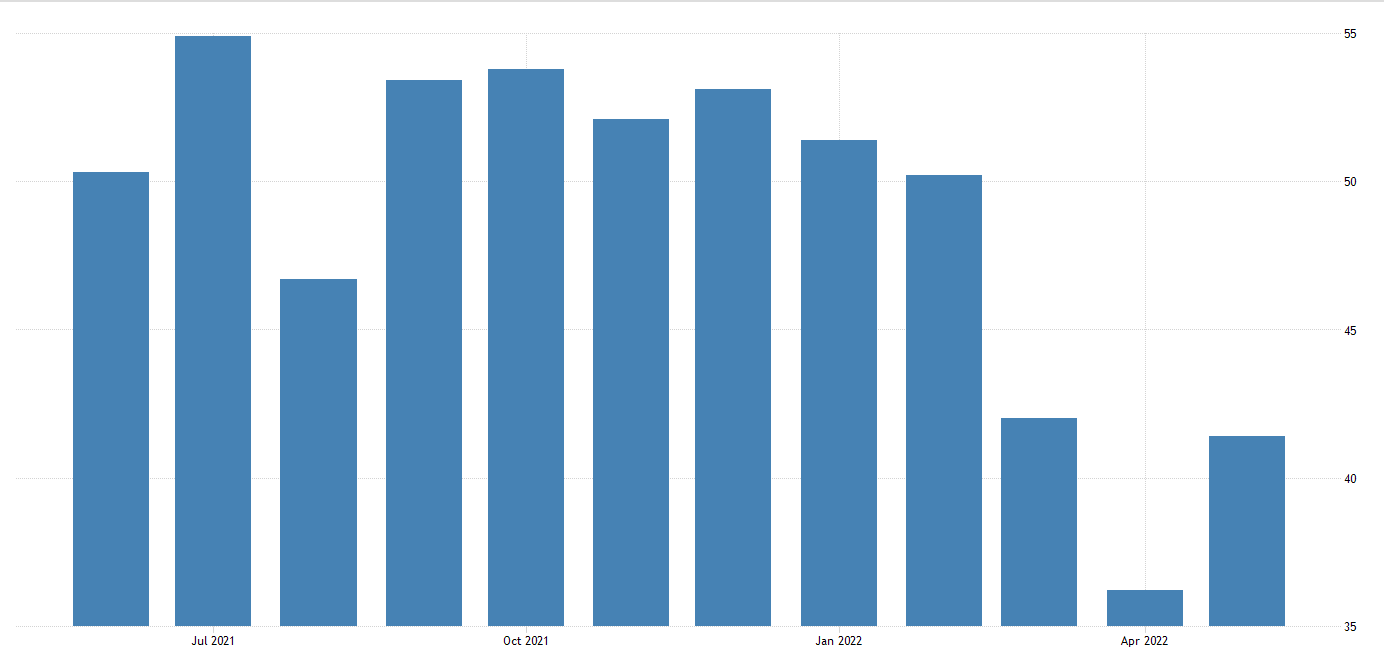

For the first time in 2 years, we’ve seen a contraction in new orders in the U.S. Now, with this particular reading, I would argue it shows how higher interest rates are destroying demand already. A reading above 50 is considered an expansion, and a reading below 50 is considered a contraction. Since the beginning of the year when inflation was floating around 5.5%, tightening in financial conditions was quickly becoming the topic of policymakers. Fast forward to inflation touching 8% and the Federal Reserve hiking a few times we can see how new orders have slowly diminished after holding on around April.

Implementing Rebecca’s 2nd order thinking mind frame; the next question on your mind should be:

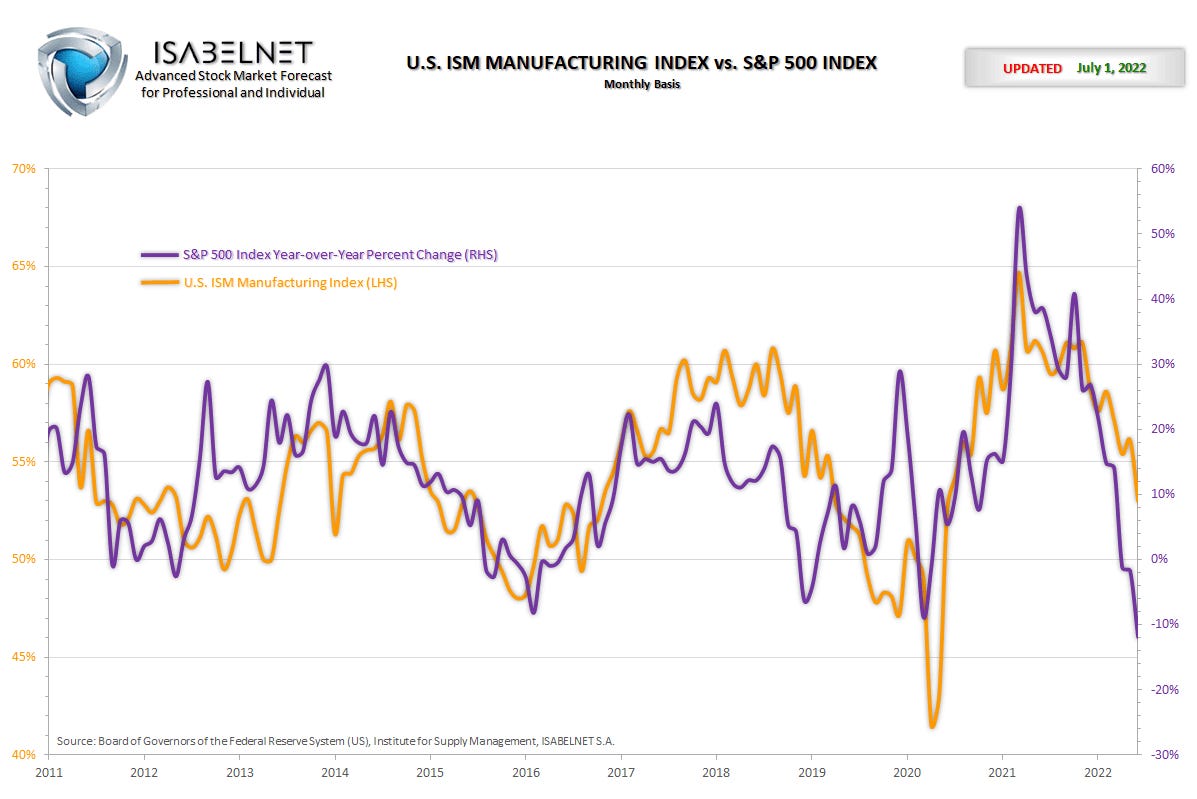

What does this mean for asset markets, particularly the S&P?

Needless to say, you can see the almost perfect correlation between the two. So when you hear ISM readings painting a cloudy picture think about how this trickles into this index.

Over the past two years, we have seen how equities and the price of bitcoin/cryptocurrencies have been a risk-on play both producing outsized returns for investors. However, this was all on free-easy access cash; so the demise in equities would only be amplified in the crypto market being the lack of quantifiable value, something investors would argue.

A few questions to arise within your mind when hearing about slowdowns/supply constraints in China:

If we can’t ship from Chinese ports where do we ship from?

How will this factor into the policy response today?

How does a slowdown in China affect producers, commodities and inflation worldwide?

Hopefully, you’re already understanding how this works when understanding the implications of global events. Russia-Ukraine plays a massive part in the current turbulence we’re experiencing in markets; and for markets to really start recovering and showing signs of strength investors need to see inflation coming under control, clarity with rate decisions/ a slowdown with hikes in further meeting and lastly peace in Ukraine. Without anyone of these pieces, the puzzle will remain distorted as markets are; moving into the fall season and winter Russia'-Ukraine tensions will play directly into one of the problems mentioned above. Inflation.

If Russia decides to restrict natural gas to the EU and other countries what does that mean for inflation? You guessed it, acceleration. Then we have OPEC and the U.S going back and forth on the number of oil barrels to be delivered only causing upward pressure on the price of crude oil/commodities. Add in a mix of supply restrains in China and this is one big mess.

The point is, when looking at data coming across your screen, try to think beyond the reading and see what could be unveiling itself.

I’ll be back this week with another piece; as usual, thanks for reading through!

Always feel free to let me know your thoughts on these posts; it’s useful for us all

Until next time