Inflation...Here To Stay?

The best traders are intensively competitive, smart risk taking and exceptional decision makers

The ECB’s Commitment To Stop Inflation

As we have heard over the quarter, the ECB has initiated rate hike talks with expectations priced in for the following meeting in July to be the start. Now let’s look at FX rates.

From recent highs, euro-dollar is down 3%; now you might be thinking why is that the case? Wasn’t the ECB fairly hawkish in their meeting?

In short, yes, initially they made hawkish statements. However, a lack of clarity always finds a way to settle into markets. Now if you recall the ECB stated that if things turn really sour they will step back into the European bund market. So that was the loophole for uncertainty. If you ask me, there’s a clear disfunction between what the markets believe and what message the ECB is delivering. As it stands there is no guidance on where we can expect the terminal rate to be for the ECB… Is it 2%, 3%? We’re all playing a guessing game and the markets are showing that. Eurodollar FX rates are down 3% over the week, Euro bund spreads are widening across all maturities, yield curves are flattening and European banks are down 7% for the prior week.

Now, just in case you’re not clued up on the basics of what shape yield curves should be, let me break that down. A normal yield curve should have a nice upward slope, longer-term yields should be higher than shorter-term yields and I’ll explain why. A nice positive upward slope means that you are paying a higher rate to borrow money for a longer period of time than for a shorter period of time. So when you hear of a yield curve flattening, this means that you are paying the same amount to borrow money for one year as you would for 5 or 10 years depending on the curve.

A positive upward slope is a sign of a healthy market, anything else isn’t. I merely keep a top-level understanding of information like this to help paint a better picture. I’m still composing a piece on breaking down the bond market, particularly the importance of US10ys; that’ll be done soon.

Jay Powell And The Fed…What To Expect

This feels like a movie sequel that I’ve been waiting months for. I know we all saw the CPI print released on Friday. For many analysts, the print of 8.3% was meant to be the “peak” of inflation. Clearly not.

With this chart above in mind take a look at what has contributed to the massive beat in the inflation print. Energy, energy and energy. That’s where the U.S consumer is losing the majority of their spending power, this is also true for us in the UK.

Whilst there’s super hot inflation in the U.S, China’s CPI reading stalled at 2.1% YoY for May. The struggles in China are growth-related due to its strict no Covid policy, so turning the production cycle back on is an evergoing question of when will that happen.

So, we’re expected to see a 50bps hike by the Fed this Wednesday to take rates into the 1.5%-2.0% range. This has been telegraphed by markets as equities and bonds took a massacre last week.

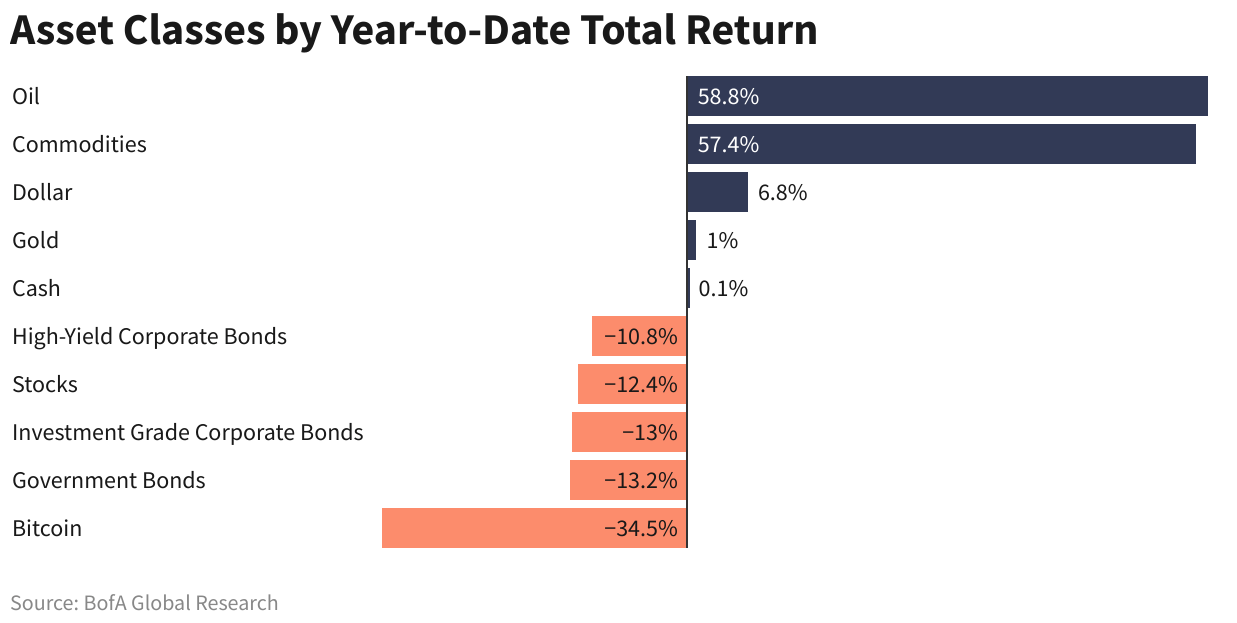

If one was to look at the above chart the clear trade would be precious metals/commodities. Although there have been talks about the relative discount perceived in individual equities, the larger picture for normalisation in equity valuations and readings looms over the optimism.

I’ll check in by the end of the action-packed week for some insights.

Don’t forget the BoE and BoJ have their interest rate decision later this week. Remember the importance of the BoJ for U.S treasuries but also global markets!

Catch you soon