Impending Elections, Europe's Competitiveness Decline, and the Role of FX Swaps

An Insight Into the Current Economic Climate and the Role of FX Swaps

Happy Sunday MMH readers!

If there’s one thing I’d recommend, it would be to focus on the tail-risks of your investments running up to the US presidential election.

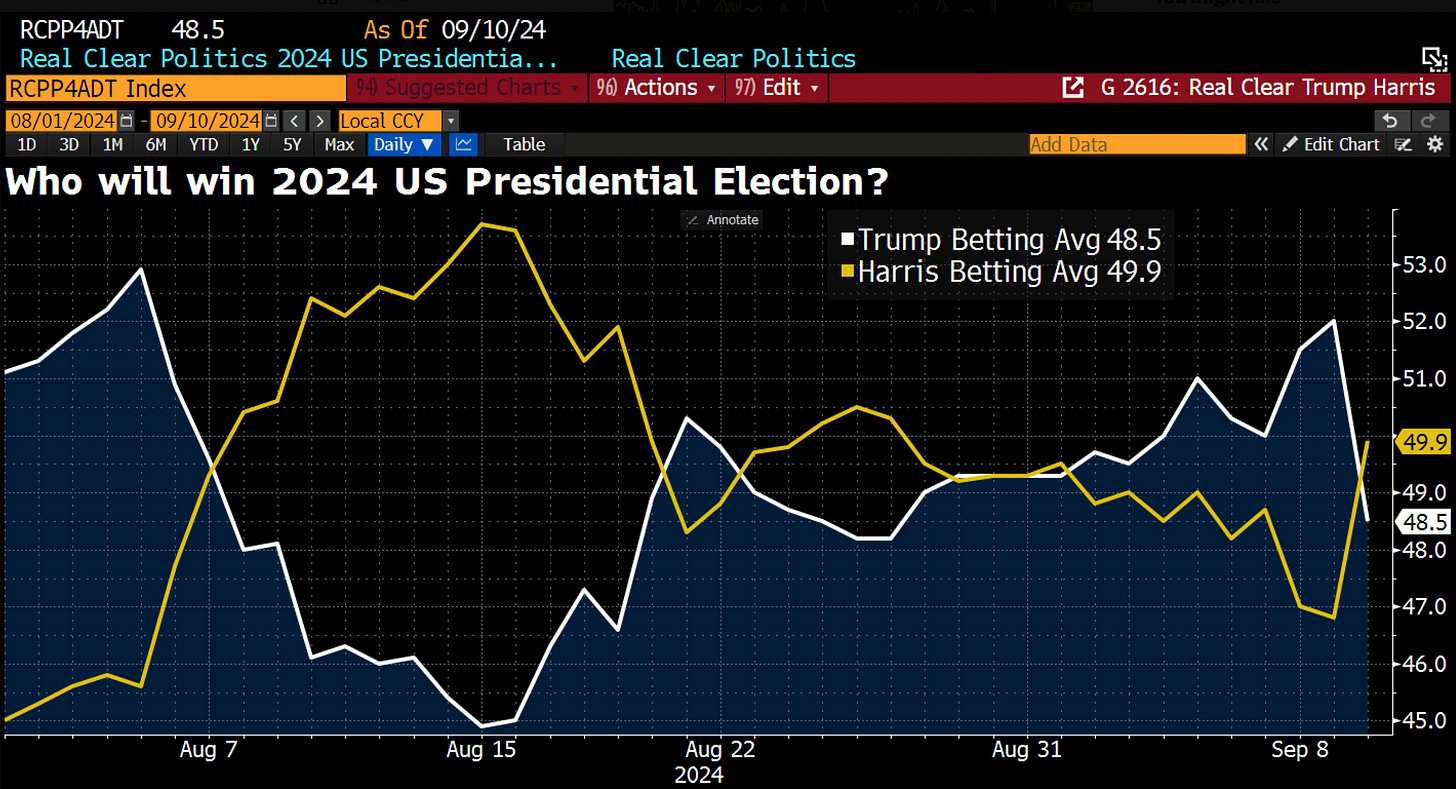

The elections are closing in, predictions are volatile but are now tilting in favour of Kamala Harris.

This means one thing, risk in financial markets. Opportunities looming.

The role of FX swaps isn’t covered enough, so let me dive into that!

Macro watch

Donald Trump and Kamala Harris debated on Tuesday at the National Constitution Center in Philadelphia. The pair clashed over the economy, immigration, foreign policy and abortion. Trump failed to commit to taking part in another debate, while the Democrats indicated Harris would be willing to.

The election predictions after the debate titled in favour of Harris winning presidency, taking the top spot from Trump, who led the race going into Tuesday.

Last week, Donald Trump threatened to impose a 100% tariff on countries that conduct business in currency other than the US Dollar, adding a new pillar to his tariff platform. Trump, who has long embraced protectionist trade policies, said the Dollar has been “under major siege” for 8 years. China, India, Brazil, Russia, and South Africa discussed de-dollarisation at a summit last year. By contrast, Trump has said he wants the Dollar to remain the world’s reserve currency, a pledge he renewed at last Saturday’s rally. While Dollar dominance has lessened in recent decades, the US currency still accounted for 59% of official FX reserves in Q1 2024, with the Euro 2nd at almost 20%.

I personally will not take too much notice of these election predictions just yet. Firstly, Trump and Harris are running so closely to each other in the predictions market that just a few bps change in poll votes changes the new party elected, however, if there was someone winning by a landslide right now then it’d be easier to rely on. Secondly, there will now be more emphasis on elections as we come into the last weeks of the race, meaning that just one comment can change the whole dynamics of the presidential election. Even Taylor Swift is causing tail-risk to Trump…

The US isn’t the only place investors are looking for opportunity in, the Euro is gaining some spotlight.

Mario Draghi, who is an Italian economist, banker, and politician and has played a key role in shaping Europe's economic policies, has made a call for joint EU bonds, which has hit a wall of opposition, irrespective of warning that it’s the only way to make EU more competitive with China & the US.

The resistance to Draghi’s call for the region to invest as much as €800 billion extra per year and commit to regularly issue common bonds prolongs a history of stalemate between rival ambitions. When you compare the large contrast in debt to GDP between each eurozone economy, the theory wouldn’t work because Germany would be paying the cost of the weak Eurozone economies and it doesn't makes sense for Germans to keep paying for everyone in the name of EU solidarity.

Market mover

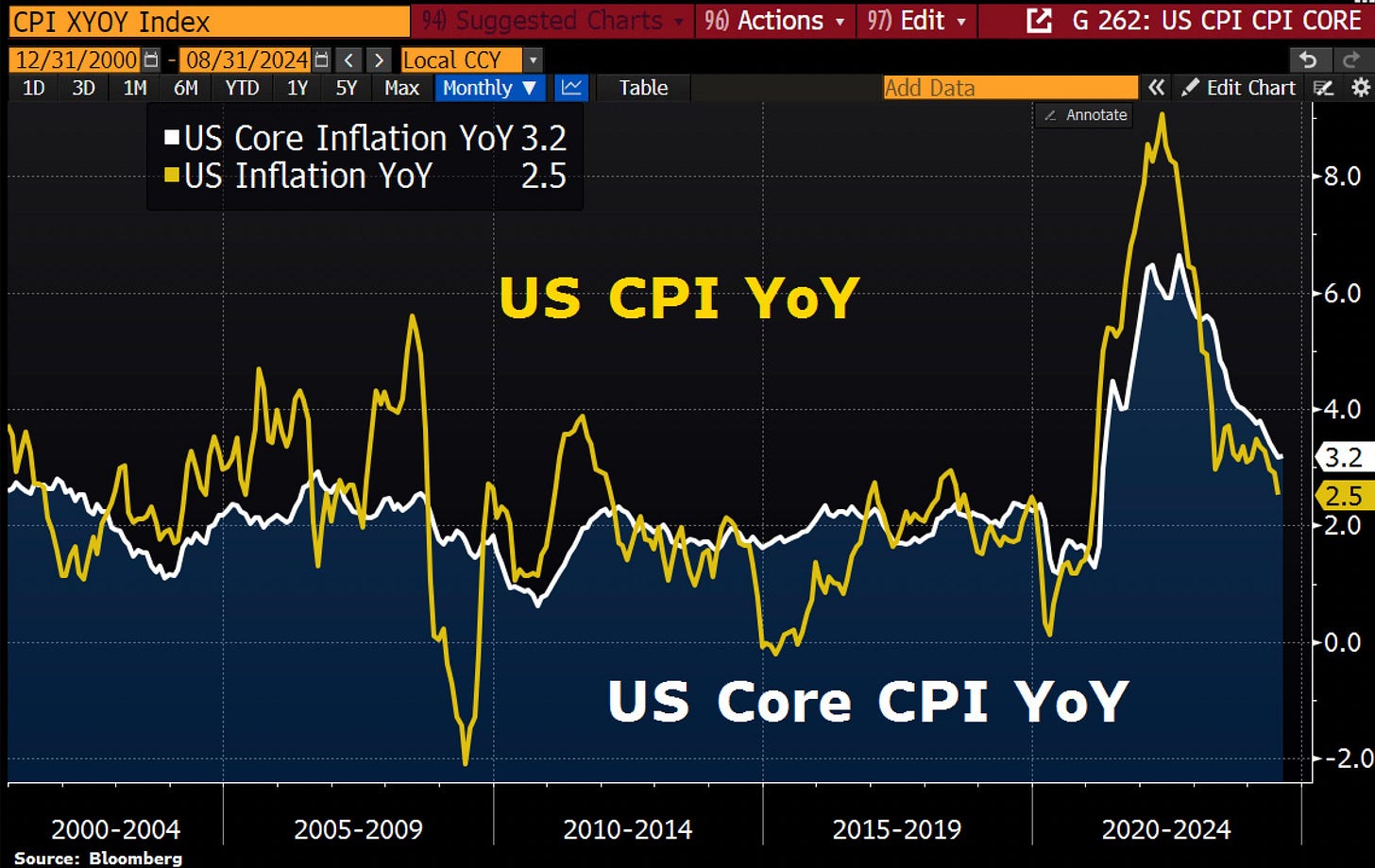

Investors have dialled back their expectations for a 50bps Fed cut next week after a somewhat hot CPI report. Overall CPI slowed to 2.5% in August YoY from 2.9% in July, Core CPI remained unchanged at 3.2% YoY as expected, but Core CPI rose 0.3% MoM vs 0.2% expected. There was good reason for both 25bps and 50bps prior to the reading, however, the inflation report on Wednesday seems to have solidified a 25bps cut.

Used cars and trucks component in CPI remained in deflation territory as of August at -10.4% YoY, while at the opposite end, owners’ equivalent rent portion of CPI (YoY) ticked up from 5.3% to 5.4% as of August. In other inflation readings, supercore CPI (inflation excluding goods, energy and housing) rose to 4.46% YoY, meaning the disinflationary trend is also present there.

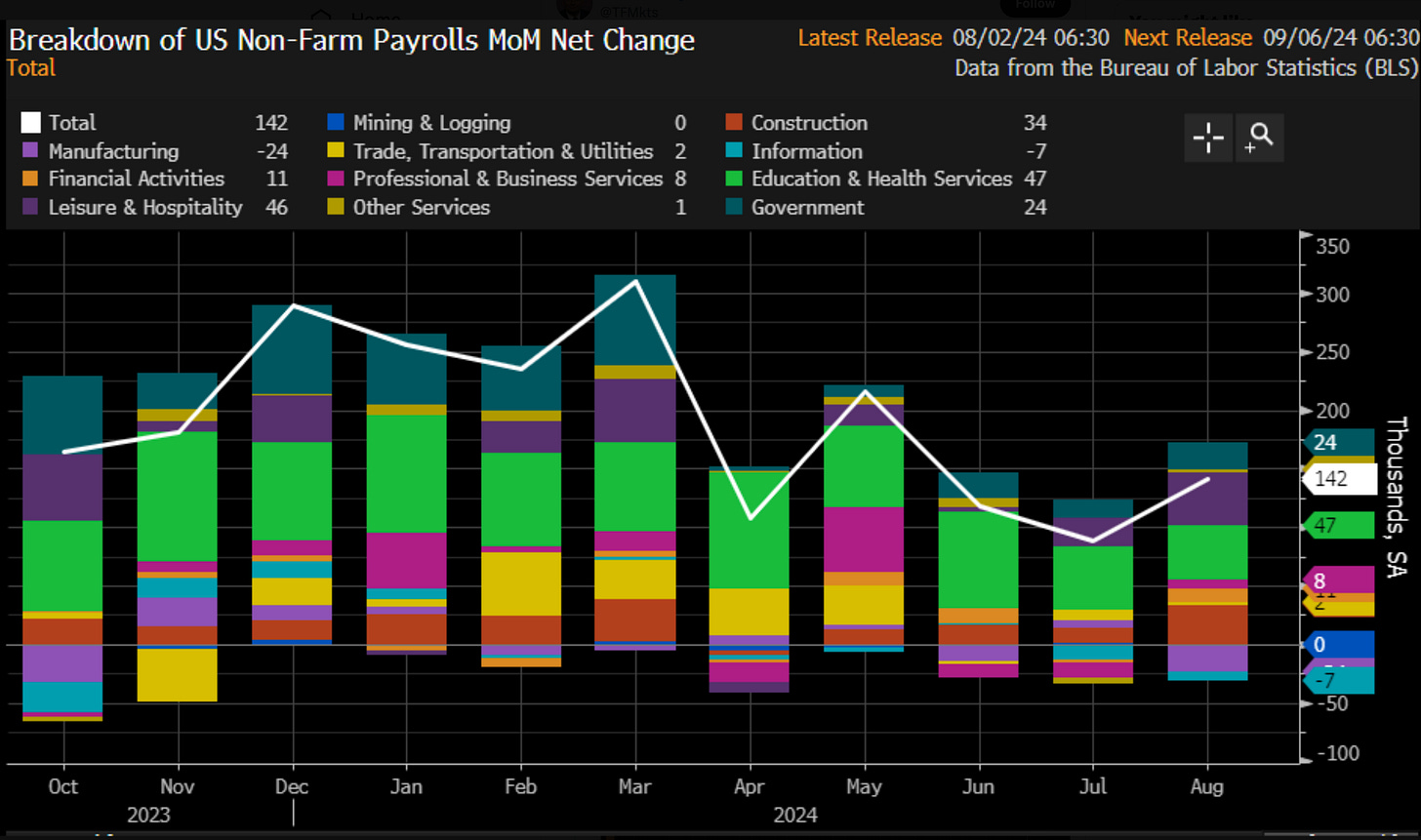

To add to the case for just a 25bps cut over a 50bps cut next week, last Friday’s data supported the fact that the labor market is softening but not enough to warrant a significant cut, with NFP nearly double the previous reading at (89K prev, 142K now).

Personally, I don’t believe NFP was the reason that just a 25bps cut was solidified, I was more focused on that average earnings MoM, which doubled to 0.4%. The figure is not anything to be extremely worried for the Fed but is enough to relax off of a larger cut (50bps), in my opinion.

The shift back and forth in rate cut expectations has seen the Dollar index consolidate since last Friday and will most likely continue to until the FOMC meeting next week. For the moment, monetary policy expectations are driving most US markets, however, I can see market dynamics shifting as the presidential election comes closer. The reason I’ve emphasised this is because data that would typically cause larger moves may see a more muted effect due to elections keeping a lid on them, or the opposite way round, where elections fuel the move further.

The role of FX swaps

FX swaps are financial tools utilised by institutions like banks, corporations, or governments to mitigate currency risk or secure short-term funding in a foreign currency. In these transactions, two parties exchange currencies and agree to reverse the exchange at a later date, with predetermined rates for both the initial and future transactions.

The two parts of the transactions are:

Spot leg - The first part of the FX swap involves the immediate exchange of two currencies at the current spot exchange rate.

Forward leg - The second part of the FX swap where the two parties agree to reverse the exchange at a specific future date, at a pre-agreed forward rate. This rate is based on interest rate differentials between the two currencies.

The forward rate is influenced by the interest rate differential between the two currencies. The party holding the currency with the higher interest rate usually earns a premium in the forward exchange, reflecting the interest difference accumulated over the swap's term.

For central banks, the liquidity could be to support domestic banks during periods of financial instability, preventing liquidity shortages that could disrupt the banking system. FX swaps involve the exchange of cash collateral, making them a lower-risk tool for managing currency exposure.

Great examples of the use of FX swaps would be during the 2008 financial crisis and the 2020 COVID-19 pandemic, the US Federal Reserve set up FX swap lines with central banks around the world. These swaps allowed the Fed to lend US dollars to foreign central banks, which then provided those dollars to their own domestic banks. This alleviated global dollar shortages and helped stabilise the international financial system.

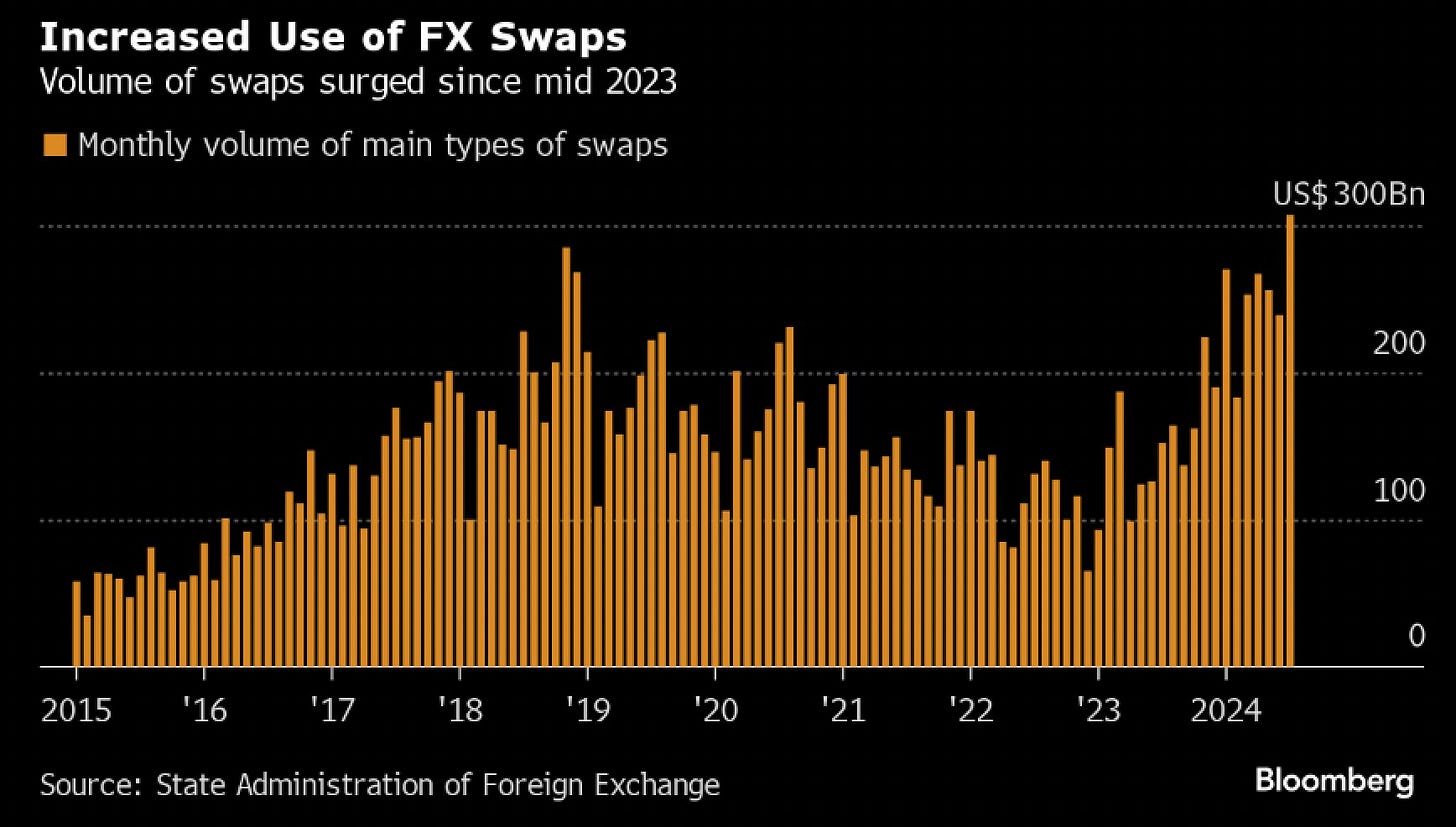

Recent use of FX swaps by a central bank have come into the spotlight, isn’t that right, China?

Chinese banks have amassed a $100 billion short position against the US Dollar to support the Yuan, and hedge funds are eager to join the trade. At the heart of this strategy is FX swaps, which have become a crucial tool for China's state-owned banks to stabilise the Yuan during times of significant selling pressure.

The idea to support the Yuan due to domestic economic concerns makes sense, but may not be a great one. The positive effects are that the supply of Yuan will decline so naturally the supply-demand effect should pull the currency higher, stabilising and strengthening it in a time of selling pressure. Although FX swaps provide temporary relief to the currency, it can’t mask the true issues China is facing like slow growth and capital outflows. By using FX swaps, the central banks avoid having to sell their foreign reserves and instead manages these reserves more efficiently.

FX swaps send a signal to the market that the central bank is willing to intervene to support the currency which will provide short term confidence, however, it doesn’t mask the true problems that China is facing as mentioned above. When there is instability in a currency, like this example in the Chinese Yuan, hedge funds could take advantage of a potential downturn in the currency eventually because there is only so much that FX swaps can do to really prop up the currency. There is little evidence to say that that FX swaps can provide a long-term solution to a currencies depreciation, meaning the use of swaps here may just be a great opportunity to sell the Yuan at a premium.

To execute these FX swaps, central banks need to engage in money market operations, which could loosen domestic liquidity in this case and push down short-term interest rates. The reason short-term rates can be affected is because engaging in FX swaps means there will be excess inflows of local currency into circulation because the central bank needs to provide US dollars to obtain their local currency (Yuan). So, when there is excess liquidity in markets, money supply is higher and short term interest rates can be pushed lower.

But what are the risks?

There is increased risk in off-balance-sheet liabilities, which may not make clear the true nature of the country’s foreign exchange risk. So, if the `Yuan starts seeing a large sell-off despite these FX swaps, there is risk of a systemic risk and currency crisis.

FX swaps is a large topic, I hope I summarised the main parts as digestible as possible!

That’s a wrap for this week… Until the next.

Thank you Alfie.