How Aggressive Will The Fed Have To Get?

“Whomsoever controls the volume of money in any country is absolute master of all industry and commerce and when you realize that the entire system is very easily controlled, one way or another, by a few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” ― James A Garfield

One Long Inflation Nightmare

Last week Thursday was a colourful day, to say the least in markets. Inflation readings for the U.S came out at 9.1%, multidecade highs; but what really stole the show was the Bank of Canada. A surprise 100bps hike came out of the Canadian central bank which rocked FX markets, particularly CAD crosses. The reasoning behind that, well I’m sure you can imagine…kill off their 7.7% inflation figure.

With the 9.1% print for June’s inflation, markets are repricing their expectations for the next Fed hike.

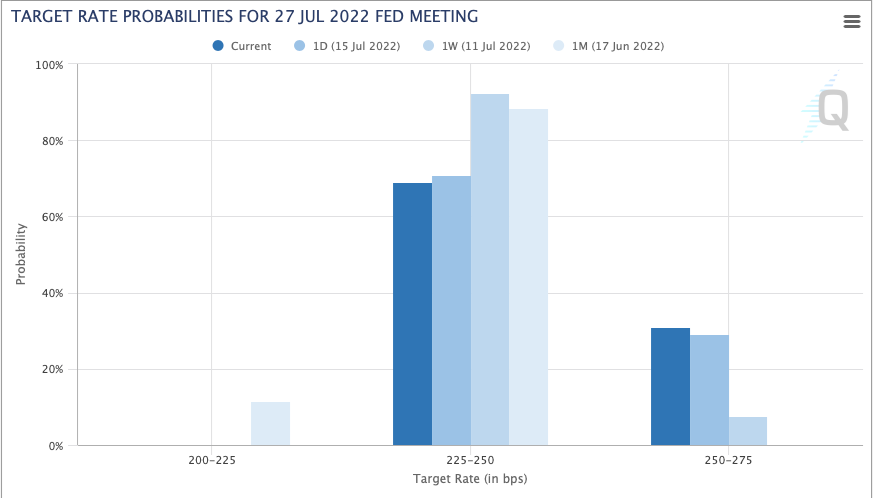

Just take a look at the image below.

Prior to the June inflation print, expectations that the Fed would hike into the 225-250bps range were >90%, after we got the reading notice how expectations have pivoted to now ruling in a 100bps hike from the Fed which was unlikely with <12% probability just a month ago.

So to answer the question; “How aggressive will the Fed have to get”. The answer the market is giving us is very aggressive; to a certain degree, I also agree the Fed will really have to tighten to its target rate of 3.4% before we see any real decline in inflation readings.

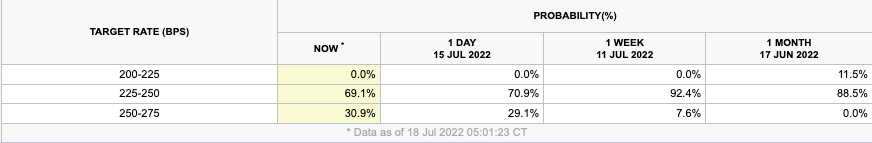

The bond market also agrees, with inversions across the 2s & 10s sighted once again.

So on the long end of the yield curve, this hiking cycle is flattening yield curves. If you’re thinking why is this bad, let me quickly explain.

If you were tomorrow to take out a loan from the bank to purchase a home (mortgage) over a 30year period with a rate of 4.00% (current mortgage rates in the U.S), and John was to take a loan out for 5 years with a similar rate of 4% that essentially means you are paying the same to borrow money for 5 years as you would for 30 years when the term/rate for 5 years should be less than the term for 30 years since there is more risk/exposure to rate changes or another inflation scare so one has to account for the added risk.

Markets clearly are expecting a steep period of tightening followed by easing where rates will be close to 3% in the long run.

All this hiking must be doing something to the dollar right?

That’s correct.

Now, remember, everything is interlocked from FX to Bonds/Credit, to Equities and even commodities. We’ll look into the finer detail of what a strong dollar means for corporate earnings.

Let’s rewind back to 2014; AAPL’s 10k filing (Apple) mentioned the below:

“A stronger dollar generally results in the company being forced to raise it’s prices overseas with the potential result of reducing demand as buyers balk at paying more for the same thing.”

A strong dollar hurts corporations’ earnings ability as a strengthening dollar cuts into their bottom line as exchange rates are no longer favourable for healthy margins. So businesses are faced with a trade-off, allow the exchange rates to eat into their bottom lines or hike prices to offset the currency exposure.

In the case of Apple, the strengthening dollar caused them to raise prices in 2015 across stores ranging from Australia, Canada, France, New Zealand and other EU-based countries. So looking forward as we always do, corporate earnings will become less attractive as we see the full effect of a bullish dollar.

Generating Alpha

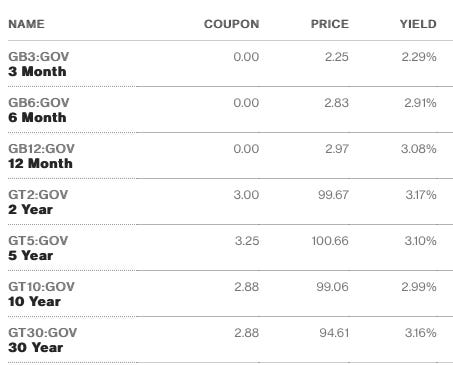

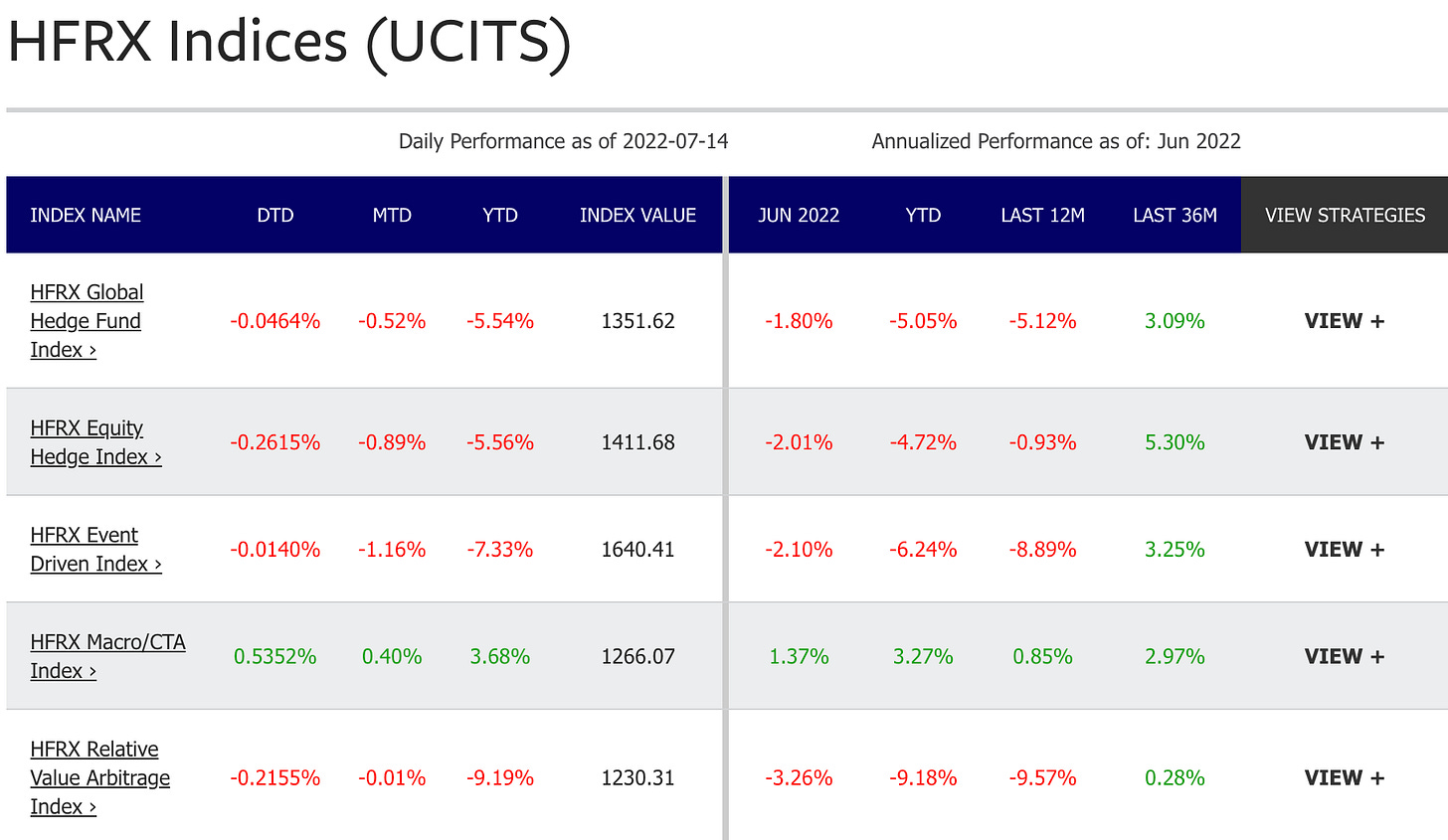

Now for the most part, and by most, I mean a large majority of institutions and retail traders these conditions have proven to be difficult to trade/maintain positive real returns. This also applies to the hedge fund industry.

You can see here that the major strategies applied by hedge funds haven’t played out as they would have liked or even forecasted to investors. One umbrella strategy seems to be doing well which is Macro & CTA. So not a bad time to be learning macro at all I’d say…

In all seriousness, we’re experiencing market conditions that haven’t yet been experienced when combining all the global events occurring at once.

Be wise with positioning and leverage in conditions such as these.

Thanks for reading once again! Always appreciated

Until next time