High Yields, Low Faith: Where’s the Trade?

Finding Alpha in the Anxiety: Yields High, Hope Low

Hey guys,

It’s crucial to continue the momentum when achieving small wins.

Many go off track and get complacent, but then the rocket runs out of fuel for take off.

Keep your work rate high, stay efficient and keep that momentum going.

We’ve had somewhat of a calm market across the last week, at least compared to previous weeks.

Read until the end where I speak on my positioning, you need the report to understand why!

Let’s unpack what’s happened!

High Yields, Low Faith

There was much talk on Moody’s downgrade of US sovereign credit rating from its highest level of Aaa to Aa1, citing the decision down to the nation’s growing $36 trillion debt.

This downgrade marks the first time Moody's has lowered the US credit rating since it began rating the country in 1917. The agency highlighted that successive US administrations and Congress have failed to implement measures to reverse the trend of large annual fiscal deficits and increasing interest payments. Moody's now projects that federal debt will rise to approximately 134% of GDP by 2035, up from 98% in 2024.

This left a lot of anticipation surrounding major moves on Monday, yet we failed to see that. We have already seen triple selling of the US (dollar, equities and bonds) so the loss in confidence was largely priced in, Moody’s rating was just affirming the markets opinion.

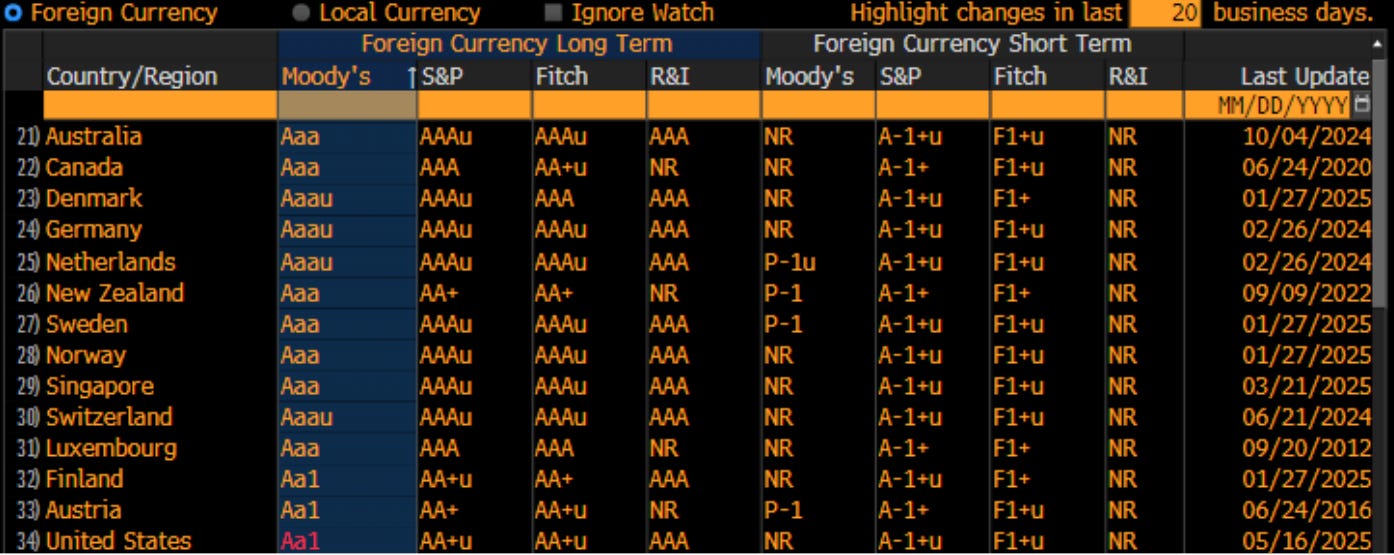

The table below shows where that leaves US credit rating vs RoW, it’s not pretty sitting at 34th.

Ok, but does this and will this have any impact on policy consideirng the decision was driven by debt?

Well it’s hard to not talk about the 30Y which exceeded a 5% yield earlier this week, it seems like the US fiscal policy has always be ignorant of debt, it doesn’t exist to them?!

The yield on the 30Y was actually the highest since November 2023, in a time where policies are meant to be easing and yields are meant to be crawling down, but no one wants US debt! Banks love a steeper yield curve and we should expect private credit creation to thrive as a consequence.

There could be pressure to tame the aggressive easing in fiscal policy but knowing how Trump and his party work, likely not. This downgrade in rating leads to almost no change in policy (in my opinion) and will likely be forgotten about in the coming weeks.

My opinion is backed up by the “Big Beautiful Bill” which is set to add $3.8 trillion to national debt over a decade and was narrowly passed by a single vote (215-214).

What’s another $3.8 trillion, right?

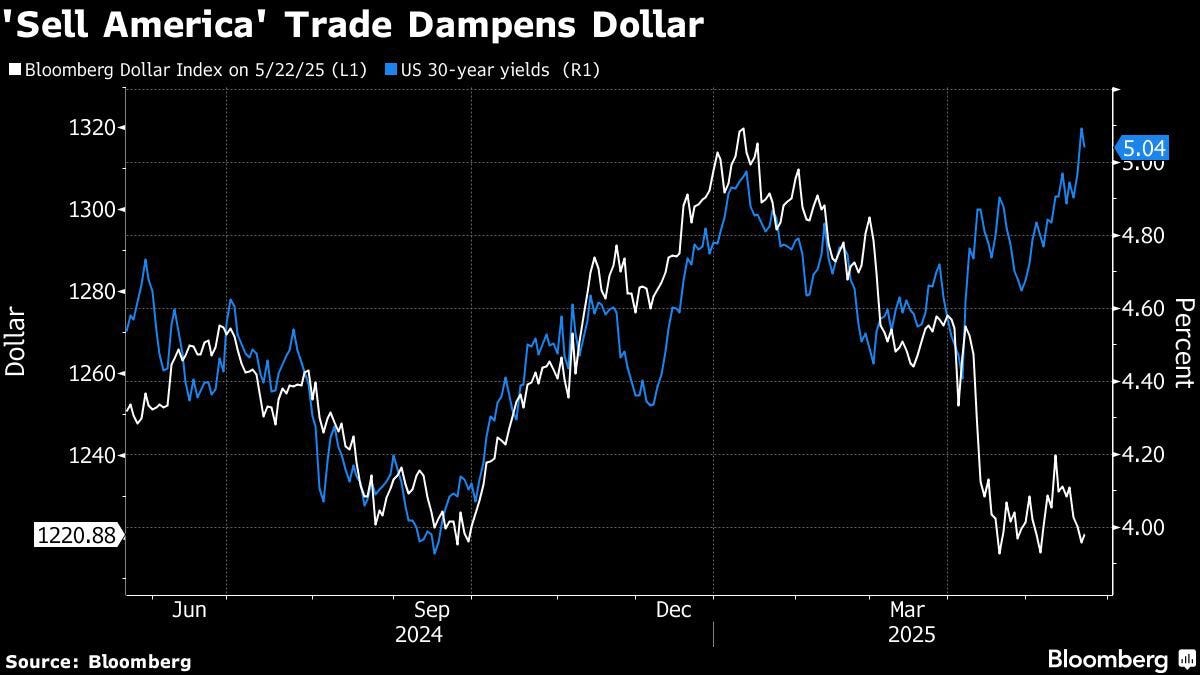

This tax bill is weighing on dollar sentient, if there was anything more that could’ve sparked fear in the US it was this. The trend between Treasury yields and the dollar continues to diverge:

The large cost of the tax cuts comes from some of the below (this lost is not them all, just the main ones):

Tips & overtime pay = Tax-free

Social security benefits = Tax-free

Extends Trump’s 2017 tax cuts (which were set to expire after 2025)

Standard deduction increases = From $1k for individuals to $16k

There was a report last week from Reuters that the ECB asked banks to stress test their USD funding needs amid concerns the Federal reserve could restrict access to emergency USD swap lines, uh oh…

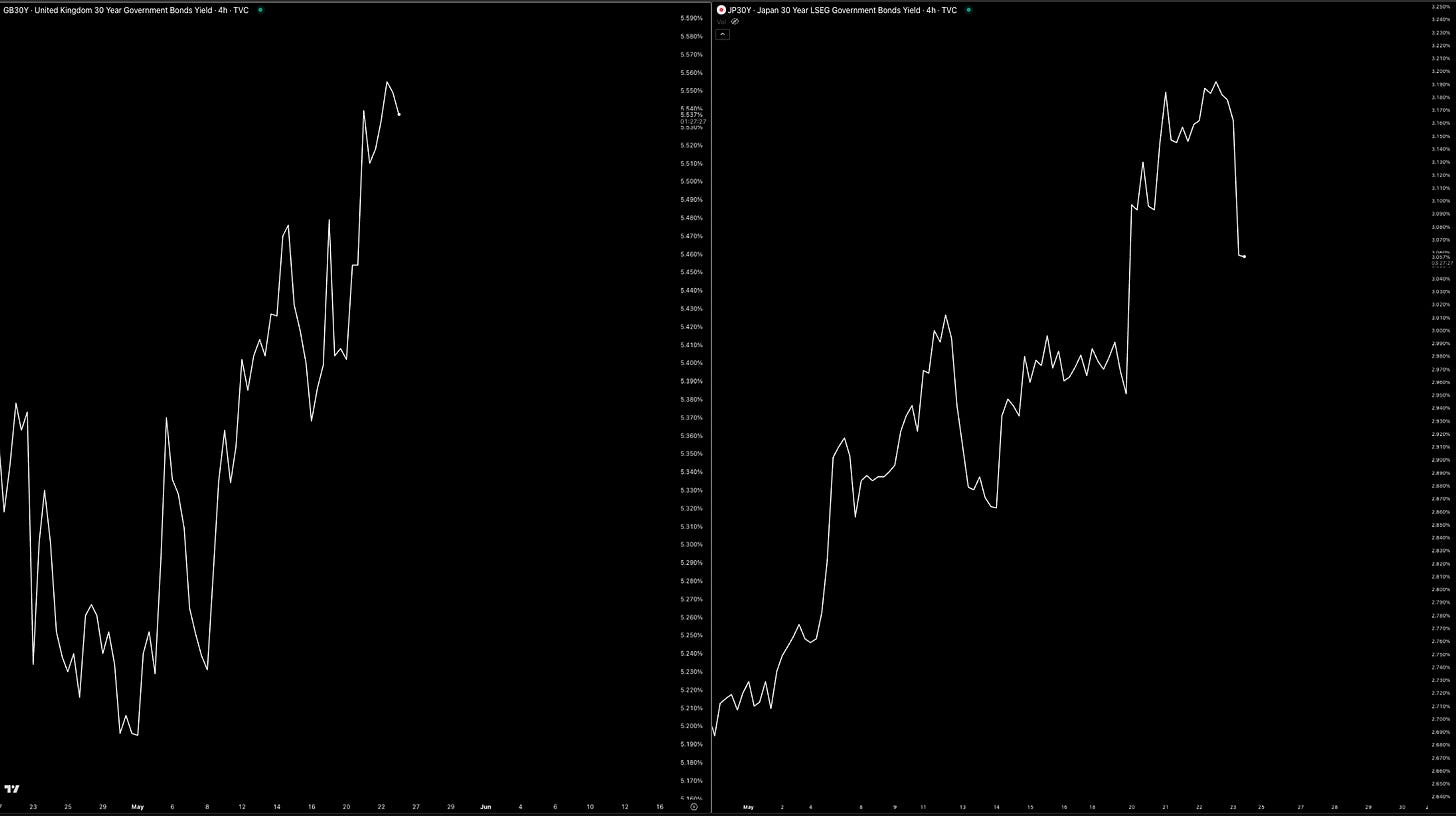

The US aren’t the only nation seeing their 30Y at extreme levels, Japan and the UK joined the group. The UK 30-year yield is at c.5.5% while Japan’s 30-year yield created an all time high at 3.1%. So, why is everyone focused on the US’ high Treasury yield but not the UK’s or Japan’s?

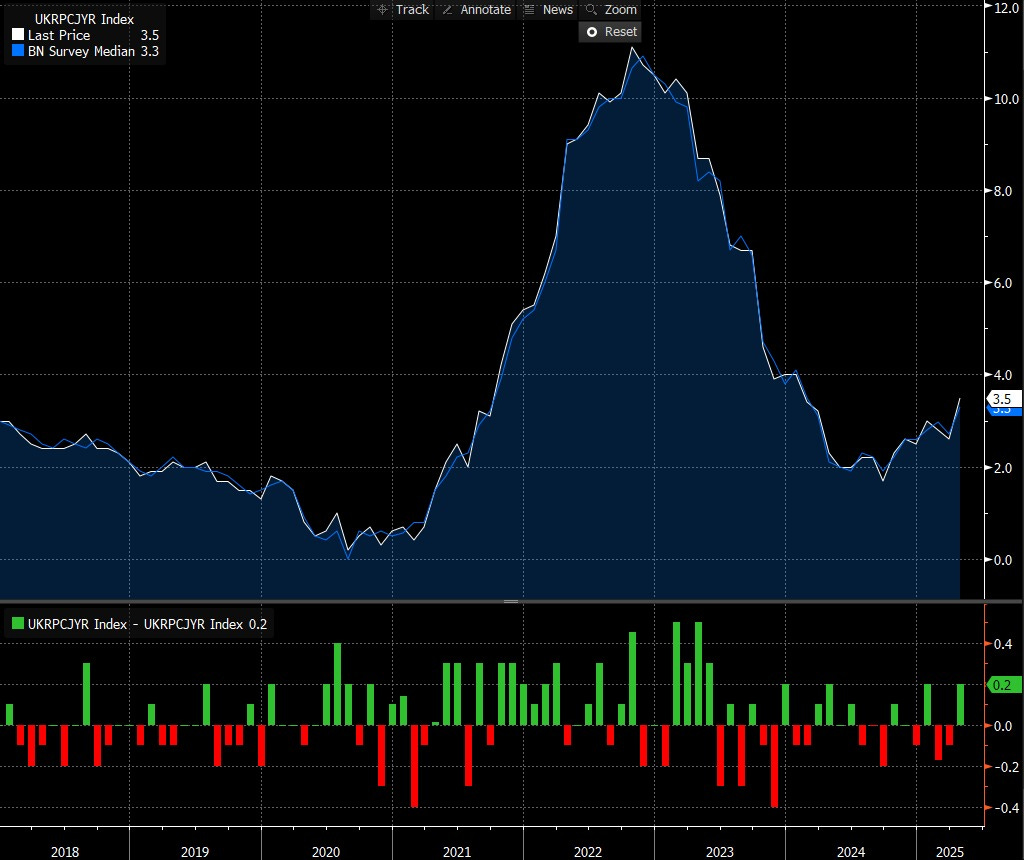

Firstly, the UK’s yield is being driven largely by sticky inflation (leaving the BoE to keep rates higher for longer) rather than a loss of confidence in their sovereign debt. It was only Wednesday when the UK had yet another hot inflation print YoY (3.5% from 2.6%).

Look at how inflation is beginning to creep up again, driving the long-end higher. The UK also doesn’t benefit from the global reserve status as the US does so volatility and selloffs can be more exaggerate which is why it’s not causing major attention.

On Japan’s side, they are finally exiting YCC and normalising the policy for the first time so the market is repricing Japan with real interest rates, being driven higher by inflation and wage pressure. So once again, there’s more of a direct issue in the yield being so high rather than a loss of sovereign debt confidence.

Now away from bond yields…

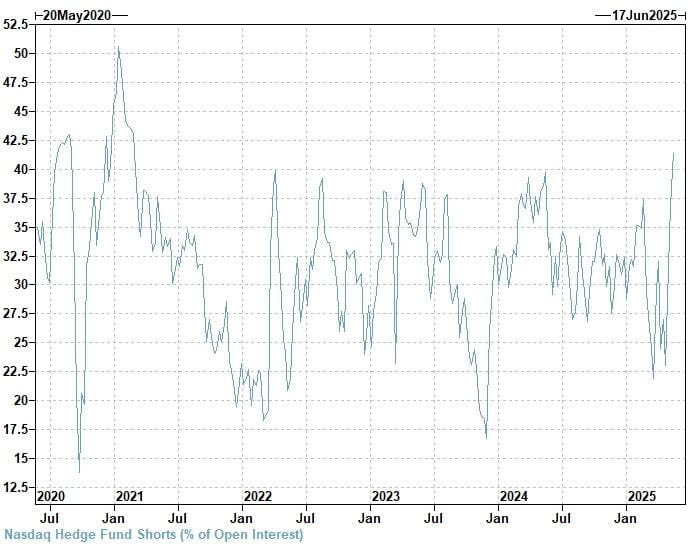

In the Nasdaq we’re seeing the same lack of confidence, hedge fund shorts of the index are increasing, we’re approaching the peak levels of shorts seen during the height of COVID. This is a great lesson, to not let your bias be changed by one market dynamic (bullish movement/one tariff announcement etc) but instead make the bias a file filled with confluences.

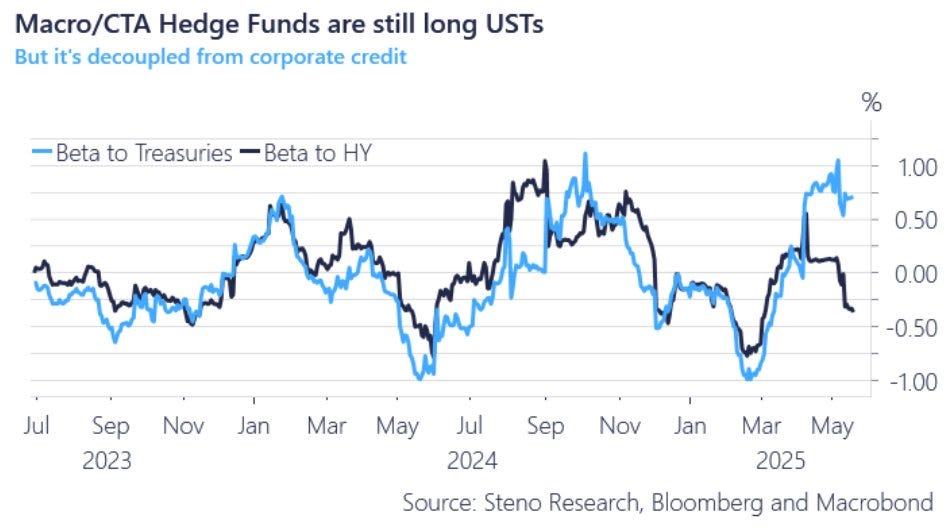

What took me by surprise is the fact that macro/CTA hedge funds are still long USTs, although the beta to HY and beta to Treasuries trend is decoupling. With many hedge funds remaining long bonds and short equities, it’s likely why we’re seeing many of the heavyweights making media rounds, pitching a revisit of the recent lows. There’s still plenty of rally chasing to come between now and July.

Quick Tariffs Brief

We’re back on the topic that has finally not been a large rollercoaster of ups and downs over the last week. Outside of the US, the EU struck a deal with the UK which has been marked as the “reset deal” as it’s the first major agreement since Brexit. Without boring you with the ins and outs, the deal agrees on things like trade in food and agriculture, fisheries access and some other smaller components.

The market had very little reaction to it (other than a c.0.8% gain in the FTSE), it’s simply not what everyone is focused on. The US is driving markets right now so it will be sensitive to data from there. The only thing I can see impactful is that the UK has another trade ally but let’s just hope that countries don’t start making these deals between them and fighting the US together because things could get messy real fast.

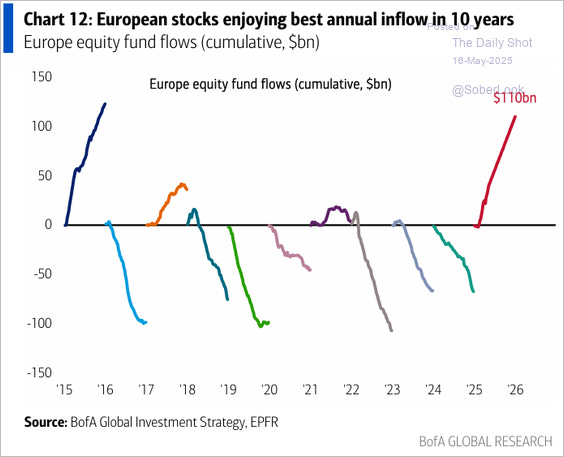

There’s not much shaking the EU either right now, their currency is booming as it’s the liquid alternative to the USD, European equities have enjoyed the best annual flows in 10 years and their central bank is easing (c.50bp priced in for 2025 leaving the terminal rate at 1.75%). Other than a tail risk of US-EU trade deal, Europe as a whole seems like a great place for return right now.

The reason I point out that the US-EU trade deal as a tail risk for European inflows is because of the tone of negotiators on both sides. The EU are demanding low tariffs (which Bessent has assured everyone isn’t realistic) and said they’re ready to fight back, while Bessent himself said that any country who wasn’t willing to negotiate in good faith would receive April 2nd tariff levels (extreme). Germany’s Merz will be hoping for a miracle after he called for an elimination for all tariffs between the US and EU.

In other news, Japan’s negotiators are also demanding an elimination of all tariffs on them, in a time where Bessent assured us all that 10% is a floor, it’s just not going to happen so this gives a tail risk to Japan. Remember that Japan is currently facing a 10% tariff + 25% on automobiles if a deal isn’t reached by July.

Positioning

If you read the report above, I explained deeper into why I’m positioned like this:

I think US equities can selloff into mid-June

In my opinion, the dollar will remain range bound into mid-June

I’m actively positioned short JPY which will also go into mid-June

See you all next week!

I missed the point on JPY, why short?

What's the play if the EU-US trade tail risk grows fatter. Could we see decline in EU equities? Or the euro currency