Hedge Fund Allocation, DeepSeek's Dominance & QE/QT

Delving into the large trends and market moves of the recent weeks

Hey guys,

After another heavy week chipping away at studies of the financial markets, I came to a realisation:

The boring work is where the magic usually happens, stay diligent.

If there is one thing I can take from my endless hours of study on financial markets, it’s the above. The cost of greatness requires prolonged periods of times where you may dread the work you need to complete, but trust me it’s worth it.

At the end of the day, financial markets are fun once you understand them, right?

Keep digging, let’s get into this report!

Macro watch

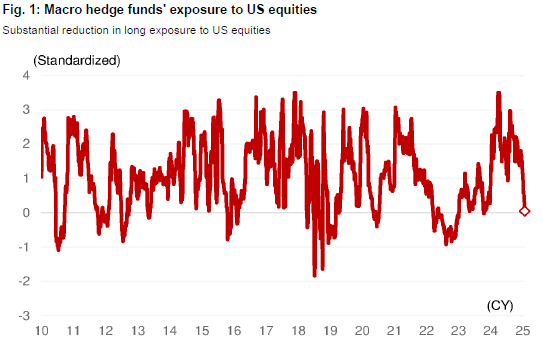

An interesting article I stumbled across, as well as some interesting data. Macro hedge funds’ backed out almost entirely from their aggregate net long positions in U.S. equities, see Figure 1.

The biggest players are simply the ones we want to monitor most.

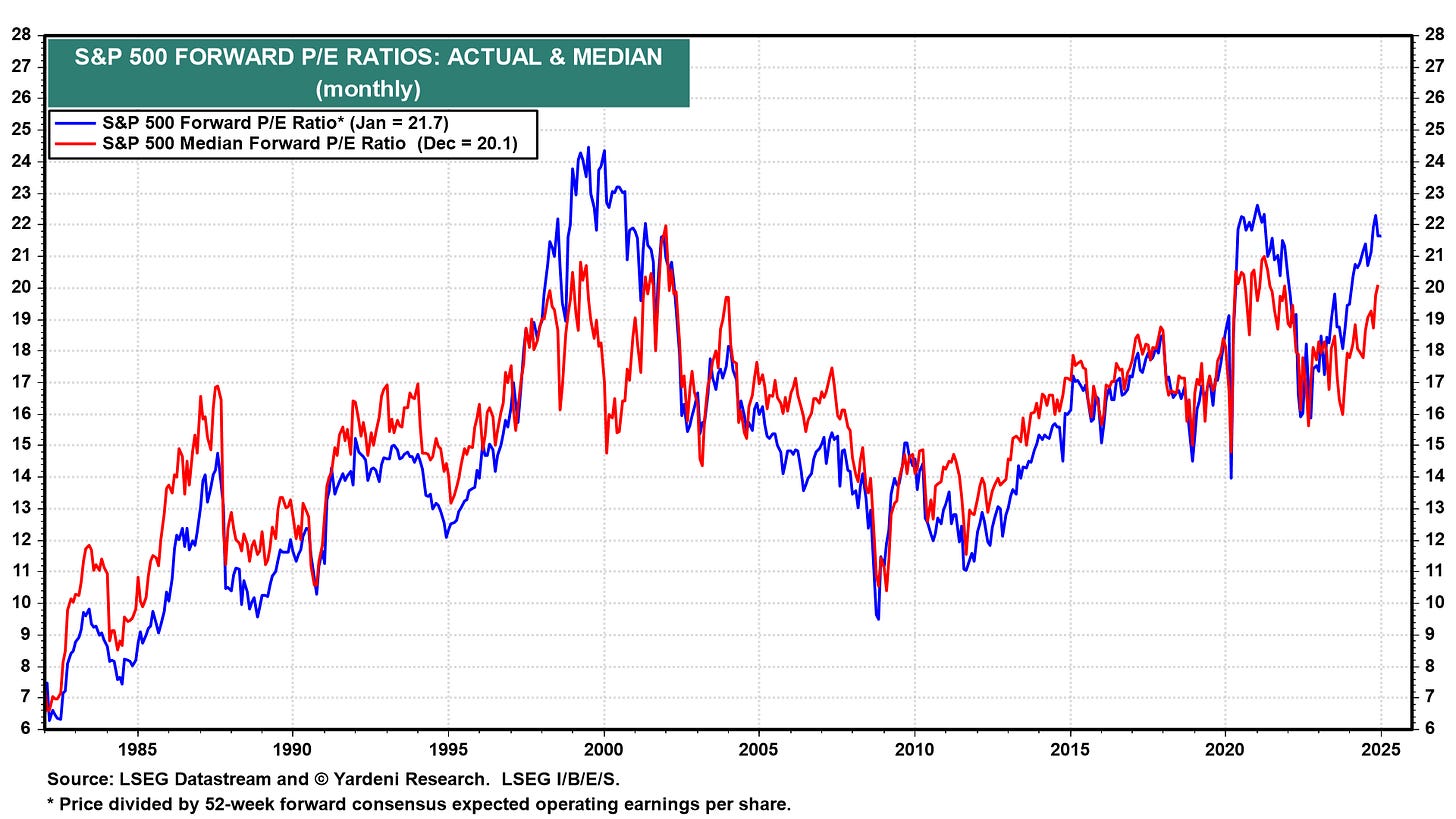

Reasons for this may lie in Figure 2 below, where P/E ratios are increasing on a pretty steep uptrend. It’s quite interesting because a large unwind of equity indexes may also be simply due to uncertainty in Trump’s election and a thesis that dollar has been pushing higher while yields have also been pushing higher, draining liquidity because:

Higher USD increases global funding costs

Higher U.S. yields may cause a shift from equities to bonds

Now, how long can the trend of large returns in the S&P 500 carry on? We’ve had 2 consecutive years of over c.24% returns! Also, is Trump’s economy going to deliver super growth without inflation? As for the recent rally in S&P, how much of that is positioning and how much is it really the macro impulse behind things?

Short the S&P 500!!! (in my humble opinion..)

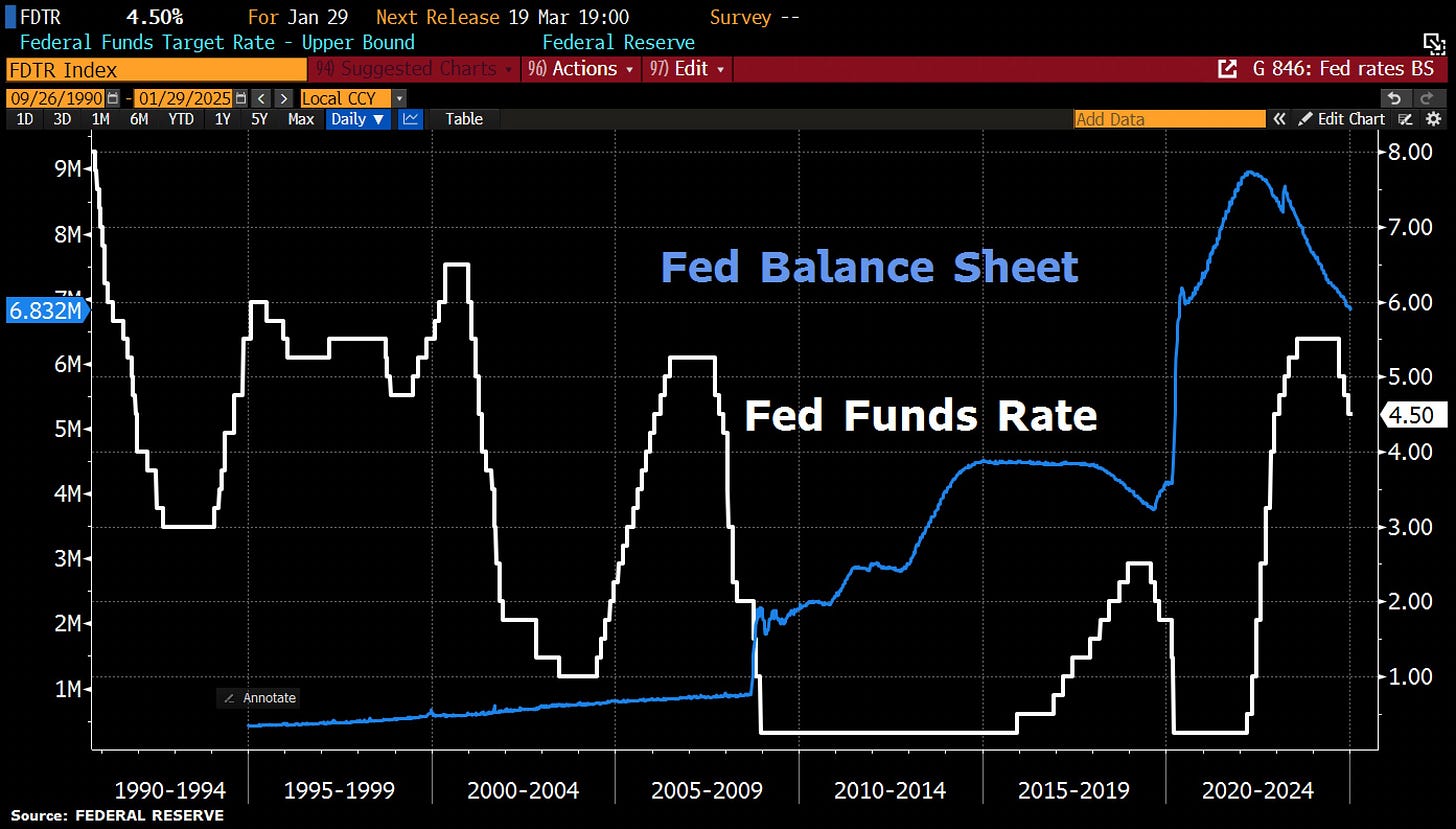

The Fed meeting on Wednesday was not an exciting one at all, but I must report…

They held rates steady at 4.50% and Powell made really general comments which had muted impact on markets:

“We do not need to be in a hurry to just policy rate”

“2024 GDP looks to have risen above 2%. Inflation has moved much closer to goal, somewhat elevated”

“Risks to achieving goals roughly in balance”

The hold on rates was already priced in, Powell made no surprising comments so therefore the market had no major move.

Market mover

I had to put this in here, wow.

Nvidia shares sunk more than c.10% in premarket trading on Monday, erasing c.$465bn in market value in a major DeepSeek sell-off. China's DeepSeek launched a free, open-source large-language model in late December, claiming it was developed in just two months at a cost of under c.$6 million.

The real reason for the sell off is because DeepSeek is a very high performance AI model and was developed at such a small fraction typically associated with such technologies. DeepSeek used c.2,000 Nvidia chips, which is significantly lower than average (considering that Chat GPT-4 used c.20,000 chips.

Nvidia’s c.$465bn DeepSeek rout is largest in market history, as Bloomberg has calculated.

It’s bitter sweet, lower material needed for such advanced AI models, yet chip companies may suffer the lower reliance on them.

Central bank policies

It’s about time a classic 101 of central banks is included here.

Central banks across the world utilise monetary policy tools to control money supply and inflation. When an economy is overheating, it calls for the action of quantitive tightening, so let’s get into the below.

Key words inside the lesson:

Reserves - Bank reserves are the money that banks keep at the central bank to follow regulatory requirements (we will get to that at the end) and make payments smoothly. These reserves can be used to make loans to other banks. Reserves are the bank’s money and do not directly flow into the economy because banks are not allowed to use them to make loans.

Balance sheet - A financial statement that shows a company’s or bank’s assets, liabilities and equity.

Quantitive tightening

Objectives:

To combat inflation inside the economy

To reduce the financial system's liquidity

When central banks begin QT, they want to reduce their balance sheet holdings of government bonds because by selling these bonds, they are reducing money supply. How so? Well, the central banks force commercial banks, financial institutions and money market funds to buy them. This is how money supply is drained, if your commercial bank (let’s say Barclays) is having to buy bonds from the central bank, they now have less reserves and that results in a higher interbank market rate. For example, if Barclays has £500bn to lend, but now they have to buy bonds from the CB, they may only have £300bn to lend, resulting in drained liquidity in the economy.

Now some of you may be thinking, if bank reserves can’t be used for loans, how does draining reserves drain liquidity in the economy?

This is because with lower reserves, the bank to bank lending rates will increase (because there is lower supply of reserves) so banks then need to implement higher interest rates on real loans to people and businesses to account for the money they’re losing inside the interbank lending market.

Drained liquidity = Lower money supply = People have less money to spend = Lower inflation.

This is a really summarised example of QT, it goes deeper. But for the sake of understanding exactly what it is, this analogy and breakdown will help. QT is exactly what central banks across the globe have been implementing over the last couple of years as inflation has spiralled out of control.

Quantitive easing

Objectives:

To spark growth inside the economy

Increase the money supply

When a central bank begins QE, they do the direct opposite of what I have explained above. The CB will purchase government bonds from the commercial banks, financial institutions and money market funds. This results in the commercial banks having more reserves because the central bank pays for the government bonds with reserves. Higher reserves for the commercial bank, which leads to lower interest rates in the interbank market (because of the higher supply).

Once again, QE can go a whole lot deeper, but for the sake of understand the operation, this will help. In the near future, we could come into a period of time where central banks implement QE to respark economic growth but time will tell…

Reserve requirements

I thought I’d add this part to help you understand the above a little easier, if you didn’t already.

Central banks around the world impose regulations on commercial banks, one of which is a reserve requirement. This rule mandates that commercial banks keep a certain amount of reserves with the central bank, helping the central bank manage the money supply in the economy. By doing this, the central bank maintains control over the economy, instead of letting individual banks have too much influence. The reserve requirement can change depending on economic conditions. For instance, if the economy is overheating, the central bank might raise the reserve requirement. Conversely, if the economy is sluggish, the central bank may lower the reserve requirement.

Both increasing and decreasing the reserve requirement has a joint end goal, to control the money supply in times of high inflation or allow growth in a slow period. We know that the amount of reserves commercial banks have, will depend on the interest rate they can lend at in the interbank market or on loans to businesses and people to make up for the higher interbank rate.

A little bit of a different report, we could go a whole lot deeper but I don’t want to turn this into a course! These three components are fundamentals of central bank policy and the explanations above are sufficient for you to grasp them.

See you all next week!