Global Tariffs Enforced: The Next Steps

Exploring What’s Next in the Tariff Saga

Hey MMH readers,

A little bit of a frustrating week for myself.

I rarely trade intraday but I was long on the FTSE100 on Wednesday, it was a great position and hit take profit… but I wasn’t taken out.

It turns out my broker closes FTSE100 trading from 9pm-1am. So a trade that should’ve been +c.1.5% was -c.3.8% due to slippage from Trump’s tariff announcements.

A great lesson nonetheless, I just wasn’t diligent enough to be aware that my broker does that.

Anyway, an unnecessary loss is not going to determine the rest of this great quarter ahead.

Let’s unpack this week’s dynamics!

Market mover

My USD shorts call from last week have been immediately fruitful. c.-3% in the beginning days of Q2, as seen in Figure 2 below.

The fruitful calls weren’t done there… The buy idea for Associated British Foods (ABF) is up c.4% already, see Figure 2 below.

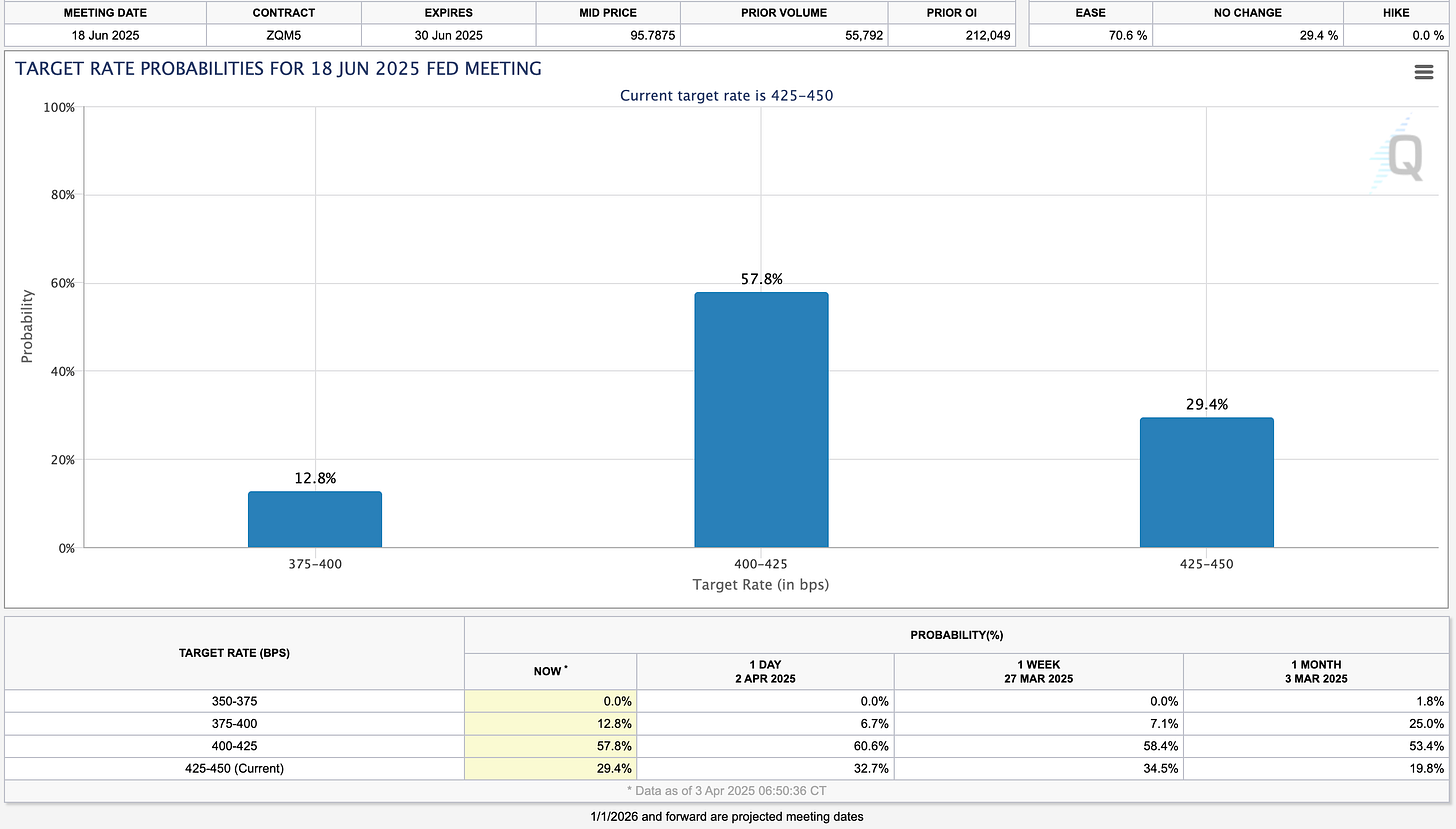

The huge U.S. equity sell off across the board has been the main driver of a lower Dollar, the rush to risk-off also included reduced exposure to the so called “safe haven” USD because of fears of unstable policies and growth in the U.S. It’s a great example of a scenario where risk-off behaviour doesn’t lead to a higher USD because market dynamics are deeper than that. On last week’s discussion of more Fed cuts, this thesis hasn’t played a part in this sell-off for the Dollar (but should and likely will be soon), although that opinion is mixed with many calling for rate holds as they see large upside risk in inflation. This is what the OIS market has to say about it (or not say about it):

Almost nothing has changed since last week amid all of this tariff talk and implementation.

News on tax cuts or deregulation can provide the Dollar some support, but my bearish bias for Q2 still remains and has begun the quarter very well. The sells across U.S. yields, equities and currency are telling me that the market either thinks these tariffs are temporary via negotiation or the U.S. growth is in trouble via retaliation from other countries.

The tariff saga

I know we’re all begging to talk about something other than tariffs but we simply can’t because they are taking over the markets, so I apologise in advance for yet another discussion on tariffs…

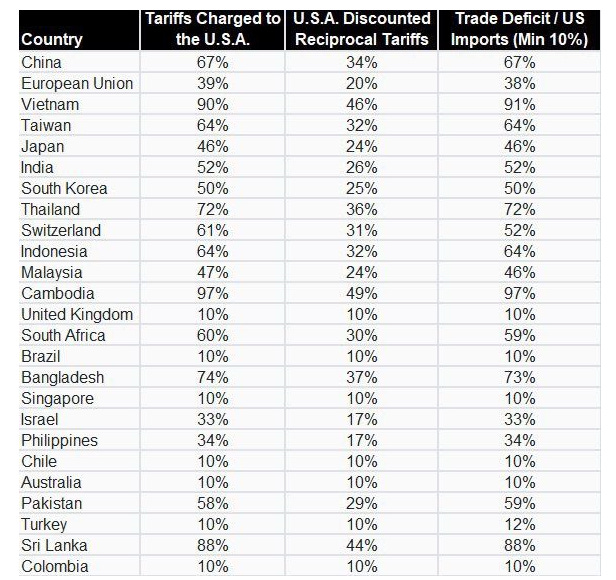

Before we begin, a quick summary for the new tariffs introduced by Trump last night (April 2nd) seen in the chart below:

Yes, most of these numbers are extreme. However, the Treasury secretary has said that Trump will be willing to negotiate these tariffs and although I think these tariffs are as bad as it’s going to get (I doubt we’ll see much worse), there is a timing issue on when he will be open to negotiate. One week, one month or one year from now?..

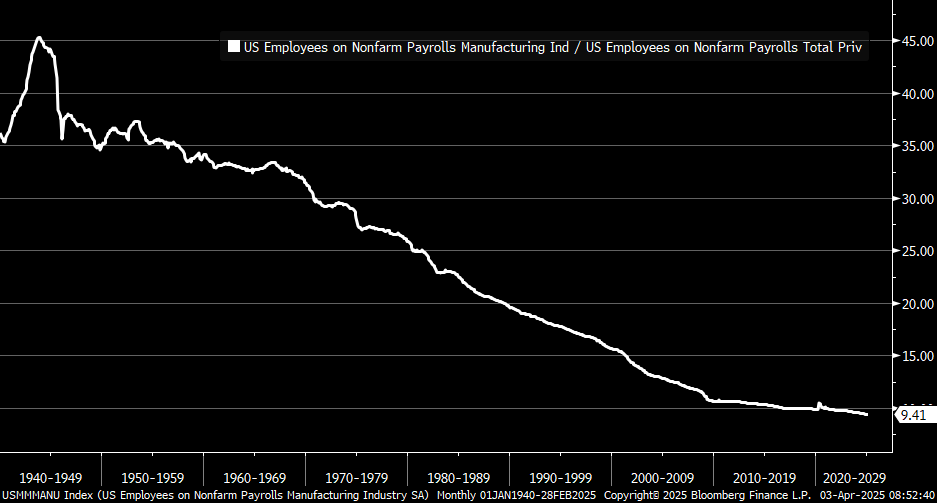

The first sign of retaliation has come from the EU, the European commission is finalising retaliation for steel and aluminium tariffs and further tariffs will be implemented if bilateral talks fail. This is the risk the U.S. run if these tariffs stay in place at these extreme levels. Firstly, retaliation from global peers is likely because they have to put up a fight otherwise he’ll walk all over them. Secondly, they may backfire on the U.S. because re-shoring can only work if there is demand for those sectors. Take manufacturing for example, an industry Trump wants to bring back to the U.S., how can they possibly bring manufacturing back if there’s no demand for it (if growth crumbles). It's worth pointing out that manufacturing payrolls as a percentage of overall payrolls have been in secular decline since the 1940s, and are at a new all-time low, so it’s essential for manufacturing to come back to the U.S. because they are relying way too hard on foreign countries for imports.

Although I don’t want to get into the habit of predicting what could happen based on data we haven’t got VS playing with the real data we have, Trump has been known to scale back these tariffs and use them as a scare tactic, we all know this. However, the data we have means a large scale global trade war with slowing growth and global rate cuts (in my opinion, I do NOT see a case for hawkish central banks).

The U.S. 10Y had it’s say, dropping c.19bp to around to 4.00% handle.

So, if yields = growth expectations + inflation expectations + term premium, why are yields taking you may ask? Investors have no other “safe bet” other than bonds so demand for bonds will naturally drag the yield. Couple that with the likelihood that the consensus on inflation re-sparking is probably overshot, there is no wonder why yields have dropped like this. Just wait for the Fed re-pricing to happen, then you’ll see these moves really fuel up.

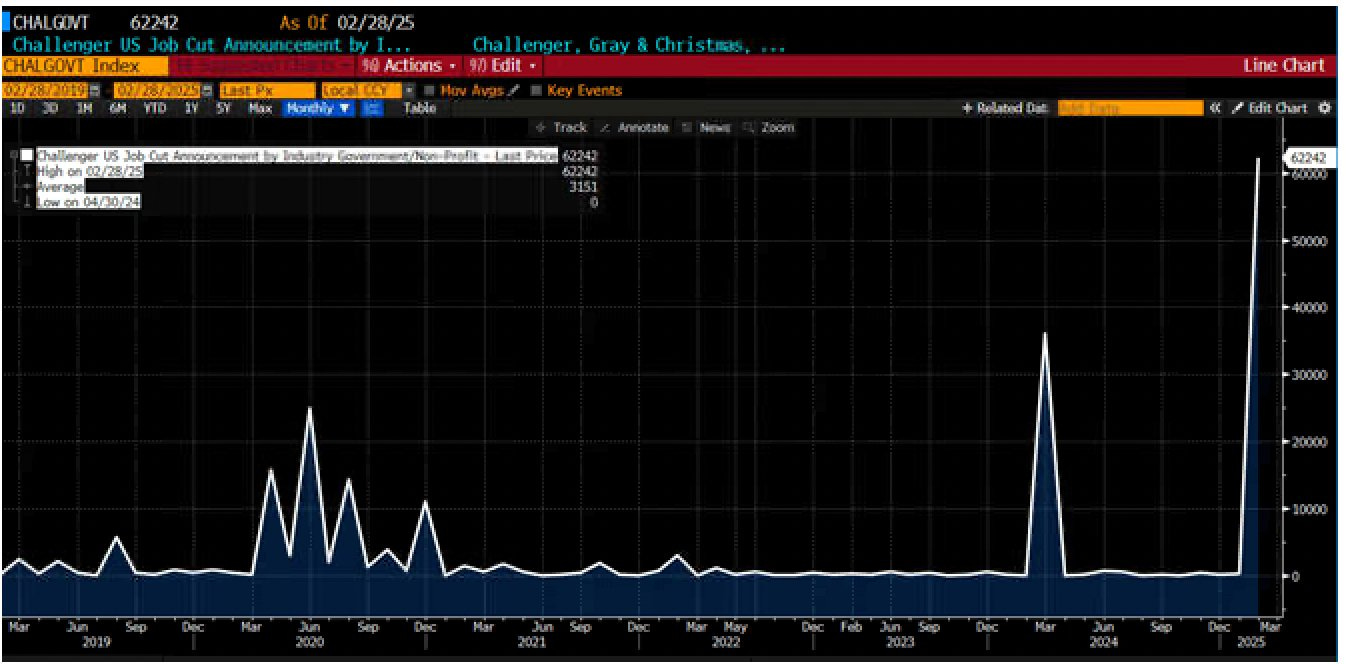

When it comes to rate expectations, many have ignored the labour market yet that plays such a key factor in the Fed’s decisions making. It can be easy to be blinded by the main driver of the markets at the current time (tariffs) but remember the Fed look holistically. NFP is set for Friday but there may be some anomalies in the report due to massive government layoffs.

Which then done this to job cut announcements:

My point here is to not get caught up on data points on face value and rather look into them because there are many new policies in place right now. Nonetheless, lower jobs, economic slowdown and overshot inflation expectations mean the Fed need to cut more than what’s priced in (sorry for repeating myself)…

The fear dragged into global equities and indices, stocks are down worldwide but this panic move may be unwound if negotiations are successful and if deals can be made. But as I said at the beginning, there is a large timing issue with the negotiations and if there is no clear sign on when they will happen then capital will likely flow from risk-on to risk-off (equities to bonds) until there is more clarity, as we have seen. Oil prices and shipping equities have also been part of this major sell-off, those were based simply off of fears surrounding global growth.

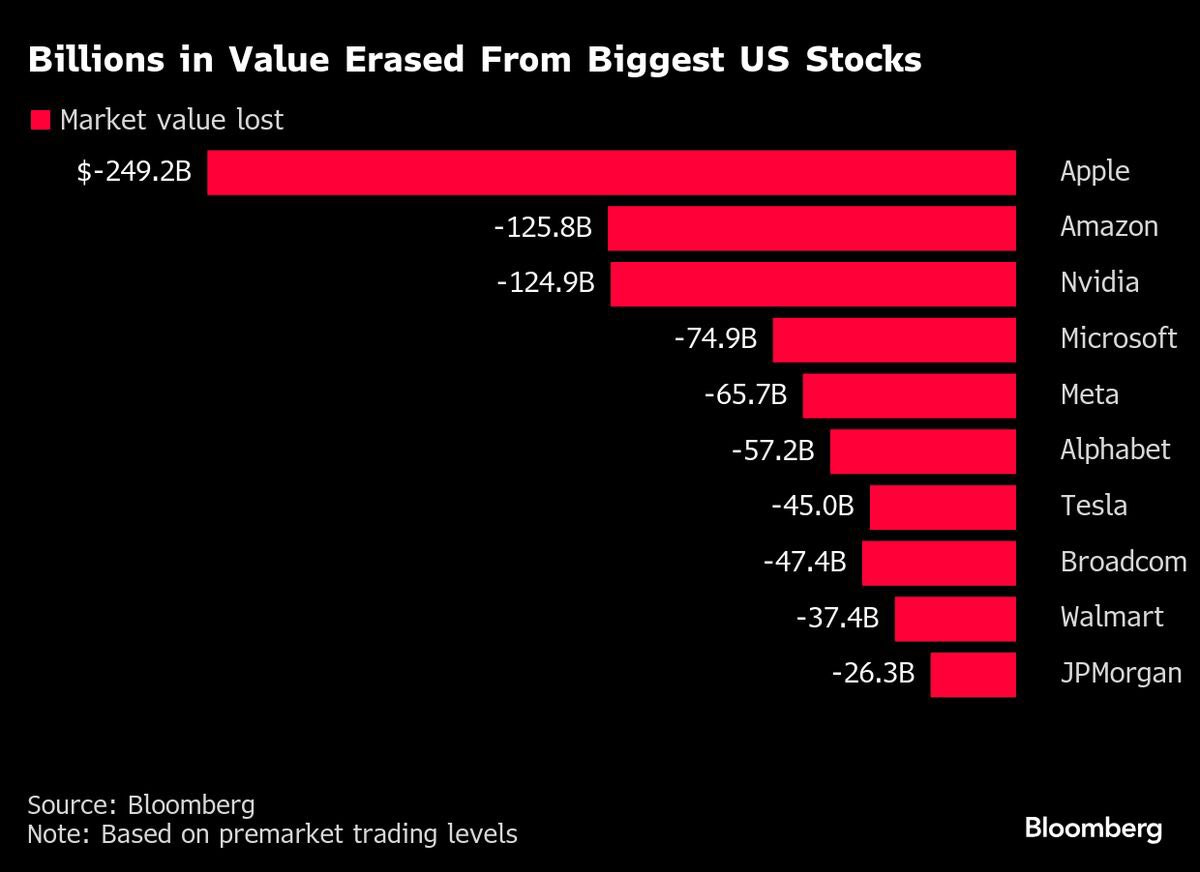

Below is an example of what tariffs will do to U.S. equities, short-term pain for long-term gain. BILLIONS wiped from big stocks.

Remember what I discussed at the end of January about macro hedge funds de-grossing of U.S. equities, this can definitely dip lower if trends in decision making persist.

Tariffs are exactly what Americans voted for, yet I see so many who are annoyed at Trump for doing what he said he’d do. Tariffs will fund your tax cuts and bring many sectors back to the U.S. and make them less dependant on foreign imports. A long-term approach sometimes blinds the short-sighted, Quinn Thompson summarised this very well:

And that’s all for this week!

sorry about the unnecessary loss, but it's a needle in a haystack of trades