Germany’s Influence in Europe, The UK Budget and Overvalued Equities

Assessing Future Prospects and Strategic Options for Euro-Related Investments

Hey guys,

The classic saying is, “Markets are slow in the summer”

I think we’re yet to experience that this summer across global markets, it’s been action packed. From global rate cuts beginning to Gold at all time highs, it’s all going on.

There is always such heavy focus on the Euro, but I don’t think Germany gets enough light, so let’s give it some!

Macro watch

Analysts at Vanguard Global issued a report indicating that corporate earnings would have to rise 40% this year to justify current stock valuations.

Is it time for a stock market correction? Maybe not.

Like anywhere else, Vanguard may not be fully accurate here, however, if they are it suggests that key valuation metrics, like the Price-to-Earnings (P/E) ratio, are unusually high. A high P/E ratio indicates that investors are paying much more for each dollar of earnings than they typically would, possibly due to overly optimistic expectations about future growth.

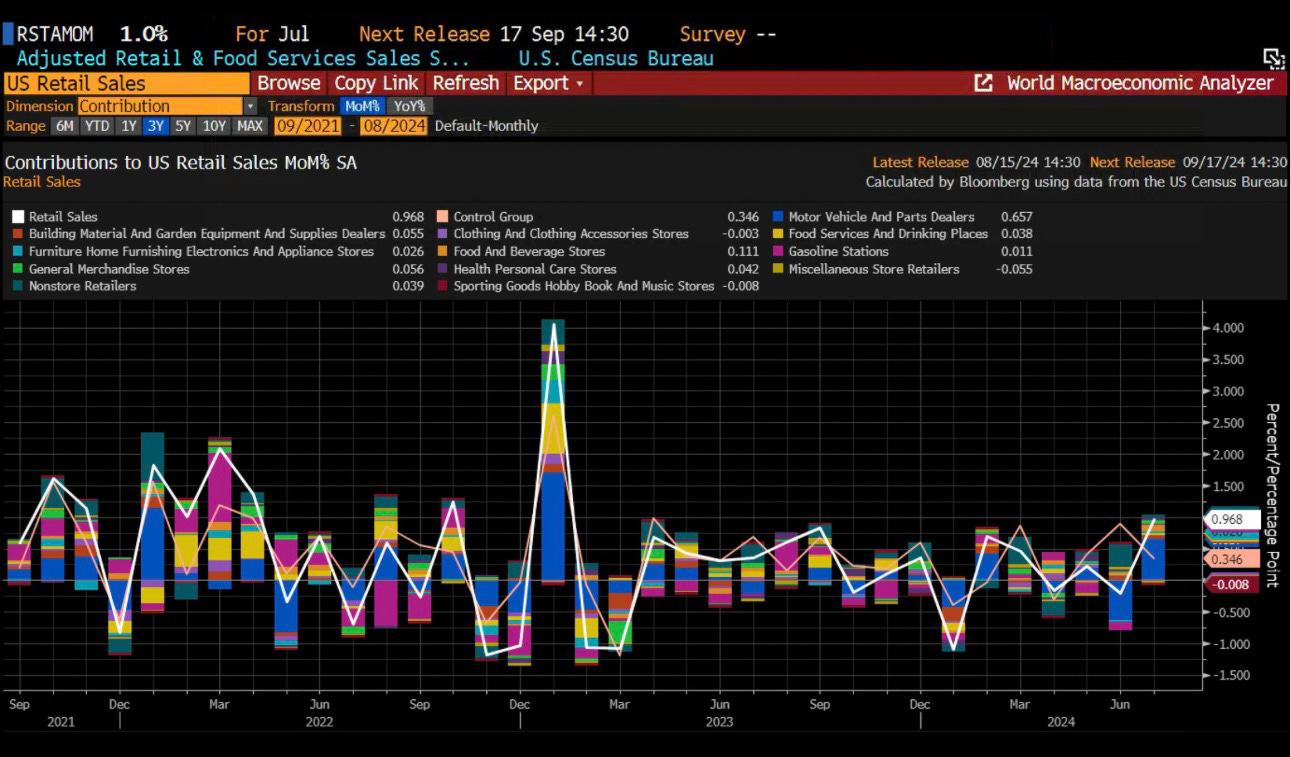

The only scenario I see such a large move coming in the US stock market is in a hard landing scenario, which doesn’t seem likely based on the solid data coming out of the US in recent weeks. Monetary policy will shift further in favour of company expansion, inflation is well under control, the labor market hasn’t been crushed, wage inflation is stable and real sales are picking up…. into company revenue.

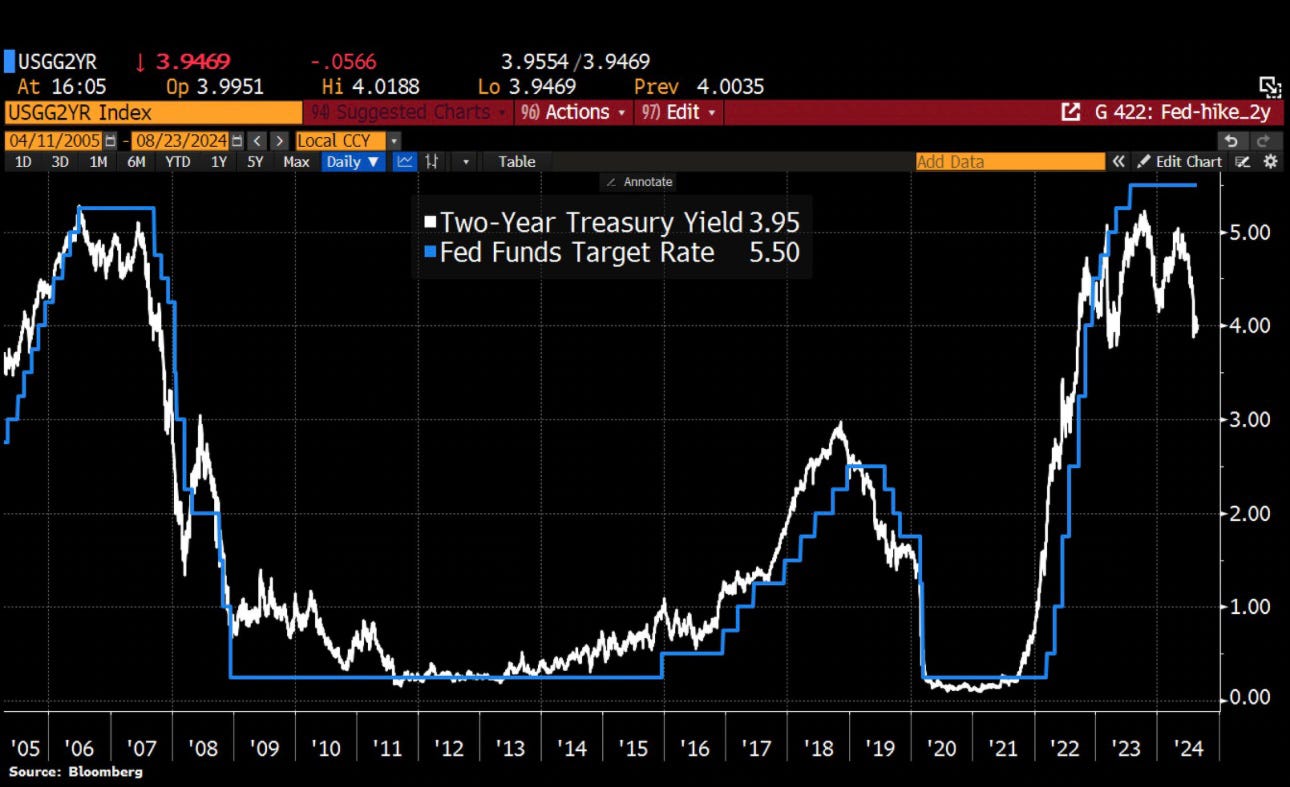

The US 2Y yields plunged to 3.95% as Fed's Powell says ‘time has come’ to cut interest rates.

Soft data in the US has been dominant for a number of weeks now, keeping the recession odds low. Fed Chair Powell has been reluctant to use dovish comments in his recent FOMC speeches, stressing data dependancy and the Fed not being ready to cut. However, the time has finally come where he has cracked, which has truly taken a hit on the Dollar, which is down 2.8% since the beginning of August. Atlanta Federal Reserve President Raphael Bostic said on Wednesday that with inflation continuing to decline and the unemployment rate rising more than expected, it’s ‘time for interest rate cuts’, Bostic is generally one of the most hawkish members of the FOMC.

The market was quick to price in c.100bps of Fed rate cuts by the end of 2024, beginning with 50bps in the September while a terminal rate was already priced at 3.00%. The reason for such losses in the USD is simply down to monetary policy expectations. The demand for safe haven assets is declining (USD negative) and yield differentials drive FX, so bearish pressure on the Greenback could divulge. Investors have evidently re-positioned into the Sterling because of the BoE’s longer and slower path to cut interest rates.

However, elections are round the corner and Trump’s tariff’s ar Dollar bullish, something that could bolster demand for the USD if he is elected as the new president. The US election is a large topic that I’m going to cover in another report, but it is a tail-wind to the bearish Dollar price action.

The UK Budget

In focus now is UK Chancellor Reeves' first budget on the 30th October. There is much speculation over £20bn of tax increases coming through - worth around 0.7% of GDP. However, this may not represent fiscal tightening since she will be using the money to address the real-terms cut in public spending under the previous Conservative government. Public sector pay rises alone may be worth as much as £10bn which may relieve some of the tax increase impact on the public.

The Sterling is at Q1 2022 levels as it continues to outperform the Dollar. The budget is unlikely to have any major impact on the GBP, however, based on history, we never know… right, Liz Truss? The BoE’s resilience to give any forward guidance on future rate cuts and reluctancy to signal any need for speed in the cutting cycle will also help prop up the Pound against other currencies.

However my thesis could be wrong, UK yields jumped after Prime Minister Starmer warned that his government’s October budget statement will be “painful” and asked the nation to accept “short-term pain for long-term good” in his first major speech in office.

However, the rise in UK yields were mis-interpreted by many, they were not caused by Starmer’s comments. The reason for the stark difference today is the change from the old benchmark (UKT 0 ⅛ 30/01/26) to the new benchmark (UKT 4 ⅛ 29/01/27). Below is the gilt benchmark changes VS Friday.

Trade update

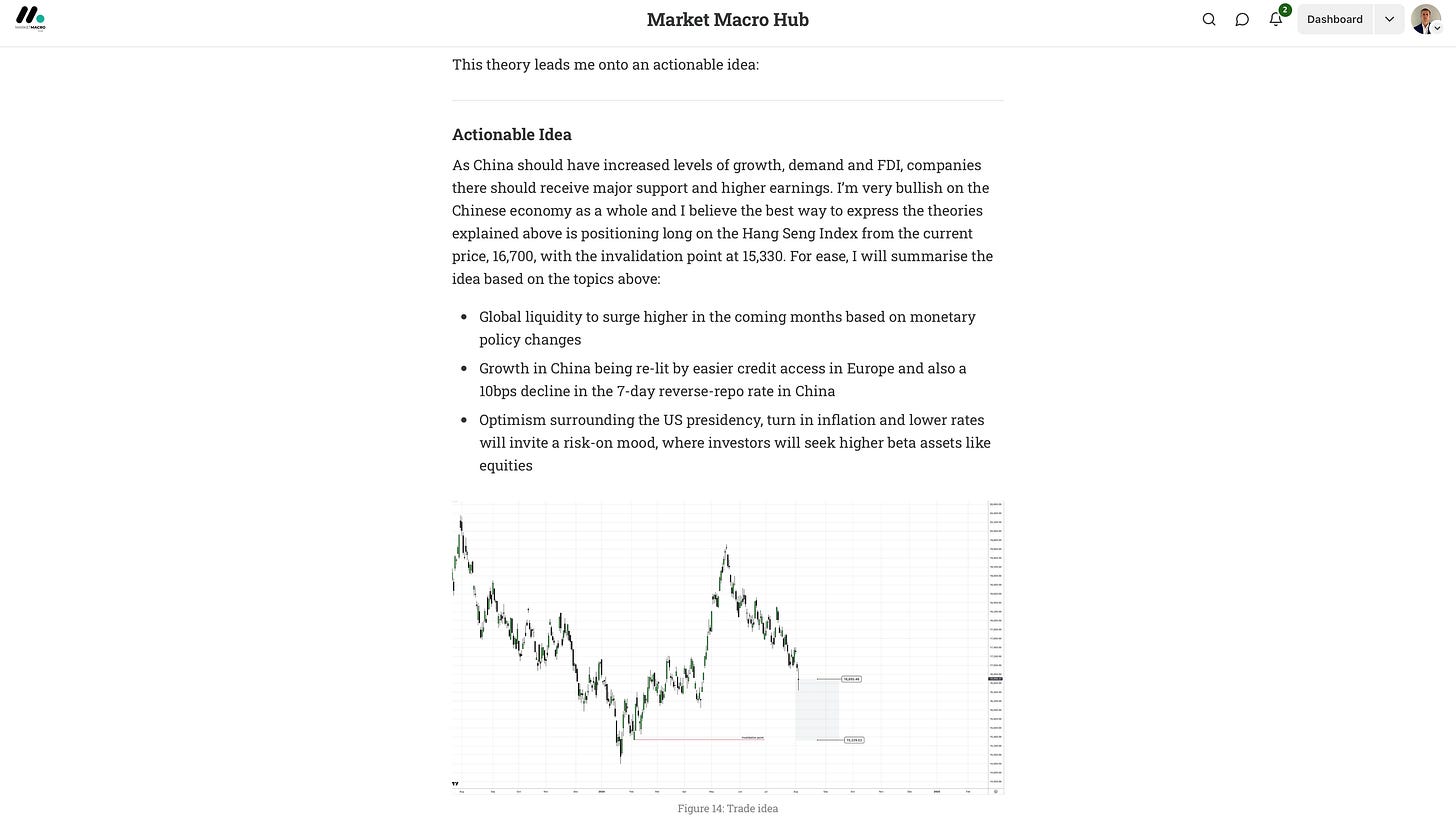

On August 5th, I gave a trade idea on the Hang Seng Index:

Hong Kong has a direct and intrinsic relationship with the Hang Seng Index (HSI) because of the companies indexed in the HSI. The trade sent in the report is running c.6.5% up from the recommended area (16,700). Exports in Hong Kong rose 13.1% in July from 10.1% the previous month with has helped bolster optimism as well as others factors spoken about in the report:

Germany’s gloom

Data in the Eurozone’s largest country, Germany, has been nothing short of poor.

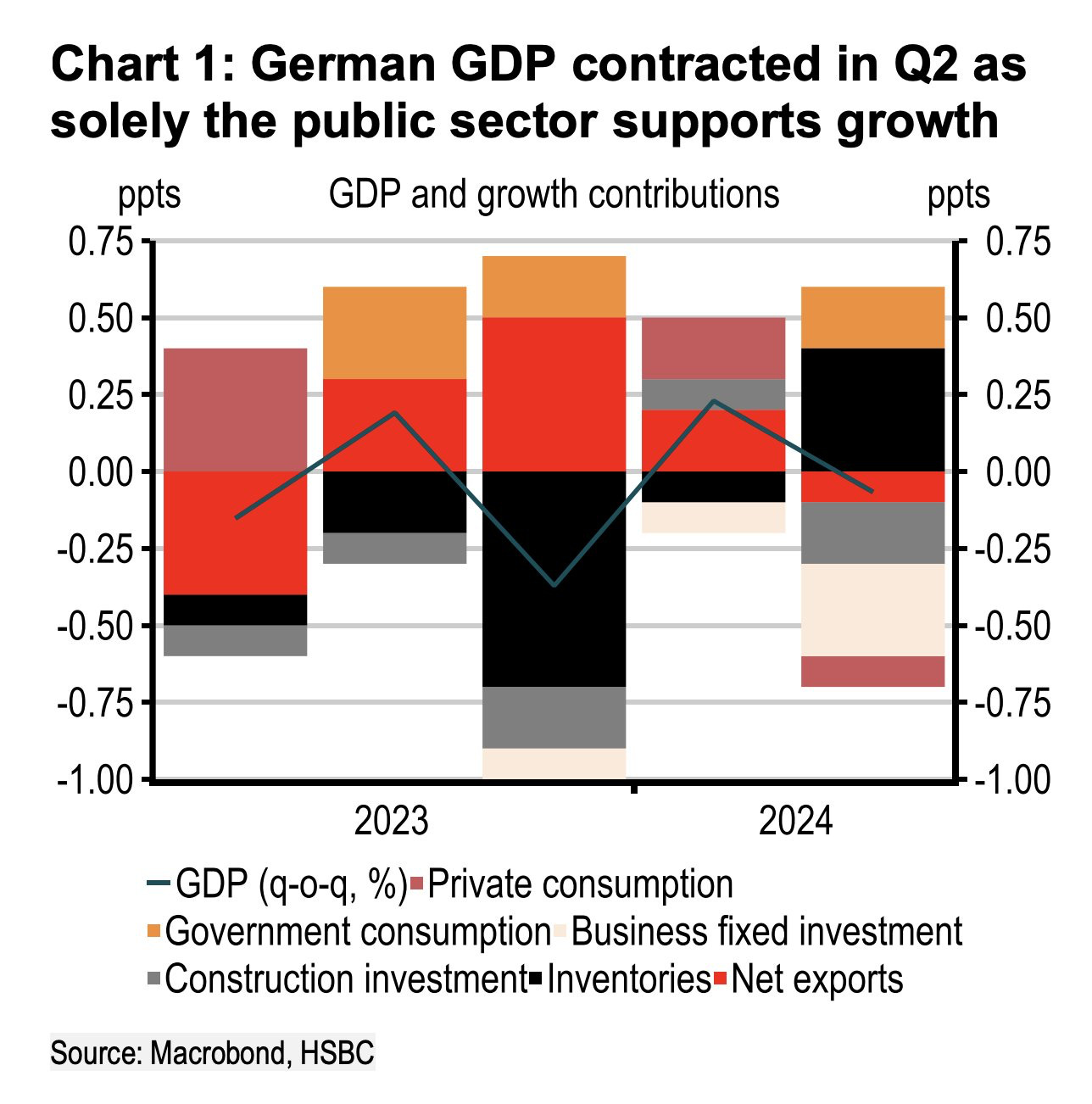

Germany’s GDP was -0.1% in Q2, down from 0.3% in Q1. If there hadn't been an increase in government spending and net inventories, the Q2 print would have looked a lot worse. Plunging investment activity sent Germany’s economy back into contraction and that is not good for future growth. The main reasons for such weak growth:

Weak industrial production - Germany is known for its strong industrial sector, however, global demand for German goods decreased, particularly from key markets like China, which had its own economic challenges.

Monetary policy effect - The tight ECB policy will and has had a negative lag effect on domestic demand in Germany.

Latest GDP figures show how gloomy Germany’s data is. Companies have cut back on investments with gross fixed formation capital (GFFC) plunged 2.2% QoQ. GFFC is the net investment in physical assets within an economy over a period

Consumer spending hasn't increased, and government spending is the only thing that kept the GDP decline in Q2 to just -0.1%. "If it hadn't been for the public sector and inventories, the Q2 print would have looked a lot worse," HSBC says.

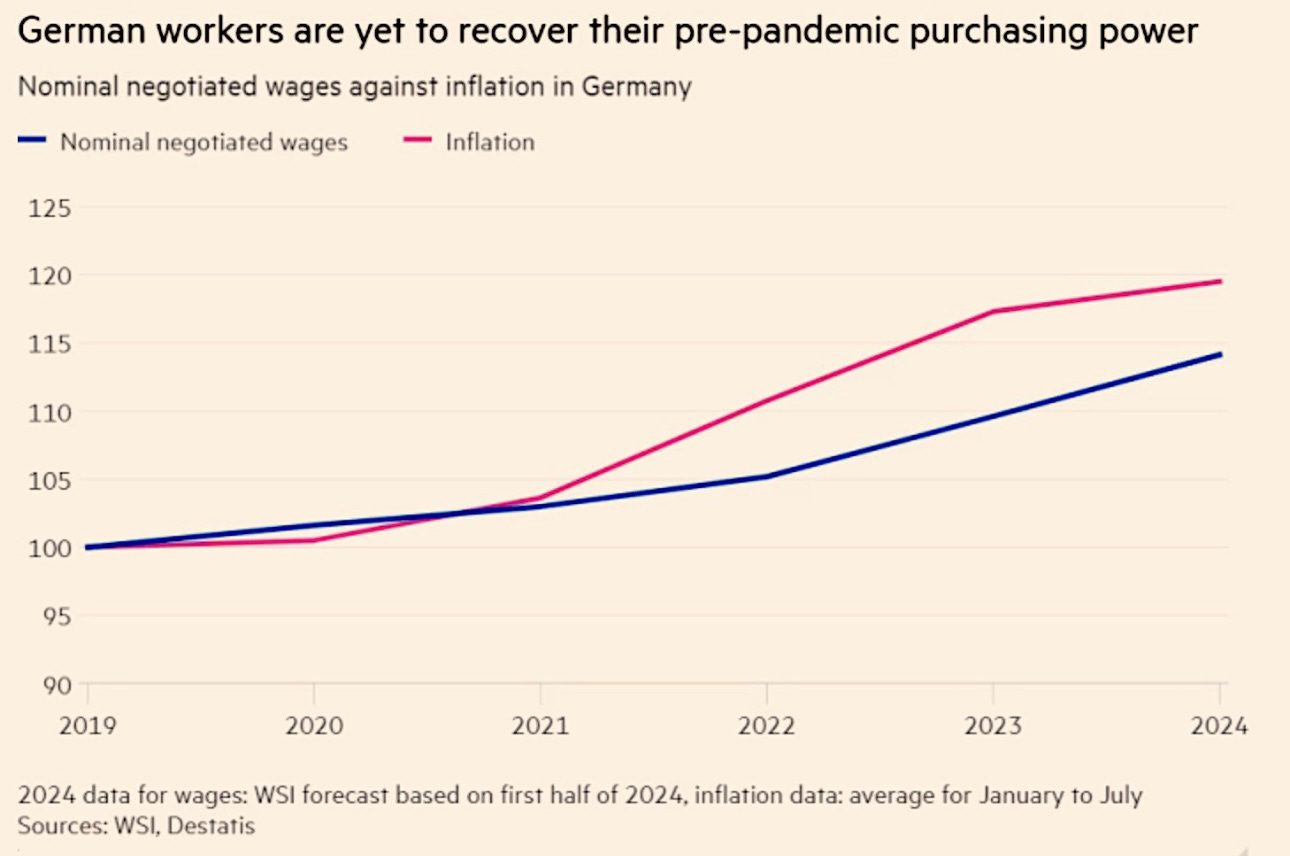

In Germany, wages are rising at their fastest pace this century. However, they still haven’t caught up with the surge in inflation since the coronavirus crisis. Negotiated wages in Germany are expected to jump by 5.6% this year, but that’s still not enough to make up for the loss of purchasing power since 2019. This indicates that inflation continues to put significant pressure on households.

The effect that lower real wages can have on an economy can be significant. The reduced purchasing power will not only dampen demand but also consumer confidence. Households cutting back on spending for luxuries and focusing on essentials can slow down an economy as consumer spending is a main driver.

The financial stress that lower real wages can cause is significant. Less income means debt becomes more expensive to service, which can be a downward spiral and result in defaults or never ending debt repayments. The issue Germany has is that purchasing power is declining, so workers are demanding higher wages but the companies can’t meet their needs because the demand for their goods and services is dropping. There will naturally be less investment and lower savings levels for as long as real wages are sitting at a gap like this with inflation.

As mentioned above, consumer sentiment has taken another hit, Germany’s GfK consumer confidence index dropped sharply from -18.6 to -22. This raises doubts about whether consumers can support Germany’s already weak economy. In Q2, private consumption fell by 0.2%, however, there was significant upward revision of Q1's figures.

Their economy is increasingly falling into crisis. Ifo business outlook dropped to lowest level since February, however, the figure was higher than expectations in both manufacturing and services so at least the index did not fall as sharply as expected. The Ifo institute’s expectations gauge dipped to 86.8 in August from a revised 87 the previous month, beating the 85.8 seen by analysts in a Bloomberg poll.

So we know Germany’s growth is weak and that they are the largest economy in the Eurozone, so why is the Euro still pumping against the Dollar? Simply just monetary policy differences. As mentioned above, the US are set the begin an aggressive rate cutting cycle while Europe are not expected to cut as aggressively (c.69bps by the end of 2024 VS c.100bps by the end of 2024 for the US).

Ok…. but the DE30 is floating around all-time highs while Germany’s economy is in the mud?!

Strong corporate earnings drive equities, many of the companies in the DAX 30 are multinational corporations with significant revenues from international markets. Strong performance and earnings from global operations can drive up their stock prices, even if the domestic economy is weak. So a company based in Germany may receive 85% of its earnings internationally (as an example), so the 15% of revenue that comes from domestic demand isn’t enough to really decline the stocks value.

Also, sector strength is a key outlier. Certain sectors within the index, such as technology or consumer goods, may perform well regardless of overall economic conditions. Tech, which makes up 10-15% of the DAX 30, is also a sector that gets significant business internationally so this sector will likely not be affected by the poor demand within Germany.

With Germany’s data sitting where it is, there is likely to be little growth in the Euro area. However, there is not a strong enough trade idea right now to act on this weak data (in my opinion), sometimes it’s better to sit on your hands.

That’s a wrap for the week!