FX Volatility, Defensive Stocks, and Global Trade Risks: A Deep Dive

Exploring Market Dynamics: The Current State of FX and Bonds

Good evening readers!

I’m already bored of the word “tariffs” and we’re only a few weeks into Trump’s presidential cycle… Buckle up.

The largest volatility seen since the start of the year has been in FX.

Mitigating risk in these conditions is more important than expanding gains, be diligent.

Anyway, let’s dive into what the market is currently unpacking!

Macro watch

On the supply side in the U.S., wage growth is at 4.1% and the share of companies intending to raise prices has remained high at 26%, which is slightly worrying considering the inflationary knock-on effect that tariffs may have. I’m keeping an eye on this, front-running tariff purchases coupled with companies intending to raise prices brings a level of stickiness to inflation in the U.S.

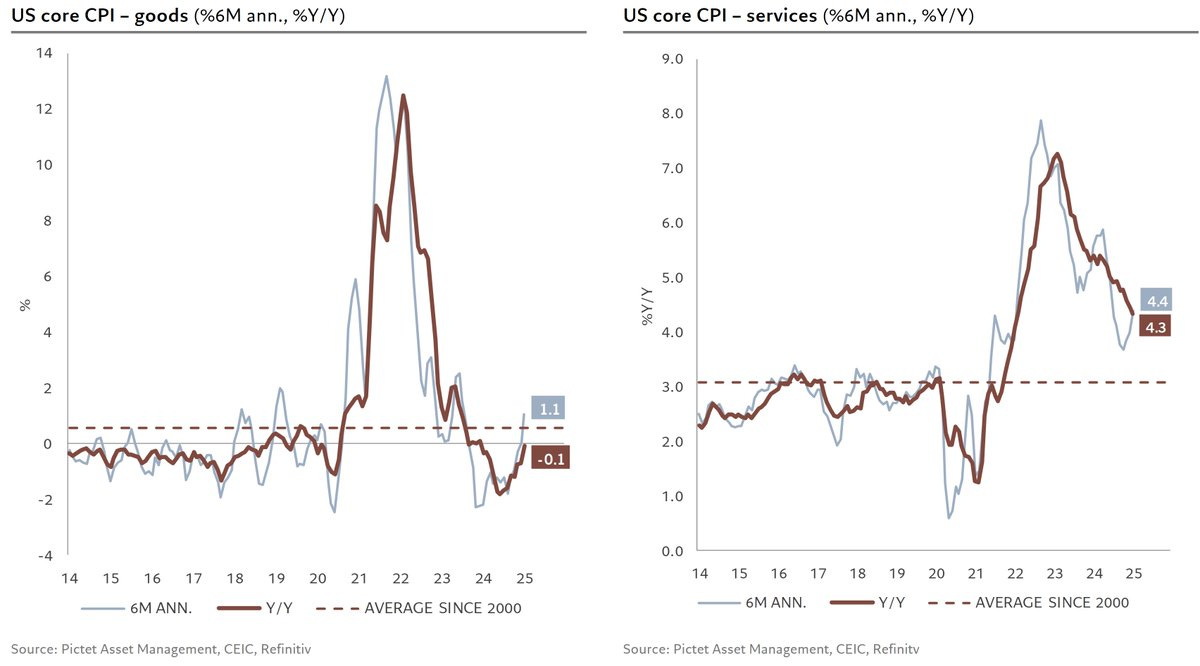

The two core categories continued to diverge, with goods prices contracting at a slower pace (-0.1% YoY) and services inflation gradually easing to 4.3%, though still 1.2% above its long-term average. Over a six-month period, both components rebounded, with goods prices surpassing their long-term average for the first time in 17 months.

The decline in services inflation was primarily driven by rents, which fell to 4.5% YoY in January. Meanwhile, inflation excluding rents—the Fed’s key focus—saw only a slight decrease to 4.1% YoY. More notably, its six-month rate continued to rise, reaching 4.7%, well above its long-term average.

You can see in Figure 3 the significance that core services has been playing in the CPI reading for quite a while now, so it’s always crucial to look into the intricacies of an inflation reading to see which components had which movement.

The real yield on 30-year TIPS (Treasury Inflation-Protected Securities) has been ranging between 2% and 2.50% for 18+ months. Last time real yields were so elevated for so long was the 2005-2007 period. A prolonged period of higher inflation expectations have driven this range so high, although I don’t see large significance in the correlation with last time we ranged this long because there have been plenty of other scenarios where TIPS has been so elevated and not led to a recession.

For those wondering why anyone would favour a 30-year TIPS over a 10-year treasury (which yields a much higher return), it’s to do with the inflation protection. TIPS provides a real return (inflation adjusted return) which also preserves your purchasing power. On the other hand, 10-year treasuries offer a nominal return (not inflation adjusted) so your purchasing power declines as inflation increases, eating into real returns.

Market mover

As volatility increases, outcomes become harder to predict, and the range of possibilities widens. Investors usually need time to adjust to these changes. Since Trump’s election, FX volatility has stayed above average. Tariffs are expected to keep it elevated in the near term too.

The reason the volatility has increased particularly in FX is because there is large speculation about the severity of the tariffs from Trump. On the lead up to his presidential win, he was aggressive and it seemed that everyone was in the firing line when it came to tariffs, yet he has delivered few of the plans so far. The postponement of tariffs on Canada and Mexico are the reference point, this was not expected coming from such strong comments in the previous months, which is why it leaves large uncertainty on tariffs on the EU and other counterparts. Also, FX markets are the most closely tied to a country's economic performance which is why moves can be quite extreme when tariff news hits.

You can see in Figure 6 how the volatility in FX is creating a range in the Dollar index, with large spikes inside the range and heavy uncertainty. Compare that to the previous months (Oct-Dec) where we see trending conditions and lower spikes in price and volatility.

I do see a level of support around this region for the U.S dollar, it may take more extreme reversals in tariff implementations to really cause further loss.

Global trade threats

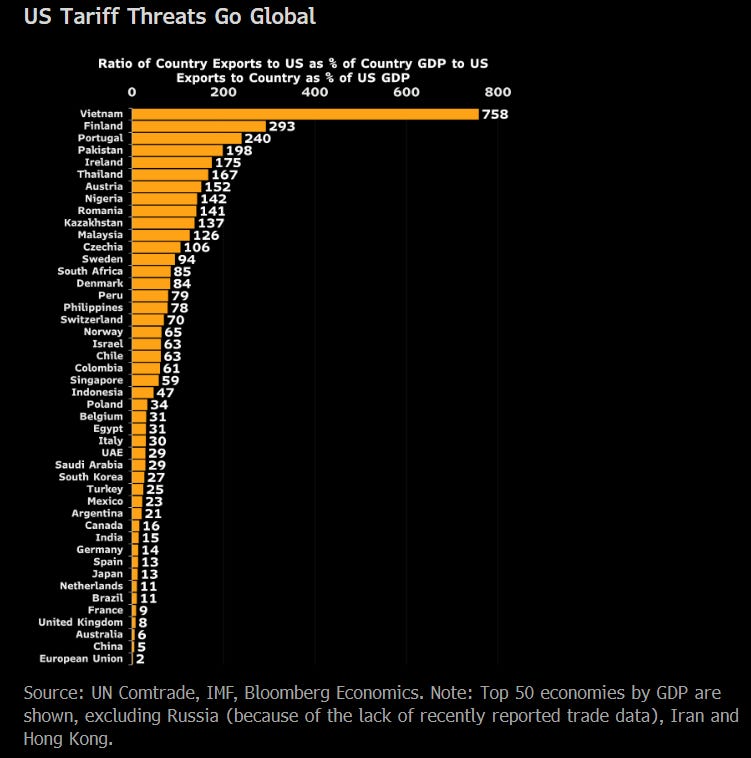

The question that most have been asking since the U.S. election - “Who's vulnerable to U.S. tariffs?”.

The answer - Everyone.

To keep things simple, in Figure 6, the numbers represent how many more times a country relies on the U.S. in comparison to how much the U.S. relies on them.

Side note - For those confused as to why EU countries are on the list in Figure 7 with the EU itself, it’s because the chart is showing the ratio of the individual countries as well as the EU as a whole.

You can see now why the Sterling has had some relief, the ratio of the UK’s exports to the U.S. as a percentage of GDP compared to the U.S. exports to GDP is just 8. Now, the reason that the European Union are so exposed to tariffs, even though their exports ratio total is 2, is because of weighting. Significant contributors to the EU’s GDP, like Italy, Germany and Spain have all made their way onto the list, all in fact have double digit ratios!

Now, aside from the main EU contributors, we see a significant collection of smaller EU members like Portugal, Ireland and Austria with pretty extreme ratios… The list of EU members goes on in Figure 7. So although some EU members may dodge a bullet, the most important ones will take a hit and the challenge that the ECB will be fighting is fragmentation risk (which is when economies inside the EU begin to divide in conditions, making the universal interest rate ineffective in some countries).

As an example, growth inside Portugal’s economy may be largely affected by tariffs but on the other hand, France’s economy may be affected at a smaller rate, but they both share the same interest rate meaning that it becomes less effective and more problematic for the ECB to choose the best rate because of the diverging economic conditions.

The largest economies (like the EU and China) are 2 and 5 times more dependent on exports to the US than vice-versa. Vietnam tops the list and is 758 times more dependent, U.S. dominance!

President Donald Trump has also announced plans to implement reciprocal tariffs on imports from various countries. The process involves U.S. trade agencies assessing the tariff rates of foreign trading partners to determine equivalent tariffs that the U.S. would impose. The agencies are expected to provide their recommendations to the President by April 1, 2025.

The tensions between Trump and the EU may only get worse because of the war in Ukraine. Tensions stem from differences in policy approach, particularly related to military support, sanctions, and diplomatic strategies. Trump's reluctance to offer strong support to Ukraine, in contrast to the EU and other NATO allies, has caused a rift. While the EU has consistently supported Ukraine with sanctions against Russia and military assistance, Trump was often hesitant to get fully involved, focusing instead on urging Ukraine to boost its defence spending and tackle corruption within its government.

The difference in policies don’t end there, the EU has consistently imposed sanctions on Russia over Ukraine, while Trump sought to ease tensions, even suggesting lifting sanctions for global cooperation!

This rift and uncertainty in outcome will also contribute to some safe haven flows, in the midst of uncertainty with tariffs too. However, there are some winners even in times of human disaster, the German defence company Rheinmetall has seen a massive c.46% gain since the start of the year as Europe looks to boost defence spending.

The above is a great example of capitalising on one specific idea (defensive stocks) over a long period of time (2-3 years). Since April 2022, this particular equity has seen a c.595% gain, pretty crazy, right? You don’t need to get every single bit of the move, but capitalising on one macro idea and focusing on one market can pay you handsomely over quite a period of time.

That’s all, until this weekend. Have a great week!

Another great read! Always looking forward to when u right a new article i think you've done an excellent job taking over for Joe. .......such good information without an excessive amount of content and you're always dropping gems , I miss joe but you've done a hell of a job with these articles