FTX Blowout & The Current Macro Picture (Pt3)

Hey guys, welcome back to pt.3 of the current macro picture!

Ok, let’s address the elephant in the room…

FTX. We’ll dive into the whats and hows of the recent saga with the FTX blowout and the cracks appearing across global markets.

FTX, Misfortune Or Blatant Fraud?

We had to touch upon this mammoth blowout that transpired over the past week; it’s clear to say that when you’re a 30-year-old with a net worth of $26 billion+, you pretty much think you can walk on water, or in his case completely put aside ethics and legal rights. And that’s just what Sam attempted; turns out he’s not untouchable.

Here’s a deeper breakdown of what happened.

As we know it, Sam Bankman-Fried built aka SBF, crypto exchange FTX to a strong point whereby he was being praised by industry veterans and private venture firms like Sequoia Capital, who even wrote a piece proclaiming his excellence. He also built a hedge fund/market maker platform called Alameda, that could make riskier bets within the market due to its nature.

Here are the details.

During the shakeup of early May this year where it was said to believe that large players within the hedge fund/investment management space (Blackrock & Citadel) borrowed 100,000 bitcoins – worth roughly $2.7b in order to buy UST, only to later ‘test’ the 1:1 peg against the stablecoin and dump all of their UST. This run on the stablecoin caused a colossal loss within the crypto space, sending a number of firms including Three Arrows Capital, a Singapore-based hedge fund, into deep losses resulting in the hedge fund collapsing due to their exposure to the cryptocurrency Luna. Industry reports say the hedge fund’s investment in Luna was $200m and their exposure grew to $560m. The story gets worse trust me.

Remember my last article where I mentioned how markets are dominoes in exaggeration; here’s a pure example. The crash in Luna sent Three Arrows (3AC) Capital into liquidation, the issue here was the capital Three Arrows Capital deployed into Luna was a loan from Voyager Crypto (a crypto exchange), the total value of the loan was $670m. Guess what? 3AC defaulted on the loan, which sent Voyager into bankruptcy, after being unable to redeem withdrawals from their customers. Pretty messy, but it gets even worse. After the collapse, SBF purchased Voyager essentially bailing them out. The only issue is, during this saga it’s believed that Bankman’s hedge fund (Alameda Research) had also taken massive losses, his bailouts were hopes to get things back on track with his fund.

When looking at the balance sheet of SBF’s hedge fund Alameda what signalled alarm bells was the fact that out of their $14b in assets, $3.66b was FTT tokens (FTX’s coin). So 1/3 of their balance sheet in FTT, an asset owned/created by their sister company which has no inherent value? To assist the lifeline of Alameda Research, Bankman loaned out roughly $6b worth of FTX client funds to the hedge fund to keep them afloat. Questionable move, if you ask me since the role of the exchange, is not to trade/invest/loan customer assets out as if they’re a regulated institution such as a bank. Typically, they should keep a 1:1 reserve of the client’s portfolio and assets, but Bankman went ahead and made the move of funds. Now, for collateral, Bankman’s Alameda Research used FTT tokens (his own coin) as collateral for the loan. Essentially backing the shady loan with no guarantee or safety in a secure or even real asset.

Now the value of the tokens held at FTX is a mere $600m!! Compared to the $5.5b figure Bankman-Fried told the public last week.

From here, the story is simple, word got out and panic set in— you know what the crypto market is like when there’s smoke and flames…

Enough FTT talk, hopefully, that clarifies whatever version of the story you have heard. Let’s talk macro!

No Rest For The Wicked, I Mean CPI…

Here are the inflation figures as it stands.

UK - 11.1% inflation

Europe - 10.6% inflation

U.S - 7.7% inflation

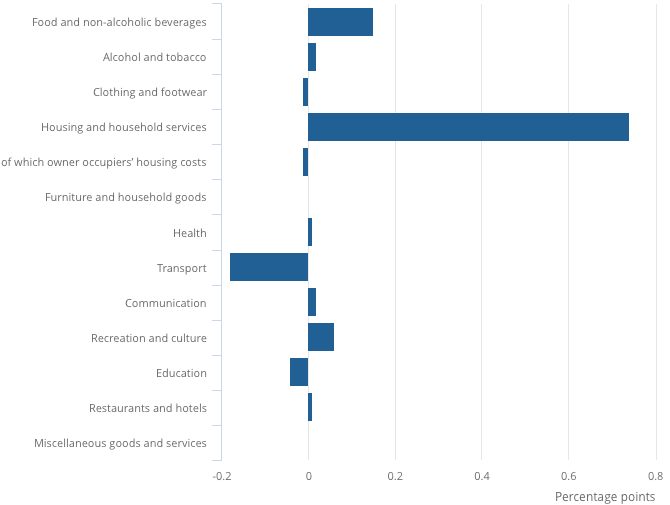

Figure 3 shows a breakdown, component by component of where inflation is coming from within the Uk.

You guessed right. Energy. You can expect to see a similar representation across Europe’s CPI by components. With the U.S being a net exporter of both natural gas (LNG) and oil, its exposure to volatile prices is subdued when compared to the UK & Europe, which is why we’ve seen a recent decline in CPI of 0.5% MoM from September to October ‘22.

The implications? A relatively hawkish Federal reserve until we see even bigger declines in the CPI figure.

Also noted in my last article, the current macro picture pt.2, to see inflation fall we’re going to need commodities, particularly oil and gas prices to significantly decline which is why I’m eyeing up a short on USOIL; a bet that as the global economy slips into a recession and with growth/demand being squeezed out the market we’ll see oil reflect the contraction we’ll be experiencing.

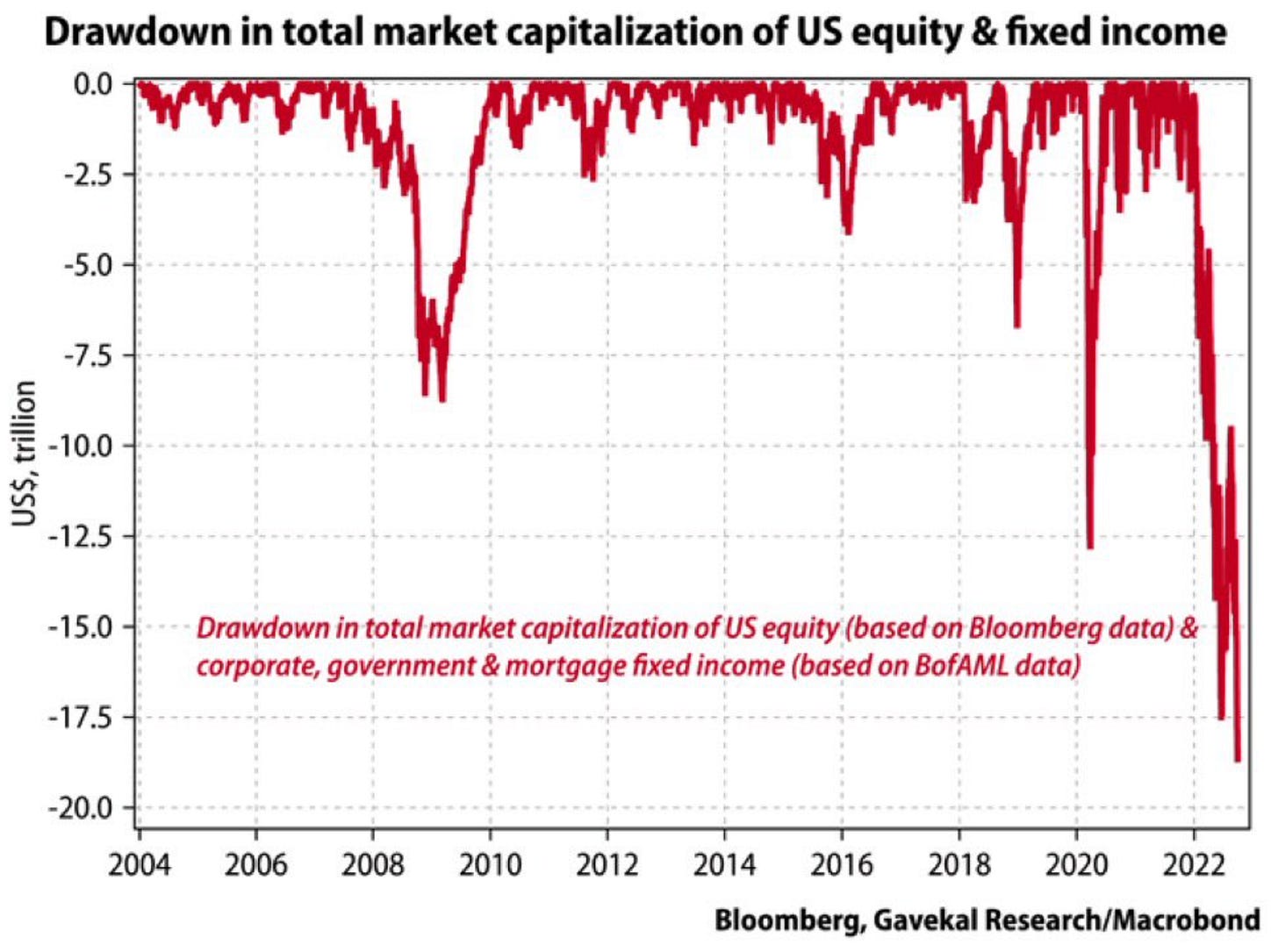

I believe the state we’re in within global asset markets is the point where all excess wealth created from years of easy returns in equities, private markets and crypto, due to available liquidity is about to be completely erased. You can call it the great reset.

This is the largest drawdown recorded in over a century. The question I pose is, have we bottomed out yet? Or are we in the eye of the storm?

Years of easy monetary policy, leverage, credit and government spending have tipped the financial world into a danger zone where we’re seeing cracks across different markets in different countries.

Private debt to GDP in Canada

Pension fund liquidity crisis

Energy prices in Europe & the Uk

Unsustainable widening in credit spreads/fragmentation risk in Europe (Italy vs Germany)

Slowing growth in China

EM currency crisis

Increased default risk as mortgages set to be re-priced at unsustainably high rates for UK, Canadian, Australian & European homeowners

Food & commodity drought led by the Ukraine-Russia war

These are to name just a few cracks within the economy, there’s much more, trust me.

One economy we’re going to dissect in an upcoming piece will be the Euro Zone. We’ll look at the crisis starting from the GFC recession till date and what the future ahead looks like in Europe.

Thank you for getting to the end!

I’ve got a backlog of insights to give you guys, the Autumn Budget recently cited by the Uk Chancellor & a decomposition of the Euro Zone so stay tuned!

Quick reminder - If you like my macro insights please do “add to address book” or reply. These are “positive signals” that help my newsletter land in your inbox.

Send this to someone who’s looking to expand their knowledge— the more this grows, the better the platform becomes for you in ways you can’t imagine!

I’m dedicating myself to ensuring you’re getting all the critical components of knowledge you need to create a deeper understanding of the macro world.

Until next time, peace ;)