From Budget to Bonds: The UK’s Budget Insights & Bond Premiums

Delving Into Budget Implications, Bond Premiums and Trade Diversification

Hey MMH readers!

This report is the most detailed in a while, get your pen and paper, I’ve left my bias on the UK budget until the end.

The next 3 months will offer remarkable opportunities in the markets, something we will be covering here at Market Macro Hub, weekly.

Coming to the end of October already, make a strong finish to the year.

The UK has dodged the limelight for a number of weeks, it’s time to shed some on it.

Macro watch - Part 1

U.S. Government Bonds are back in focus.

We know that bond yields = growth expectations + inflation expectations + term premium, so let’s do some maths.

GDP growth was 3% in Q2, the unemployment rate is again approaching its historical lows at 4.1%, services are growing steadily and the manufacturing sector seems to be coming out of contracting territory. In addition, productivity is at its best and companies are reporting very positive corporate results.

But yields are climbing simply due to interest rate expectations.

The other reason that we are seeing the greater yield from bonds is because of the probability of Donald Trump's victory in the next presidential election, November 5th. The tax cuts, protectionist policies and proposed fiscal stimuli are driving up their profitability, investors seek premiums due to the perceived risks and uncertainty that accompany a fast-growing economy

Donald Trump, who was previously the driver of a bullish dollar in his previous presidential term, has heightened probabilities of winning. When we couple this with growth, inflation, productivity and the labor market, U.S. treasury bonds seem to offer such a great premium right now.

To add to my bullish idea on bonds, the US OIS curve is pricing c.37bp of rate cuts by year-end, giving us a prolonged period of premium bond yields.

U.S. bond market volatility is at highs of 2024, as expected with such uncertainty around the next policies introduced by either president. I always repeat the same statement, with volatility comes opportunity.

Macro watch - Part 2

No market mover this week in this week’s report, there wasn’t a significant enough change in any assets I track to discuss. So instead, I’ll discuss what else caught my eye this week.

Chancellor of Germany, Olaf Scholz, is redirecting their focus towards India (an emerging economy) to lessen its economic dependence on China, which has come off the back of China’s large slowdown. Currently, Germany is exporting c.€16 billion in goods to India each year, a figure that keeps India outside Germany’s top 20 trading partners. By comparison, exports to China total c.€94.5 billion, placing China as Germany’s fourth-largest export market after the U.S., France and the Netherlands. Germany is now urging both the EU and India to accelerate their free trade agreement, with Scholz suggesting it could be completed "in months rather than years."

The trend of supply chain diversification is becoming strong, it’s no longer effective to rely on a single country so heavily. Premium’s will be paid on global trade, but the sustainability that diversification offers is worth the higher cost, Germany may not be struggling as much as they are if they had done this earlier.

UK budget insight

Since the UK Labour Party won the election on July 4th, 2024, the UK has dodged the spotlight in macroeconomics, with such little speech from the BoE and new policies from the government not yet implemented. Their Autumn budget for 2024 is scheduled to be released next Wednesday, October 30th.

Here are some key things that the budget may include:

Next week’s Budget will go beyond typical tax and spending adjustments, marking a significant shift with changes in how the UK calculates public debt. This adjustment, confirmed by the Chancellor, Rachel Reeves, after initial press leaks, is expected to create c.£50 billion in additional fiscal space. This surplus has exceeded analysts' projections and has impacted the bond market, particularly weighing on UK bonds. Over recent weeks, UK yields have surpassed U.S. and German yields, as shown in the chart below that compares normalised 10-year bond yields across the UK, U.S., and Germany.

The Chancellor claims to have a c.£22bn black hole (lack of public finances) that she needs to remedy, we’re past mid-way through the fiscal year, and the UK has already overshot the OBR’s borrowing forecast by c.£7bn.

The Chancellor has established two fiscal rules: the first, termed the “stability rule,” requires that daily expenditures be funded through revenues. The second, known as the “investment rule,” aims to create room for increased investment in the UK economy’s infrastructure. These investments will be overseen by new bodies, including the National Infrastructure and Service Transformation Authority and the Office for Value for Money, with audits conducted by the National Audit Office.

In her op-ed, the Chancellor did not detail the specific amount of funds that would be made available by altering these fiscal rules, leading some to believe that her spending may fall short of the estimated c.£50 billion potential. The proposed changes to the second debt rule appear promising; the Chancellor asserts that the investment rule will lead to a reduction in debt as a percentage of GDP, though she did not clarify when this would occur or the expected magnitude of the reduction.

Labour’s emphasis will be on fostering growth, and Reeves indicates that she will thoroughly evaluate projects to ensure they enhance productivity and growth, which has been notably lacking in the UK. However, the effectiveness of these plans will ultimately be reflected in the OBR’s growth forecasts. Will the OBR provide a favourable assessment of Reeves’ strategies and significantly revise GDP projections?

In March, the OBR forecasted GDP growth at 0.8% for 2024, which may be revised upward given the economy's stronger-than-anticipated performance. The 2025 forecast of 2% is also under review. Additionally, the OBR will evaluate future debt levels. If debt does not decrease significantly despite tax increases and budget cuts, along with the adjustment to the second fiscal rule, market reactions could be negative.

The IMF has upgraded the UK’s growth forecast for this year and next. It now expects 2024 growth to register 1.1%, a 0.4% increase, while growth in 2025 is expected to be 1.5%. Although this is behind the rate for Canada and the U.S., it is the strongest rate of growth in Europe. However, the bad news was the third highest ever rate of borrowing for the UK for September on record. Borrowing topped c.£16.6bn, lower than economists expected, but still more than £2bn higher than the September borrowing rate in 2023.

A proposed “tiering system” could limit the interest income of UK banks based on their size. Last year, the UK’s largest banks generated c.£9.2 billion from interest on their reserves. This system could safeguard smaller banks, who depend on these interest payments, while placing a heavier burden on larger institutions. Reeves may also engage with the Bank of England, potentially advising against selling bond holdings at a loss during quantitative tightening. Instead, she could suggest maintaining these bonds until maturity to avoid financial repercussions for the Treasury. However, such a move could undermine the Bank of England's reputation for independence as a central bank.

A lack of independence from a key central will have large impacts on the UK’s asset markets, if the BoE are to lose such independence. This would force the Uk to join the team of other non-independent central banks like the PbOC, BoJ and CBRT.

Let’s hope this doesn’t come into play. Support is good, independence isn’t.

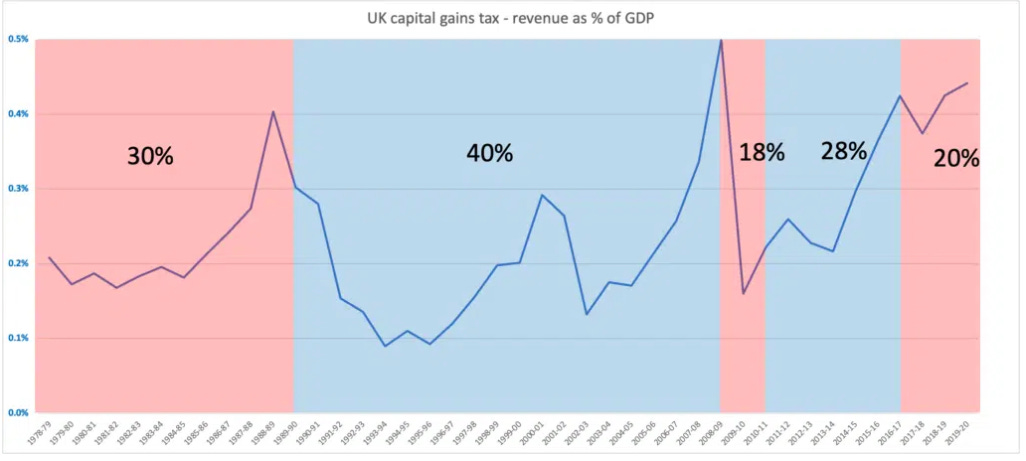

The tax rises that are most likely at this budget include an increase to Capital gains tax, in comparison to income, corporation tax, or VAT. An easier option to raise tax would be a small increase to income tax or VAT, but Reeves has already ruled out changing those.

It’s clear to see why the focus is on CGT:

In comparison to income tax earnings for the UK:

Inheritance tax is also in line for an increase, including removing tax relief for smaller companies listed on the UK junior market. Pensions could also be subject to inheritance tax, and the Chancellor may extend the time period needed to make gifts inheritance tax free.

There was a c.16.3% surge in CGT tax receipts (revenue collected by the government from CGT) last month ahead of next week’s budget. Tax rises could come into force at the start of the next fiscal year, on 6th April, meaning we could see a surge in CGT receipts in the next 5 months.

The 10-year Gilt yield has already traded c.30bp higher in October so far, ahead of next week’s budget announcement.

Equity traders will be focused on any changed that could impact sentiment towards UK companies. Based on topics discusses above, I see fairly equal upside and downside risk to the domestic equity market. Higher taxes may eat in to company revenue while extra spending from the government will boost growth. It all comes down to how log each will take to really transfer into the real economy.

There has been no real trend in UK equities, which is partially down to a slowdown in economic data for the UK but also because of the uncertainty that the autumn budget holds.

To wrap this up, I will give my take on the outcome for the budget in a concise way.

Bias: Bullish

Bias is relevant for: UK equity market, GBP (FX)

(I think bond yields may be elevated for a while due to increased probability of high rates for longer coupled with some uncertainty surrounding growth that will linger for a number of months.

Reasoning:

Rise in capital gains tax stimulating extra government spending and declining debt levels. Also taking the edge off of the c.£22bn ‘black hole’

No rise in income tax will bring consumer spending back to ‘normal’ levels faster than if there would be changes to it, once again sparking growth

New fiscal rules freeing up a significant amount, c.£50bn which will be reinvested back into the economy and drag the UK from sluggish growth, potentially giving another prevision in GDP forecasts for 2025.

Tail-risks:

Rise in capital gains tax having low effectiveness on debt levels, there’s a chance that this may be a more long-sighted change that the UK will not see the rewards of for the next few years

Higher government spending sparking inflation, extra pressure for the BoE who may be forced to hold rates higher for longer, adding further downside risk to growth & expectations.

See you all next week!

EURGBP to new lows looks fairly reasonable then.

I would say at least 0.8250.