Fight or Flight? Eurozone Snapshot

Analysing the worrying economic picture evolving from the Eurozone.

Hey crew,

I’m back.

The past few days were a struggle, found myself not being productive like I usually am.

So I dusted myself off and reminded myself there’s 4 months left this year.

Time waits for no man.

It’s important to remind yourself of such things from time to time.

Anyways, there’s a lot going on with central bank policy as we all know and the euro area finds itself in a predicament with rates set to increase next week and a slowing economy stemming from its centre piece Germany.

A Divided Central Bank

All roads point to stagflation.

The story of the euro area if you were to ask me. 13 months ago the ECB inclined on their 425bps tightening cycle which has led them to where we are now. All three ECB rates are in restrictive territory, but inflation still seems to be causing issues for the ECB.

Before I dive into the details, let’s rewind and take a look at the policy that has long driven the ECB.

As a brief insight, the MLF rate is the interest rate financial institutions, namely banks, pay for collateralised overnight borrowing from the ECB. The main refinancing rate is the rate at which banks can borrow money from the central bank for a duration of one week.

If you’re like me then you’re probably thinking, hold on a minute, why is the overnight rate (MLF) higher than the 1-week borrowing rate (MRO)?

Here’s the simplest explanation I could find. The main refinancing rate costs less than the marginal lending facility because the MRO is a regular operation that provides liquidity to the banking system, while the MLF is a backup facility that banks can use only if they’re in urgent need of funds. Similar to how banks and financial institutions utilised the Fed discount window during the SVB and FRB banking crisis. So the additional cost to access the MLF acts as a way to discourage banks from utilising this line of funding.

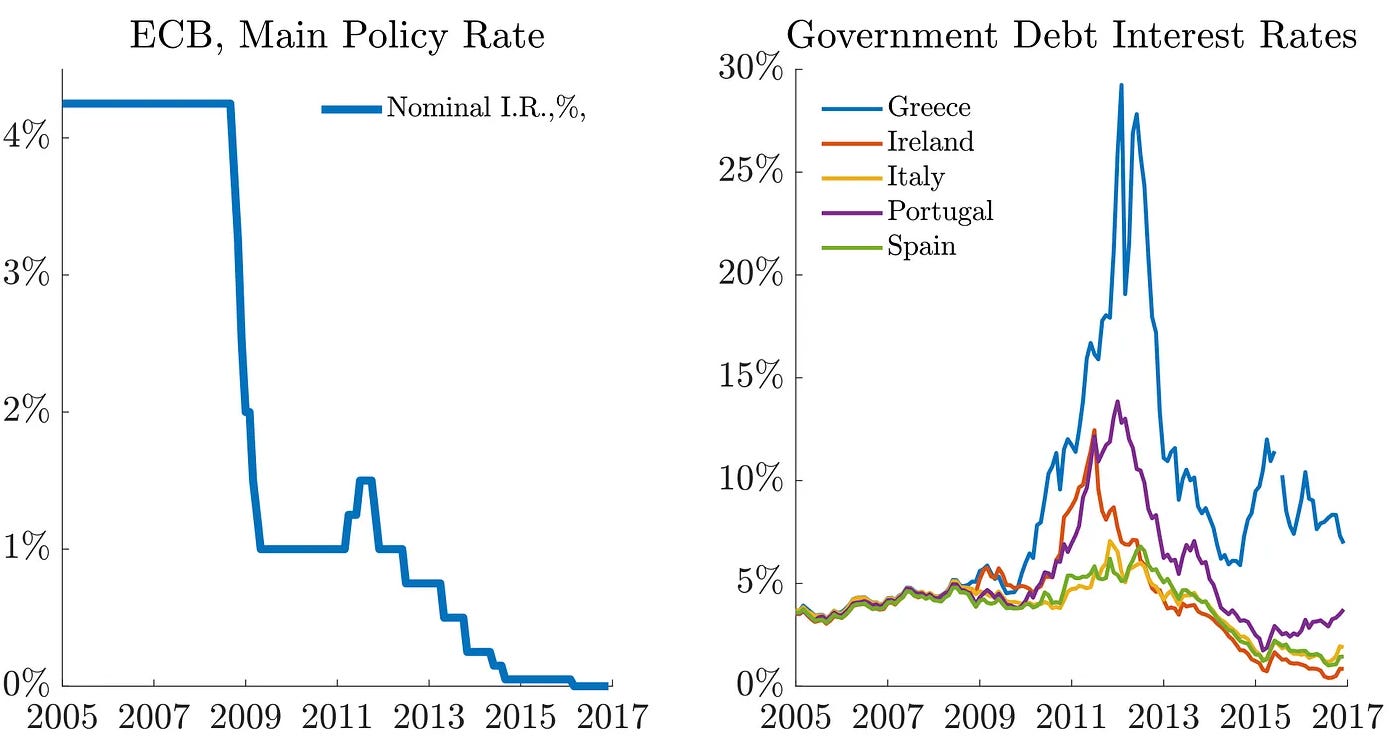

Coming out of the GFC crisis of 2008 rates across the Eurozone were 4.25%, for the MRO (main refinancing operation rate). Rates sharply dropped to 1.00% respectively until 2011 which was the epicentre of the European sovereign debt crisis.

As you can see, the yield on a number of European debt countries, such as Greece, skyrocketed to highs of 29.24% during the European sovereign debt crisis, coming out of the 2007-2009 recession. From my endeavour working in emerging markets sovereign debt, yields this high is what you would expect to see from a small frontier country at risk of default. Not from an emerging market economy like Greece.

So, after battling two back-to-back crises, the ECB decided that the natural rate of interest, the rate which supports full employment and maximum output, would be 0.00% from 2014. With interest rates 400 basis points higher than they were 12 months ago, there is now real cause for concern about the eurozone. Let’s start with Germany, the heartbeat of the European economy.

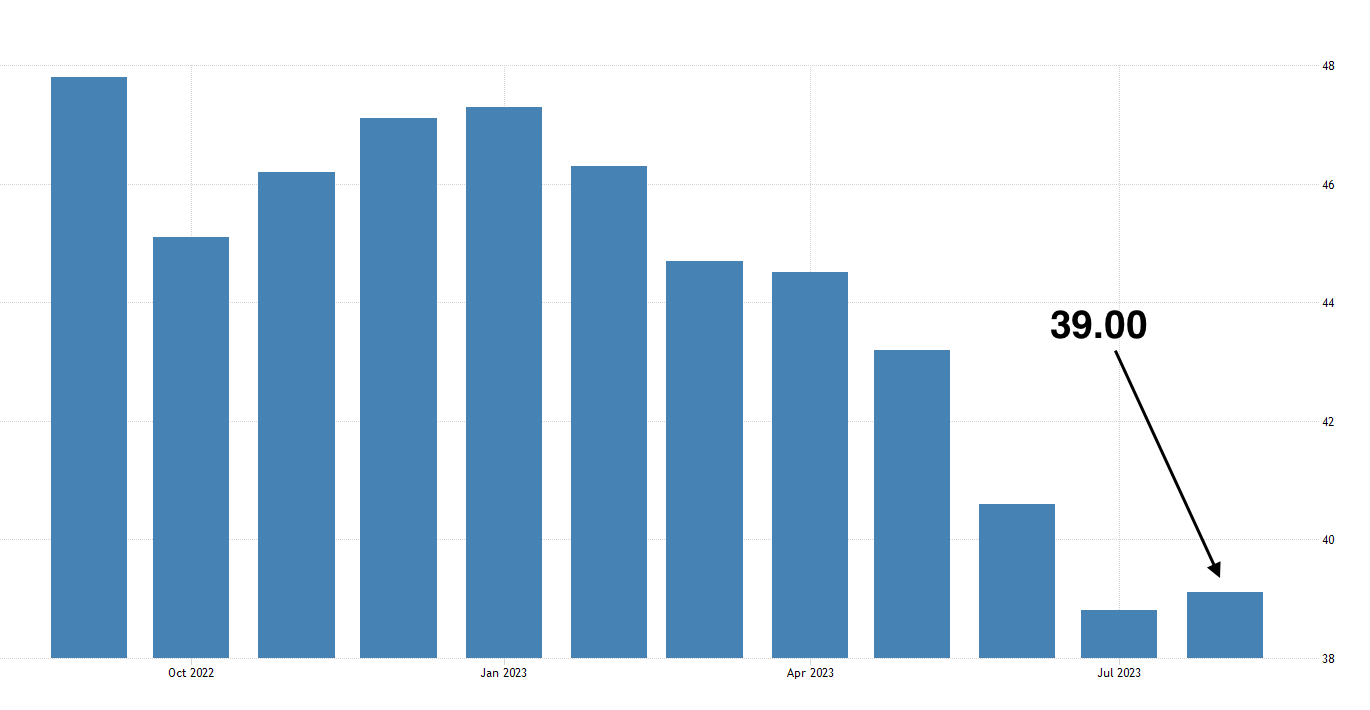

39.00 is a far way away from the expansionary figure of 51.00, here’s the severity of this reading, Germany’s manufacturing sector accounts for 20% of the German economy and as you know the German economy is the benchmark for the Eurozone. Prior to this reading, German manufacturing PMI was on a six-month consecutive decline.

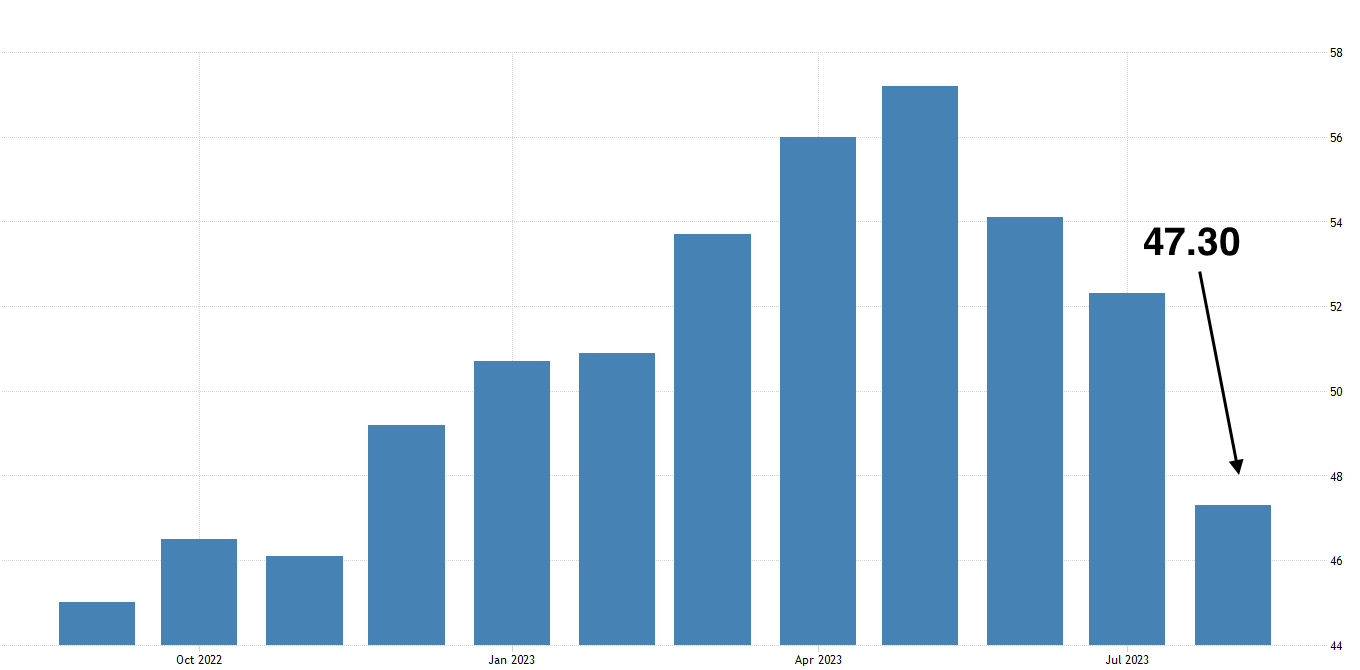

Services PMI are also in contractionary territory, the first contraction in eight months was recorded last month which if interpreted well foretells the risk of Germany slipping back into a recession over the near term.

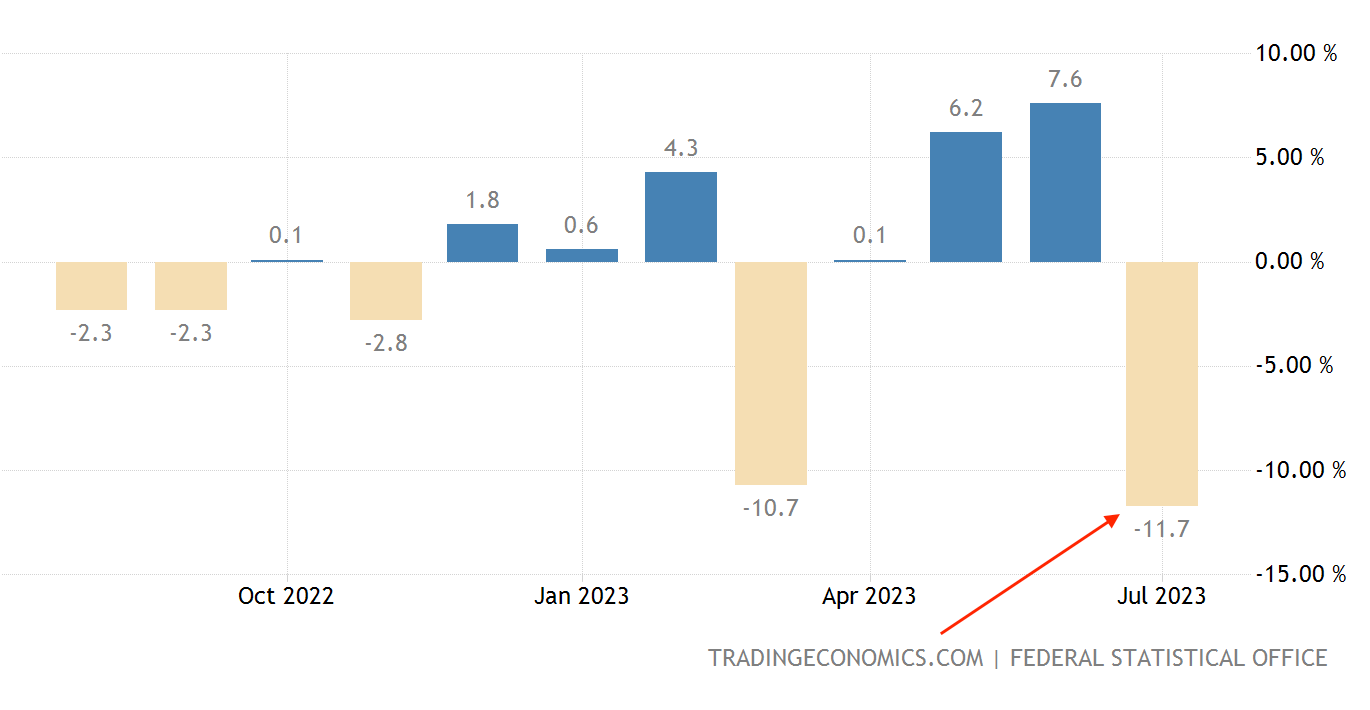

The data doesn’t lie. This morning Q2 GDP was revised lower for the region, expanding by a margin of only 0.1% vs 0.3% expectations, on a YoY basis GDP grew 0.5%, still lower than forecast. But why?

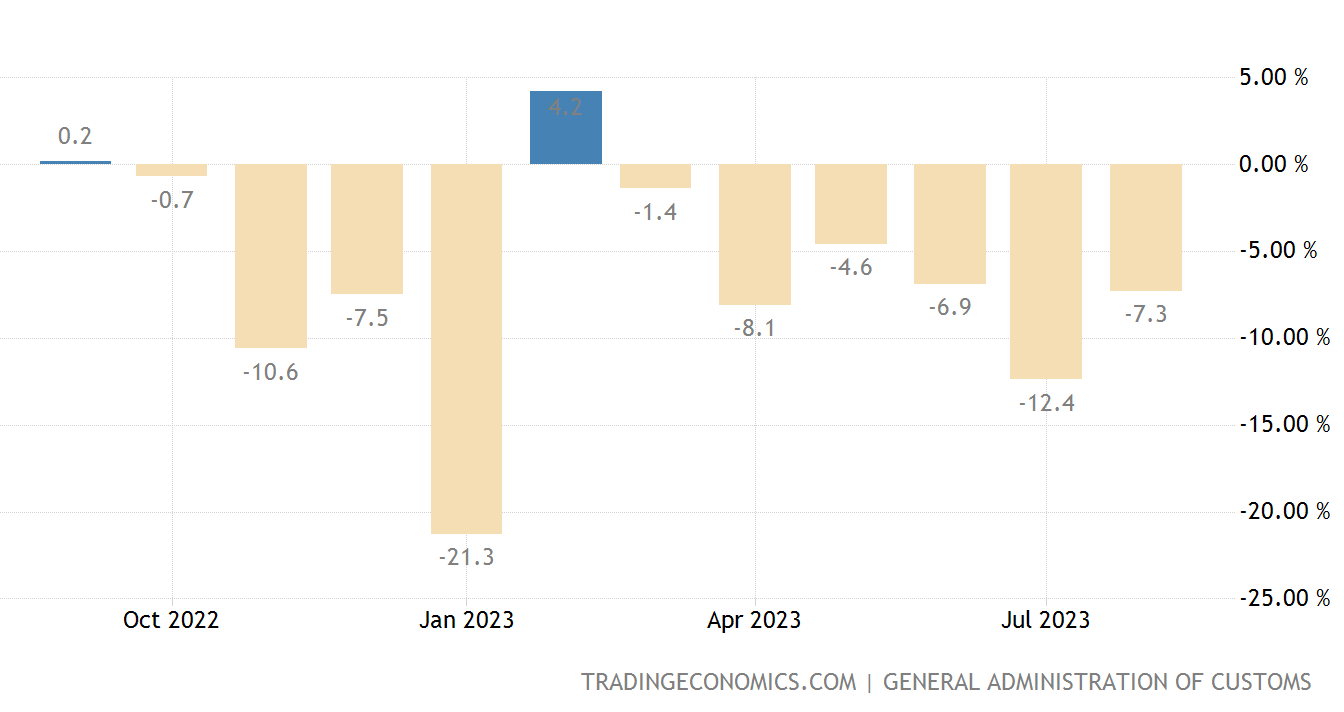

You have to look at where the majority of German manufacturing business comes from, and that’s China. The link is very simple yet complex, so I’ll explain from this angle. For the seventh year running, China has been Germany’s largest trading partner, just under €300bn were traded between the nations last year. This is where 2nd order thinking comes into play. Over the past few months, I’ve broken down how weak Chinese exports and imports have led the country to where it is now, currently facing deflationary pressures and extreme weakness in consumer demand.

The train of thought once you see such data is to then look past China and think, “If China slows down what countries will this have immediate implications on?” You’ll think of Australia, other APAC countries but then also Europe particularly Germany’s manufacturing sector. This is the interconnectedness of macro.

Germany is a major exporter of machinery, chemicals and of course automobiles to China, but in order for German factory orders to thrive, the consumer (China) must be growing in order to facilitate these imports. The exact opposite has happened, Chinese imports have fallen much more than anyone expected six months ago. When China’s economy is well-oiled and functioning you see a ripple effect shown through German new factor orders.

Although you may point to countries like France and raise the argument that it has performed better than Germany boosting the Eurozone, remember that the French economy like many others battles stagflation amidst escalated social climates stemming from the killing of a minor by French police which resulted in heavy riots, unrest, and further reducing consumer confidence.

The Euro confirms the weakness in the macro landscape.

The Euro is fast approaching 1.06300 which is a key technical level for the pair, so keep your eye out as price nears this level. The ECB meet next week Thursday to set interest rates and with the increasingly negative data from its superstar nations, a 25bps hike could be a dangerous decision for President Lagarde.

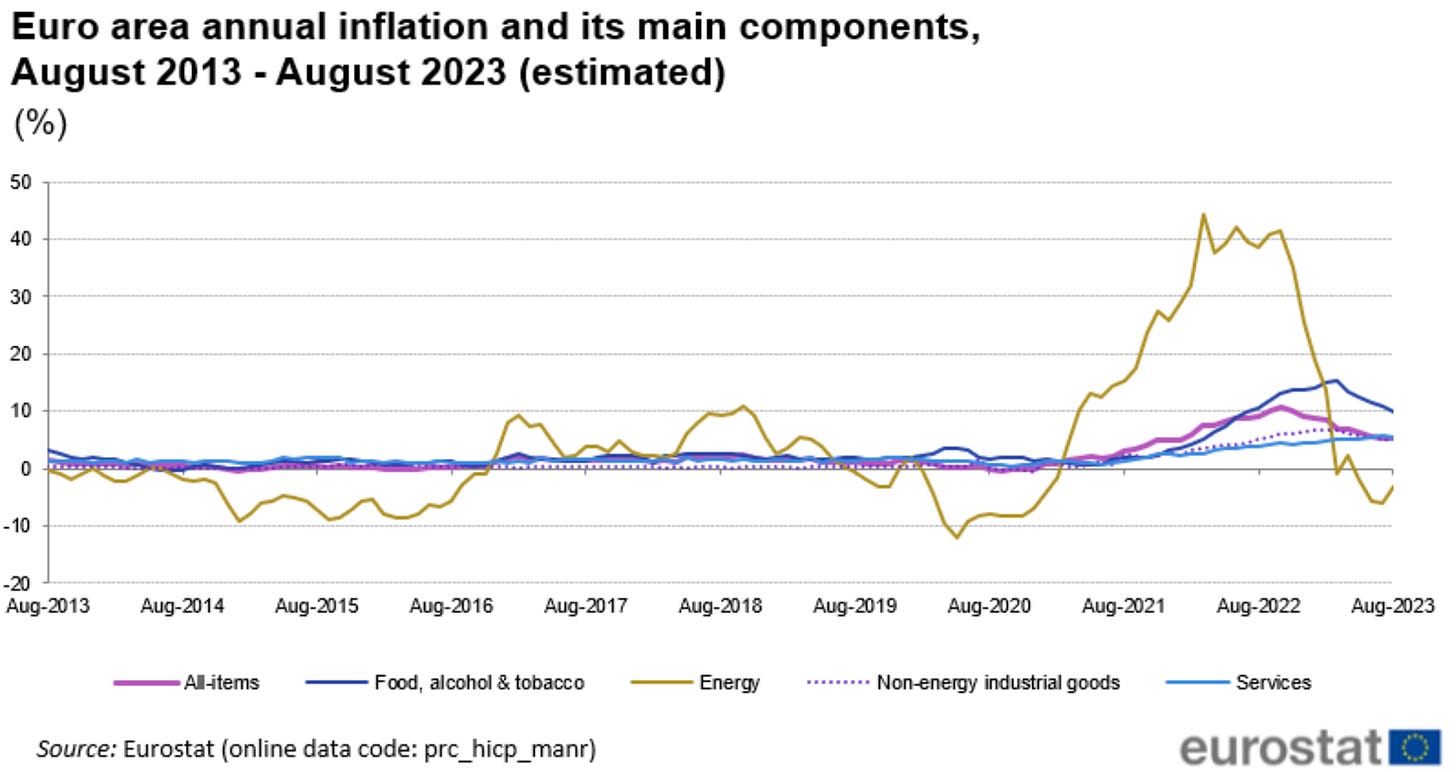

The main contributor to sky-high inflation is now in negative territory, energy, but the persistent services and food, alcohol & tobacco segments remain the Achilles heel of the Eurozone. CPI is still at 5.3% with growth just floating above 0% and slowing, the definition of stagflation; my focus will be pinned on data out of the region and the rate decision next week.

Although I truly believe another hike would be a stupid move, speaking frankly, judging President Lagarde’s tone at the Central Bank forum in Sintra, Portugal pivoting to an easy monetary stance doesn’t seem to be her next plan of action since the Fed has made it clear they will not ease up either. That’s the round-up of the current macro climate across the Eurozone.

As always guys, I appreciate your readership!

Let me know in the comments, discord, some concepts you would want some coverage on as we embrace September’s macro moves.