Fed Powell Resizes Further Rate Hikes

Overview of Fed Chair Powell’s Press Conference

Equities’ response to Powell’s forward guidance

Money markets’ reaction to the FOMC meeting

As expected the Federal Reserve hiked rates to 1.00% after a 50bps hike not seen since the Dot-com crash of 2000. The markets quickly turned around to close in the green after the FOMC Press Conference where Fed Chair Powell ruled out the expected 75bps rate hike. Powell went on to confirm saying “additional 50 basis-point increases should be on the table for the next couple of meetings.”

Prior to the announcement, markets had been pricing in a 75bps hike for the June meeting however with Powell putting all bets to bed this allowed equities to rebound as the broader equity market had already priced in such aggressive hikes. The S&P 500 closed up 3%, the Dow Jones was up 2.5% and the Nasdaq was the biggest gainer up more than 3% on the day.

Fed Tightening

Powell confirmed that the balance sheet runoff will kick in from June 1st at a rate of $47.5bn per month and increase to a maximum of $95bn per month after a quarter. Although there’s a certain runway to the tapering process Powell mentioned that “I would stress how uncertain it is on shrinking the balance sheet”. Going further to mention the difficulty of providing forward guidance up to 60 days due to the economic uncertainty presented right now.

One thing that stood out from the press conference was Powell’s hawkish tone towards the labour market; stating that the labour market is overly tight with little availability of workers for open positions. Powell said “There is a way to decrease labour market demand without increasing unemployment” which seems increasingly challenging as killing demand isn’t something that the Fed can do without any repercussions in the labour market.

The question is, is there a point where supply truly meets demand in the labour market?

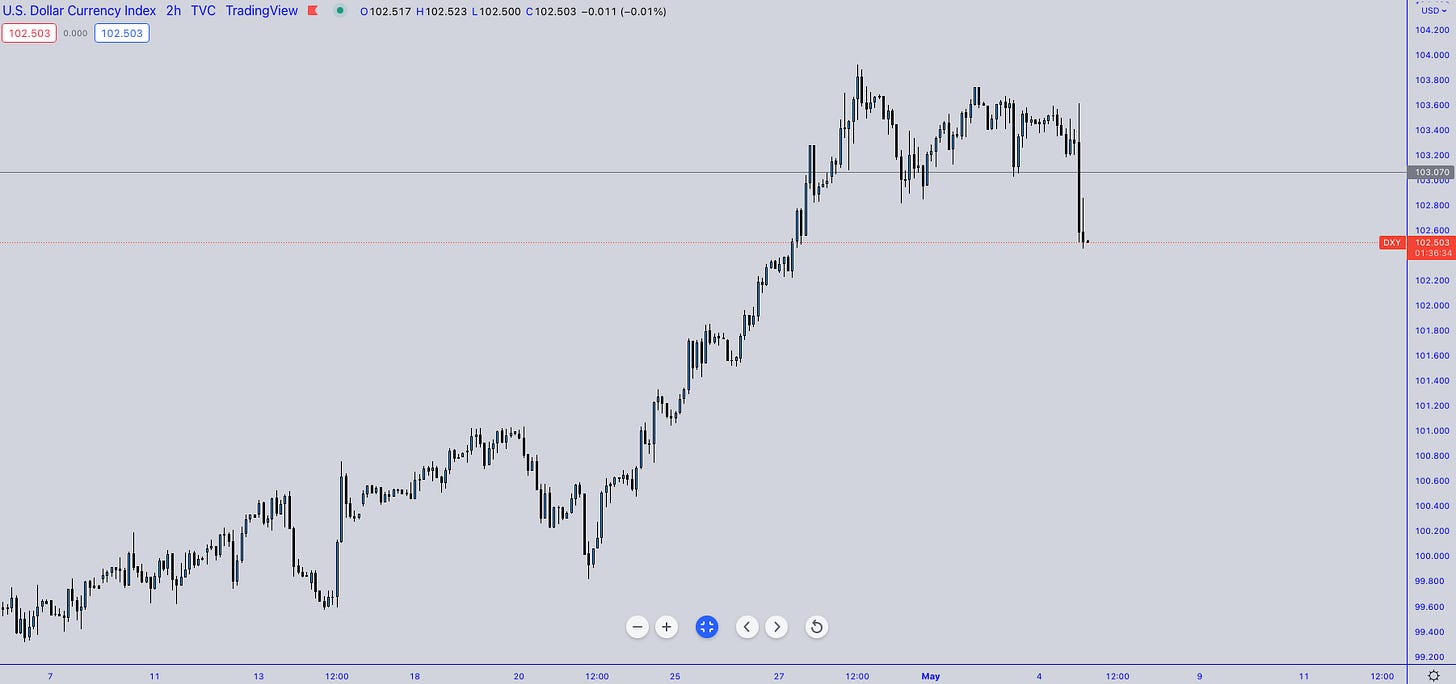

Money market reprices dollar strength

A “knee-jerk reaction” could be the best way to describe what we saw across G-7 currencies mainly the dollar. At the time of writing the Dollar index is trading above the 102.00 handle.

Cable managed to get some breathing room to the upside trading north above 1.2600 ahead of the BoE meeting today where we expect to see possible upside unless Gov Bailey delivers the message of doom regarding the wider economy which is highly likely to keep cable below 1.2600.

The Euro managed to squeeze above the 1.0600 handle as a soft dollar pushed the rates higher; on a wider spectrum, the euro is expected to hold below the 1.0500 mark as the U.S initiate its quantitative tightening process.