Equity Idea: Nothing Beats a Jet2 Holiday… Or Does It?

The stock market’s sleeping on this airline’s next takeoff

Hey everyone,

I’ve been thinking a lot about how markets test patience, not just through volatility, but through silence.

Sometimes the hardest part isn’t reacting, it’s waiting for conviction to return.

Anyway, there’s nothing like an airline equity idea on your Sunday evening to set you up for the week…

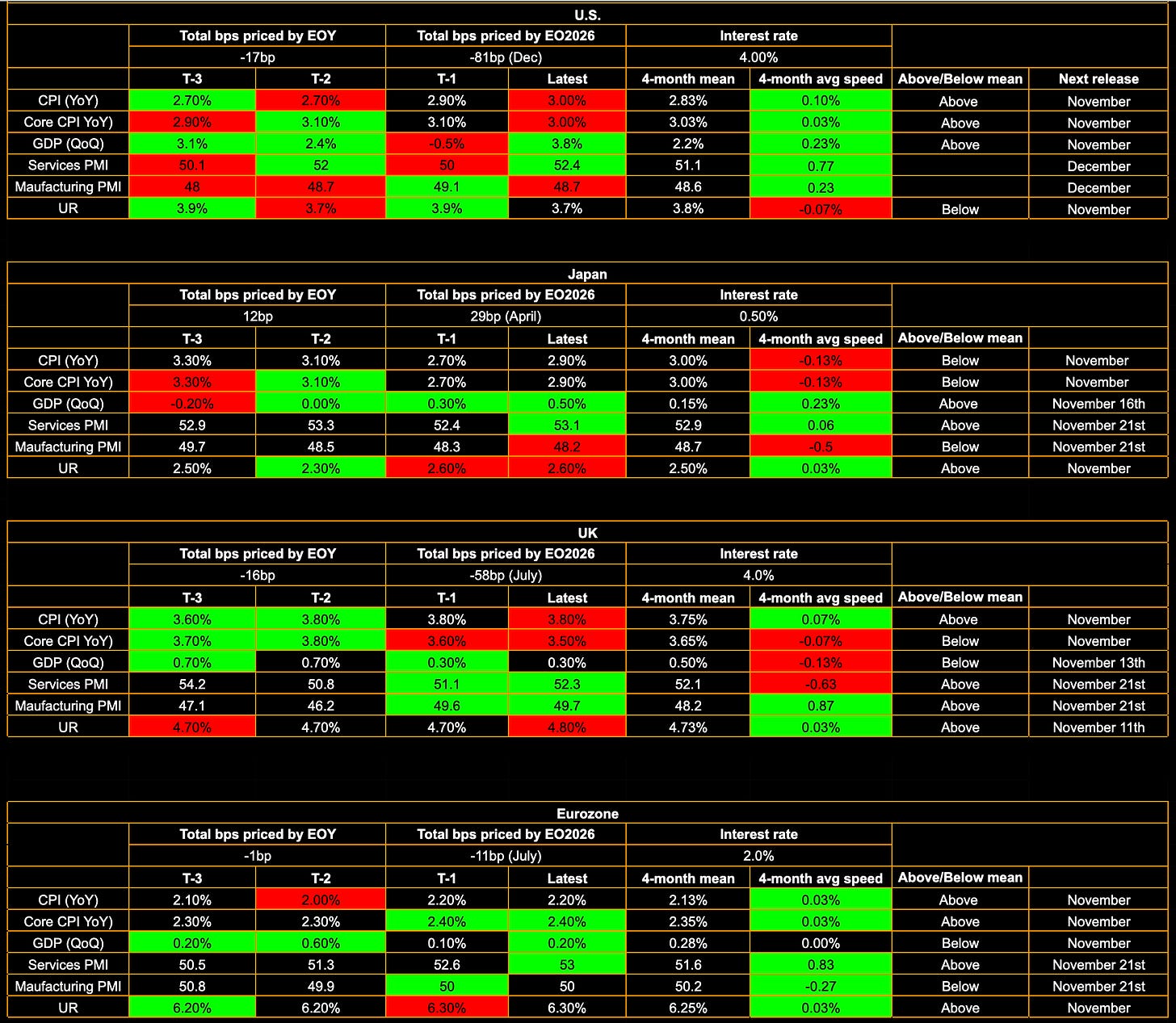

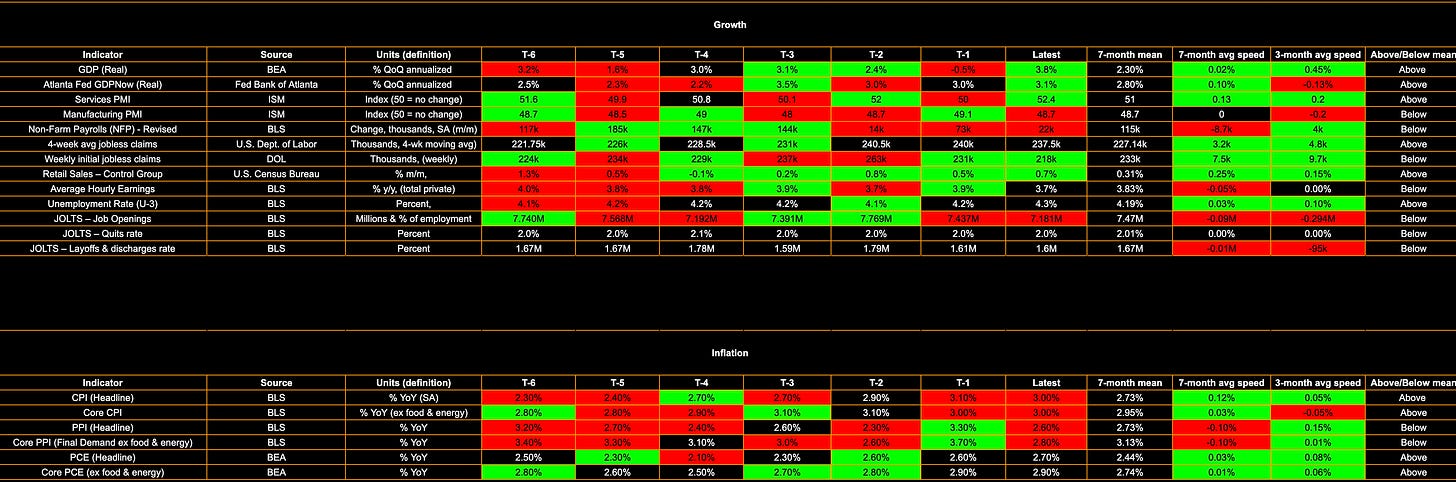

G4 Tracker

U.S. Tracker

My Equity Idea

So, as most of you know, my focus is usually on macro, that’s where I spend 99% of my time and what most of my reports are about. I’ve only ever put out one single name equity idea before, which was Associated British Foods (ABF) back in March, that one’s up about 18% since, by the way. I’ll link that report below for anyone who wants a refresher.

Nothing beats a Jet2 holiday….. but it could.

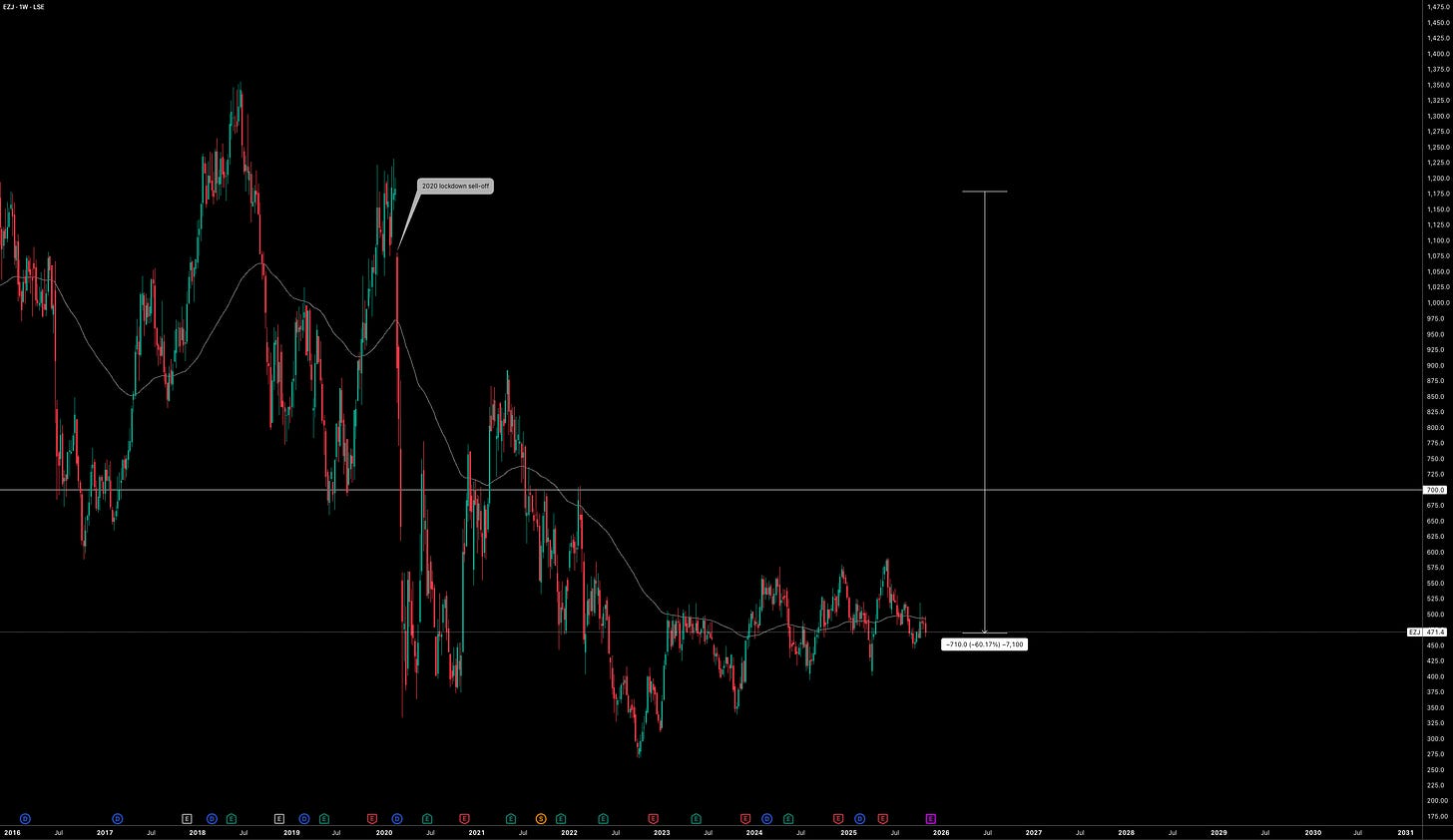

Let’s talk easyJet, Europe’s #2 low-cost carrier that somehow still trades like it’s in 2020 lockdown mode. The story here is pretty simple: they’re lean, profitable, sitting on net cash, scaling a high margin holidays arm, and finally paying dividends again. Yet the market’s still treating them like a struggling budget airline. I think that disconnect is exactly where the upside lives. The stock is still trading at a 60% discount to pre-COVID levels:

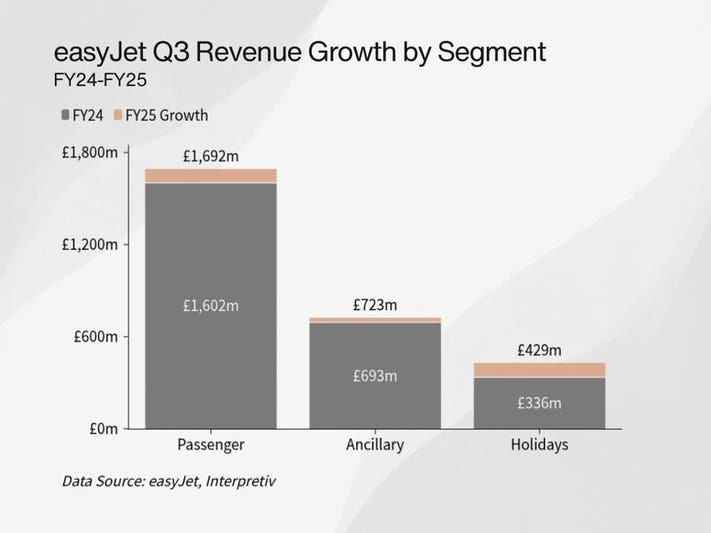

Now, let’s talk recent earnings. Let’s start with the basics. The first half of FY25 (that’s up to March 2025) wasn’t exactly pretty, they posted a £394 million pre-tax loss, but before you panic, that’s completely normal for the winter period in Europe when no one wants to go anywhere except maybe Tenerife. What matters is that revenue was up 8% to £3.53 billion and the load factor (basically how full the planes were) ticked up to about 88%, which is a solid sign of underlying demand.

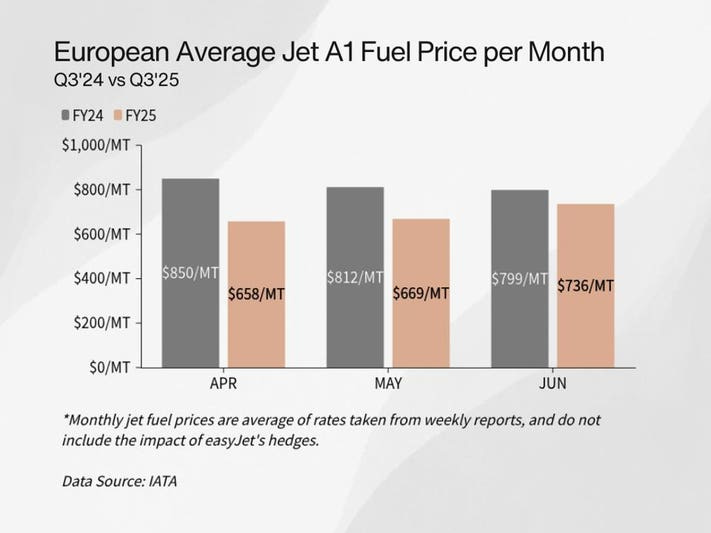

Now fast forward to the Q3 trading update, that’s when easyJet actually starts printing money. Profit before tax came in at £286 million, up roughly £50 million YoY, and they managed to grow capacity by nearly 8% while cutting costs per seat (CASK) by about 0.5%. Even excluding fuel, costs were under control. Revenue hit £2.92 billion, load factor nudged above 90%, and management guided for around 9% capacity growth for the full year. Simply put, the summer’s been good, and they’re finally getting some operating leverage back.

The backdrop helps too. The entire European short-haul market is capacity constrained right now because Airbus and Boeing can’t deliver new planes fast enough. Normally that would be bad, but for easyJet it’s great because less new supply means ticket prices stay high and planes stay full. Add in the fact that easyJet operates from prime slots at Gatwick, Luton, Milan Malpensa, and Geneva (airports everyone actually wants to fly from), and you’ve got a company with real pricing power.

And then there’s easyJet Holidays, which has quietly become a profit machine in its own right. It did £190 million of profit before tax last year and continues to grow fast. The beauty of that segment is that it’s vertically integrated, they sell you the flight and the hotel, so margins stack nicely, and the holidays division helps smooth out seasonality. It’s like Ryanair meets Jet2 Holidays, just with a slightly less aggressive CEO. Future forecasts show EasyJet shifting from survival mode to self funding, the worst of its debt pressure is behind it, leverage is set to decline each year, and cash generation looks solid.

Financially, the company’s in pretty decent shape. They came into FY25 with £181 million of net cash, reinstated their dividend last year, and are now talking about low single digit CASK reductions for this year. That’s impressive given how much fuel, wages, and airport costs have climbed. It shows proper discipline. Focusing just on the projections in the chart, we’re not looking at anything explosive like the AI boom, more a story of steady, consistent growth ahead.

Of course, there are risks… there always are. Jet fuel, strikes, slower growth and European weather systems will always do their best to ruin a good quarter. Airbus delays can also limit how much capacity they can add. But here’s the thing: those same delivery delays are what’s keeping the whole sector profitable. It’s a bit like everyone else missing the train, more seats and less noise for you.. Although I mentioned fuel prices, they’ve been pretty stable as of recent.

So where does that leave us? easyJet is guiding toward another strong full year when they report officially on 25 November 2025, with improving costs, solid demand, and some of the best operational momentum in years. The market’s still treating it like a low growth, budget carrier, but the numbers suggest it’s quietly turning into something much sturdier, a cash generator with a growing holiday arm, real slot advantages, and a management team that’s finally walking the efficiency talk.

In short, it’s not flashy but it’s working. People are still flying, capacity’s tight, and the orange planes are full. That’s all you really need to know. If you’re looking for something to own into the results, easyJet looks like one of those “boring but beautiful” trades, the kind you ignore for six months, then check back and wonder how it’s up 25%.

Around 56% of easyJet’s customers touch the UK, where the brand’s basically part of the wallpaper, people say “I’ll easyJet it” like they say “I’ll Google it.”… maybe I’ve gone a bit far to say that, but the idea is there. It’s one of the few low cost carriers with real scale and a fast growing holidays arm, which it can cross sell effortlessly. Throw in the Gatwick Northern Runway expansion (approved in September 2025) and you’ve got a capacity boost straight into its biggest hub. And because the entire fleet’s Airbus with CFM LEAP engines, easyJet’s sidestepped the GTF engine fiasco grounding Wizz Air’s planes, an underrated win that means more planes flying, more seats filled, more cash flowing.

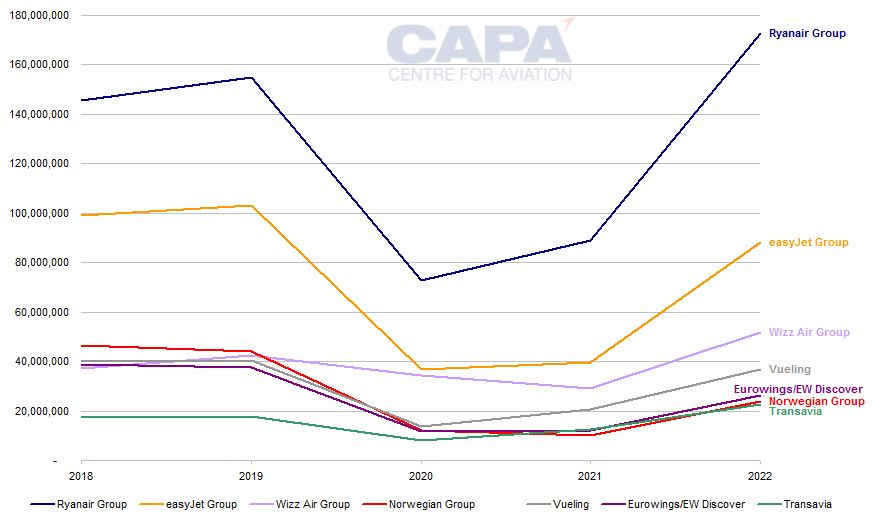

Competition is no joke, Ryanair’s still the scale monster with unmatched cost discipline, and Wizz Air (engine drama and all) keeps throwing elbows on key leisure routes. Then there’s the usual chaos like ATC strikes, airport staffing meltdowns, bad weather, there’s never a smooth flight path in this business (sorry for the pun). Add in tightening green policies and rising SAF and carbon scheme costs, and margins will keep feeling the squeeze. But compared with the rest, easyJet’s balance sheet and operations give it a solid cushion, it can take a few bumps and still stay airborne. The chart below shows the total annual passenger numbers for major European low-cost carriers, which supports the idea that easyJet’s demand is sufficient.

But a quick word on their so-called competition… which might not even be competition a few years from now.

Wizz Air’s still flying, but it’s doing so with one engine tied behind its back, literally. Around 41 of its A320neo-family jets are grounded for Pratt & Whitney GTF engine inspections, and management now says full normalisation won’t come until FY27, a year later than hoped. That’s throttling capacity and pushing revenue pressure across multiple seasons. Even so, Wizz somehow turned a profit in FY25 (sitting on about €1.7-2.0bn in cash and liquidity, equal to roughly a third of its annual revenue. Debt remains heavy (€5 billion), but most of it’s tied to aircraft leases, so it’s manageable if cash keeps flowing. They’ve also deferred 88 Airbus deliveries to FY33 and trimmed their A321XLR order to save near-term capex… smart, but it still leaves a monster orderbook that needs financing. The kicker? They’ve stuck with Pratt & Whitney for another 177 engines, which means near-term compensation, but continued reliance on the same headache-prone tech.

The real risk is that the engine fixes slip again. If that happens, Wizz keeps flying sub-scale while fixed costs and lease payments pile up, the slow bleed that kills cash flow. Add in higher fuel prices and tougher carbon rules (EU/UK ETS costs going full auction by 2026), and you’ve got a nasty squeeze. Regulators are also circling, Spain already fined LCCs €179 million over fees, and competition from Ryanair, easyJet, and local carriers is fierce. Combine that with a heavy fleet orderbook and tricky funding markets, and it’s easy to see how things could go wrong.

That said, a bust isn’t the base case. Wizz is still profitable, well hedged, and backed by Pratt compensation to offset grounding pain. Management’s delaying deliveries, trimming complexity, and cutting near-term spend, while ULCCs historically outlast downturns by staying the cheapest seat in the sky. The only way it truly breaks is if everything goes wrong at once like engine delays, fuel spikes, dollar strength, regulation, funding stress, all while cash drains through two more summers. Not impossible, but not likely either, it just means that easyJet is more favoured from a stability POV in regards to the actual equity itself.

In my view, this is an airline moving from “recovery story” to “cash compounder.” It’s not trying to be a rock bottom discounter, and it’s not pretending to be British Airways 2.0. It’s carving a middle lane, large scale, mid-market yield, disciplined growth while monetising its customer base through holidays. That model should command a higher multiple than where the shares sit today. And with net cash rising (from £181 million at FY24 to £803 million by June 2025), easyJet’s in a better financial position than almost any point in its history.

So yes, I’m long. I think the combination of a strong balance sheet, a cash flowing holidays arm, operational leverage through new aircraft, and favourable industry tailwinds creates a pretty attractive setup. The risk/reward skews positive, especially with a management team that seems determined to balance growth with discipline. If they keep delivering, I think this could easily re-rate 20-30% over the next year, with more if holidays keeps compounding. It’s not a meme stock, it’s a good business trading like a bad one. The stock market’s sleeping on easyJet’s next takeoff, and I’m happy to be in the cabin before everyone else boards. I’m targetting the £615 level by the beginning of Q4 2026, setting up for a nice 30% upside:

Guys, I apologise for all the puns, but what a great oppurtunity I had to use them…

Have an amazing week!