Equities Blaze, Power Plays, and Dollar Gains

Triple D Tension: Dollar, Deals & Deadlines

Hey guys,

I’d like to introduce the newest member of Market Macro Hub, who has been working with us in the background since last year.

So, let’s welcome Emmanuel.

Emmanuel will be delivering the “Macro Watch” and “Market Mover” part of these reports, fortnightly.

The future for MMH is big, so stick with us for this ride and let’s see where it takes us.

This is a big report, but as you can see from the last few months, you do not want to skip ANYTHING in our reports.

Without further adieu, let’s get into it!

Macro watch

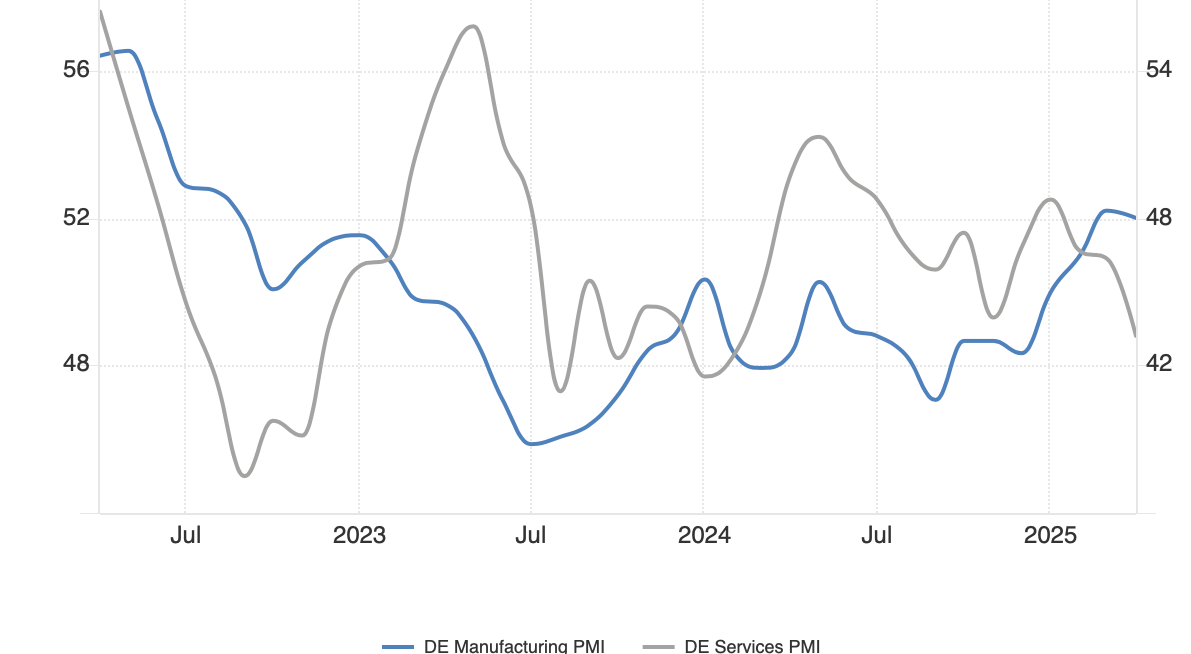

Amid tariff turmoil, Euro area sentiment is souring, with PMI data sending mixed signals. Hopes for a strong start to the year faded as global growth fears and tariffs weighed in. Europe remains stagnant, and Germany has slipped back into contraction.

Services dragged down the latest Eurozone PMI, missing expectations at 48.8, while manufacturing ticked up, likely due to stockpiling, not demand. UK sentiment is worse, hitting two-year lows, with PMIs lagging the real picture. Bundesbank’s Nagel is blunt: recession is likely, and rate cuts are coming. Both the ECB and BoE are expected to ease further because challenges persist. Germany’s aiming for 1% GDP growth by 2026, which, given falling productivity and a shrinking labor force, would be a real shift.

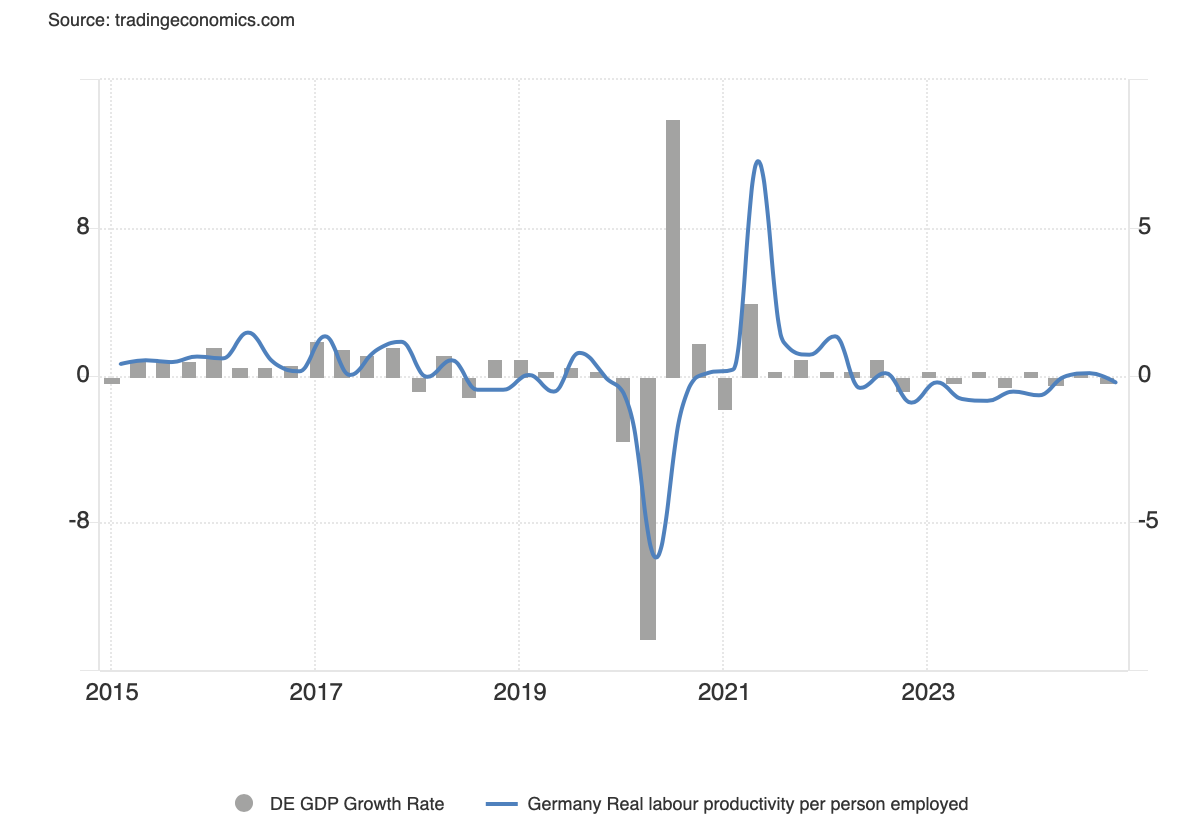

Germany’s biggest challenge isn’t just inefficiency, it’s external. China’s overcapacity and shifting US-China trade dynamics could flood Europe with cheap exports, making Germany the shock absorber. Rising wages widen the Unit Labour Cost gap, squeezing margins and export competitiveness.

Demographics are another drag: fertility is low, and the working-age population may shrink by nearly a million by 2029. Proposed fixes like incentivising senior work face political resistance, especially with immigration tensions rising.

Capital investment is getting a €500B boost, focused on energy and digital. But while that may lift near-term GDP, long-term gains hinge on political will and policy consistency. For now, Germany’s outlook is less stagnant—but not accelerating.

Market mover

Markets brushed off strong durable goods and jobless data, what really moved things was a shift in tone from the White House. After last week’s protectionist rhetoric and Fed Chair threats, this week saw softer messaging on China, progress on trade with India and South Korea, and a walk-back on Powell. That narrative pivot, though fragile, was enough to halt the “sell America” trend. Even China’s dismissal of trade talks didn’t derail the rally. Equities bounced, the yield curve bull-flattened, and the dollar outperformed on positive trade sentiment.

This isn’t a bullish shift, just a less bearish one. Tone improved, but core issues remain; markets are reacting to relief, not real optimism.

Smart money is still selling, while retail is taking heavy losses, many bought the top. The key players are still the ones to watch. I’m considering a scenario where markets aren’t pricing in Europe’s lower growth, mild domestic recovery, trade deals, and sticky inflation. A long shot, but worth noting.

Market recap & outlook

Before we get into it, let me summarise the last 3 weeks in a chart:

I think the representation shown in the chart doesn’t even do it justice, in times where we’re rethinking capital and trade flows (from a man-made crisis), its crucial to follow market news but it’s even more important really differentiate noise vs real data.

The dollar recovery was evident this week thanks to a broader de-escalation by the Trump administration on both US protectionism and Fed independence. Some key de-escalating quotes from Trump this week are below to help context:

Trump was asked if he’ll play hardball with china, he said no.

He stated that the tariff on China will come down significantly, likely around the 50-65% range.

Trump stated he has no intention of firing Powell

Thanks to those comments from Trump, the dollar rounded the week off c.0.6% higher, not anything to shout about just yet. Bessent has definitely taken control here in my opinion, he knows that if the administration loses financial markets in the long-term, there’s high risk of them losing mid-terms. I suspect that in the coming weeks we’ll see the rally’s in markets fuelled by noise (de-escalating comments) and then sold off by real data (no move at all in negotiations etc). Once again, be aware of noise vs real data.

So it went from Trump “looking into how to terminate Powell as Fed chair”, to Trump “having no intention to fire Powell”, that sums up the current market quite well, doesn’t it. Trump threatening to sack Powell loses confidence in the reserve currency with an independent and inflation-responsible central bank so it was pretty evident that he needed to backtrack or at least cool the tone his had on Powell, which he did.

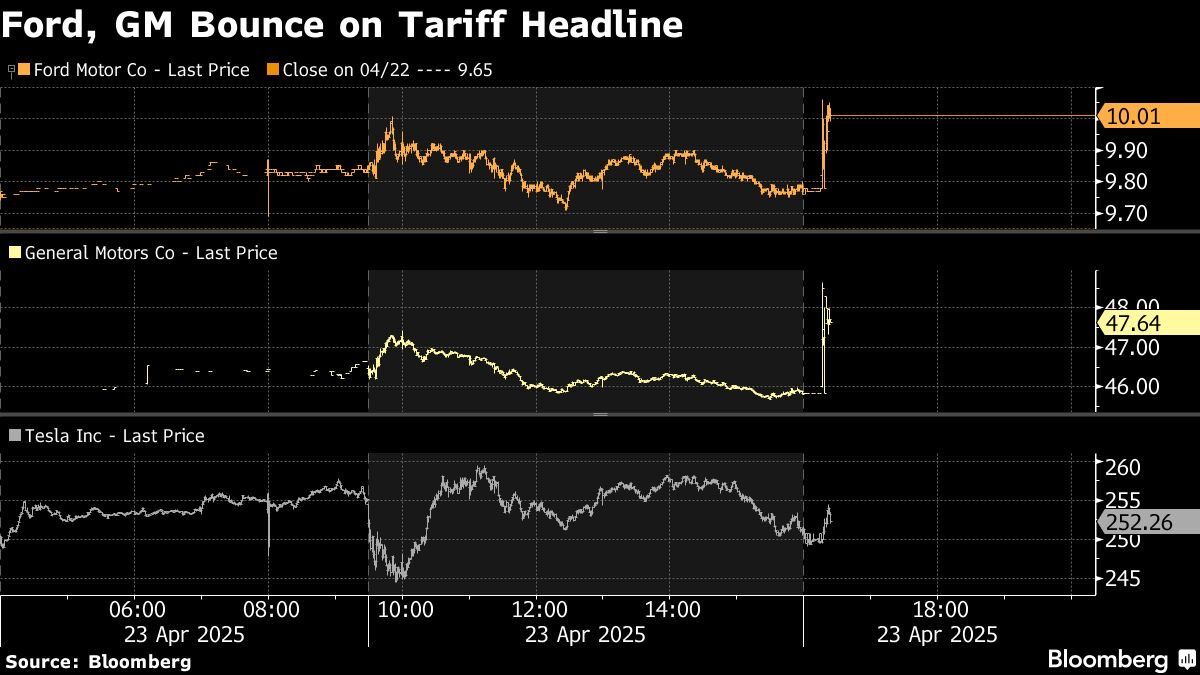

Some of you equity readers will have received some relief this week, especially if you’re exposed to auto’s. Auto’s bounced on the news that tariffs on China will be watered down. Unfortunately for you guys, they have’t fully recovered from the “liberation day” fall, but the sensitivity to watered tariffs definitely sets my eye on autos, although I don’t see any prime positioning right now. The reason I like affordable auto’s is because they’re a type of non-cyclical product that can stay in demand through these difficult times, just like associated British Foods (ABF), which was the equity pick for Q2.

While we’re on the topic of equities, Apple announced plans this week to complete the shift of US iPhone production to India by the end of 2026, which sets the stage for more companies (like the auto ones below) to open doors for a shift in their supply chain.

Global asset relocation is what’s causing the decoupling in asset correlations. Treasury concerns are fuelling the flight to Gold, which reached another new high on Tuesday. The rise in gold, decline in USD and jump in treasury yields is causing threat to investors. However, as trade wars calm (to an extent) and deals start getting made (if they do anytime soon), some recouping of these trends may be seen.

Another positive for the dollar this week was that the popular de-dolarisation risk-off trades cooled. The dollar selloff has been heavy, it’s natural for a pullback to happen and the catalyst has been Trump. For those questioning whether this is a full scale reversal, don’t get ahead just yet. The rally may be fuelled by Trump’s de-escalating comments but can be dragged by the large uncertainty that the US carries (noise vs data) - which I think is still the base case.

It’s now become clear that over the last few weeks, the US found itself negotiating with itself over China tariffs, calling them unsustainable and hinting at future cuts in tariff rates. Meanwhile, China kept the yuan steady, projecting stability and predictability. With Washington wavering, Beijing is capitalising on US inconsistency. In the trade war, China’s playing the long game… and winning.

This is something I spoke about in my report a couple weeks back, China are not in the position they were back in 2018, they have a much larger global dominance now and I think they will come out of this battle less damaged that the US. In that same report I mentioned the length that these deals may go on for. The misconception among many people is that the deal needs to happen fast and it needs to be permanaent, that’s definitely not the case. Instead, tariffs may be watered down and risen as negotiations proceed, Bessent actually said this week that preparing a full trade agreement with China may take 2-3 years. Buckle up.

Think of China proxies, but be aware of the global growth scare that has downside risk to them, this makes your proxy trade a little harder to pick. I haven’t chosen my direct proxy for this just yet, but something like the AUS200 has definitely got my attention and has outperformed other indices as of recent. Asia as a whole may even win, China and Japan leading the victory. Remember that this week, Japanese Finance Minister Katsunobu Kato said that currency targets were not discussed in meetings with Scott Bessent meaning that the JPY can trade lower temporarily Japan also announced emergency economic package to counter US tariffs. This includes partial coverage of electrical bills, lower gasoline prices and corporate financing support - All funded by a combination of reserve funds and pre-allocated gasoline subsidy resources.

Well done, Asia.

Oh, and not to mention that China aren’t scared of a trade war. They’re warning the RoW to not fight them…

The negative impact of heightened policy uncertainty and fears over disruption from trade tariffs were evident in the latest PMI surveys released yesterday from the Europe and the US which were weak across the board. That being said, although the economy is globally weak, to reach the lows seen across the board on indices will be tough. Those lows had priced in the most extreme scenarios possibly available at that time (no tariff pause, recession, uncertainty etc.), so there’d need to be sentiment even more extreme than that to even test the lows. I think the lows are in for indices across the board, but trading them won’t be a simple upwards trajectory. To keep it simple, my bearish thesis for the S&P500 given in January has definitely ran it’s time and I am no longer short on it. This doesn’t mean broad dollar shorts are off the table, I just think there will be a small recovery in the USD vs the low actually being printed already in the S&P500 - It’s unlikely that the bottom is in for the dollar index.

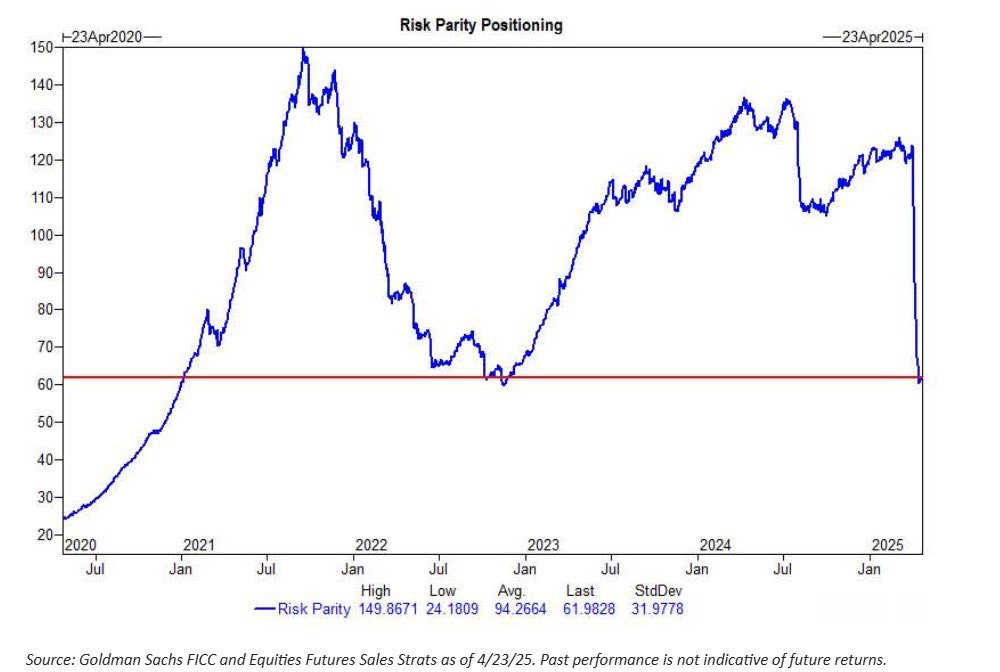

Sentiment is starting to flow through multiple data points now, not just PMIs. Just look at how risk parity positioning has fallen since “liberation day”. For anyone that doesn’t know, risk parity is an investment strategy where the goal is to balance risk (not just money) equally across different types of assets, like stocks, bonds, and commodities. Low risk parity, as simple as possible, low-risk parity means using the risk parity strategy, but with a focus on keeping the overall risk very low.

That’s a wrap for the week, many ideas have been shared in this report so I hope you have taken note.

Enjoy your weekend!